Commercial Loan Officer Resume examples & templates

Copyable Commercial Loan Officer Resume examples

Ever wondered who's behind the scenes making those big business expansions possible? Commercial Loan Officers are the financial matchmakers who connect ambitious businesses with the capital they need to grow. It's a role that blends analytical precision with relationship-building skills—you're part number-cruncher, part trusted advisor, and sometimes even part therapist when deals get complicated! In today's economy, with interest rates finally stabilizing after a period of historic volatility, Commercial Loan Officers find themselves navigating a landscape where businesses are cautiously returning to expansion plans.

The field is evolving quickly, with digital lending platforms transforming the application process while creating new opportunities for loan officers who can blend traditional relationship banking with tech-savvy approaches. According to the Bureau of Labor Statistics, loan officers (including commercial) earn a median annual wage of $63,380, though top performers at larger institutions can easily earn into six figures with commission structures. Commercial lending expertise is becoming particularly valuable as banks compete for quality business loans in an environment where 37% of small businesses report difficulty accessing adequate financing. Looking ahead, those who can effectively assess risk while building genuine relationships with clients will find themselves in high demand as economic cycles continue to evolve.

Junior Commercial Loan Officer Resume Example

Anthony J. Ferrera

Hartford, CT 06103 • (860) 555-4287 • aferrera@email.com • linkedin.com/in/anthonyferrera

Detail-oriented Commercial Loan Officer with foundational experience in credit analysis and loan processing. Quick learner who combines financial acumen with relationship-building skills to support business clients. Proven track record of accurately reviewing financial documentation and assisting with loan applications that resulted in successful loan closings. Recent graduate with relevant internship experience and formal banking training.

Experience

Junior Commercial Loan Officer

First Connecticut Bank • Hartford, CT • January 2023 – Present

- Process and analyze 12-15 commercial loan applications monthly, performing initial risk assessments and financial spreads

- Support senior loan officers in managing a $42M portfolio of small to mid-sized business loans

- Prepare loan documentation packages and coordinate with legal team to ensure compliance with bank policies

- Participate in client meetings to gather financial information and explain loan products

- Reduced loan processing time by 17% by implementing a new documentation checklist system

Commercial Credit Analyst Intern

First Connecticut Bank • Hartford, CT • June 2022 – December 2022

- Analyzed financial statements, tax returns, and business plans to assess credit risk for potential borrowers

- Assisted in reviewing 30+ loan applications for businesses with annual revenues between $500K and $5M

- Created financial spreads using Excel and the bank’s proprietary lending software

- Drafted credit memos summarizing financial position and risk factors for loan committee review

Customer Service Representative

Main Street Credit Union • New Haven, CT • May 2021 – May 2022

- Handled daily transactions and resolved customer inquiries in a fast-paced branch environment

- Cross-sold banking products, exceeding quarterly referral goals by 23%

- Identified potential commercial clients and referred them to the business banking department

- Processed consumer loan applications and gathered required documentation

Education

Bachelor of Science in Finance

University of Connecticut • Storrs, CT • Graduated May 2022

- Relevant Coursework: Commercial Banking, Financial Statement Analysis, Business Lending, Risk Management

- Senior Project: Analysis of Small Business Lending Practices in Community Banks

- GPA: 3.7/4.0

Certifications

- Commercial Lending School Certificate – Connecticut Bankers Association (2023)

- ABA Certificate in Business and Commercial Lending (In progress, expected completion August 2023)

- Excel Specialist Certification (2022)

Skills

- Financial Statement Analysis

- Credit Risk Assessment

- Loan Documentation

- Relationship Management

- Moody’s Analytics

- nCino Loan Origination Software

- Microsoft Office Suite (advanced Excel)

- Commercial Real Estate Fundamentals

- Regulatory Compliance (BSA/AML)

- Small Business Administration (SBA) Loan Programs

Professional Affiliations

- Connecticut Young Bankers Association, Member

- Risk Management Association (RMA), Associate Member

Mid-level Commercial Loan Officer Resume Example

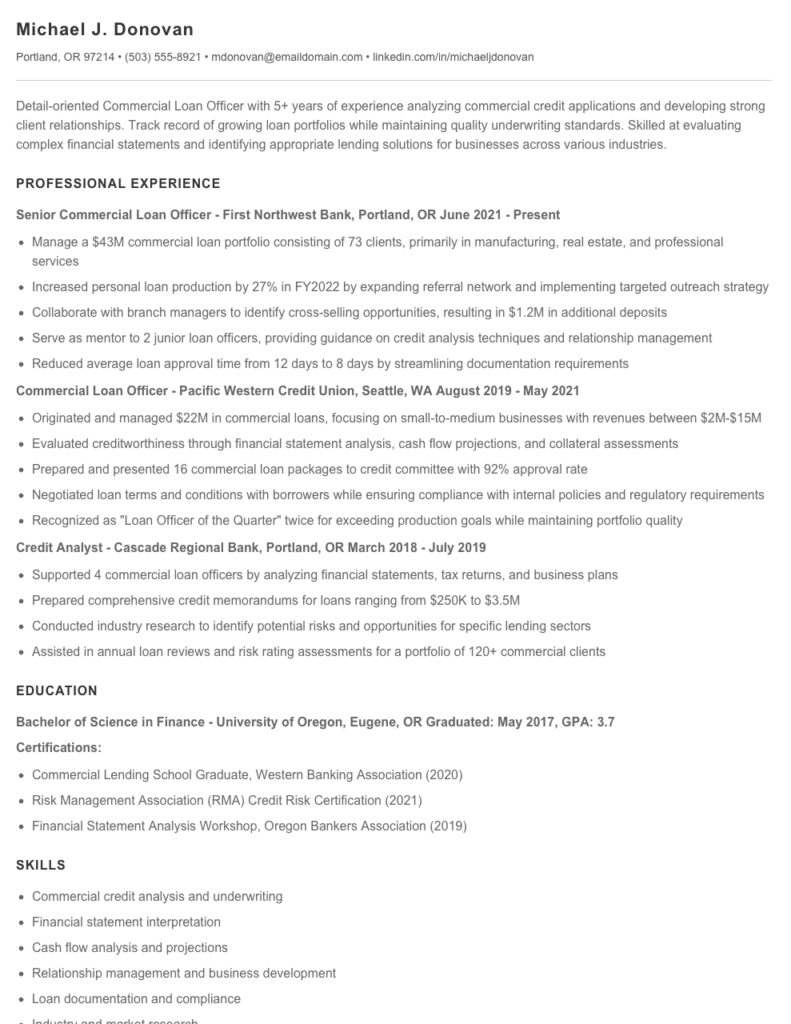

Michael J. Donovan

Portland, OR 97214 • (503) 555-8921 • mdonovan@emaildomain.com • linkedin.com/in/michaeljdonovan

Detail-oriented Commercial Loan Officer with 5+ years of experience analyzing commercial credit applications and developing strong client relationships. Track record of growing loan portfolios while maintaining quality underwriting standards. Skilled at evaluating complex financial statements and identifying appropriate lending solutions for businesses across various industries.

PROFESSIONAL EXPERIENCE

Senior Commercial Loan Officer – First Northwest Bank, Portland, OR

June 2021 – Present

- Manage a $43M commercial loan portfolio consisting of 73 clients, primarily in manufacturing, real estate, and professional services

- Increased personal loan production by 27% in FY2022 by expanding referral network and implementing targeted outreach strategy

- Collaborate with branch managers to identify cross-selling opportunities, resulting in $1.2M in additional deposits

- Serve as mentor to 2 junior loan officers, providing guidance on credit analysis techniques and relationship management

- Reduced average loan approval time from 12 days to 8 days by streamlining documentation requirements

Commercial Loan Officer – Pacific Western Credit Union, Seattle, WA

August 2019 – May 2021

- Originated and managed $22M in commercial loans, focusing on small-to-medium businesses with revenues between $2M-$15M

- Evaluated creditworthiness through financial statement analysis, cash flow projections, and collateral assessments

- Prepared and presented 16 commercial loan packages to credit committee with 92% approval rate

- Negotiated loan terms and conditions with borrowers while ensuring compliance with internal policies and regulatory requirements

- Recognized as “Loan Officer of the Quarter” twice for exceeding production goals while maintaining portfolio quality

Credit Analyst – Cascade Regional Bank, Portland, OR

March 2018 – July 2019

- Supported 4 commercial loan officers by analyzing financial statements, tax returns, and business plans

- Prepared comprehensive credit memorandums for loans ranging from $250K to $3.5M

- Conducted industry research to identify potential risks and opportunities for specific lending sectors

- Assisted in annual loan reviews and risk rating assessments for a portfolio of 120+ commercial clients

EDUCATION

Bachelor of Science in Finance – University of Oregon, Eugene, OR

Graduated: May 2017, GPA: 3.7

Certifications:

- Commercial Lending School Graduate, Western Banking Association (2020)

- Risk Management Association (RMA) Credit Risk Certification (2021)

- Financial Statement Analysis Workshop, Oregon Bankers Association (2019)

SKILLS

- Commercial credit analysis and underwriting

- Financial statement interpretation

- Cash flow analysis and projections

- Relationship management and business development

- Loan documentation and compliance

- Industry and market research

- Moody’s Financial Analyst (proficient)

- nCino Loan Origination System

- SBA loan programs (7(a) and 504)

- Commercial real estate lending

PROFESSIONAL AFFILIATIONS

- Risk Management Association (RMA), Member since 2019

- Oregon Bankers Association, Commercial Lending Committee

- Portland Business Alliance, Attended quarterly networking events

Senior / Experienced Commercial Loan Officer Resume Example

ALEXANDER J. MORRIS

Portland, OR 97214 | (503) 555-8976 | alex.morris@email.com | linkedin.com/in/alexanderjmorris

PROFESSIONAL SUMMARY

Commercial Loan Officer with 11+ years of progressive experience in financial services, specializing in commercial real estate financing and business lending. Consistent record of exceeding annual loan production goals by an average

of 17%, while maintaining a loan portfolio default rate below 1.2%. Known for building lasting client relationships through consultative approach and deep understanding of local market conditions. Skilled at navigating complex credit decisions and structuring creative financing solutions for middle-market companies.

PROFESSIONAL EXPERIENCE

SENIOR COMMERCIAL LOAN OFFICER | First Pacific Northwest Bank | Portland, OR | March 2019 – Present

- Manage $76M commercial loan portfolio consisting of 43 commercial real estate, equipment financing, and business acquisition loans

- Exceeded annual loan production targets by 21% in 2022 and 19% in 2021, generating $3.2M in new revenue

- Developed and implemented streamlined underwriting process that reduced approval time from 14 days to 8 days

- Lead team of 3 junior loan officers, providing mentorship and training on complex loan structuring

- Cultivated relationships with 12 CPA firms and 8 commercial real estate brokerages, resulting in 27 qualified referrals annually

- Rescued 4 troubled loans totaling $7.3M through creative restructuring, preventing potential charge-offs

COMMERCIAL LOAN OFFICER | Oregon Community Bank | Eugene, OR | June 2015 – February 2019

- Generated $42M in new commercial loans over 3.5 years, focusing on manufacturing, healthcare, and professional services sectors

- Maintained portfolio of 37 clients with average relationship size of $1.2M

- Collaborated with credit analysts to develop loan packages that met both client needs and bank risk parameters

- Created and presented quarterly market analysis reports to senior management, highlighting emerging lending opportunities

- Implemented risk-based pricing model that improved portfolio yield by 32 basis points

- Won “Loan Officer of the Year” award in 2017 for outstanding client satisfaction scores (4.8/5.0)

ASSISTANT COMMERCIAL LOAN OFFICER | Pacific Credit Union | Portland, OR | August 2012 – May 2015

- Assisted senior lender in managing $45M commercial loan portfolio

- Conducted financial analysis and prepared credit memorandums for loan committee review

- Processed loan documentation and coordinated with legal counsel on complex transactions

- Developed expertise in SBA 7(a) and 504 loan programs, closing 7 SBA-guaranteed loans totaling $4.7M

- Created and maintained loan tickler system that improved portfolio monitoring efficiency by 22%

EDUCATION & CERTIFICATIONS

Master of Business Administration, Finance Concentration | Portland State University | 2014

Bachelor of Science, Business Administration | University of Oregon | 2011

Certified Commercial Lender (CCL) | Risk Management Association | 2017

Commercial Real Estate Lending Certificate | Oregon Bankers Association | 2016

SKILLS

- Commercial Credit Analysis

- Financial Statement Review

- Business Valuation

- Loan Structuring & Pricing

- SBA Lending Programs

- Commercial Real Estate Financing

- Equipment Leasing

- Relationship Management

- Risk Assessment

- Loan Documentation

- nCino & Fiserv Banking Platforms

PROFESSIONAL AFFILIATIONS

- Risk Management Association (RMA), Member since 2014

- Oregon Bankers Association, Commercial Lending Committee Member

- Portland Business Alliance, Finance Forum Participant

How to Write a Commercial Loan Officer Resume

Introduction

Landing a Commercial Loan Officer position means convincing hiring managers you can balance risk assessment with business development skills. Your resume isn't just a list of jobs—it's your financial prospectus that needs to show immediate ROI potential. In my 15+ years helping finance professionals land jobs, I've seen what works (and what falls flat) for commercial lending positions at institutions from small credit unions to multinational banks.

Resume Structure and Format

Commercial lending is detail-oriented work, and your resume should reflect that precision. Keep these structural elements in mind:

- Length: 1-2 pages maximum (1 page for under 7 years experience, 2 pages for senior roles)

- Format: Clean, professional layout with clear section headings

- Fonts: Stick with readable classics like Calibri, Arial, or Garamond (10-12pt)

- Margins: 0.75-1 inch on all sides

- File format: PDF (unless specifically requested otherwise)

For commercial lending roles, quantifiable results aren't optional—they're essential. Numbers speak the language of finance. Include loan portfolio sizes, approval rates, and revenue generated whenever possible.

Profile/Summary Section

Your profile needs to hit hard and fast—just like a good loan pitch. In 3-5 lines, summarize your

commercial lending experience, specialization areas, and biggest accomplishments. For example:

"Commercial Loan Officer with 6+ years specializing in manufacturing sector financing ($5M-$25M range). Maintained a 91% approval rate while growing portfolio by $43.2M in 24 months at First National Bank. Recognized for exceptional client retention (96%) and risk assessment accuracy."

Professional Experience

This section makes or breaks your application. For each position, include:

- Job title, company name, location, dates (month/year)

- Brief description of role (1-2 lines max)

- 4-6 bullet points highlighting achievements, not just responsibilities

- Metrics whenever possible (dollar amounts, percentages, portfolio sizes)

Example bullet points that work:

- Evaluated and approved $17.3M in commercial real estate loans with zero defaults in first 12 months

- Cut underwriting time by 27% by implementing streamlined documentation protocols

- Developed relationships with 14 new business clients, generating $374K in first-year fee income

Education and Certifications

List degrees in reverse chronological order. For mid-career and senior lenders, this section should be brief and follow your experience. Include:

- Degree, institution, graduation year (leave off dates if over 15 years ago)

- Relevant certifications: CLP (Certified Loan Professional), RMA Credit Risk Certification, etc.

- Continuing education or specialized training in credit analysis, underwriting systems

Keywords and ATS Tips

Most banks use Applicant Tracking Systems to filter resumes before human eyes see them. Include these terms naturally throughout your resume:

- Credit analysis

- Loan underwriting

- Portfolio management

- Commercial & industrial lending

- Risk assessment

- Financial statement analysis

- Relationship management

- SBA loans (if applicable)

Industry-specific Terms

Show your expertise by correctly using industry terminology. Include relevant terms like debt service coverage ratio, loan-to-value ratio, collateral valuation, syndicated loans, or covenant compliance monitoring. Just make sure you've actually worked with these concepts—banking interviews often probe deeper into resume claims!

Common Mistakes to Avoid

- Focusing on daily tasks instead of achievements and results

- Omitting loan sizes, portfolio values, or approval percentages

- Using generic descriptions that could apply to any financial role

- Failing to mention specific industries or loan types you specialize in

- Neglecting to highlight both analytical AND relationship-building skills

Before/After Example

Before: "Responsible for reviewing loan applications and meeting with business clients."

After: "Evaluated 75+ commercial loan applications quarterly, specializing in manufacturing sector facilities ($2M-$15M range). Built relationships with 8 key business clients who returned for additional financing, resulting in $12.7M portfolio growth in 2022."

The difference? Specificity, results, and a clear picture of what makes you an excellent Commercial Loan Officer. Let your resume tell your professional story with the same attention to detail you bring to analyzing a complex loan application.

Related Resume Examples

Soft skills for your Commercial Loan Officer resume

- Client relationship management – able to build trust with business owners while maintaining appropriate boundaries during financial discussions

- Financial storytelling – translating complex balance sheets and cash flow statements into compelling narratives for loan committees

- Consultative listening skills that help identify underlying business needs beyond the stated loan request

- Negotiation finesse (can find middle ground between bank risk tolerance and borrower requirements)

- Cross-functional collaboration with credit analysts, underwriters and branch managers

- Calm demeanor during high-pressure situations, particularly when managing troubled loans or tight closing deadlines

Hard skills for your Commercial Loan Officer resume

- Credit analysis using Moody’s Risk Analyst and RMA Statement Studies

- Commercial loan documentation preparation (term sheets, commitment letters)

- Cash flow modeling and financial statement analysis

- Commercial real estate (CRE) loan structuring and underwriting

- Salesforce CRM and nCino loan origination system

- SBA 7(a) and 504 loan program expertise

- Construction loan monitoring and draw administration

- Compliance with BSA/AML regulations and HMDA reporting

- Portfolio risk assessment using CECL methodology