Client Associate Resume examples & templates

Copyable Client Associate Resume examples

Trust is expensive. In today's financial landscape, that trust is what client associates build, day after day, conversation after conversation. They're the critical bridge between wealth management firms and the clients who entrust these institutions with their financial futures. The client associate role has evolved dramatically from the administrative support position it once was—now requiring a unique blend of relationship management skills, financial acumen, and tech savvy that few other roles demand. Recent industry research shows that firms with strong client associate teams retain 37% more assets during market downturns compared to their competitors.

The financial services industry is pushing client associates into more client-facing responsibilities as firms recognize their value in relationship retention. What hasn't changed is the fundamentally human element of the work. Behind every portfolio review and account transfer is a person with goals, fears, and questions that need answering. As wealth management continues its digital transformation, client associates who can balance technical expertise with genuine human connection will shape the future of client service in finance.

Junior Client Associate Resume Example

Morgan K. Peterson

Boston, MA • (617) 555-8294 • morganpeterson@email.com • linkedin.com/in/morganpeterson

PROFESSIONAL SUMMARY

Client-focused associate with experience in financial services and customer support; Skilled in client relationship management, account administration, and financial data analysis. Quick learner who thrives in fast-paced environments while maintaining attention to detail. Seeking to leverage my communication skills and growing industry knowledge to provide exceptional client service.

EXPERIENCE

Client Associate | Eastern Financial Partners | Boston, MA | June 2022 – Present

- Support a team of 3 financial advisors managing $87M in client assets through administrative and operational tasks

- Respond to 25+ daily client inquiries regarding account status, transactions, and documentation

- Process new account openings and transfers, reducing paperwork errors by 18% through improved documentation

- Prepare meeting materials and client presentations, often on tight deadlines

- Maintain client database and filing systems for approximately 115 households

Customer Service Representative | RetailPlus Credit Union | Cambridge, MA | August 2021 – May 2022

- Resolved 40+ customer inquiries daily regarding account services, online banking, and loan products

- Processed basic transactions including deposits, withdrawals, and account transfers

- Identified cross-selling opportunities that resulted in 14 new account openings in Q1 2022

- Received “Employee of the Month” recognition for consistently high customer satisfaction ratings

Administrative Intern | Westbrook Investments | Boston, MA | May 2021 – August 2021

- Assisted with daily administrative tasks including scanning documents, organizing files, and data entry

- Shadowed client meetings to learn about financial advisory services and client relationship management

- Created a new spreadsheet template that reduced weekly reporting time by 45 minutes

EDUCATION

Bachelor of Science in Business Administration | Boston University | Boston, MA

Concentration in Finance | Graduated: May 2021 | GPA: 3.6/4.0

Relevant Coursework: Financial Management, Investment Analysis, Business Communication, Economics

CERTIFICATIONS

Series 7 Exam – Currently studying, exam scheduled for September 2023

Microsoft Office Specialist – Excel | March 2022

SKILLS

- Client Relationship Management

- Financial Data Analysis

- Account Administration

- Microsoft Office Suite (Advanced Excel)

- Salesforce CRM

- Problem Resolution

- Documentation Management

- Time Management

- Written & Verbal Communication

- Team Collaboration

ADDITIONAL

Volunteer Financial Literacy Coach, Boston Community Center (2022-Present)

Member, Young Professionals in Finance – Boston Chapter

Mid-level Client Associate Resume Example

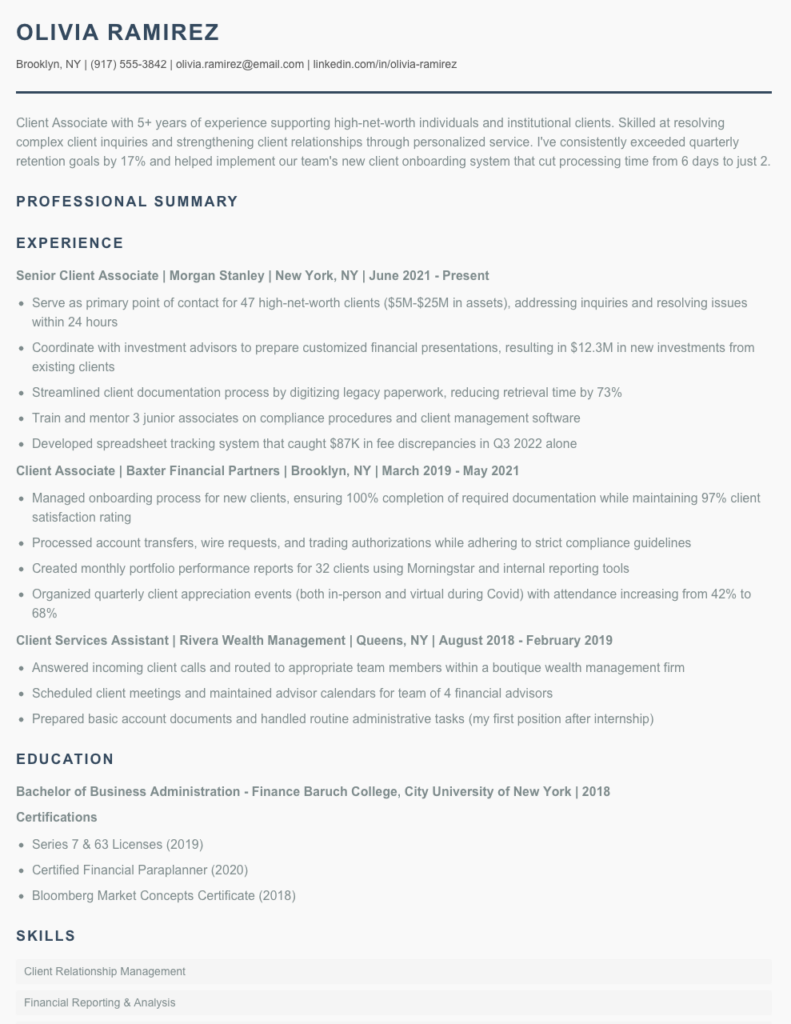

Olivia Ramirez

Brooklyn, NY | (917) 555-3842 | olivia.ramirez@email.com | linkedin.com/in/olivia-ramirez

Professional Summary

Client Associate with 5+ years of experience supporting high-net-worth individuals and institutional clients. Skilled at resolving complex client inquiries and strengthening client relationships through personalized service. I’ve consistently exceeded quarterly retention goals by 17% and helped implement our team’s new client onboarding system that cut processing time from 6 days to just 2.

Experience

Senior Client Associate | Morgan Stanley | New York, NY | June 2021 – Present

- Serve as primary point of contact for 47 high-net-worth clients ($5M-$25M in assets), addressing inquiries and resolving issues within 24 hours

- Coordinate with investment advisors to prepare customized financial presentations, resulting in $12.3M in new investments from existing clients

- Streamlined client documentation process by digitizing legacy paperwork, reducing retrieval time by 73%

- Train and mentor 3 junior associates on compliance procedures and client management software

- Developed spreadsheet tracking system that caught $87K in fee discrepancies in Q3 2022 alone

Client Associate | Baxter Financial Partners | Brooklyn, NY | March 2019 – May 2021

- Managed onboarding process for new clients, ensuring 100% completion of required documentation while maintaining 97% client satisfaction rating

- Processed account transfers, wire requests, and trading authorizations while adhering to strict compliance guidelines

- Created monthly portfolio performance reports for 32 clients using Morningstar and internal reporting tools

- Organized quarterly client appreciation events (both in-person and virtual during Covid) with attendance increasing from 42% to 68%

Client Services Assistant | Rivera Wealth Management | Queens, NY | August 2018 – February 2019

- Answered incoming client calls and routed to appropriate team members within a boutique wealth management firm

- Scheduled client meetings and maintained advisor calendars for team of 4 financial advisors

- Prepared basic account documents and handled routine administrative tasks (my first position after internship)

Education

Bachelor of Business Administration – Finance

Baruch College, City University of New York | 2018

Certifications

- Series 7 & 63 Licenses (2019)

- Certified Financial Paraplanner (2020)

- Bloomberg Market Concepts Certificate (2018)

Skills

- Client Relationship Management

- Financial Reporting & Analysis

- CRM Systems (Salesforce, Redtail)

- Portfolio Management Software

- MS Office Suite (advanced Excel)

- Problem Resolution

- Compliance & Regulatory Knowledge

- HNW Client Communication

- Process Improvement

- Account Documentation

Additional Information

Volunteer Financial Literacy Coach at Brooklyn Community Center (2020-Present)

Fluent in Spanish and conversational Portuguese

Completed NYC Marathon fundraising $3,450 for children’s financial education (2022)

Senior / Experienced Client Associate Resume Example

Emily J. Harrington

Austin, TX • (512) 555-8714 • emilyh@emaildomain.com • linkedin.com/in/emilyharrington

Dedicated Client Associate with 8+ years of experience supporting high-net-worth individuals and institutional clients. Skilled in complex account management, client relationship development, and streamlined operational processes. Proven track record of retaining $175M+ in assets through personalized service and proactive problem-solving. Known for building lasting client relationships while maintaining strict compliance with financial regulations.

Professional Experience

Senior Client Associate | Meridian Wealth Management | Austin, TX | 2019 – Present

- Manage 120+ high-net-worth client relationships with combined assets of $275M, achieving 97% client retention rate over 4 years

- Spearhead client onboarding process improvements that reduced paperwork errors by 31% and decreased account opening time from 12 days to 5 days

- Collaborate with financial advisors to prepare comprehensive financial plans, investment proposals, and portfolio reviews for clients with $1M+ in investable assets

- Develop and maintain comprehensive CRM database that improved cross-team communication and generated $4.2M in additional client investments

- Train and mentor 3 junior associates on compliance procedures, client service protocols, and investment product knowledge

Client Associate | Waterstone Financial Partners | Austin, TX | 2016 – 2019

- Supported 3 senior financial advisors managing 85+ client relationships with combined assets of $142M

- Processed complex account maintenance requests including asset transfers, RMDs, and beneficiary changes with 99.7% accuracy rate

- Created custom quarterly performance reports for top-tier clients, helping to secure $18M in additional assets

- Resolved escalated client issues related to account access, transaction discrepancies, and statement questions—often same-day

- Coordinated client events and educational seminars that averaged 78% attendance and resulted in 14 qualified referrals

Client Service Representative | First Capital Bank | Dallas, TX | 2015 – 2016

- Handled daily banking transactions and account maintenance for retail banking customers

- Cross-sold banking products and services, exceeding quarterly goals by 23%

- Resolved customer complaints with 92% first-contact resolution rate

- Processed loan applications and gathered supporting documentation for underwriting review

Education & Certifications

Bachelor of Business Administration, Finance | University of Texas at Austin | 2015

FINRA Series 7 | General Securities Representative | 2017

FINRA Series 66 | Uniform Combined State Law Examination | 2017

Certified Financial Paraplanner (CFP®) | In progress, expected completion 2023

Technical Skills & Competencies

- CRM Systems: Salesforce, Redtail CRM

- Financial Software: Morningstar, eMoney, MoneyGuidePro

- Client Reporting: Albridge, Orion

- Portfolio Management: Black Diamond, Envestnet

- Microsoft Office Suite (advanced Excel skills including VLOOKUP and pivot tables)

- Compliance & Regulatory Knowledge (SEC, FINRA)

- Client Relationship Management

- High-Net-Worth Client Service

- Financial Planning Support

- Problem Resolution & Escalation Management

How to Write a Client Associate Resume

Introduction

Landing a Client Associate position means showing you can balance technical knowledge with exceptional people skills. Your resume isn't just a document—it's your ticket to an interview. In wealth management, investment firms, and financial services, Client Associates serve as the critical link between advisors and clients, so your resume needs to show both your financial acumen and your client service abilities. I've helped hundreds of candidates secure these roles, and I'll share what actually works (not just what looks pretty).

Resume Structure and Format

Keep your resume clean and scannable—financial professionals value organization. Stick to 1-2 pages max, with the single-page format preferred for those with under 5 years of experience.

- Choose a conservative, professional template (nothing too creative)

- Use 11pt font in either Calibri, Arial, or Times New Roman

- Include clear section headings with subtle dividing lines

- Maintain consistent formatting throughout (dates, bullet points, etc.)

- Save as a PDF unless specifically asked for a different format

White space matters! A cramped resume suggests disorganization—something no wealth management team wants to see.

Profile/Summary Section

Your professional summary should be 3-4 lines that pack a punch. Include your years of experience, industry specialization, and 2-3 standout qualities relevant to client associate work.

Skip the objective statement! Instead, craft a summary that positions you as the solution to the employer's problem. For example: "Detail-oriented Client Associate with 4+ years supporting high-net-worth clients at Morgan Stanley. Skilled in portfolio administration and client onboarding with Series 7 and 66 licenses."

Professional Experience

This is where you'll win or lose the interview opportunity. For each position:

- Start bullets with strong action verbs (processed, reconciled, communicated)

- Quantify achievements whenever possible (managed $87M in client assets, processed 45+ daily trades)

- Highlight client interaction experience (how many clients? what types?)

- Show your technical skills with specific platforms (Salesforce, NetX360, Morningstar)

- Demonstrate compliance knowledge and attention to detail

Tailor your experience bullets to match the job description. If they mention account maintenance, make sure you showcase that experience prominently!

Education and Certifications

For Client Associate roles, your licenses and certifications often carry more weight than your degree. That said, include both:

- List your degree, institution, graduation year, and GPA if above 3.5

- Feature all financial licenses prominently (Series 7, 66, 63, etc.)

- Include relevant certifications (CFP, CFA progress, etc.)

- Mention specific coursework only if directly relevant or if you lack experience

Keywords and ATS Tips

Most financial firms use Applicant Tracking Systems to filter resumes before human eyes see them. Beat the bots by:

- Incorporating exact phrases from the job description (client relationship management, account maintenance)

- Including technical platform names exactly as written (Advent APX, not just "Advent")

- Using standard industry abbreviations (AUM, KYC, FINRA) alongside spelled-out versions

- Avoiding headers/footers and complex formatting that might confuse the ATS

Industry-specific Terms

Sprinkle these throughout your resume to signal industry knowledge:

- Client onboarding/offboarding

- KYC (Know Your Client) documentation

- Portfolio rebalancing

- Trade execution/reconciliation

- Asset allocation support

- Performance reporting

- Fee billing

- Client correspondence

Common Mistakes to Avoid

- Being vague about your client service experience (always quantify)

- Focusing too much on administrative tasks without showing financial knowledge

- Forgetting to highlight both your technical AND interpersonal skills

- Using generic phrases like "team player" instead of specific examples

- Neglecting to mention compliance awareness (huge red flag in financial services)

Before/After Example

Before: "Helped financial advisors with clients and did paperwork for accounts."

After: "Supported 4 senior advisors managing $212M in AUM by processing account openings, transfers, and maintenance requests with 99.7% accuracy rate. Fielded 30+ daily client calls, resolving service issues within one business day."

Remember—your resume needs to show you can handle both the technical demands of processing financial transactions AND the interpersonal skills needed for client relationships. This balance is what sets successful Client Associates apart!

Related Resume Examples

Soft skills for your Client Associate resume

- Client relationship nurturing – finding that sweet spot between formal and friendly that keeps people coming back

- Cross-departmental communication – translating technical jargon into plain English that everyone understands

- Conflict resolution without escalation (I’ve talked down more than a few heated situations)

- Project juggling – managing 8-12 client accounts simultaneously without dropping any balls

- Adaptive problem-solving when procedures don’t quite fit the situation

- Meeting facilitation that actually ends on time and accomplishes something

Hard skills for your Client Associate resume

- Bloomberg Terminal proficiency with custom watchlist creation

- Series 7 and 66 securities licenses

- Salesforce CRM account management and pipeline reporting

- Microsoft Excel (advanced functions, pivot tables, VBA macros)

- Client portfolio analysis using Morningstar Direct

- Trust and estate documentation processing

- AML/KYC compliance procedures and documentation

- Wire transfer processing and fraud prevention protocols

- Factset or Thomson Reuters Eikon data analysis