Treasurer Resume examples & templates

Copyable Treasurer Resume examples

Ever wondered who's really keeping the financial ship afloat while everyone else is busy charting the course? In today's volatile economic climate, Treasurers have evolved far beyond their traditional role as corporate cash managers. They've become strategic partners who balance risk management with opportunity seeking—a challenging tightrope walk that requires both analytical precision and business intuition. With global markets more interconnected than ever, a single Treasury decision can ripple across an organization's entire financial ecosystem.

According to a 2023 survey by the Association for Financial Professionals, 76% of organizations now involve their Treasury departments in strategic business decisions, up from just 53% a decade ago; This shift reflects how Treasury roles have expanded to encompass capital structure planning, M&A support, and even ESG financing initiatives. The job has gotten more complex, but also more rewarding. Treasury professionals who can blend technical skills with business acumen will find themselves increasingly valued in boardrooms where liquidity management and funding strategies can make or break ambitious growth plans. As regulatory requirements continue to tighten and financial technologies advance, tomorrow's Treasurers will need to be part financial expert, part technologist, and part strategic advisor.

Junior Treasurer Resume Example

Jessica M. Ramirez

Boston, MA • (617) 555-9082 • jessica.ramirez@email.com • linkedin.com/in/jessicamramirez

Recent finance graduate with Treasury Assistant experience at a mid-sized manufacturing company. Strong analytical skills with proven ability to improve cash forecasting accuracy. Looking to leverage my accounting background and Excel proficiency to grow into a full Treasurer role. Quick learner who thrives in fast-paced environments.

EXPERIENCE

Treasury Assistant – Northshore Manufacturing Inc., Boston, MA (June 2022 – Present)

- Manage daily cash position reports and assist with weekly cash forecasting for $43M annual revenue business

- Reconcile bank statements and research discrepancies, resolving 98% of issues without supervisor assistance

- Process wire transfers and ACH payments worth $2.1M monthly, maintaining perfect accuracy record

- Developed Excel template that reduced monthly bank fee analysis time from 6 hours to 1.5 hours

- Assist with drafting quarterly treasury reports for senior management review

Finance Intern – Eastern Credit Union, Cambridge, MA (January 2022 – May 2022)

- Supported treasury operations team with daily cash management activities

- Helped analyze bank fee structures to identify potential savings of $12,400 annually

- Prepared investment portfolio reports and assisted with liquidity analysis

Accounting Intern – Bright Solutions LLC, Boston, MA (Summer 2021)

- Assisted with accounts payable and receivable processing for small consulting firm

- Reconciled credit card statements and organized receipt documentation

- Created basic financial reports using QuickBooks and Excel

EDUCATION

Bachelor of Science in Finance – Boston University, Boston, MA (May 2022)

- GPA: 3.7/4.0

- Relevant Coursework: Corporate Finance, Financial Markets, Investment Analysis, Financial Accounting

- Member, Finance Club: Participated in case competitions and networking events

CERTIFICATIONS

Certified Treasury Professional (CTP) – In progress, expected completion December 2023

Bloomberg Market Concepts – Completed May 2022

SKILLS

- Cash Management & Forecasting

- Bank Reconciliation

- Wire/ACH Processing

- Financial Analysis

- Advanced Excel (VLOOKUP, PivotTables)

- QuickBooks

- Microsoft Dynamics (basic)

- Bloomberg Terminal (basic)

- SQL (basic)

- Treasury Management Systems (learning)

Mid-level Treasurer Resume Example

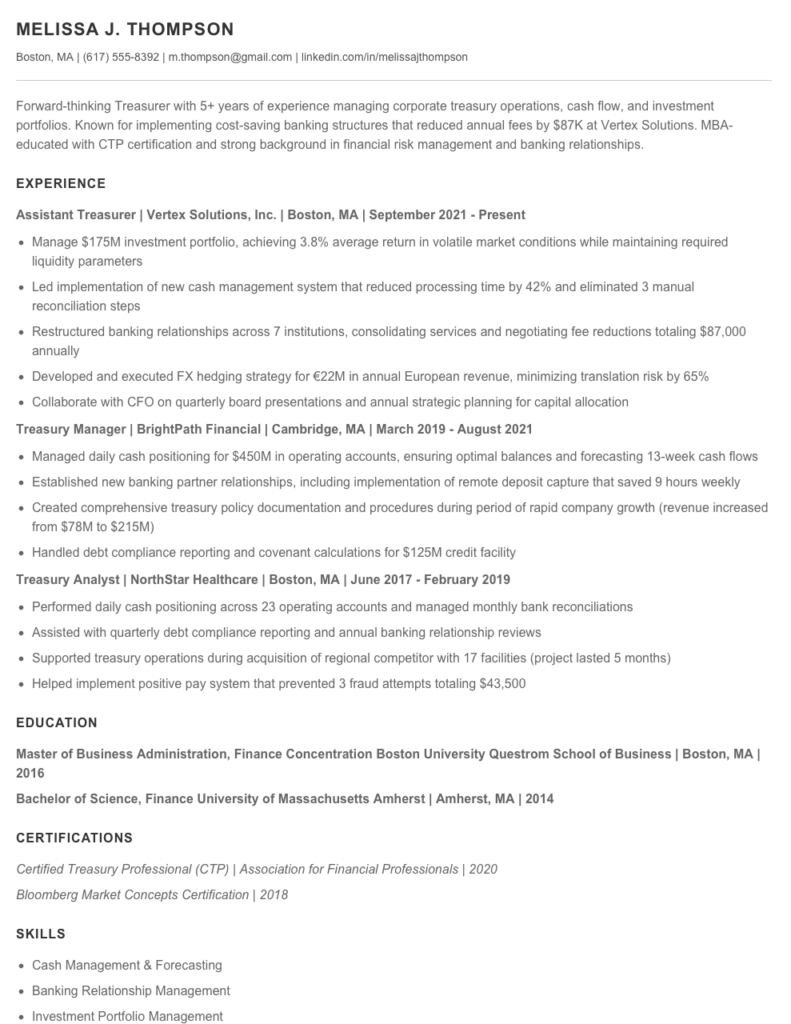

MELISSA J. THOMPSON

Boston, MA | (617) 555-8392 | m.thompson@gmail.com | linkedin.com/in/melissajthompson

Forward-thinking Treasurer with 5+ years of experience managing corporate treasury operations, cash flow, and investment portfolios. Known for implementing cost-saving banking structures that reduced annual fees by $87K at Vertex Solutions. MBA-educated with CTP certification and strong background in financial risk management and banking relationships.

EXPERIENCE

Assistant Treasurer | Vertex Solutions, Inc. | Boston, MA | September 2021 – Present

- Manage $175M investment portfolio, achieving 3.8% average return in volatile market conditions while maintaining required liquidity parameters

- Led implementation of new cash management system that reduced processing time by 42% and eliminated 3 manual reconciliation steps

- Restructured banking relationships across 7 institutions, consolidating services and negotiating fee reductions totaling $87,000 annually

- Developed and executed FX hedging strategy for €22M in annual European revenue, minimizing translation risk by 65%

- Collaborate with CFO on quarterly board presentations and annual strategic planning for capital allocation

Treasury Manager | BrightPath Financial | Cambridge, MA | March 2019 – August 2021

- Managed daily cash positioning for $450M in operating accounts, ensuring optimal balances and forecasting 13-week cash flows

- Established new banking partner relationships, including implementation of remote deposit capture that saved 9 hours weekly

- Created comprehensive treasury policy documentation and procedures during period of rapid company growth (revenue increased from $78M to $215M)

- Handled debt compliance reporting and covenant calculations for $125M credit facility

Treasury Analyst | NorthStar Healthcare | Boston, MA | June 2017 – February 2019

- Performed daily cash positioning across 23 operating accounts and managed monthly bank reconciliations

- Assisted with quarterly debt compliance reporting and annual banking relationship reviews

- Supported treasury operations during acquisition of regional competitor with 17 facilities (project lasted 5 months)

- Helped implement positive pay system that prevented 3 fraud attempts totaling $43,500

EDUCATION

Master of Business Administration, Finance Concentration

Boston University Questrom School of Business | Boston, MA | 2016

Bachelor of Science, Finance

University of Massachusetts Amherst | Amherst, MA | 2014

CERTIFICATIONS

Certified Treasury Professional (CTP) | Association for Financial Professionals | 2020

Bloomberg Market Concepts Certification | 2018

SKILLS

- Cash Management & Forecasting

- Banking Relationship Management

- Investment Portfolio Management

- Foreign Exchange Risk Hedging

- Treasury Management Systems (Kyriba, GTreasury)

- Debt Compliance & Reporting

- Financial Risk Assessment

- ERP Systems (SAP, Oracle)

- Advanced Excel & Financial Modeling

- Capital Structure Planning

PROFESSIONAL AFFILIATIONS

Association for Financial Professionals (AFP) – Member since 2018

Boston Women in Finance – Member since 2020

Senior / Experienced Treasurer Resume Example

Michael J. Harrison, CTP

mharrison@financialstrategy.com | (312) 555-8427 | Chicago, IL 60604

linkedin.com/in/michaeljharrison | Available for relocation

PROFESSIONAL SUMMARY

Strategic Treasury executive with 12+ years managing complex capital structures and optimizing cash operations for multinational organizations. Proven track record reducing borrowing costs by $4.2M annually through debt restructuring and implementing sophisticated cash forecasting models. CTP with expertise in FX risk management, banking relationship oversight, and treasury technology transformations who thrives in fast-paced environments requiring quick analytical thinking.

PROFESSIONAL EXPERIENCE

Treasurer | Apex Global Manufacturing, Inc. | Chicago, IL | 2019 – Present

- Lead all treasury functions for $2.8B multinational manufacturer operating in 17 countries with 8 direct reports

- Orchestrated complete treasury management system implementation that consolidated 43 bank accounts, reducing monthly fees by 27% ($276K annually) while improving visibility into global cash positions

- Developed and executed FX hedging strategy that protected margins during 2022 currency volatility, saving $3.1M compared to unhedged exposure

- Renegotiated $750M revolving credit facility, securing 35 bps reduction in spread over benchmark despite challenging market conditions

- Spearheaded working capital initiative that reduced DSO from 47 to 39 days, freeing up $42M in cash previously trapped in AR cycle

Assistant Treasurer | Wellston Consumer Products | Cincinnati, OH | 2015 – 2019

- Managed daily cash operations, bank relationships, and debt compliance for $1.2B consumer goods manufacturer

- Led cross-functional team that implemented real-time cash forecasting model, reducing forecast variance from 18% to 6%

- Restructured $450M debt portfolio, extending maturities and reducing weighted average cost of capital by 87 bps

- Established in-house banking structure for European subsidiaries, eliminating $720K in annual bank fees and improving intercompany settlement processes

- Developed and presented quarterly treasury updates to CFO and Board’s Finance Committee, including liquidity forecasts and risk assessments

Treasury Manager | Brightway Financial Services | Columbus, OH | 2012 – 2015

- Oversaw daily cash positioning and short-term investment portfolio averaging $175M

- Created comprehensive cash flow forecasting model that improved 13-week forecast accuracy by 24%

- Managed banking relationships across 6 primary financial institutions, negotiating service fee reductions totaling $190K annually

- Implemented automated payment approval workflow that reduced processing time by 68% while strengthening internal controls

EDUCATION & CERTIFICATIONS

Master of Business Administration, Finance – Northwestern University, Kellogg School of Management, 2011

Bachelor of Science, Finance – Indiana University, Kelley School of Business, 2008

Certified Treasury Professional (CTP) – Association for Financial Professionals, 2013 (Renewed 2022)

Bloomberg Market Concepts Certification – Bloomberg LP, 2019

TECHNICAL SKILLS

- Treasury Management Systems: Kyriba, FIS Quantum, SkySuite

- Cash Forecasting & Working Capital Analysis

- ERP Systems: SAP, Oracle Financials

- FX Risk Management & Hedging Strategies

- Debt & Capital Structure Management

- Banking Relationship Management

- Advanced Financial Modeling (Excel, Power BI)

- Investment Portfolio Management

- Payment Factories & In-House Banking

- Financial Controls & Compliance (SOX, FBAR)

PROFESSIONAL AFFILIATIONS

- Association for Financial Professionals (AFP) – Member since 2012

- Chicago Treasury Management Association – Board Member (2020-Present)

- National Association of Corporate Treasurers – Member

How to Write a Treasurer Resume

Introduction

Landing a Treasurer position means showcasing your financial expertise, leadership abilities, and technical know-how on a single page (or maybe two). Your resume isn't just a career history—it's your financial credibility statement. I've helped dozens of finance professionals land Treasurer roles, and I've noticed the candidates who succeed share one thing: they quantify their financial impact and tailor their experience to the specific treasury functions the employer needs.

Resume Structure and Format

Keep your Treasurer resume clean and structured—just like a well-organized financial statement. Finance professionals expect precision, so your formatting choices matter.

- Length: 1-2 pages maximum (2 pages only if you have 8+ years of relevant experience)

- Font: Standard professional fonts like Calibri, Arial, or Garamond in 10-12pt size

- Margins: 0.75" to 1" on all sides

- Sections: Contact info, summary, experience, skills, education, certifications

- File format: PDF (maintains formatting across all systems)

Profile/Summary Section

Your professional summary should pack a punch—like your most impressive financial analysis condensed into 3-4 lines. Think of it as your elevator pitch.

Skip the objective statement. Instead, craft a summary that highlights your treasury specialties (cash management, debt financing, risk mitigation) and quantifies your impact (managed $127M cash portfolio, reduced borrowing costs by 4.3%).

Example: "Treasury Manager with 6+ years optimizing cash flow for mid-sized manufacturers. Implemented automated cash forecasting system that improved accuracy by 31% and reduced idle cash by $4.2M. Skilled in hedge accounting, FX risk management, and treasury workstation systems."

Professional Experience

This is where you prove your financial chops. Each bullet should showcase a responsibility, action, and result—preferably with numbers.

- Start bullets with strong action verbs: managed, optimized, reduced, negotiated, implemented

- Quantify wherever possible: portfolio sizes, cost savings, efficiency gains

- Highlight relevant treasury functions: cash management, banking relationships, debt issuance, investments

- Show progression by emphasizing increased responsibilities over time

For junior candidates: Emphasize internships, relevant coursework projects, and technical skills. Even managing the budget for a student organization counts!

Education and Certifications

Finance credentials matter. List your degrees but also emphasize any treasury-specific certifications that set you apart.

- Degrees: Finance, Accounting, Economics, Business Administration

- Key certifications: CTP (Certified Treasury Professional), CFA, CPA, FRM

- Relevant coursework: For early-career professionals, list specific finance courses

- GPA: Include if 3.5+ and you graduated within the last 5 years

Keywords and ATS Tips

Most companies use Applicant Tracking Systems to filter resumes before human eyes see them. Getting past this digital gatekeeper means including the right keywords.

- Study the job posting and mirror key terms (cash forecasting, debt management, FX hedging)

- Include specific treasury systems you've used (Kyriba, SAP Treasury, GTreasury, etc.)

- Mention regulations you're familiar with (SOX, IFRS 9, ASC 815)

- Avoid excessive formatting, tables, or headers/footers that can confuse ATS systems

Industry-specific Terms

Show you speak the language of treasury by naturally incorporating these terms (where truthful):

- Cash pooling and concentration

- Working capital optimization

- Liquidity management

- Bank relationship management

- Covenant compliance

- FX exposure hedging

- Interest rate risk management

- Treasury workstation implementation

Common Mistakes

I've reviewed thousands of Treasurer resumes, and these missteps appear way too often:

- Being vague about portfolio sizes or financial impacts

- Focusing on routine tasks rather than achievements

- Omitting technical systems know-how (TMS, ERP, banking platforms)

- Listing every job duty instead of highlighting relevant treasury accomplishments

- Failing to explain how your actions benefited the company's bottom line

Before/After Example

Before: "Responsible for company's cash management and banking relationships."

After: "Optimized $87M cash portfolio across 12 currencies, implementing regional cash pooling structure that reduced idle balances by 18% and saved $342K in annual interest expenses while maintaining required liquidity ratios."

See the difference? The second version demonstrates expertise, scope, and measurable results—exactly what hiring managers for Treasurer positions want to see.

Related Resume Examples

Soft skills for your Treasurer resume

- Clear financial communication – translating complex data into actionable insights for executives who don’t speak “finance”

- Relationship building with banking partners and financial institutions (saved our company $47K in fees last year through negotiation)

- Crisis management during cash flow disruptions – maintaining composure when others panic

- Cross-departmental collaboration, particularly with accounting and operations teams

- Ethical decision-making when balancing competing financial priorities

- Mentoring junior team members on treasury fundamentals and career development

Hard skills for your Treasurer resume

- Financial statement analysis and cash flow forecasting (5+ years using Hyperion)

- Treasury management systems expertise (GTreasury, Kyriba)

- Advanced Excel modeling for debt capacity analysis

- Working capital optimization and cash pooling structures

- Bloomberg Terminal proficiency for market monitoring

- FX hedging strategies and derivative instrument management

- Bank relationship management and covenant compliance tracking

- Certified Treasury Professional (CTP) designation

- SAP Treasury Module configuration and implementation