Investment Accountant Resume examples & templates

Copyable Investment Accountant Resume examples

Ever wondered what happens behind the scenes when a hedge fund makes a billion-dollar investment? Investment Accountants are the financial detectives who track every penny of those transactions. They're not just number-crunchers—they're the guardians of financial accuracy in a world where a decimal point in the wrong place could mean millions lost. With the investment management industry projected to handle over $145.4 trillion in assets globally by 2025, these professionals face growing complexity and responsibility.

The field is evolving fast. ESG (Environmental, Social, Governance) accounting has jumped from a niche concern to a mainstream requirement, with 76% of institutional investors now incorporating these factors into their investment decisions. Gone are the days when spreadsheet skills alone would cut it. Today's Investment Accountants need to navigate sophisticated portfolio management systems, understand regulatory frameworks across borders, and translate complex financial data into actionable insights. As investment vehicles become more exotic and regulatory scrutiny intensifies, these professionals find themselves at the intersection of accounting precision and investment strategy—a challenging spot, but one with tremendous growth potential.

Junior Investment Accountant Resume Example

JORDAN MCALLISTER

Boston, MA • (617) 555-8421 • jmcallister92@email.com • linkedin.com/in/jordanmcallister

Detail-oriented Investment Accountant with 1+ year experience supporting fund accounting operations and financial reporting processes. Skilled in reconciliation, NAV calculation, and financial analysis within private equity environments. Quick learner with strong analytical abilities and experience using Bloomberg Terminal, Excel, and fund accounting systems.

EXPERIENCE

Investment Accountant | Meridian Financial Services | Boston, MA | June 2022 – Present

- Process daily NAV calculations and valuations for 6 funds totaling $478M in AUM, ensuring 99.7% accuracy in price reporting

- Reconcile cash positions, security transactions and holdings across multiple custodian accounts, resolving 30+ discrepancies monthly

- Prepare monthly financial statements and investor reports for private equity funds, reducing delivery time by 2 days

- Assist with month-end closing procedures including journal entry preparation and account reconciliations

- Support audit requests by gathering documentation and explaining transaction history to external auditors

Fund Accounting Intern | Wellington Investment Services | Boston, MA | January 2022 – May 2022

- Assisted senior accountants with daily trade settlements and cash reconciliations for 4 mutual funds

- Helped compile quarterly performance reports using Bloomberg Terminal data and Excel models

- Participated in developing process improvements that decreased monthly close time by 1.5 days

- Updated fund expense accruals and tracked dividend/interest income across portfolios

Finance Intern | Northeast Credit Union | Portsmouth, NH | May 2021 – August 2021

- Supported accounting team with daily cash reconciliation and basic financial reporting tasks

- Assisted with accounts payable processing and bank statement reconciliation

- Created Excel templates to automate routine reporting functions (saved ~4 hours weekly)

EDUCATION

Bachelor of Science in Finance | Boston University | Boston, MA | May 2022

- GPA: 3.78/4.0

- Relevant Coursework: Investment Analysis, Financial Accounting, Advanced Excel for Finance, Securities Analysis

- Finance Club Treasurer (2020-2022)

CERTIFICATIONS

Investment Foundations Certificate | CFA Institute | August 2022

Bloomberg Market Concepts (BMC) | Bloomberg LP | March 2022

SKILLS

- Fund Accounting: NAV calculations, portfolio reconciliation, financial reporting

- Software: Bloomberg Terminal, MS Excel (advanced formulas, pivot tables, VBA basics), QuickBooks

- Technical: Fund accounting systems (Advent Geneva – basic user), SQL (beginner)

- Financial Analysis: Cash flow analysis, variance analysis, financial modeling

- Regulatory: Basic knowledge of SEC reporting requirements for investment funds

ADDITIONAL

Currently studying for CFA Level I exam (scheduled for June 2023)

Volunteer Tax Preparer, VITA Program (2022 tax season)

Mid-level Investment Accountant Resume Example

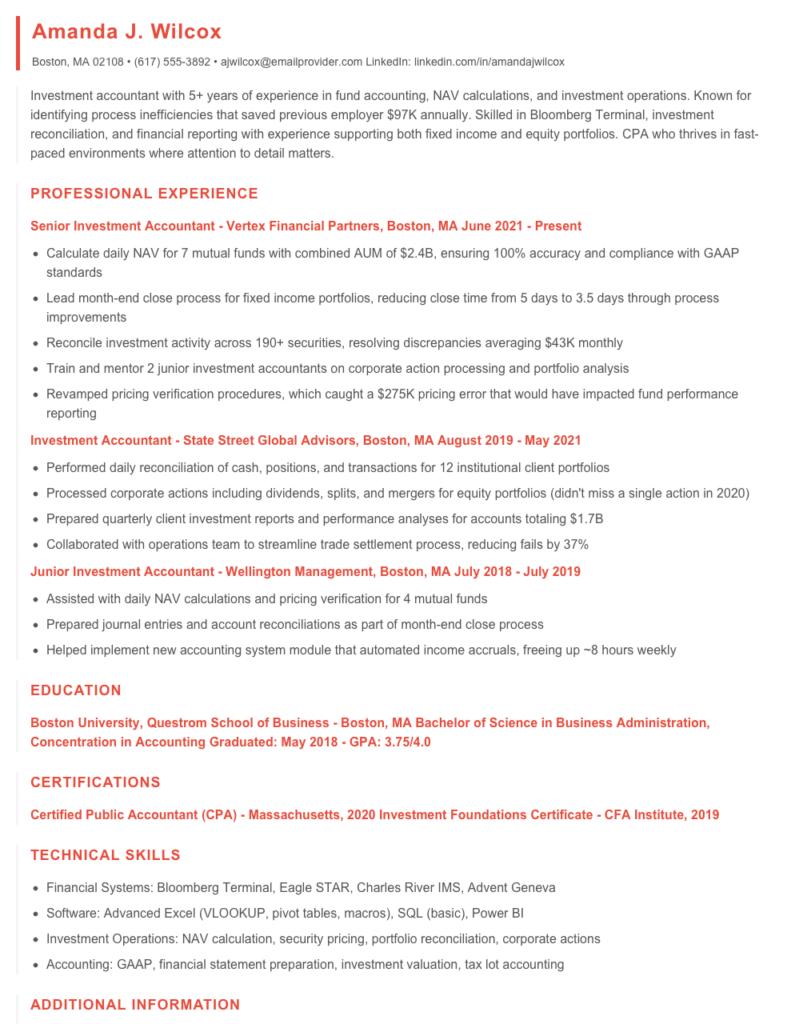

Amanda J. Wilcox

Boston, MA 02108 • (617) 555-3892 • ajwilcox@emailprovider.com

LinkedIn: linkedin.com/in/amandajwilcox

Investment accountant with 5+ years of experience in fund accounting, NAV calculations, and investment operations. Known for identifying process inefficiencies that saved previous employer $97K annually. Skilled in Bloomberg Terminal, investment reconciliation, and financial reporting with experience supporting both fixed income and equity portfolios. CPA who thrives in fast-paced environments where attention to detail matters.

PROFESSIONAL EXPERIENCE

Senior Investment Accountant – Vertex Financial Partners, Boston, MA

June 2021 – Present

- Calculate daily NAV for 7 mutual funds with combined AUM of $2.4B, ensuring 100% accuracy and compliance with GAAP standards

- Lead month-end close process for fixed income portfolios, reducing close time from 5 days to 3.5 days through process improvements

- Reconcile investment activity across 190+ securities, resolving discrepancies averaging $43K monthly

- Train and mentor 2 junior investment accountants on corporate action processing and portfolio analysis

- Revamped pricing verification procedures, which caught a $275K pricing error that would have impacted fund performance reporting

Investment Accountant – State Street Global Advisors, Boston, MA

August 2019 – May 2021

- Performed daily reconciliation of cash, positions, and transactions for 12 institutional client portfolios

- Processed corporate actions including dividends, splits, and mergers for equity portfolios (didn’t miss a single action in 2020)

- Prepared quarterly client investment reports and performance analyses for accounts totaling $1.7B

- Collaborated with operations team to streamline trade settlement process, reducing fails by 37%

Junior Investment Accountant – Wellington Management, Boston, MA

July 2018 – July 2019

- Assisted with daily NAV calculations and pricing verification for 4 mutual funds

- Prepared journal entries and account reconciliations as part of month-end close process

- Helped implement new accounting system module that automated income accruals, freeing up ~8 hours weekly

EDUCATION

Boston University, Questrom School of Business – Boston, MA

Bachelor of Science in Business Administration, Concentration in Accounting

Graduated: May 2018 – GPA: 3.75/4.0

CERTIFICATIONS

Certified Public Accountant (CPA) – Massachusetts, 2020

Investment Foundations Certificate – CFA Institute, 2019

TECHNICAL SKILLS

- Financial Systems: Bloomberg Terminal, Eagle STAR, Charles River IMS, Advent Geneva

- Software: Advanced Excel (VLOOKUP, pivot tables, macros), SQL (basic), Power BI

- Investment Operations: NAV calculation, security pricing, portfolio reconciliation, corporate actions

- Accounting: GAAP, financial statement preparation, investment valuation, tax lot accounting

ADDITIONAL INFORMATION

Active member of Boston Society of Financial Analysts

Volunteer tax preparer for low-income families through VITA program (2019-present)

Senior / Experienced Investment Accountant Resume Example

MARCUS D. WILSON

Boston, MA | (617) 555-8472 | m.wilson@emailprovider.com | linkedin.com/in/marcusdwilson

Detail-oriented Investment Accountant with 10+ years of experience in financial reporting, fund accounting, and portfolio analysis. Specialized in alternative investments and private equity with a track record of streamlining accounting processes and implementing controls that reduced reporting errors by 42%. Excel at creating clear financial narratives for complex investment structures while ensuring regulatory compliance.

PROFESSIONAL EXPERIENCE

Senior Investment Accountant – Harbor Point Capital Partners, Boston, MA (April 2018 – Present)

- Manage full-cycle accounting for $2.3B in alternative investments including hedge funds, private equity, and real estate portfolios

- Lead month-end and year-end closing processes for 17 investment funds, delivering reports 3 days faster than previous benchmarks

- Implemented new reconciliation procedures that identified $4.7M in previously unrecognized gains across multiple limited partnerships

- Collaborated with IT to develop custom Excel macros that automated NAV calculations, reducing processing time by 37%

- Train and mentor junior accountants on investment valuation methodologies and partnership accounting principles

Investment Accountant – Eastern Financial Services, Providence, RI (June 2015 – March 2018)

- Performed daily pricing, income accruals, and corporate actions for fixed income and equity securities

- Prepared quarterly financial statements for 8 mutual funds with combined AUM of $1.2B

- Calculated daily NAVs and reconciled positions with custodian records, identifying and resolving discrepancies within 24 hours

- Spearheaded transition to new portfolio accounting system, reducing manual data entry by 63%

- Worked with external auditors to complete annual audits with zero material findings for 3 consecutive years

Junior Accountant – Meridian Investment Group, Boston, MA (August 2013 – May 2015)

- Assisted with daily fund accounting operations for 5 domestic equity mutual funds

- Processed trade settlements and cash reconciliations between accounting records and custodian statements

- Created monthly performance reports for portfolio managers and institutional clients

- Developed spreadsheet templates for tracking dividend accruals that became standard practice firmwide

EDUCATION & CERTIFICATIONS

Master of Science in Finance – Boston University, Boston, MA (2013)

Bachelor of Science in Accounting – University of Massachusetts, Amherst, MA (2011)

Certified Public Accountant (CPA) – Massachusetts, License #MA-78293 (2014)

Investment Foundations Certificate – CFA Institute (2016)

Financial Modeling & Valuation Analyst (FMVA) – Corporate Finance Institute (2019)

TECHNICAL SKILLS

- Financial Systems: Bloomberg Terminal, Advent Geneva, SS&C Portia, Eagle STAR

- Advanced Excel (VBA, pivot tables, complex financial formulas, data modeling)

- Fund accounting software: FundCount, Investran, eFront

- Investment performance calculation methodologies (GIPS compliant)

- Financial reporting (GAAP, IFRS) and regulatory filings

- Data analysis tools: SQL, Power BI, Tableau

- Partnership accounting and waterfall calculations

PROFESSIONAL AFFILIATIONS

American Institute of Certified Public Accountants (AICPA)

Boston Security Analysts Society (BSAS)

Financial Accounting Standards Board (FASB) – Private Company Forum participant

How to Write an Investment Accountant Resume

Introduction

Landing that perfect Investment Accountant job starts with a resume that showcases your financial expertise, analytical skills, and attention to detail. I've reviewed thousands of finance resumes over the years, and I can tell you that investment firms are particularly selective—they want proof you can handle complex financial data with precision. Your resume needs to speak their language while highlighting your unique value proposition in the investment accounting world.

Resume Structure and Format

Keep your resume clean and professional—just like your accounting work. Most hiring managers in financial services spend less than 45 seconds on initial resume screening, so make every inch count.

- Stick to 1-2 pages (1 page for juniors, 2 pages max for seniors with 8+ years)

- Use a clean, readable font like Calibri or Arial (10-12pt)

- Include clear section headings to guide the reader's eye

- Incorporate white space strategically—cramped resumes get skimmed

- Save as a PDF to preserve formatting (unless specifically asked for Word)

Profile/Summary Section

Your summary should be a 3-4 line snapshot of your investment accounting expertise. Think of it as your "balance sheet at a glance"—what makes you a valuable asset?

Pro Tip: Customize your summary for each application. For a fund accounting role, highlight your NAV calculation experience. For a position with a real estate investment firm, emphasize your property valuation knowledge.

Example: "Investment Accountant with 5+ years specializing in hedge fund accounting and financial reporting. Proficient in Geneva and eFront with experience preparing NAV calculations for funds totaling $2.3B in AUM. Known for reconciling complex derivative positions with 99.7% accuracy rate."

Professional Experience

This is where you prove your financial chops. For each position:

- Start with company name, your title, and dates (month/year)

- Add a brief description of the firm if it's not well-known (AUM size, type of funds)

- List 4-6 bullet points emphasizing achievements, not just duties

- Begin bullets with strong action verbs (Reconciled, Prepared, Analyzed)

- Include metrics wherever possible ($, %, time saved)

Strong example: "Streamlined month-end close process from 8 days to 5 days by implementing automated reconciliation procedures, reducing manual entry errors by 37%."

Weak example: "Responsible for month-end close process and reconciliations."

Education and Certifications

Investment accounting values credentials. List your degree(s) with graduation year, school name, and GPA if above 3.5. Then showcase your financial certifications:

- CPA (Certified Public Accountant)

- CFA (Chartered Financial Analyst)

- CAIA (Chartered Alternative Investment Analyst)

- MBA with finance concentration

- Relevant software certifications (Bloomberg, eFront, etc.)

Keywords and ATS Tips

Most investment firms use Applicant Tracking Systems to filter resumes. Include these terms naturally throughout your resume (but only if you actually have the skill!):

- NAV calculation

- Financial reporting

- Portfolio valuation

- Fund accounting

- GAAP/IFRS

- Reconciliation

- Performance measurement

- Financial modeling

Industry-specific Terms

Speak the language of investment accounting by incorporating relevant terminology. Jim, a hiring manager at Blackrock, once told me he specifically looks for candidates who demonstrate familiarity with:

- Alternative investments

- Partnership accounting

- Carried interest calculations

- Fair value measurements

- Side pocket allocations

- Waterfall distributions

- Treasury management

Common Mistakes to Avoid

- Focusing only on responsibilities rather than achievements

- Omitting relevant accounting software proficiency

- Being vague about the types/sizes of funds you've worked with

- Overlooking proofreading (unforgivable for detail-oriented roles!)

- Using generic descriptions that could apply to any accountant

Before/After Example

Before: "Responsible for monthly NAV calculations and investor reporting."

After: "Calculated monthly NAV for 17 hedge funds ($1.8B AUM) with zero restatements during tenure; produced comprehensive investor reporting packages that reduced client queries by 42% through enhanced transparency on fee calculations and performance attribution."

Remember—your resume should demonstrate not just what you did, but how well you did it. Good luck with your investment accounting career journey!

Related Resume Examples

Soft skills for your Investment Accountant resume

- Cross-functional relationship building (especially with fund managers, auditors, and tax specialists)

- Technical concept translation – explaining complex accounting treatments to non-finance stakeholders

- Deadline management during peak reporting periods

- Regulatory change adaptation – quickly adjusting to new accounting standards

- Detail orientation balanced with big-picture thinking

- Mentoring junior staff on reconciliation techniques and variance analysis

Hard skills for your Investment Accountant resume

- Advanced Excel modeling (scenario analysis, VBA macros, pivot tables)

- Investment portfolio accounting and reconciliation using Advent Geneva

- NAV calculation for 40+ Act mutual funds and private partnerships

- CFA Level II certification (Level III in progress)

- Fixed income attribution analysis and performance reporting

- Bloomberg Terminal data extraction and financial analysis

- GAAP/IFRS accounting standards for financial instruments

- SQL querying for investment data extraction and reporting

- SEC regulatory filing preparation (N-PORT, N-CEN)