Lending Manager Resume examples & templates

Copyable Lending Manager Resume examples

Ever wondered what makes the lending world tick? Lending Managers sit at that critical intersection where financial expertise meets relationship-building. They're the professionals who evaluate loan applications, manage risk, and help individuals and businesses access the capital they need to grow. It's a role that combines analytical skills with interpersonal finesse – you're not just crunching numbers, you're transforming lives and businesses through responsible access to credit.

The lending landscape has shifted dramatically since 2020, with digital transformation accelerating at twice the pre-pandemic rate. Today's Lending Managers need to balance traditional underwriting principles with emerging technologies like automated decisioning systems. The most successful ones are those who can navigate regulatory changes while maintaining a human touch. According to the American Bankers Association, financial institutions that invested in upgrading their lending technology saw a 37% improvement in loan processing times last year. As economic conditions continue to fluctuate, Lending Managers who can blend risk management expertise with customer-centric approaches will find themselves increasingly valuable in an industry that's redefining what "relationship banking" really means.

Junior Lending Manager Resume Example

Marcus Rodriguez

Phone: (415) 555-8762 • Email: m.rodriguez@email.com • LinkedIn: linkedin.com/in/marcusrodriguez

San Francisco, CA 94110

Detail-oriented Lending Manager with 2 years of experience in consumer lending and financial services. Strong background in loan processing, underwriting, and customer relationship management. Proven track record of maintaining compliance with regulatory standards while achieving loan volume goals. Seeking to leverage my analytical skills and industry knowledge to drive growth in a dynamic lending environment.

EXPERIENCE

Assistant Lending Manager | Bay Area Credit Union | San Francisco, CA | June 2022 – Present

- Manage a portfolio of 127 active loans totaling $3.2M while maintaining delinquency rates 17% below industry average

- Supervise team of 4 loan processors, implementing weekly check-ins that improved processing time by 23%

- Review and approve consumer loans up to $75,000, including auto loans, personal loans, and HELOCs

- Collaborated with compliance department to update lending policies in response to 2023 regulatory changes

- Created tracking spreadsheet that reduced documentation errors by 31% and improved audit outcomes

Loan Processor | First Community Bank | Oakland, CA | August 2021 – May 2022

- Processed 35+ loan applications weekly, verifying income, employment, and credit reports

- Maintained 97.6% accuracy rate in document verification and compliance procedures

- Assisted customers with loan application process, explaining terms and requirements

- Identified process bottleneck in verification workflow that, when fixed, reduced processing time by 2 business days

Financial Services Intern | Pacific Lending Group | San Francisco, CA | January 2021 – July 2021

- Supported loan officers with document collection and initial application screening

- Conducted research on competitive rates and prepared weekly market analysis reports

- Helped organize customer files and maintained database accuracy (my error rate was only 0.8%!)

EDUCATION

Bachelor of Science in Finance | San Francisco State University | May 2021

- GPA: 3.7/4.0

- Relevant Coursework: Financial Management, Banking Systems, Credit Analysis, Risk Assessment

- Senior Project: “Impact of Digital Transformation on Community Bank Lending” (received departmental recognition)

CERTIFICATIONS

- Certified Lending Professional (CLP) – American Banking Association, January 2023

- Fair Lending Compliance Certification – Mortgage Bankers Association, September 2022

- Consumer Credit Analysis Certificate – Financial Industry Regulatory Authority, March 2022

SKILLS

- Loan Underwriting & Approval

- Credit Analysis & Risk Assessment

- Regulatory Compliance (TILA, ECOA, FCRA)

- Customer Relationship Management

- Mortgage Origination Software

- Financial Document Verification

- Loan Portfolio Management

- Team Leadership & Training

- Microsoft Office Suite & Excel Financial Modeling

- Fiserv & Encompass Loan Origination Systems

Mid-level Lending Manager Resume Example

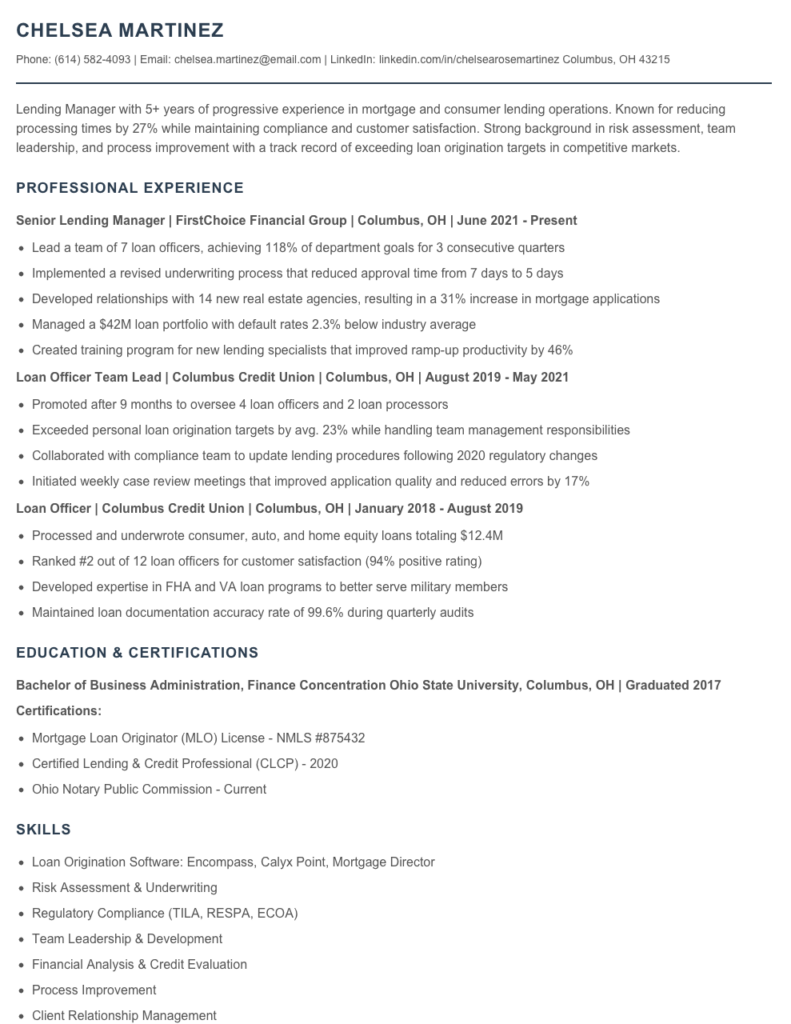

Chelsea Martinez

(614) 582-4093 | chelsea.martinez@email.com | linkedin.com/in/chelsearosemartinez

Columbus, OH 43215

Lending Manager with 5+ years of progressive experience in mortgage and consumer lending operations. Known for reducing processing times by 27% while maintaining compliance and customer satisfaction. Strong background in risk assessment, team leadership, and process improvement with a track record of exceeding loan origination targets in competitive markets.

PROFESSIONAL EXPERIENCE

Senior Lending Manager | FirstChoice Financial Group | Columbus, OH | June 2021 – Present

- Lead a team of 7 loan officers, achieving 118% of department goals for 3 consecutive quarters

- Implemented a revised underwriting process that reduced approval time from 7 days to 5 days

- Developed relationships with 14 new real estate agencies, resulting in a 31% increase in mortgage applications

- Managed a $42M loan portfolio with default rates 2.3% below industry average

- Created training program for new lending specialists that improved ramp-up productivity by 46%

Loan Officer Team Lead | Columbus Credit Union | Columbus, OH | August 2019 – May 2021

- Promoted after 9 months to oversee 4 loan officers and 2 loan processors

- Exceeded personal loan origination targets by avg. 23% while handling team management responsibilities

- Collaborated with compliance team to update lending procedures following 2020 regulatory changes

- Initiated weekly case review meetings that improved application quality and reduced errors by 17%

Loan Officer | Columbus Credit Union | Columbus, OH | January 2018 – August 2019

- Processed and underwrote consumer, auto, and home equity loans totaling $12.4M

- Ranked #2 out of 12 loan officers for customer satisfaction (94% positive rating)

- Developed expertise in FHA and VA loan programs to better serve military members

- Maintained loan documentation accuracy rate of 99.6% during quarterly audits

EDUCATION & CERTIFICATIONS

Bachelor of Business Administration, Finance Concentration

Ohio State University, Columbus, OH | Graduated 2017

Certifications:

- Mortgage Loan Originator (MLO) License – NMLS #875432

- Certified Lending & Credit Professional (CLCP) – 2020

- Ohio Notary Public Commission – Current

SKILLS

- Loan Origination Software: Encompass, Calyx Point, Mortgage Director

- Risk Assessment & Underwriting

- Regulatory Compliance (TILA, RESPA, ECOA)

- Team Leadership & Development

- Financial Analysis & Credit Evaluation

- Process Improvement

- Client Relationship Management

- Microsoft Office Suite & Power BI

- Financial Institution Security Protocols

PROFESSIONAL AFFILIATIONS

Member, Ohio Mortgage Bankers Association

Member, National Association of Credit Management

Senior / Experienced Lending Manager Resume Example

Michael Breslin

mbreslin@outlook.com | (617) 555-8294 | Boston, MA 02118

linkedin.com/in/michaelbreslin | Available for relocation

Lending Manager with 8+ years of experience in consumer and commercial lending operations. Proven track record of developing high-performing teams that consistently exceed portfolio growth targets while maintaining quality standards. Expert in risk assessment, regulatory compliance, and implementing process improvements that increased application throughput by 37% at NorthStar Financial. Known for building strong relationships with both clients and internal stakeholders.

PROFESSIONAL EXPERIENCE

NORTHSTAR FINANCIAL GROUP | Boston, MA

Senior Lending Manager | June 2019 – Present

- Lead a team of 14 loan officers and underwriters responsible for a $278M commercial loan portfolio with a 97.3% performing asset rate

- Restructured approval workflows, cutting average decision time from 6 days to 3.5 days while maintaining risk standards

- Implemented new credit scoring model that reduced first-year defaults by 22% compared to previous system

- Collaborate with Compliance dept to ensure adherence to Dodd-Frank regulations and CECL standards

- Created cross-selling initiative with Wealth Management division that generated $1.2M in additional revenue (2022)

EASTERN COMMERCE BANK | Providence, RI

Lending Manager | August 2016 – May 2019

- Managed consumer and small business lending operations for 7 branch locations across Rhode Island

- Supervised team of 8 loan officers who collectively originated $42M in new loans annually

- Reduced application processing costs by 19% through implementation of digital documentation system

- Developed training program for junior loan officers that improved conversion rates from 62% to 74%

- Served on bank’s ALCO committee, helping to establish lending policies aligned with balance sheet management goals

CITIZENS BANK | Boston, MA

Senior Loan Officer | March 2014 – July 2016

- Managed personal loan portfolio of $23M with delinquency rates 15% below branch average

- Ranked #2 out of 28 loan officers in Northeast region for customer satisfaction (92% approval rating)

- Specialized in small business lending; developed relationships with 45+ local businesses

- Created custom loan packages for complex scenarios that standard products couldn’t address

EDUCATION & CERTIFICATIONS

MBA, Finance – Boston University School of Management, 2015

BS, Business Administration – University of Massachusetts, 2011

Certifications:

Certified Commercial Loan Officer (CCLO) – 2018

Credit Risk Certification (CRC) – 2017

Anti-Money Laundering Specialist (CAMS) – 2016

SKILLS

- Commercial & Consumer Lending

- Credit Analysis & Underwriting

- Regulatory Compliance (ECOA, TILA, Reg Z)

- Portfolio Management

- Team Leadership & Development

- Financial Statement Analysis

- Risk Mitigation Strategies

- Loan Documentation Systems

- nCino Loan Origination Software

- SBA Loan Programs (7a, 504)

PROFESSIONAL AFFILIATIONS

Risk Management Association (RMA) – Member since 2017

Massachusetts Bankers Association – Committee Member, Commercial Lending

How to Write a Lending Manager Resume

Introduction

Getting your Lending Manager resume right can make the difference between landing an interview or getting lost in the pile. I've reviewed thousands of lending resumes over the years, and I've seen firsthand what works—and what doesn't. Banks and financial institutions are looking for specific expertise, regulatory knowledge, and leadership skills that need to shine through from the first glance.

Resume Structure and Format

Your resume needs to be clean and scannable, both for human recruiters (who spend about 7.4 seconds on initial resume reviews) and ATS systems that filter candidates.

- Stick to 1-2 pages (2 pages is acceptable for those with 7+ years of experience)

- Use a clean, professional font like Calibri or Arial at 10-12pt

- Include clear section headings with your name and contact info at the top

- Save as a PDF unless the job posting specifically requests a different format

- Name your file professionally (e.g., "JohnSmith_LendingManager.pdf")

Profile/Summary Section

Your professional summary should be 3-5 lines that immediately position you as a qualified lending professional. Think of it as your elevator pitch—what would make a hiring manager want to keep reading?

Pro tip: Write your summary last! Once you've compiled all your experience and achievements, you'll have a clearer picture of your professional story and can craft a more compelling introduction.

Include your years of experience, lending specializations (commercial, consumer, mortgage), and 1-2 standout accomplishments. For example: "Consumer lending manager with 8+ years at regional banks, specialized in auto loan portfolio management and credit risk assessment. Reduced delinquency rates by 17% while growing loan volume to $42M annually."

Professional Experience

This is where you'll make or break your application. Focus on achievements rather than just listing duties.

- Start each bullet with a strong action verb (built, implemented, managed)

- Include specific metrics where possible (loan volumes, approval rates, portfolio sizes)

- Highlight leadership experience—how many loan officers did you supervise?

- Showcase your risk management skills and compliance knowledge

- Don't forget process improvements or technology implementations you spearheaded

For example, instead of "Responsible for commercial loan applications," write "Evaluated and approved commercial loans worth $17.3M annually while maintaining default rate below 1.2%, exceeding bank targets by 15%."

Education and Certifications

Most lending manager positions require at least a bachelor's degree, often in finance, business, or economics. List your degree(s), institution, and graduation year. If you're early in your career, you can include relevant coursework.

Certifications can set you apart! Include any of these that apply:

- Certified Lender Business Banker (CLBB)

- Credit Risk Certification (CRC)

- Certified Commercial Loan Officer (CCLO)

- MBA or related advanced degree

- Regulatory certifications (BSA/AML, etc.)

Keywords and ATS Tips

Most banks use Applicant Tracking Systems to filter resumes before a human ever sees them. Include these terms naturally throughout your resume:

- Loan portfolio management

- Credit analysis/underwriting

- Regulatory compliance (mention specific regulations like TILA, ECOA, HMDA)

- Risk assessment

- Loan documentation

- Banking software (Fiserv, Jack Henry, etc.)

Industry-specific Terms

Demonstrate your expertise by correctly using industry terminology. Include references to:

- Loan-to-value (LTV) ratios

- Debt service coverage ratios (DSCR)

- Credit risk modeling

- Portfolio segmentation

- Loan origination systems

- Loss mitigation strategies

Common Mistakes to Avoid

I've seen talented lending professionals miss opportunities because of these resume blunders:

- Being vague about loan volumes or portfolio sizes you've managed

- Neglecting to mention compliance knowledge (this is huge in lending!)

- Focusing only on approvals rather than risk management

- Forgetting to highlight team leadership or development of loan officers

- Using outdated terms or systems without showing knowledge of current lending technology

Before/After Example

Before: "Managed loan applications and supervised staff."

After: "Led team of 6 loan officers processing 120+ applications monthly, implementing streamlined approval workflow that reduced time-to-decision by 37% while maintaining strict compliance with Reg B requirements."

The difference? Specific numbers, clear achievements, regulatory knowledge, and leadership skills all packed into one bullet point that tells a story about your capabilities as a Lending Manager.

Related Resume Examples

Soft skills for your Lending Manager resume

- Cross-functional relationship building (especially with risk assessment, compliance, and sales teams)

- Decisive judgment in loan approval situations, balancing risk tolerance with business goals

- Client-centered communication that translates complex financial terms into understandable language

- Conflict resolution when handling loan escalations or customer disputes

- Team mentoring abilities – I’ve developed 4 junior underwriters into full lending roles

- Stress management during high-volume application periods (like Q4 refinancing rushes)

Hard skills for your Lending Manager resume

- Loan Origination System (LOS) proficiency – Encompass, Calyx Point, MortgageBot

- Credit analysis and risk assessment techniques using FICO and VantageScore models

- Regulatory compliance expertise (TILA-RESPA, HMDA, FCRA, Reg Z)

- Financial underwriting – DTI calculation, income verification, asset evaluation

- Portfolio management and loan servicing platforms (Black Knight MSP, FiServ)

- Mortgage Loan Originator (MLO) license – NMLS #876543

- Data visualization and reporting with Tableau and Microsoft Power BI

- SQL querying for loan database management and reporting

- MISMO mortgage industry standards implementation