Business Banker Resume examples & templates

Copyable Business Banker Resume examples

Ever wondered why some business bankers thrive in economic uncertainty while others struggle? The secret often lies in their ability to balance analytical skills with genuine relationship building. Business banking has evolved far beyond simple credit decisions and deposit accounts—today's bankers serve as strategic financial partners who help businesses navigate complex challenges from cash flow optimization to expansion financing. With the rise of fintech disruption (small business lending from non-traditional sources grew by 17.3% in 2022), modern business bankers need both traditional financial expertise and digital fluency.

The banking landscape is shifting rapidly, with many institutions investing in specialized industry knowledge to differentiate themselves. Bankers who understand sector-specific challenges—whether in healthcare, manufacturing, or professional services—bring extra value to their clients. Even as AI and automation handle more routine transactions, the human element remains crucial. Looking ahead, successful business bankers will likely be those who can translate mountains of financial data into practical, actionable guidance while maintaining the personal touch that technology simply can't replicate.

Junior Business Banker Resume Example

Tyler Jacobson

Pittsburgh, PA • (412) 555-7834 • tjacobson@emailpro.com

linkedin.com/in/tylerjacobson • Available for relocation

Junior Business Banker with 1+ year of experience in commercial banking operations and small business lending. Strong background in relationship management and financial analysis developed through internships and recent professional experience. Quick learner who thrives in collaborative environments while managing multiple priorities. Currently pursuing CTP certification to strengthen technical banking knowledge.

EXPERIENCE

Business Banking Associate • First Commonwealth Bank • Pittsburgh, PA • January 2023 – Present

- Support portfolio of 47 small-to-medium business clients with combined deposits of $14.2M

- Process loan applications for commercial lines of credit up to $250K, completing initial assessments and gathering documentation

- Collaborate with senior business bankers to prepare and present cash management solutions, resulting in 3 new merchant services implementations

- Respond to client inquiries regarding account services, loan status, and online banking issues, maintaining 94% client satisfaction rating

- Participate in weekly business development meetings and assist with 2-3 client site visits monthly

Commercial Banking Intern • PNC Bank • Pittsburgh, PA • May 2022 – August 2022

- Assisted commercial lending team with credit analyses and financial statement reviews for 12 business clients

- Researched industry trends to support relationship managers’ business development efforts

- Created Excel tracking system for pending loan applications that reduced processing time by 9%

- Shadowed business bankers during client meetings and prepared follow-up documentation

Branch Teller (Part-time) • Citizens Bank • Pittsburgh, PA • September 2021 – December 2022

- Processed average of 75+ daily transactions including deposits, withdrawals, and loan payments

- Identified opportunities to refer customers to personal bankers for business accounts and services

- Balanced daily transactions with 100% accuracy and assisted with vault counts

- Recognized for excellent customer service during quarterly branch evaluations

EDUCATION

Bachelor of Science in Finance • University of Pittsburgh • Pittsburgh, PA • May 2022

- Minor: Business Administration

- GPA: 3.7/4.0

- Relevant Coursework: Commercial Banking, Financial Statement Analysis, Corporate Finance, Business Law

- Member, Finance Club; Participant, Banking Career Development Program

CERTIFICATIONS & PROFESSIONAL DEVELOPMENT

Certified Treasury Professional (CTP) • In Progress, Expected Completion December 2023

Commercial Lending Fundamentals Certificate • American Bankers Association • June 2023

Pennsylvania Notary Public License • October 2022

SKILLS

- Commercial Lending: Basic loan analysis, document collection, credit assessment

- Financial Analysis: Cash flow analysis, balance sheet review, financial statement interpretation

- Banking Systems: Fiserv, nCino, Jack Henry (basic proficiency)

- CRM Software: Salesforce (basic), Microsoft Dynamics

- Technical: Advanced Excel (VLOOKUP, pivot tables, financial modeling), PowerPoint, Word

- Soft Skills: Client relationship building, active listening, problem-solving, attention to detail

- Compliance: Familiar with BSA/AML requirements, KYC procedures, Reg B

ADDITIONAL

Active volunteer with Junior Achievement of Western Pennsylvania, teaching financial literacy to high school students

Mid-level Business Banker Resume Example

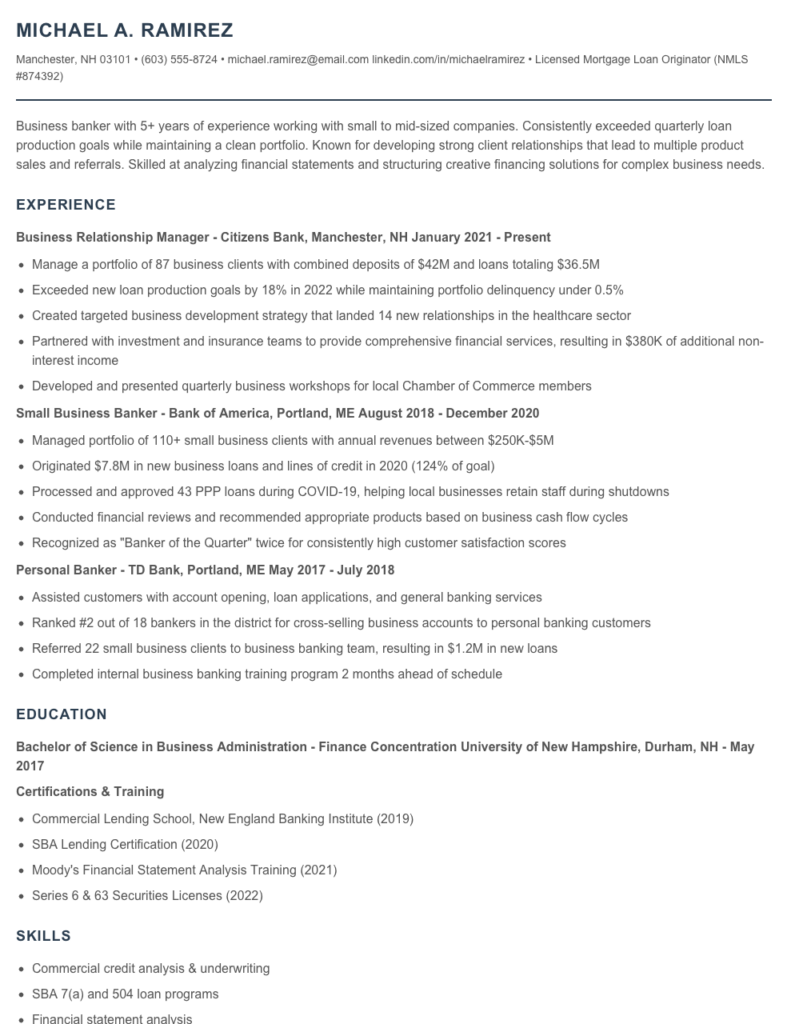

Michael A. Ramirez

Manchester, NH 03101 • (603) 555-8724 • michael.ramirez@email.com

linkedin.com/in/michaelramirez • Licensed Mortgage Loan Originator (NMLS #874392)

Business banker with 5+ years of experience working with small to mid-sized companies. Consistently exceeded quarterly loan production goals while maintaining a clean portfolio. Known for developing strong client relationships that lead to multiple product sales and referrals. Skilled at analyzing financial statements and structuring creative financing solutions for complex business needs.

EXPERIENCE

Business Relationship Manager – Citizens Bank, Manchester, NH

January 2021 – Present

- Manage a portfolio of 87 business clients with combined deposits of $42M and loans totaling $36.5M

- Exceeded new loan production goals by 18% in 2022 while maintaining portfolio delinquency under 0.5%

- Created targeted business development strategy that landed 14 new relationships in the healthcare sector

- Partnered with investment and insurance teams to provide comprehensive financial services, resulting in $380K of additional non-interest income

- Developed and presented quarterly business workshops for local Chamber of Commerce members

Small Business Banker – Bank of America, Portland, ME

August 2018 – December 2020

- Managed portfolio of 110+ small business clients with annual revenues between $250K-$5M

- Originated $7.8M in new business loans and lines of credit in 2020 (124% of goal)

- Processed and approved 43 PPP loans during COVID-19, helping local businesses retain staff during shutdowns

- Conducted financial reviews and recommended appropriate products based on business cash flow cycles

- Recognized as “Banker of the Quarter” twice for consistently high customer satisfaction scores

Personal Banker – TD Bank, Portland, ME

May 2017 – July 2018

- Assisted customers with account opening, loan applications, and general banking services

- Ranked #2 out of 18 bankers in the district for cross-selling business accounts to personal banking customers

- Referred 22 small business clients to business banking team, resulting in $1.2M in new loans

- Completed internal business banking training program 2 months ahead of schedule

EDUCATION

Bachelor of Science in Business Administration – Finance Concentration

University of New Hampshire, Durham, NH – May 2017

Certifications & Training

- Commercial Lending School, New England Banking Institute (2019)

- SBA Lending Certification (2020)

- Moody’s Financial Statement Analysis Training (2021)

- Series 6 & 63 Securities Licenses (2022)

SKILLS

- Commercial credit analysis & underwriting

- SBA 7(a) and 504 loan programs

- Financial statement analysis

- Cash flow forecasting

- Business development & relationship management

- Salesforce CRM

- nCino loan origination platform

- MS Excel (advanced formulas, pivot tables)

- Public speaking & client presentations

- Commercial real estate lending

COMMUNITY INVOLVEMENT

Greater Manchester Chamber of Commerce – Ambassador Committee Member (2021-Present)

Junior Achievement of New Hampshire – Volunteer Financial Literacy Instructor (2019-Present)

Senior / Experienced Business Banker Resume Example

JEFFREY M. HARRISON

Portland, OR | (503) 555-8972 | jharrison@emaildomain.com | linkedin.com/in/jeffreyharrison

Business Banking professional with 9+ years of experience managing commercial relationships and loan portfolios. Track record of growing deposits by $42M across a diverse client base while maintaining exceptional credit quality. Known for developing lasting client relationships through financial analysis and customized banking solutions. Consistently exceeded quarterly goals by an average of 17% over the past 5 years.

PROFESSIONAL EXPERIENCE

SENIOR RELATIONSHIP MANAGER, BUSINESS BANKING

First Northwest Bank, Portland, OR | August 2019 – Present

- Manage portfolio of 87 business relationships with combined deposits of $78M and loans totaling $112M

- Spearheaded bank’s PPP loan initiative during COVID-19, processing 134 loans totaling $22.8M while creating streamlined documentation process that reduced approval time by 31%

- Expanded existing client relationships by 23% through proactive financial reviews and cross-selling treasury management services

- Recruited and mentored 4 junior bankers, 2 of whom were promoted to Relationship Manager positions

- Serve on bank’s Commercial Credit Committee, reviewing complex loan structures exceeding $1M

BUSINESS BANKING RELATIONSHIP MANAGER

Pacific Commerce Bank, Seattle, WA | June 2016 – July 2019

- Managed portfolio of 65+ business clients with annual revenues between $1M-$15M

- Grew loan portfolio from $42M to $68M while maintaining delinquency rates below 0.7%

- Collaborated with wealth management team to capture $14.2M in investment assets from business owners

- Led bank’s Manufacturing Industry Group, developing specialized knowledge in equipment financing

- Achieved President’s Club recognition in 2017 and 2018 for exceeding production goals

BUSINESS BANKING OFFICER

United Regional Bank, Portland, OR | March 2014 – May 2016

- Developed and managed portfolio of small business clients with revenues under $5M

- Originated $12.4M in new loans and $8.7M in deposits within first 18 months

- Partnered with branch managers to identify referral opportunities, resulting in 28 new business relationships

- Completed bank’s intensive credit training program (finished top 3 in class of 22)

EDUCATION & CERTIFICATIONS

MASTER OF BUSINESS ADMINISTRATION – Finance Concentration

University of Washington, Seattle, WA (2013)

BACHELOR OF SCIENCE, BUSINESS ADMINISTRATION

Oregon State University, Corvallis, OR (2011)

CERTIFICATIONS

- Commercial Lending School Graduate, Western Banking Association (2018)

- Certified Treasury Professional (CTP) (2020)

- RMA Credit Risk Certification (2017)

SKILLS & EXPERTISE

- Commercial Credit Analysis & Underwriting

- Financial Statement Analysis

- Complex Loan Structuring

- Cash Flow Projections

- Treasury Management Solutions

- Relationship Management

- Business Development & Networking

- SBA Lending Programs (7a, 504)

- Microsoft Office Suite & Moody’s Financial Analyst

- Salesforce CRM

COMMUNITY INVOLVEMENT

Board Treasurer, Portland Small Business Development Center (2020-Present)

Member, Oregon Bankers Association – Young Professionals Committee (2017-Present)

How to Write a Business Banker Resume

Introduction

Landing that perfect Business Banker job starts with a resume that speaks the language of financial institutions. I've reviewed thousands of banking resumes over the years, and the difference between those that get interviews and those that don't often comes down to how effectively candidates showcase their banking expertise, relationship-building skills, and understanding of business finances. Your resume isn't just a career history—it's your ticket to getting past gatekeepers and into the interview room where you can really shine.

Resume Structure and Format

First impressions matter in banking, just like they do with your resume. Keep these format basics in mind:

- Length: Stick to 1-2 pages maximum (1 page for those with under 7 years experience)

- Font: Conservative choices like Calibri, Arial, or Garamond in 10-12pt size

- Margins: 0.75-1 inch all around for a clean, professional look

- File format: Submit as PDF unless specifically asked for another format

- Structure: Chronological format works best for most banking positions

Beyond these basics, make sure your contact info is prominent and includes your LinkedIn URL. Many hiring managers will check you out there before even finishing your resume.

Profile/Summary Section

Your professional summary should hook the reader in 3-5 lines. For a Business Banker position, highlight your lending experience, client portfolio management skills, and track record in growing business relationships.

Think of your summary as your "elevator pitch"—if you had 30 seconds to explain why you're the perfect Business Banker, what would you say?

Example: "Business Banking Officer with 6+ years experience managing a $42M loan portfolio and growing business deposits by 27% YOY. Specialized in relationship banking for manufacturing clients with revenues of $5-25M. Known for converting 8 out of 10 prospects through consultative needs analysis."

Professional Experience

This section carries the most weight. Focus on these elements:

- Quantify your results (loan portfolio size, deposit growth, client retention rates)

- Highlight specific industries you've worked with (manufacturing, healthcare, etc.)

- Showcase credit analysis and underwriting expertise

- Mention any cross-selling success with treasury management, merchant services, etc.

- Include experience with specific lending products (SBA loans, lines of credit, commercial real estate)

For example, rather than saying "Managed business clients," write "Managed relationships with 47 business clients with annual revenues between $2-15M, resulting in $3.8M in new loan originations and $5.2M in deposit growth in 2022."

Education and Certifications

List your degrees in reverse chronological order. For Business Banker positions, these certifications can set you apart:

- Certified Treasury Professional (CTP)

- Credit Risk Certification (CRC)

- Commercial Lending Certification

- Series 6, 7, or 63 licenses (if applicable)

- MBA or Finance-related master's degrees

Even if your degree isn't in finance or business, highlight relevant coursework or continuing education that demonstrates your commitment to the field.

Keywords and ATS Tips

Most banks use Applicant Tracking Systems that scan for specific keywords. These terms should appear naturally throughout your resume:

- Commercial lending

- Relationship management

- Portfolio growth

- Credit analysis

- Financial statement analysis

- Business development

- Cash management services

- Loan origination

Industry-specific Terms

Show your banking knowledge by naturally incorporating industry terms like:

- Global cash positioning

- Treasury management

- Working capital solutions

- Debt service coverage ratio

- Covenant compliance

- Cross-collateralization

Common Mistakes to Avoid

- Listing job duties instead of achievements (say "increased loan portfolio by 31%" not "responsible for loan portfolio")

- Focusing too much on consumer banking if applying for business banking

- Leaving out metrics and numbers (banking is all about the figures!)

- Using generic terms like "team player" or "hard worker" instead of specific banking skills

- Failing to customize for each bank's specific business client focus

Before/After Example

Before: "Responsible for developing new business relationships and maintaining existing ones."

After: "Cultivated 12 new business banking relationships ($1-5M revenue range) generating $875K in new loans and $1.2M in deposits within first 6 months. Retained 93% of existing portfolio during bank merger by conducting proactive client consultations."

Remember—your resume isn't just a list of jobs. It's a marketing document that should tell the story of how your banking experience makes you the perfect fit for their specific business banking needs. Good luck!

Related Resume Examples

Soft skills for your Business Banker resume

- Relationship building with varied client types – from small businesses to mid-sized companies (developed trust with 40+ long-term clients)

- Consultative selling approach rather than transaction-focused interactions

- Financial storytelling – translating complex banking products into meaningful business solutions

- Crisis management during unexpected client situations (payment issues, fraud concerns, etc.)

- Cross-functional teamwork with credit analysts, underwriters, and branch staff

- Active listening to uncover unstated client needs beyond initial requests

Hard skills for your Business Banker resume

- Loan Underwriting & Portfolio Risk Analysis

- Financial Statements Interpretation (Cash Flow, Balance Sheet, P&L)

- Small Business Administration (SBA) Loan Processing

- CRM Software – Salesforce & nCino

- Commercial Credit Analysis & Financial Modeling

- Treasury Management Solutions & Implementation

- Compliance with BSA/AML & KYC Guidelines

- Business Valuation & Collateral Assessment

- Banking Software – Fiserv, FIS, or Jack Henry