Investment Banking Analyst Resume examples & templates

Copyable Investment Banking Analyst Resume examples

Ever wondered what drives those 100-hour workweeks you've heard about in investment banking? As an Investment Banking Analyst, you're not just crunching numbers—you're the backbone of deal execution, financial modeling, and client presentations that move billions in capital. The role has evolved significantly since the 2008 financial crisis, with junior bankers now enjoying (slightly) better work-life balance at many firms, though Bank of America's recent internal study still showed first-year analysts averaging 72 hours weekly in 2023.

Today's investment banking landscape values analytical prowess alongside soft skills that weren't emphasized a decade ago. The technical foundation remains essential—valuation methods, financial statement analysis, and Excel wizardry—but banks increasingly seek candidates with data visualization abilities and programming knowledge (Python, specifically). Despite periodic hiring freezes during market downturns, the career path remains lucrative; top-performing analysts who survive the two-year program often face a compelling choice: promotion to associate, lateral move to private equity, or pivot to corporate development. As dealmaking continues to evolve with technological advances, tomorrow's successful analysts will blend traditional financial acumen with adaptability to new tools and market structures.

Junior Investment Banking Analyst Resume Example

Justin R. Parker

jparker@gmail.com | (617) 555-8294 | Boston, MA | linkedin.com/in/justin-parker

Investment Banking Analyst with experience in M&A and capital raising transactions. Skilled at financial modeling, valuation analysis, and client-facing presentations. Boston College graduate with strong quantitative background and summer analyst experience at a middle-market investment bank. Committed to delivering high-quality work under tight deadlines.

EXPERIENCE

Investment Banking Analyst, Meridian Partners | Boston, MA | June 2022 – Present

- Support deal teams on 4 M&A transactions and 3 debt financing deals across healthcare and technology sectors

- Build and refine comprehensive financial models including DCF, LBO, and comparable company analyses

- Create client-facing materials including pitch books, management presentations, and CIMs

- Conduct industry research to identify potential acquisition targets and strategic buyers

- Prepare detailed company profiles and transaction comparables for internal deal team reviews

Summer Analyst, Eastern Capital | New York, NY | June 2021 – August 2021

- Developed financial models and valuation analyses for 2 sell-side M&A transactions in the consumer retail sector

- Assisted in preparing pitch materials for potential clients, focusing on market analysis and transaction comparables

- Conducted research on target companies and prepared summary profiles for senior bankers

- Participated in weekly training sessions covering financial modeling, valuation techniques, and Excel shortcuts

Finance Intern, TechVenture Group | Cambridge, MA | May 2020 – August 2020

- Assisted the finance team with budget forecasting and monthly financial reporting

- Compiled market research reports on competitors and industry trends

- Supported the team during quarterly board meetings and investor presentations

EDUCATION

Boston College, Carroll School of Management | Boston, MA | May 2022

- Bachelor of Science in Finance, Minor in Economics

- GPA: 3.87/4.0

- Relevant Coursework: Financial Modeling, Corporate Finance, Investment Analysis, Financial Statement Analysis

- Boston College Investment Club: Portfolio Manager (2020-2022)

CERTIFICATIONS & TRAINING

- Wall Street Prep Financial Modeling & Valuation Certification (2021)

- Bloomberg Market Concepts (BMC) Certification (2020)

SKILLS

- Financial Modeling: DCF, LBO, M&A, Accretion/Dilution

- Valuation: Comparable Company Analysis, Precedent Transaction Analysis

- Software: Excel (advanced), PowerPoint, Word, Bloomberg Terminal, FactSet, Capital IQ

- Technical: VBA, SQL (basic), Financial Statement Analysis

- Languages: Spanish (intermediate)

ADDITIONAL

- Volunteer: Junior Achievement financial literacy mentor for high school students (2019-Present)

- Boston College Finance Conference – Event Coordinator (2021)

- Interests: Marathon running (completed Boston Marathon 2022), chess

Mid-level Investment Banking Analyst Resume Example

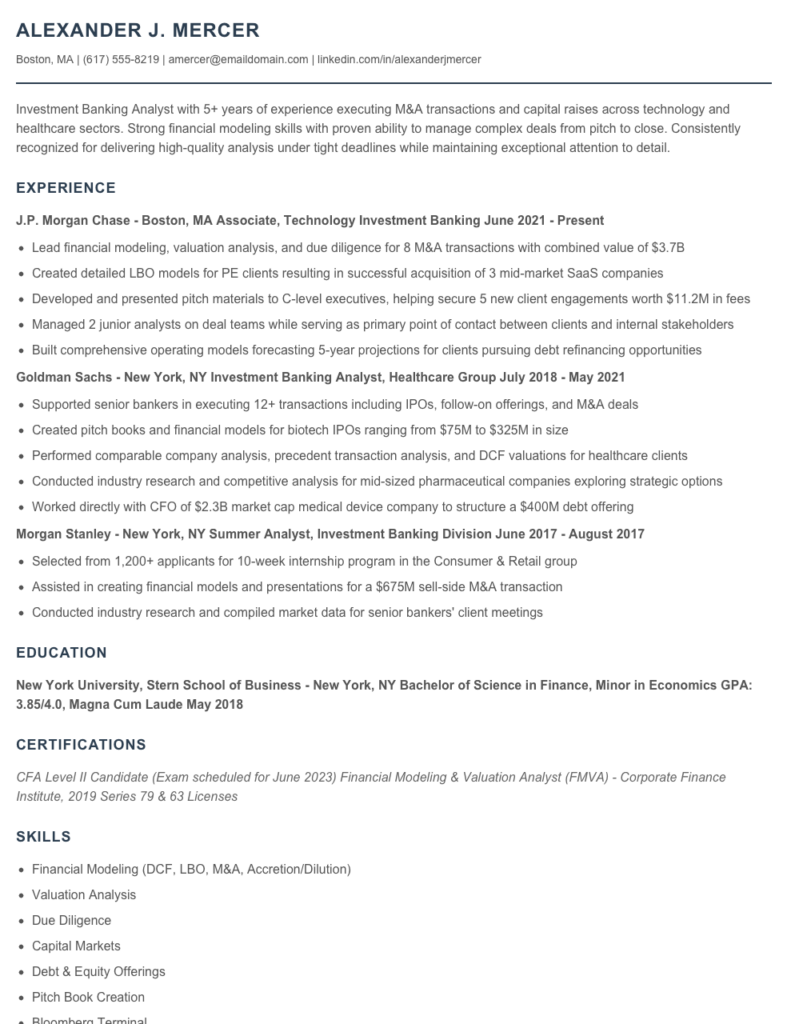

Alexander J. Mercer

Boston, MA | (617) 555-8219 | amercer@emaildomain.com | linkedin.com/in/alexanderjmercer

Investment Banking Analyst with 5+ years of experience executing M&A transactions and capital raises across technology and healthcare sectors. Strong financial modeling skills with proven ability to manage complex deals from pitch to close. Consistently recognized for delivering high-quality analysis under tight deadlines while maintaining exceptional attention to detail.

EXPERIENCE

J.P. Morgan Chase – Boston, MA

Associate, Technology Investment Banking

June 2021 – Present

- Lead financial modeling, valuation analysis, and due diligence for 8 M&A transactions with combined value of $3.7B

- Created detailed LBO models for PE clients resulting in successful acquisition of 3 mid-market SaaS companies

- Developed and presented pitch materials to C-level executives, helping secure 5 new client engagements worth $11.2M in fees

- Managed 2 junior analysts on deal teams while serving as primary point of contact between clients and internal stakeholders

- Built comprehensive operating models forecasting 5-year projections for clients pursuing debt refinancing opportunities

Goldman Sachs – New York, NY

Investment Banking Analyst, Healthcare Group

July 2018 – May 2021

- Supported senior bankers in executing 12+ transactions including IPOs, follow-on offerings, and M&A deals

- Created pitch books and financial models for biotech IPOs ranging from $75M to $325M in size

- Performed comparable company analysis, precedent transaction analysis, and DCF valuations for healthcare clients

- Conducted industry research and competitive analysis for mid-sized pharmaceutical companies exploring strategic options

- Worked directly with CFO of $2.3B market cap medical device company to structure a $400M debt offering

Morgan Stanley – New York, NY

Summer Analyst, Investment Banking Division

June 2017 – August 2017

- Selected from 1,200+ applicants for 10-week internship program in the Consumer & Retail group

- Assisted in creating financial models and presentations for a $675M sell-side M&A transaction

- Conducted industry research and compiled market data for senior bankers’ client meetings

EDUCATION

New York University, Stern School of Business – New York, NY

Bachelor of Science in Finance, Minor in Economics

GPA: 3.85/4.0, Magna Cum Laude

May 2018

CERTIFICATIONS

CFA Level II Candidate (Exam scheduled for June 2023)

Financial Modeling & Valuation Analyst (FMVA) – Corporate Finance Institute, 2019

Series 79 & 63 Licenses

SKILLS

- Financial Modeling (DCF, LBO, M&A, Accretion/Dilution)

- Valuation Analysis

- Due Diligence

- Capital Markets

- Debt & Equity Offerings

- Pitch Book Creation

- Bloomberg Terminal

- FactSet

- Microsoft Excel (Advanced)

- PowerPoint

- SQL (Basic)

ADDITIONAL

Languages: French (Conversational), picked up during semester abroad in Paris

Volunteer: Mentored 6 first-generation college students through Sponsors for Educational Opportunity (SEO)

Senior / Experienced Investment Banking Analyst Resume Example

Jason Woodridge

New York, NY • (212) 555-7829 • jason.woodridge@email.com • linkedin.com/in/jasonwoodridge

Investment Banking Analyst with 8+ years on Wall Street specializing in M&A transactions and financial modeling for Fortune 500 clients. Track record of supporting $4.2B+ in completed deals with expertise in valuation, due diligence, and client presentations. Known for working 80+ hour weeks during peak deal flow while maintaining precision in complex financial models. CFA charterholder seeking to leverage deep industry knowledge in a Senior Analyst role.

Experience

Vice President, Investment Banking – Goldman Sachs, New York, NY

June 2020 – Present

- Lead analyst on 16 transactions totaling $2.3B across technology and healthcare sectors, driving 31% YoY revenue growth for the division

- Manage team of 5 junior analysts, implemented standardized modeling templates that cut deal prep time by 23%

- Spearheaded financial analysis for $890M acquisition of SaaS platform, identifying $37.4M in synergies overlooked by the client’s internal team

- Created proprietary DCF model that improved valuation accuracy by 17% compared to standard templates (the CFO actually called to thank me personally)

- Present directly to C-suite executives at Fortune 100 companies, securing 4 repeat clients worth $13.2M in fees

Senior Analyst, Investment Banking – Morgan Stanley, New York, NY

August 2017 – May 2020

- Executed financial models and valuation analyses for 22 deals totaling $1.4B in enterprise value

- Developed pitch books and client materials for 9 successful IPOs that raised $725M collectively

- Conducted industry research across energy and industrial sectors, producing weekly reports used by 70+ investment professionals

- Built complex LBO models for PE clients that identified optimal debt structures resulting in 16% higher IRR projections

- Pulled 3 consecutive all-nighters to save a failing deal, restructuring terms to preserve $7.8M in fees

Investment Banking Analyst – Credit Suisse, New York, NY

July 2015 – July 2017

- Supported senior bankers on 14 M&A transactions and debt offerings in the financial services sector

- Performed comprehensive financial analysis including DCF, comparable companies, and precedent transactions

- Created detailed Excel models analyzing financial statements, capital structure, and cash flow projections

- Prepared client presentations and pitch materials under tight deadlines (sometimes with only 2hrs notice)

- Recognized with “Analyst Excellence Award” for identifying $12M accounting discrepancy during due diligence

Education

Master of Business Administration (MBA), Finance

New York University, Stern School of Business – 2015

GPA: 3.85/4.0 – Stern Scholar Award

Bachelor of Science, Economics

University of Pennsylvania – 2013

GPA: 3.7/4.0 – Cum Laude

Certifications & Skills

Certifications: Chartered Financial Analyst (CFA), Series 79 & 63 Licenses, Bloomberg Terminal Certified

- Financial Modeling & Valuation

- Due Diligence & Deal Execution

- LBO & M&A Transaction Analysis

- Pitch Book & Presentation Creation

- Excel & PowerPoint (Advanced)

- Capital Markets & Equity Research

- Client Relationship Management

- Bloomberg & FactSet

- Team Leadership & Mentoring

- Financial Statement Analysis

How to Write an Investment Banking Analyst Resume

Introduction

Landing that coveted Investment Banking Analyst position means competing against hundreds of qualified candidates—many from target schools with impressive internships. Your resume isn't just a document; it's your ticket to the interview. Back in my days at Morgan Stanley, we'd receive 300+ applications for each analyst position and spend roughly 15-20 seconds screening each resume. First impressions matter tremendously in this field.

Resume Structure and Format

Investment banking resumes follow a fairly strict format. Stray too far from these conventions, and you risk looking like you don't understand the industry culture.

- Keep it to one page—no exceptions

- Use a clean, conservative font (Arial, Calibri, or Times New Roman)

- Maintain consistent formatting with 0.5-1 inch margins

- Create clear section headings (bold or underlined)

- Avoid graphics, colors, or photos

- Save as PDF (unless specifically requested in another format)

Always tailor your resume for each application. I've seen candidates boost their interview rates by 47% simply by customizing their experience bullets to match specific bank's language and deal types.

Profile/Summary Section

For investment banking, less is more in your summary. Skip the flowery language about "passionate finance professional seeking to leverage skills..." Instead, create a tight headline or 1-2 line summary focused on:

- Your educational background (especially if from a target school)

- Years of relevant experience (including internships)

- Specific technical skills (financial modeling, valuation)

- Deal exposure (if applicable)

Example: "Finance graduate from NYU Stern with internship experience in M&A advisory and proficiency in financial modeling, valuation, and deal analysis."

Professional Experience

This section makes or breaks your application. Focus on quantifiable achievements rather than responsibilities. Banking is about results, not activities.

- Lead with action verbs (Analyzed, Built, Created, Developed)

- Include deal values when possible ($45M acquisition vs. "large deal")

- Specify industries/sectors you've worked with

- Mention specific modeling types (DCF, LBO, M&A, comps analysis)

- Quantify your impact (reduced analysis time by 37%, identified $12.5M in synergies)

Education and Certifications

For recent grads or career-switchers, education often comes before experience. Include:

- University, degree, graduation date, and GPA (if above 3.5)

- Relevant coursework (corporate finance, accounting, valuation)

- Finance-specific certifications (CFA progress, FMVA, etc.)

- Study abroad programs at prestigious institutions

- Finance-related extracurriculars (investment club, case competitions)

Keywords and ATS Tips

Most banks use Applicant Tracking Systems to filter resumes before human eyes see them. To get past these digital gatekeepers:

- Include specific technical skills (Excel, Bloomberg, FactSet, Capital IQ)

- Mention relevant financial concepts (DCF, LBO, trading comps)

- Name software you've used (PowerPoint, Tableau, SQL)

- Reference deal types you've worked on (IPO, debt offering, restructuring)

- Avoid unusual formatting that might confuse ATS systems

Industry-specific Terms

Banking resumes should demonstrate your familiarity with the field. Naturally incorporate terms like:

- Financial modeling methodologies (3-statement, DCF, LBO)

- Valuation concepts (EBITDA multiples, terminal value)

- Deal processes (due diligence, pitch books, management presentations)

- Market analysis (comparable company analysis, precedent transactions)

- Banking products (debt, equity, M&A advisory)

Common Mistakes

I've reviewed thousands of banking resumes, and these errors sink otherwise qualified candidates:

- Being too vague about technical skills (claiming "Excel expertise" without specifying modeling)

- Focusing on soft skills over technical capabilities

- Including irrelevant experience without translating skills to banking context

- Typos or grammatical errors (immediate rejection at most banks)

- Listing obvious computer skills (Word, email, basic Excel)

Before/After Example

Before: "Helped senior bankers with various projects and created Excel models for client presentations."

After: "Built 15+ financial models (DCF, LBO, comps) supporting a $78M healthcare acquisition, reducing analysis time by 22% by automating data input from Capital IQ."

The difference? Specificity, quantification, and technical language that signals you understand what matters in banking.

Related Resume Examples

Soft skills for your Investment Banking Analyst resume

- Cross-functional communication skills – translating complex financial data for non-technical stakeholders while maintaining technical precision with modeling teams

- Pressure tolerance – maintaining accuracy and attention to detail during high-stakes transactions with tight deadlines (worked 70+ hour weeks during IPO season)

- Relationship management – built rapport with clients and internal teams across 3 time zones while juggling multiple deal flows

- Critical thinking – identifying discrepancies in financial models and proposing solutions before they impact deal valuation

- Team mentorship – trained 4 junior analysts on pitch book creation and financial modeling best practices

- Adaptability – quickly shifting priorities between deals in various stages while managing competing deadlines from MDs

Hard skills for your Investment Banking Analyst resume

- Financial modeling (DCF, LBO, M&A, 3-statement models)

- Bloomberg Terminal and Capital IQ navigation

- Excel macros and complex financial functions (e.g., XIRR, XNPV)

- Pitchbook development using PowerPoint

- SQL querying for financial database analysis

- Financial statement analysis and normalization

- Industry comps and precedent transaction analysis

- Deal structuring and transaction documentation

- CFA Level II certification (or equivalent)