Investment Analyst Resume examples & templates

Copyable Investment Analyst Resume examples

Ever wondered who's behind the scenes when a fund consistently outperforms the market? Investment Analysts are the financial detectives who dig through mountains of data to uncover hidden opportunities and risks. They're the ones who can spot the difference between a temporary market blip and the start of a major trend—skills that have become even more crucial since the pandemic upended traditional market patterns.

The field is evolving fast, with 73% of investment firms now seeking candidates with both quantitative analysis skills and ESG (Environmental, Social, Governance) knowledge, according to a 2023 CFA Institute survey. Gone are the days when Excel prowess alone could land you a top spot. Today's investment landscape demands analysts who can navigate alternative data sources, leverage AI tools, and translate complex findings into actionable recommendations. With global assets under management projected to grow despite economic uncertainties, sharp-minded analysts who can blend technical expertise with strategic thinking will find themselves in an increasingly influential position as we move through this decade.

Junior Investment Analyst Resume Example

Alexander “Alex” Chen

New York, NY 10016 | (212) 555-7890 | aleychen@emaildomain.com | linkedin.com/in/alexanderchen

Detail-oriented Investment Analyst with foundational experience in financial modeling, market research and investment due diligence. Strong quantitative background with proven ability to analyze complex data sets and identify value opportunities. Recently completed the CFA Level I exam while contributing to deal evaluation for a $215M acquisition. Quick learner who thrives in fast-paced environments.

EXPERIENCE

Investment Analyst – Meridian Capital Partners, New York, NY

June 2022 – Present

- Conduct fundamental research and financial analysis for potential investments across healthcare and technology sectors

- Build and maintain DCF and comparable company analysis models to support investment decisions, identifying 3 acquisition targets that advanced to due diligence

- Assist in preparing investment committee materials, including detailed company profiles and risk assessments

- Collaborate with senior analysts to monitor portfolio performance and prepare quarterly client presentations

- Created a specialized Excel tool that reduced report generation time by 37%, now used by the entire analyst team

Investment Banking Summer Analyst – Morgan Stanley, New York, NY

June 2021 – August 2021

- Supported M&A and capital raising activities for clients in the TMT sector

- Prepared company profiles, industry analyses and competitive benchmarking for pitch books

- Participated in due diligence calls and compiled findings for senior bankers

- Developed financial models to evaluate various transaction scenarios and potential outcomes

Finance Intern – Blackrock, Boston, MA

January 2021 – May 2021

- Assisted investment team with market research and competitive analysis for ETF products

- Compiled and organized data for quarterly performance reports

- Shadowed portfolio managers during client meetings and investment strategy sessions

EDUCATION

Boston University, School of Management – Boston, MA

Bachelor of Science in Finance, Minor in Economics

GPA: 3.78/4.0, Graduated May 2021

- Relevant Coursework: Investment Analysis, Financial Modeling, Corporate Valuation, Statistics for Finance

- Activities: Investment Club (VP of Research), Case Competition Team (2nd Place, 2020 Regional Finance Challenge)

CERTIFICATIONS & TRAINING

CFA Level I – Passed June 2022

Bloomberg Market Concepts (BMC) – Completed August 2021

Financial Modeling & Valuation Analyst (FMVA) – In Progress

SKILLS

- Financial Modeling (DCF, LBO, M&A, Accretion/Dilution)

- Valuation Methodologies

- Financial Statement Analysis

- Excel (Advanced – VLOOKUP, Pivot Tables, Macros)

- Bloomberg Terminal & FactSet

- Capital IQ

- PowerPoint & Presentation Skills

- SQL (Basic)

- Python (Basic – Pandas, NumPy)

- Research & Due Diligence

ADDITIONAL INFORMATION

Languages: English (Native), Mandarin Chinese (Conversational)

Interests: Chess (club rating 1750), amateur triathlete, podcast enthusiast

Mid-level Investment Analyst Resume Example

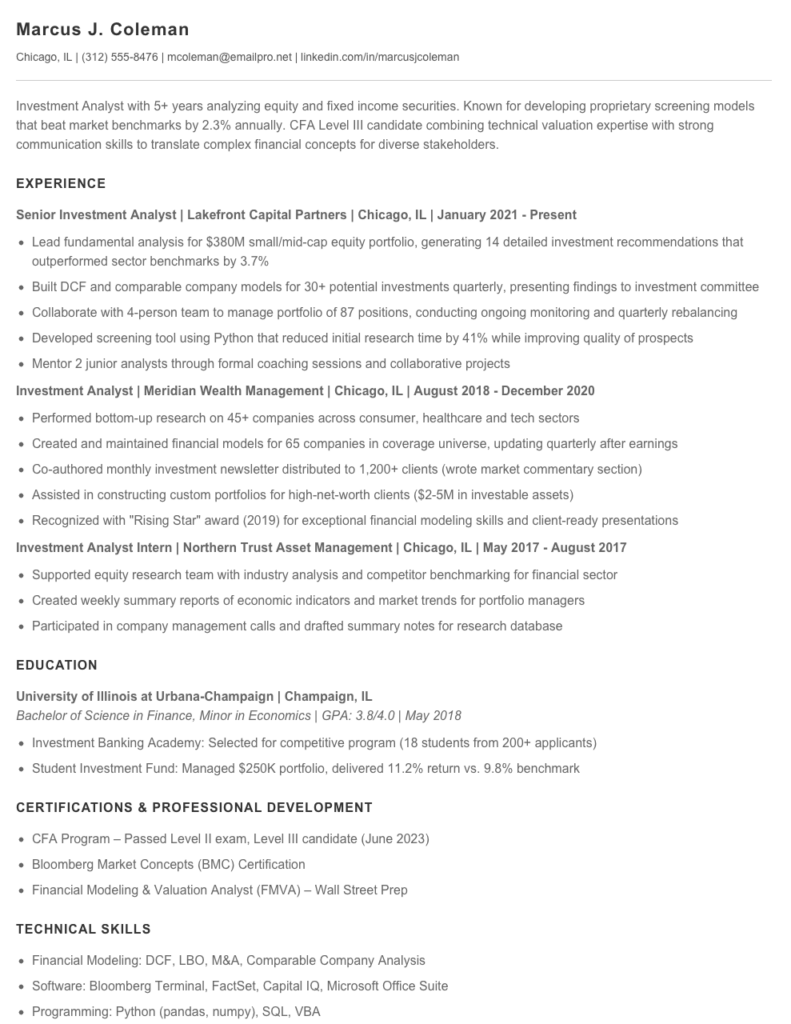

Marcus J. Coleman

Chicago, IL | (312) 555-8476 | mcoleman@emailpro.net | linkedin.com/in/marcusjcoleman

Investment Analyst with 5+ years analyzing equity and fixed income securities. Known for developing proprietary screening models that beat market benchmarks by 2.3% annually. CFA Level III candidate combining technical valuation expertise with strong communication skills to translate complex financial concepts for diverse stakeholders.

EXPERIENCE

Senior Investment Analyst | Lakefront Capital Partners | Chicago, IL | January 2021 – Present

- Lead fundamental analysis for $380M small/mid-cap equity portfolio, generating 14 detailed investment recommendations that outperformed sector benchmarks by 3.7%

- Built DCF and comparable company models for 30+ potential investments quarterly, presenting findings to investment committee

- Collaborate with 4-person team to manage portfolio of 87 positions, conducting ongoing monitoring and quarterly rebalancing

- Developed screening tool using Python that reduced initial research time by 41% while improving quality of prospects

- Mentor 2 junior analysts through formal coaching sessions and collaborative projects

Investment Analyst | Meridian Wealth Management | Chicago, IL | August 2018 – December 2020

- Performed bottom-up research on 45+ companies across consumer, healthcare and tech sectors

- Created and maintained financial models for 65 companies in coverage universe, updating quarterly after earnings

- Co-authored monthly investment newsletter distributed to 1,200+ clients (wrote market commentary section)

- Assisted in constructing custom portfolios for high-net-worth clients ($2-5M in investable assets)

- Recognized with “Rising Star” award (2019) for exceptional financial modeling skills and client-ready presentations

Investment Analyst Intern | Northern Trust Asset Management | Chicago, IL | May 2017 – August 2017

- Supported equity research team with industry analysis and competitor benchmarking for financial sector

- Created weekly summary reports of economic indicators and market trends for portfolio managers

- Participated in company management calls and drafted summary notes for research database

EDUCATION

University of Illinois at Urbana-Champaign | Champaign, IL

Bachelor of Science in Finance, Minor in Economics | GPA: 3.8/4.0 | May 2018

- Investment Banking Academy: Selected for competitive program (18 students from 200+ applicants)

- Student Investment Fund: Managed $250K portfolio, delivered 11.2% return vs. 9.8% benchmark

CERTIFICATIONS & PROFESSIONAL DEVELOPMENT

- CFA Program – Passed Level II exam, Level III candidate (June 2023)

- Bloomberg Market Concepts (BMC) Certification

- Financial Modeling & Valuation Analyst (FMVA) – Wall Street Prep

TECHNICAL SKILLS

- Financial Modeling: DCF, LBO, M&A, Comparable Company Analysis

- Software: Bloomberg Terminal, FactSet, Capital IQ, Microsoft Office Suite

- Programming: Python (pandas, numpy), SQL, VBA

- Specialized Skills: Equity Valuation, Fixed Income Analysis, Portfolio Construction, Risk Management

ADDITIONAL INFORMATION

Volunteer Investment Committee Member for Lincoln Park Community Foundation ($5.3M endowment) | Active member of CFA Society Chicago | Conversational Spanish proficiency

Senior / Experienced Investment Analyst Resume Example

MICHAEL J. THOMPSON

Boston, MA | (617) 555-8942 | mthompson@emaildomain.com | linkedin.com/in/michaeljthompson

Investment Analyst with 8+ years of experience analyzing market trends and generating investment recommendations. Strong track record of identifying undervalued securities and delivering portfolio performance that consistently outpaces market benchmarks. Known for combining quantitative analysis with qualitative business assessment to uncover hidden value opportunities.

PROFESSIONAL EXPERIENCE

SENIOR INVESTMENT ANALYST | Meridian Capital Partners | Boston, MA | January 2019 – Present

- Lead analysis for $430M AUM fund focused on mid-cap equities, generating 12.4% annualized returns vs. 8.7% benchmark

- Developed proprietary DCF model incorporating scenario-based risk analysis, improving valuation accuracy by 17%

- Manage team of 3 junior analysts, implementing structured research process that increased coverage by 35+ companies

- Present quarterly investment theses to 20+ institutional clients representing over $2B in potential capital

- Spearheaded integration of alternative data sources (satellite imagery, payment processing data) into research process

INVESTMENT ANALYST | BlueHarbor Investments | New York, NY | March 2016 – December 2018

- Conducted fundamental analysis on 40+ companies in consumer discretionary and technology sectors

- Generated 5 high-conviction investment ideas that returned average of 22.7% over 18-month holding period

- Built multi-factor screening tool that identified 3 overlooked acquisition targets before deals were announced

- Collaborated with portfolio managers to develop position sizing framework based on conviction and downside risk

- Expanded coverage universe to include emerging SaaS companies, resulting in early positions in 2 multi-baggers

RESEARCH ASSOCIATE | Wellington Asset Management | Boston, MA | June 2014 – February 2016

- Supported senior analysts in covering financial and industrial sectors across $12B equity fund

- Created detailed financial models using three-statement modeling techniques for 25+ companies

- Conducted channel checks with suppliers and customers to validate management growth projections

- Drafted weekly sector reports highlighting key catalysts and risks for portfolio managers

EDUCATION & CERTIFICATIONS

MASTER OF BUSINESS ADMINISTRATION | Boston University Questrom School of Business | 2014

Concentration in Finance | President, Investment Club | 3.92 GPA

BACHELOR OF SCIENCE, ECONOMICS | University of Michigan | 2012

Minor in Mathematics | Research Assistant, Department of Economics

CHARTERED FINANCIAL ANALYST (CFA) | CFA Institute | Completed all three levels

FINANCIAL MODELING & VALUATION ANALYST (FMVA) | Corporate Finance Institute | 2017

TECHNICAL SKILLS

- Financial Modeling: DCF, LBO, M&A, Comparable Company Analysis

- Valuation Methodologies: Intrinsic, Relative, Precedent Transaction

- Software: Bloomberg Terminal, FactSet, Capital IQ, Microsoft Office Suite

- Programming: Python (pandas, numpy), SQL, VBA

- Statistical Analysis: Regression analysis, Monte Carlo simulation, time series forecasting

- Investment Research: Primary research, channel checks, expert network utilization

ADDITIONAL INFORMATION

Conference Speaker, Boston Security Analysts Society Annual Conference (2021)

Mentor, Boston University Finance Club (2018-Present)

Languages: Conversational Mandarin Chinese (studied during 6-month project in Shanghai)

How to Write an Investment Analyst Resume

Introduction

Landing that dream Investment Analyst job means getting past the first hurdle: your resume. As someone who's reviewed thousands of finance resumes over the years, I can tell you that investment firms receive stacks of applications for each opening. Most hiring managers spend just 7-8 seconds scanning each resume before deciding whether to toss it or keep reading. Your resume needs to make those seconds count!

The best Investment Analyst resumes aren't just lists of responsibilities—they tell a story about your analytical abilities, financial expertise, and the tangible value you've brought to past employers.

Resume Structure and Format

First impressions matter. Your resume should be clean, scannable, and professionally formatted:

- Length: Stick to 1 page for junior roles (0-3 years); 2 pages max for experienced analysts

- Font: Classic choices like Calibri, Arial, or Georgia in 10-12pt size

- Margins: 0.75-1 inch on all sides (0.5 inch if you're really tight on space)

- File format: PDF only! Word docs can break formatting between systems

- Sections: Contact info, summary, experience, education, skills, certifications

Skip the objective statement—it's outdated. And please, no photos unless you're applying internationally where it's expected.

Profile/Summary Section

Your professional summary should be 3-4 lines that pack a punch. This isn't your life story—it's your elevator pitch that highlights your investment experience, analytical strengths, and specializations.

For example: "Investment analyst with 4+ years specializing in equity research for consumer goods. Developed valuation models that identified 3 undervalued stocks delivering 37% returns. Proficient in Bloomberg Terminal, FactSet, and financial modeling. CFA Level II candidate."

Professional Experience

This is where you'll win or lose the interview. Each bullet point should showcase accomplishments, not just job duties:

- Start with strong action verbs (analyzed, developed, modeled—not "responsible for")

- Include metrics whenever possible ($, %, #)

- Highlight your analytical process AND results

- Tailor to the specific firm's investment approach (value, growth, quant, etc.)

Compare these two bullets:

Weak: "Responsible for researching potential investments"

Strong: "Researched 40+ mid-cap healthcare companies, identifying 5 undervalued acquisition targets that outperformed sector benchmark by 18.7%"

Education and Certifications

Finance is credential-heavy, so this section matters. Include:

- Degrees with GPA (if above 3.5)

- Relevant coursework (for recent grads)

- Progress toward CFA, CAIA, or other designations

- Financial modeling certifications (FMVA, etc.)

- Bloomberg, FactSet, or other platform certifications

For experienced analysts, this section can move below experience. For recent grads, keep it at the top.

Keywords and ATS Tips

Most investment firms use Applicant Tracking Systems to filter resumes before human eyes ever see them. To clear this hurdle:

- Study the job description and mirror key terms

- Include specific technical skills (DCF modeling, comps analysis, LBO modeling)

- Mention software proficiencies (Excel, Bloomberg, Capital IQ, etc.)

- Use standard section headings the ATS can recognize

Industry-specific Terms

Show you speak the language by naturally incorporating terminology like:

- Valuation methodologies (DCF, comps, precedent transactions)

- Financial metrics (EV/EBITDA, P/E, ROIC, IRR)

- Sector-specific benchmarks relevant to your experience

- Modeling techniques (sensitivity analysis, scenario modeling)

Common Mistakes to Avoid

I've seen these resume killers too many times:

- Vague claims without supporting evidence ("excellent analytical skills")

- Focusing on responsibilities instead of achievements

- Grammar/spelling errors (seriously, one typo can sink you in this detail-oriented field)

- Generic templates that scream "I sent this to 100 firms"

- Cramming too much text—white space matters!

Before/After Example

Before: "Helped with investment research and created Excel models."

After: "Conducted bottom-up research on 15 SaaS companies, building 3-statement models that projected cash flows within 4.3% of actual results and identified a $42M revenue opportunity overlooked by market consensus."

The difference? Specificity, metrics, and demonstrating both process and results. That's what gets investment analysts hired.

Related Resume Examples

Soft skills for your Investment Analyst resume

- Cross-functional communication – able to translate complex financial data into actionable insights for non-finance stakeholders

- Collaborative problem-solving, particularly when working with portfolio managers to identify investment opportunities in uncertain market conditions

- Deadline management while maintaining accuracy – demonstrated during quarterly earnings seasons when analyzing 40+ companies in compressed timeframes

- Client relationship building – developed rapport with institutional clients through clear presentations and thoughtful responses to challenging questions

- Resilience under pressure, especially when market volatility requires quick portfolio reassessment

- Mentorship of junior analysts, including informal lunch-and-learns on financial modeling techniques

Hard skills for your Investment Analyst resume

- Financial modeling (DCF, LBO, M&A) and sensitivity analysis

- Bloomberg Terminal and Capital IQ

- VBA and SQL for data extraction and manipulation

- Python for quantitative analysis (NumPy, pandas, matplotlib)

- CFA Level II certification (Level III candidate)

- Risk assessment using Monte Carlo simulations

- Sector-specific valuation techniques (SOTP, NAV, WACC)

- Statistical analysis using STATA and R

- Advanced Excel (INDEX-MATCH, pivot tables, macros)