Banking Officer Resume examples & templates

Copyable Banking Officer Resume examples

Ever wonder what it's like to be the friendly face of financial expertise who helps customers navigate their biggest money decisions? Banking Officers sit at that crucial intersection between institutional banking and personalized customer service. They're the professionals who turn complex financial jargon into actionable advice for everyone from first-time homebuyers to small business owners trying to expand.

The banking landscape has shifted dramatically in recent years, with digital transformation creating both challenges and opportunities for today's Banking Officers. While online banking usage jumped 37% since 2019, the demand for knowledgeable professionals who can provide personalized guidance remains strong. Modern Banking Officers need a unique blend of financial acumen, relationship-building skills, and technological fluency. The most successful ones aren't just transaction processors—they're trusted advisors who help customers reach their financial goals. As financial institutions continue adapting to changing customer expectations (and fintechs keep disrupting the status quo), Banking Officers who can balance digital savvy with authentic human connection will find themselves increasingly valuable in tomorrow's banking world.

Junior Banking Officer Resume Example

Ryan Mitchell

Philadelphia, PA • (267) 555-8291 • ryan.mitchell@email.com • linkedin.com/in/ryanmitchell

Recent finance graduate with customer service background transitioning into banking. Completed intensive bank operations training and gained practical experience in account management and financial product offerings. Strong math skills and attention to detail with a knack for explaining complex financial concepts in simple terms. Looking to grow my career at a community-focused financial institution.

EXPERIENCE

Banking Officer – First Community Bank, Philadelphia, PA (Jan 2023 – Present)

- Process 30+ daily transactions including deposits, withdrawals, and loan payments while maintaining 99.7% accuracy rate

- Assist customers with account openings, completing 8-10 new applications weekly and cross-selling relevant products

- Resolve customer inquiries regarding account discrepancies, fee structures, and online banking issues

- Help branch exceed quarterly mortgage referral targets by 17% through effective needs assessment

- Created quick-reference guide for new banking products that reduced training time for 3 new hires

Bank Teller (Part-time) – Citizens Financial Group, Philadelphia, PA (May 2022 – Dec 2022)

- Handled cash transactions accurately, balancing drawer within $0 variance for 94% of shifts

- Greeted customers and directed them to appropriate bank services or representatives

- Identified and reported 3 potential fraud attempts following bank security protocols

- Learned core banking software systems while completing coursework

Customer Service Associate – Retail Solutions Inc., King of Prussia, PA (Jun 2021 – Apr 2022)

- Managed point-of-sale transactions and resolved customer complaints in high-volume retail environment

- Balanced cash drawer and prepared daily deposits, often handling $5,000+ in daily transactions

- Recognized twice for outstanding customer service based on customer feedback surveys

EDUCATION

Bachelor of Science in Finance – Temple University, Philadelphia, PA (2022)

- Relevant coursework: Financial Markets, Banking Systems, Economics, Accounting Principles

- GPA: 3.6/4.0

- Finance Club member; participated in investment simulation competition (placed 3rd of 18 teams)

Certifications & Training

- Bank Operations Fundamentals – American Bankers Association (2022)

- Anti-Money Laundering (AML) Compliance – First Community Bank (2023)

- Consumer Lending Basics – Online Banking Institute (In progress)

SKILLS

- Banking Software: Fiserv, Jack Henry Banking

- Financial Products: Checking/Savings accounts, CDs, IRAs, consumer loans

- Cash handling & drawer balancing

- Customer needs assessment

- Regulatory compliance (BSA, KYC)

- Microsoft Office (Excel, Word, Outlook)

- Data entry (65 WPM)

- Problem-solving & conflict resolution

- Basic Spanish proficiency

Mid-level Banking Officer Resume Example

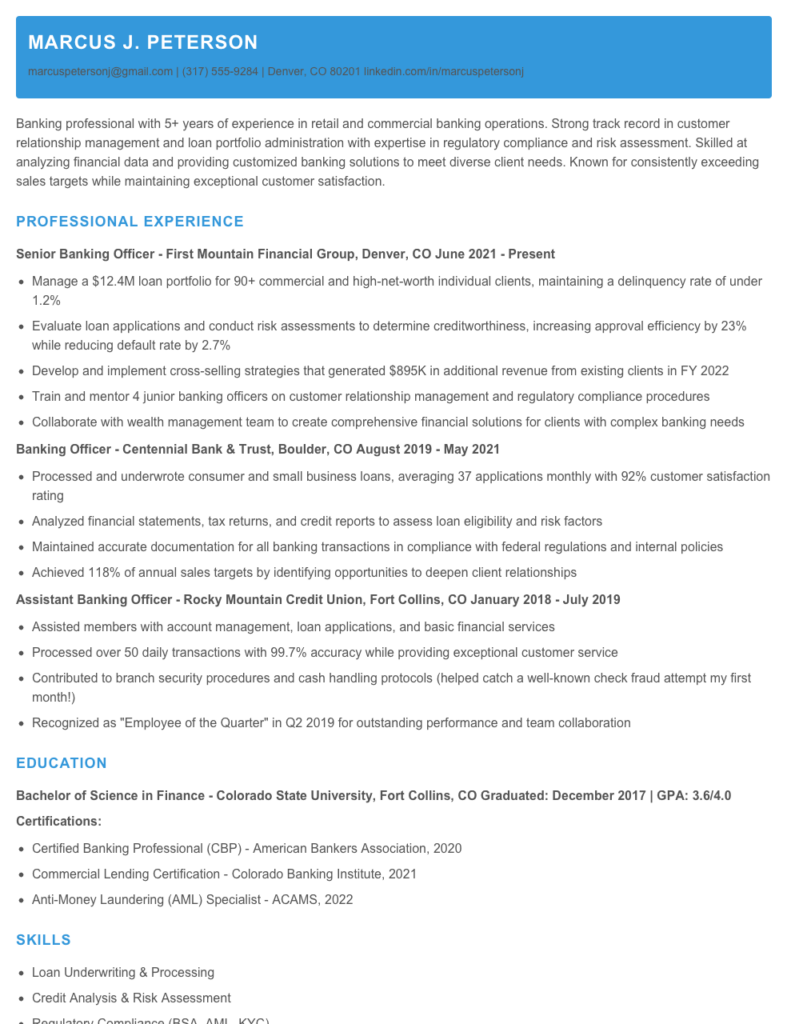

MARCUS J. PETERSON

marcuspetersonj@gmail.com | (317) 555-9284 | Denver, CO 80201

linkedin.com/in/marcuspetersonj

Banking professional with 5+ years of experience in retail and commercial banking operations. Strong track record in customer relationship management and loan portfolio administration with expertise in regulatory compliance and risk assessment. Skilled at analyzing financial data and providing customized banking solutions to meet diverse client needs. Known for consistently exceeding sales targets while maintaining exceptional customer satisfaction.

PROFESSIONAL EXPERIENCE

Senior Banking Officer – First Mountain Financial Group, Denver, CO

June 2021 – Present

- Manage a $12.4M loan portfolio for 90+ commercial and high-net-worth individual clients, maintaining a delinquency rate of under 1.2%

- Evaluate loan applications and conduct risk assessments to determine creditworthiness, increasing approval efficiency by 23% while reducing default rate by 2.7%

- Develop and implement cross-selling strategies that generated $895K in additional revenue from existing clients in FY 2022

- Train and mentor 4 junior banking officers on customer relationship management and regulatory compliance procedures

- Collaborate with wealth management team to create comprehensive financial solutions for clients with complex banking needs

Banking Officer – Centennial Bank & Trust, Boulder, CO

August 2019 – May 2021

- Processed and underwrote consumer and small business loans, averaging 37 applications monthly with 92% customer satisfaction rating

- Analyzed financial statements, tax returns, and credit reports to assess loan eligibility and risk factors

- Maintained accurate documentation for all banking transactions in compliance with federal regulations and internal policies

- Achieved 118% of annual sales targets by identifying opportunities to deepen client relationships

Assistant Banking Officer – Rocky Mountain Credit Union, Fort Collins, CO

January 2018 – July 2019

- Assisted members with account management, loan applications, and basic financial services

- Processed over 50 daily transactions with 99.7% accuracy while providing exceptional customer service

- Contributed to branch security procedures and cash handling protocols (helped catch a well-known check fraud attempt my first month!)

- Recognized as “Employee of the Quarter” in Q2 2019 for outstanding performance and team collaboration

EDUCATION

Bachelor of Science in Finance – Colorado State University, Fort Collins, CO

Graduated: December 2017 | GPA: 3.6/4.0

Certifications:

- Certified Banking Professional (CBP) – American Bankers Association, 2020

- Commercial Lending Certification – Colorado Banking Institute, 2021

- Anti-Money Laundering (AML) Specialist – ACAMS, 2022

SKILLS

- Loan Underwriting & Processing

- Credit Analysis & Risk Assessment

- Regulatory Compliance (BSA, AML, KYC)

- Customer Relationship Management

- Financial Statement Analysis

- Commercial & Consumer Lending

- Banking Software: FIS, Fiserv, Jack Henry

- Cross-selling Financial Products

- Microsoft Office Suite & Banking CRM Systems

- Problem Resolution & Negotiation

PROFESSIONAL AFFILIATIONS

- Colorado Bankers Association – Member since 2019

- Young Professionals in Finance – Denver Chapter, 2020-Present

Senior / Experienced Banking Officer Resume Example

MICHAEL J. WINTERS

Boston, MA | (617) 555-8214 | mjwinters@emailpro.net | linkedin.com/in/michaeljwinters

Detail-oriented Banking Officer with 10+ years in retail and commercial banking operations. Known for developing streamlined processes that improved customer satisfaction while reducing operational costs. Skilled at managing high-value client relationships and training junior team members. Proven track record of exceeding loan targets by 17% while maintaining portfolio quality.

PROFESSIONAL EXPERIENCE

SENIOR BANKING OFFICER | First National Commerce Bank, Boston, MA | June 2019 – Present

- Lead team of 12 banking associates, overseeing $187M in loans and $230M in deposits across 3 branches

- Developed and implemented new customer onboarding process that cut account opening time by 23% and reduced paperwork errors by 31%

- Manage 78 high-net-worth relationships generating $1.4M in annual revenue (up from $980K in 2019)

- Created cross-selling initiative that increased products-per-customer from 2.1 to 3.4 within 18 months

- Spearheaded rollout of mobile banking platform to commercial clients, increasing digital engagement by 47%

BANKING OFFICER | Eastern Regional Bank, Cambridge, MA | March 2016 – May 2019

- Managed $42M loan portfolio with 90+ day delinquency rate of just 0.8% (vs. branch average of 2.3%)

- Exceeded new loan targets by avg. 14% annually while maintaining stringent underwriting standards

- Conducted quarterly portfolio reviews and risk assessments, identifying 5 major accounts for proactive restructuring before they became problematic

- Trained 7 junior bankers on credit analysis and relationship management, with 4 earning promotions

- Recognized as “Employee of the Quarter” twice for exceptional client service and loan production

ASSISTANT BANKING OFFICER | Community Trust Bank, Worcester, MA | July 2013 – February 2016

- Processed and underwrote consumer and small business loans up to $250K

- Opened 127 new accounts in first year, exceeding target by 42%

- Collaborated with mortgage department to identify cross-selling opportunities, generating 31 qualified referrals

- Created customer follow-up system that improved retention from 76% to 89% (still in use today)

EDUCATION & CERTIFICATIONS

Master of Business Administration – Finance Concentration

Boston University School of Management, Boston, MA (2017)

Bachelor of Science in Finance

University of Massachusetts, Amherst, MA (2012)

Certifications:

- Certified Commercial Lender (CCL) – 2018

- Certified Financial Marketing Professional (CFMP) – 2020

- Anti-Money Laundering Specialist (CAMS) – 2019

TECHNICAL SKILLS

- Banking Systems: FIS Core, Fiserv DNA, nCino, Salesforce Financial Services Cloud

- Credit Analysis: FICO Small Business Scoring, Moody’s RiskAnalyst, Experian BizSource

- Compliance: BSA/AML protocols, OFAC screening, KYC procedures, Reg B, HMDA reporting

- Financial Analysis: Cash flow analysis, balance sheet restructuring, risk-based pricing models

- Advanced Excel: Pivot tables, VLOOKUP, macros, financial modeling, scenario analysis

ADDITIONAL INFORMATION

Board Member, Greater Boston Financial Literacy Coalition (volunteer position)

Committee Chair, Massachusetts Bankers Association – Next Generation Bankers (2020-Present)

Fluent in Spanish – Used regularly with approximately 15% of client base

How to Write a Banking Officer Resume

Introduction

Landing that Banking Officer job means first getting past the resume screening stage—no small feat in financial services, where competition is fierce. Your resume isn't just a list of past jobs; it's your personal marketing document that needs to showcase your financial expertise, customer service skills, and regulatory knowledge. I've helped hundreds of banking professionals land interviews, and I can tell you that the difference between getting called in or passed over often comes down to how well your resume speaks the language of banking.

Resume Structure and Format

Keep your banking resume clean and professional—just like the industry itself. Flashy designs might work in creative fields, but banking employers value clarity and precision.

- Stick to 1-2 pages (1 page for those with under 5 years of experience)

- Use a clean, readable font like Calibri or Arial at 10-12pt

- Include clear section headings with consistent formatting

- Incorporate white space to improve readability

- Save as a PDF unless specifically asked for a different format

Your contact info should be prominent at the top—include your LinkedIn profile if it's up-to-date. Skip the objective statement (it's outdated) and jump straight into a professional summary instead.

Profile/Summary Section

This 3-4 line opener needs to pack a punch. Think of it as your elevator pitch that answers: "Why should we hire you as our Banking Officer?"

Pro Tip: Customize your summary for each job application. Look at the specific requirements in the job posting and reflect those skills and qualities here. Generic summaries scream "mass application" to hiring managers.

A strong Banking Officer summary might mention years of experience, areas of specialization (consumer lending, account management, etc.), notable achievements (loan portfolio growth, customer satisfaction metrics), and banking certifications.

Professional Experience

This section carries the most weight. For each position, include:

- Company name, location, and dates employed (month/year)

- Your exact job title (no embellishments!)

- 4-6 bullet points highlighting accomplishments, not just duties

- Quantifiable results whenever possible

Instead of saying "Responsible for opening new accounts," try "Opened 187 new accounts in Q2 2022, exceeding quarterly target by 31% and generating $1.4M in new deposits." Numbers speak volumes in banking!

Focus on relevant banking skills: loan processing, regulatory compliance, client relationship management, cross-selling financial products, risk assessment, and fraud prevention.

Education and Certifications

List your degrees in reverse chronological order. For banking roles, relevant certifications can sometimes be as valuable as degrees, so don't bury them! Highlight:

- Bachelor's degree (finance, economics, business preferred)

- Banking-specific certifications (ABA certifications, CFA, Series 6/7)

- Compliance training (BSA/AML, OFAC)

- Financial software proficiencies (Fiserv, Jack Henry, FIS)

Keywords and ATS Tips

Most banks use Applicant Tracking Systems to filter resumes before a human ever sees them. To get past these digital gatekeepers:

- Include exact keywords from the job posting

- Use standard section headings (Experience, Education, Skills)

- Avoid tables, headers/footers, and text boxes

- Spell out acronyms at least once (Bank Secrecy Act (BSA))

Industry-specific Terms

Demonstrate your banking knowledge by naturally incorporating industry terminology. Consider terms like depository services, underwriting, KYC procedures, CRA compliance, credit analysis, wealth management, and relationship banking. But don't just list them—show how you've applied these concepts in your work.

Common Mistakes to Avoid

- Being vague about compliance knowledge (banks need specifics!)

- Focusing on customer service without mentioning financial aspects

- Neglecting to highlight sales achievements (banking is still sales)

- Including outdated software or regulations

- Typos! (In an industry where attention to detail is paramount)

Before/After Example

Before: "Helped customers with their banking needs and processed loans."

After: "Processed 75+ consumer loan applications monthly with 97% accuracy rate while maintaining customer satisfaction score of 4.8/5; consistently ranked among top 3 loan officers for cross-selling investment products to existing clients."

The difference? Specificity, achievements, and metrics that banking hiring managers can actually evaluate.

Related Resume Examples

Soft skills for your Banking Officer resume

- Cross-functional relationship building (particularly with credit, compliance, and retail teams)

- Financial consultation with high-value clients under tight deadlines

- Conflict resolution during tense account disputes or service failures

- Active listening to uncover hidden client needs beyond stated requests

- Adaptability to shifting regulatory requirements and bank policies

- Team mentoring of junior bankers while managing personal portfolios

Hard skills for your Banking Officer resume

- Risk assessment and credit analysis using FICO and proprietary bank scoring models

- Commercial loan documentation preparation and processing in nCino

- BSA/AML compliance monitoring and suspicious activity reporting

- Proficient with core banking systems (Jack Henry, FIS, or Fiserv platforms)

- Financial statement analysis and cash flow projection modeling

- Mortgage underwriting up to $647,200 conforming loan limits

- Familiarity with regulatory frameworks (Dodd-Frank, TRID, Reg Z)

- Treasury management product knowledge including ACH, positive pay, and lockbox services

- Banking CRM systems (Salesforce Financial Services Cloud)