Banking Analyst Resume examples & templates

Copyable Banking Analyst Resume examples

Ever wondered what goes on behind the massive quarterly earnings reports that banks publish? Banking Analysts are the financial detectives who dig through mountains of data to uncover the stories those numbers tell. These professionals blend quantitative skills with business acumen to evaluate lending portfolios, assess risk factors, and forecast market trends—often juggling multiple critical projects with competing deadlines.

The role has evolved dramatically since the 2008 financial crisis, with regulatory compliance becoming a much bigger piece of the puzzle. Banking Analysts now spend approximately 37% of their time on risk assessment and compliance matters, according to a 2023 survey by the Financial Services Institute. This shift coincides with the industry's growing adoption of AI-powered analytics tools that are changing how data gets processed (though not replacing the critical thinking that experienced analysts bring to the table). For those with strong quantitative skills and attention to detail, banking analysis offers a challenging career path with median salaries hovering around $95,700—and plenty of room for growth as digital banking continues reshaping the financial landscape.

Junior Banking Analyst Resume Example

MARCUS RIVERA

Phone: (312) 555-7821 | Email: m.rivera.finance@gmail.com | LinkedIn: linkedin.com/in/marcusrivera | Chicago, IL

Recent finance graduate with banking operations internship experience and strong analytical skills. Quick learner who thrives in fast-paced environments and has a knack for identifying process improvements. Seeking to leverage my financial analysis abilities and customer service background to grow as a Banking Analyst while contributing to operational efficiency.

EXPERIENCE

Junior Banking Analyst – First Midwest Financial Group, Chicago, IL (January 2023 – Present)

- Analyze daily banking transactions and prepare reports for branch managers, reducing reporting time by 27%

- Reconcile accounts and identify discrepancies, recovering approximately $23,400 in misallocated funds

- Assist with loan documentation review for compliance with bank policies and federal regulations

- Monitor suspicious activity reports and help implement new AML screening procedures

- Collaborate with IT team to improve data visualization dashboards for executive presentations

Banking Operations Intern – First Midwest Financial Group, Chicago, IL (May 2022 – December 2022)

- Supported back-office operations team with transaction processing and account maintenance

- Helped develop Excel models to track branch performance metrics and identify trends

- Participated in weekly team meetings and contributed ideas for workflow improvements

- Assisted customers with online banking setup and basic troubleshooting (covered for staff during lunch hours)

Customer Service Representative – RetailPlus, Chicago, IL (June 2020 – April 2022)

- Handled 40+ customer interactions daily, maintaining 94% positive feedback rating

- Processed payments and managed cash drawer with zero discrepancies

- Trained 3 new team members on POS system and company policies

EDUCATION

Bachelor of Science in Finance – University of Illinois Chicago (2018-2022)

- GPA: 3.7/4.0

- Relevant Coursework: Financial Markets, Banking Regulations, Financial Statement Analysis, Risk Management, Business Statistics

- Finance Club Treasurer (2021-2022)

CERTIFICATIONS

- Bloomberg Market Concepts (BMC) – Completed June 2022

- Excel for Financial Analysis – LinkedIn Learning, March 2022

- Currently studying for Series 6 exam

SKILLS

- Financial Analysis & Reporting

- Microsoft Excel (VLOOKUP, Pivot Tables, Macros)

- Banking Regulations & Compliance

- Transaction Monitoring

- Data Visualization (Power BI)

- Customer Relationship Management

- SQL (basic queries)

- Problem-solving & Critical Thinking

- Bloomberg Terminal (basic functions)

ADDITIONAL

Volunteer Financial Literacy Coach, Urban Youth Program (2021-Present)

Fluent

in Spanish

Avid participant in local finance meetups and banking industry webinars

Mid-level Banking Analyst Resume Example

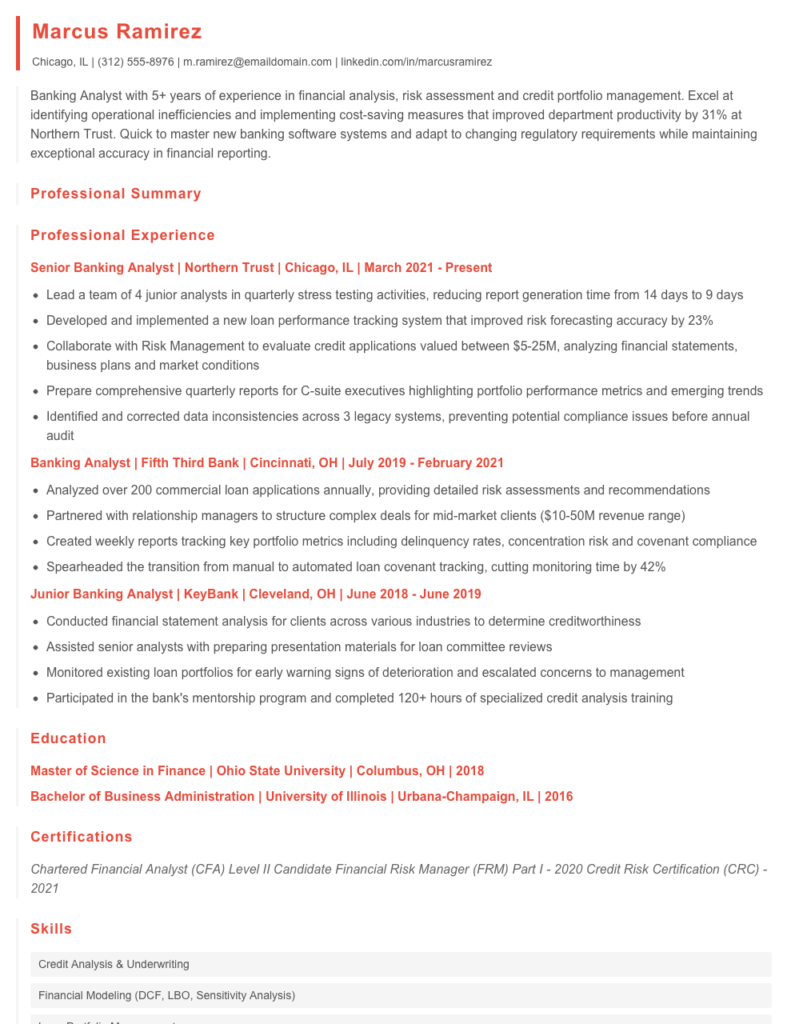

Marcus Ramirez

Chicago, IL | (312) 555-8976 | m.ramirez@emaildomain.com | linkedin.com/in/marcusramirez

Professional Summary

Banking Analyst with 5+ years of experience in financial analysis, risk assessment and credit portfolio management. Excel at identifying operational inefficiencies and implementing cost-saving measures that improved department productivity by 31% at Northern Trust. Quick to master new banking software systems and adapt to changing regulatory requirements while maintaining exceptional accuracy in financial reporting.

Professional Experience

Senior Banking Analyst | Northern Trust | Chicago, IL | March 2021 – Present

- Lead a team of 4 junior analysts in quarterly stress testing activities, reducing report generation time from 14 days to 9 days

- Developed and implemented a new loan performance tracking system that improved risk forecasting accuracy by 23%

- Collaborate with Risk Management to evaluate credit applications valued between $5-25M, analyzing financial statements, business plans and market conditions

- Prepare comprehensive quarterly reports for C-suite executives highlighting portfolio performance metrics and emerging trends

- Identified and corrected data inconsistencies across 3 legacy systems, preventing potential compliance issues before annual audit

Banking Analyst | Fifth Third Bank | Cincinnati, OH | July 2019 – February 2021

- Analyzed over 200 commercial loan applications annually, providing detailed risk assessments and recommendations

- Partnered with relationship managers to structure complex deals for mid-market clients ($10-50M revenue range)

- Created weekly reports tracking key portfolio metrics including delinquency rates, concentration risk and covenant compliance

- Spearheaded the transition from manual to automated loan covenant tracking, cutting monitoring time by 42%

Junior Banking Analyst | KeyBank | Cleveland, OH | June 2018 – June 2019

- Conducted financial statement analysis for clients across various industries to determine creditworthiness

- Assisted senior analysts with preparing presentation materials for loan committee reviews

- Monitored existing loan portfolios for early warning signs of deterioration and escalated concerns to management

- Participated in the bank’s mentorship program and completed 120+ hours of specialized credit analysis training

Education

Master of Science in Finance | Ohio State University | Columbus, OH | 2018

Bachelor of Business Administration | University of Illinois | Urbana-Champaign, IL | 2016

Certifications

Chartered Financial Analyst (CFA) Level II Candidate

Financial Risk Manager (FRM) Part I – 2020

Credit Risk Certification (CRC) – 2021

Skills

- Credit Analysis & Underwriting

- Financial Modeling (DCF, LBO, Sensitivity Analysis)

- Loan Portfolio Management

- Risk Assessment & Mitigation

- Regulatory Compliance (Basel III, Dodd-Frank)

- Advanced Excel & VBA

- Moody’s Analytics Credit Lens

- Bloomberg Terminal

- PowerBI & Tableau

- SQL Database Querying

Additional Information

Active member of the Risk Management Association (RMA), Chicago Chapter

Fluent in Spanish (professional working proficiency)

Volunteer financial literacy instructor at Chicago Public Schools (2021-Present)

Senior / Experienced Banking Analyst Resume Example

Alex R. Martinez

Boston, MA • (617) 555-8921 • a.martinez@email.com • linkedin.com/in/alexrmartinez

Banking Analyst with 9+ years of experience working across credit risk management, financial modeling, and regulatory compliance. Track record of identifying cost-saving opportunities while ensuring adherence to Basel III requirements. Skilled in translating complex financial data into actionable recommendations for senior management. Currently pursuing CFA Level III with expected completion in 2023.

PROFESSIONAL EXPERIENCE

Senior Banking Analyst – Northeast Financial Group, Boston, MA (March 2019 – Present)

- Lead team of 4 junior analysts in conducting comprehensive portfolio risk assessments, resulting in 31% reduction in non-performing loans

- Developed custom Python-based model that improved loan default prediction accuracy by 17% compared to previous system

- Collaborated with Risk Management Committee to establish new lending guidelines that reduced exposure to high-risk sectors by $12.3M

- Present quarterly financial analysis findings to C-suite executives, translating technical data into strategic recommendations

- Spearheaded implementation of new credit scoring methodology that shortened approval process from 4 days to 36 hours while maintaining risk parameters

Banking Analyst – Commerce Trust Bank, Providence, RI (June 2016 – February 2019)

- Performed stress testing on commercial loan portfolio worth $470M, uncovering potential vulnerabilities that led to policy revisions

- Created monthly financial reports tracking key performance indicators across retail banking operations

- Analyzed competitor rate structures and market conditions to recommend pricing strategies that increased new account openings by 14%

- Partnered with IT to automate repetitive reporting tasks, freeing approximately 7 hours weekly for higher-value analysis

Junior Banking Analyst – First Metro Bank, Hartford, CT (August 2014 – May 2016)

- Supported senior analysts in gathering and organizing financial data for quarterly reports

- Monitored compliance with internal lending policies and federal regulations

- Assisted in developing Excel models to track performance metrics of various banking products

- Conducted basic credit risk assessments for small business loan applications

EDUCATION

Master of Science in Finance – Boston University, Boston, MA (2014)

Concentration in Financial Risk Management • GPA: 3.8/4.0

Bachelor of Business Administration – University of Connecticut, Storrs, CT (2012)

Major in Banking and Finance • Minor in Economics • GPA: 3.6/4.0

CERTIFICATIONS & PROFESSIONAL DEVELOPMENT

- CFA Level II (Passed 2021), Level III Candidate

- Financial Risk Manager (FRM) Certification (2018)

- Advanced Excel for Financial Modeling, Wall Street Prep (2017)

- Python for Financial Analysis, Online certification (2020)

TECHNICAL SKILLS

- Financial Modeling & Forecasting

- Credit Risk Analysis

- Regulatory Compliance (Basel III, Dodd-Frank)

- Loan Portfolio Management

- Bloomberg Terminal

- Advanced Excel (VBA, PivotTables, VLOOKUP)

- SAS, Python, SQL

- Power BI & Tableau

- Moody’s Analytics & S&P Capital IQ

ADDITIONAL INFORMATION

Fluent in English and Spanish • Member of Risk Management Association (RMA) • Volunteer financial literacy instructor at Boston Community Center

How to Write a Banking Analyst Resume

Introduction

Landing that Banking Analyst job means first getting past the resume gatekeepers. Financial institutions receive hundreds of applications for each opening, and your resume is your ticket to the interview. I've reviewed thousands of banking resumes over my career, and the difference between those that get

calls and those that don't often comes down to surprisingly small details. This guide will walk you through creating a resume that showcases your financial acumen, analytical skills, and attention to detail—qualities every hiring manager in banking is searching for.

Resume Structure and Format

Banking is a conservative industry, and your resume format should reflect this professional environment. Keep these guidelines in mind:

- Length: Stick to 1 page for early-career positions (0-5 years); 2 pages max for more senior roles

- Font: Use clean, readable fonts like Calibri, Arial, or Times New Roman (10-12pt)

- Margins: 0.5-1 inch all around (0.7" tends to work well)

- Section order: Contact info → Summary → Experience → Education → Skills → Certifications

- File format: Submit as PDF unless specifically requested otherwise

Your resume should look crisp and organized—just like the financial reports you'll be preparing. White space matters! A cluttered resume suggests disorganized thinking, while a well-structured one demonstrates your ability to present information clearly.

Profile/Summary Section

Your summary is like the executive summary of a financial report—concise, impactful, and highlighting key value. In 3-4 lines, you need to establish:

- Your current role/experience level (e.g., "Banking Analyst with 4+ years in commercial lending")

- Your specific banking specialization (credit analysis, financial modeling, risk assessment)

- 1-2 standout achievements or skills that differentiate you

- What you bring to the specific institution (this should be customized for each application)

Pro Tip: Write your summary last! After you've crafted the rest of your resume, you'll have a clearer picture of your strongest selling points to highlight up top.

Professional Experience

Banking resumes thrive on quantifiable results. For each position, include:

- Company name, location, your title, and dates (month/year)

- Brief context about your role (1 line max)

- 4-6 bullet points highlighting achievements, not just responsibilities

- Metrics wherever possible (dollar amounts, percentages, portfolio sizes)

Strong example: "Analyzed 17 potential acquisition targets resulting in successful $43M purchase that increased company revenue by 27% within first fiscal year"

Weak example: "Responsible for analyzing acquisition targets and making recommendations"

Education and Certifications

Banking values credentials. List your degrees in reverse chronological order with:

- Institution name, location, degree, major, graduation year

- GPA if 3.5+ (or relevant academic honors)

- Relevant coursework (especially for recent grads)

- Certifications with completion dates or "In Progress" status

Highlight finance-specific certifications like CFA (any level), Series 7/63, Bloomberg certification, or Financial Modeling certifications. Even if you're still working toward these, listing "CFA Level I Candidate (Exam scheduled June 2023)" shows professional commitment.

Keywords and ATS Tips

Most banks use Applicant Tracking Systems to screen resumes before human eyes see them. To pass this digital gatekeeper:

- Include job-specific terms from the posting (financial modeling, credit analysis, due diligence)

- Mention specific software skills (Excel, Bloomberg Terminal, Capital IQ, Factset)

- Name relevant regulations you're familiar with (Basel III, Dodd-Frank)

- Use both spelled-out terms and acronyms (Net Present Value/NPV, Internal Rate of Return/IRR)

Common Mistakes to Avoid

- Vague statements without supporting evidence ("excellent analytical skills")

- Too much jargon without demonstrating understanding

- Grammar or math errors (fatal in banking!)

- Listing only responsibilities rather than achievements

- Using an unprofessional email address (create a firstname.lastname@gmail.com if needed)

Before/After Example

Before: "Responsible for analyzing company financials and making recommendations."

After: "Developed comprehensive financial models for 12 mid-market companies ($50M-$120M revenue), identifying a previously overlooked acquisition target that generated $3.2M in first-year revenue after purchase."

The difference? Specific details, quantifiable results, and clear demonstration of value added. That's what gets banking resumes noticed and interviews scheduled.

Related Resume Examples

Soft skills for your Banking Analyst resume

- Cross-functional relationship building (especially with compliance and risk teams)

- Financial storytelling – translating complex data into actionable insights for non-technical stakeholders

- Resilience under pressure during market volatility and quarterly reporting periods

- Detail orientation without losing sight of broader implications

- Active listening skills that help identify client needs beyond stated requirements

- Diplomatic pushback when necessary – challenging assumptions constructively

Hard skills for your Banking Analyst resume

- SQL database querying and advanced Excel modeling (VLOOKUP, INDEX/MATCH, pivot tables)

- Risk analysis using Monte Carlo simulations and stress testing methodologies

- Bloomberg Terminal navigation and financial data extraction

- Credit scoring models and loan portfolio analytics

- Financial statement analysis and cash flow forecasting

- Python scripting for data cleaning and reporting automation

- Bank regulatory compliance frameworks (Basel III, Dodd-Frank)

- Treasury management systems and liquidity ratio calculations

- Tableau or Power BI for creating executive dashboards