Accounts Receivable Clerk Resume examples & templates

Copyable Accounts Receivable Clerk Resume examples

Ever wondered who makes sure a company actually gets paid? That's where Accounts Receivable Clerks come in—the unsung heroes of cash flow who turn sales into actual money in the bank. These financial detectives track down payments, reconcile accounts, and keep the lifeblood of business flowing smoothly. It's not just about sending invoices; it's about building relationships with customers while maintaining the financial integrity that keeps companies afloat.

The field is evolving quickly as automation reshapes routine tasks. While basic data entry jobs have decreased by 19% since 2018, specialized AR positions requiring analytical skills and software proficiency have grown. Today's successful AR Clerks are embracing cloud-based accounting platforms and developing skills in exception handling rather than transaction processing. Many are finding new opportunities in specialized industries like healthcare (where billing complexity creates job security) or tech startups (where rapid growth demands cash flow management). As businesses continue digitizing their financial operations, AR professionals who can interpret data trends and collaborate across departments will find themselves in increasingly strategic roles.

Junior Accounts Receivable Clerk Resume Example

Emily Rodriguez

Tampa, FL • (813) 555-0192 • emilyr@emaildomain.com • linkedin.com/in/emilyrodriguez

PROFESSIONAL SUMMARY

Detail-oriented Accounts Receivable Clerk with 1+ year of experience in invoice processing and payment reconciliation. Strong math aptitude with proven ability to manage aging reports and resolve discrepancies. Quick learner who has reduced payment posting errors by 17% through implementing double-check procedures. Seeking to grow my accounting career while continuing to refine AR processes.

EXPERIENCE

Accounts Receivable Clerk

Sunshine Health Services • Tampa, FL • January 2023 – Present

- Process 80+ customer payments daily, including checks, ACH, and credit card transactions with 99.5% accuracy

- Maintain aging reports and contact customers with past-due accounts, recovering $14,750 in outstanding balances within first 6 months

- Prepare and send 120+ monthly invoices, ensuring accuracy of charges and customer information

- Reconcile daily deposits and resolve payment discrepancies, typically within 24-48 hours

- Assist with month-end close process by preparing receivables reports and journal entries

Accounting Intern

Bayside Financial Group • Tampa, FL • June 2022 – December 2022

- Supported AR department by entering payment data into QuickBooks and filing related documentation

- Helped with customer account maintenance, including updating contact information and payment terms

- Assisted with scanning and organizing over 1,200 invoices for digital record-keeping initiative

- Created Excel spreadsheet to track payment histories, which was adopted by the full-time team

Customer Service Representative (Part-time)

Retail Solutions Inc. • Tampa, FL • September 2021 – May 2022

- Processed customer payments and maintained accurate cash drawer balances

- Addressed billing questions and directed complex inquiries to appropriate departments

- Developed strong communication skills while handling 30+ customer interactions daily

EDUCATION

Associate of Science in Accounting

Hillsborough Community College • Tampa, FL • 2022

GPA: 3.7/4.0 • Relevant Coursework: Principles of Accounting I & II, Business Math, Excel for Business

QuickBooks Online Certification

Intuit • 2023

SKILLS

- Accounts Receivable/Collections

- Invoice Processing

- Payment Posting & Reconciliation

- Aging Reports

- QuickBooks & QuickBooks Online

- Microsoft Excel (vlookups, pivot tables)

- Data Entry (60 WPM)

- General Accounting Principles

- Customer Service

- Time Management

Mid-level Accounts Receivable Clerk Resume Example

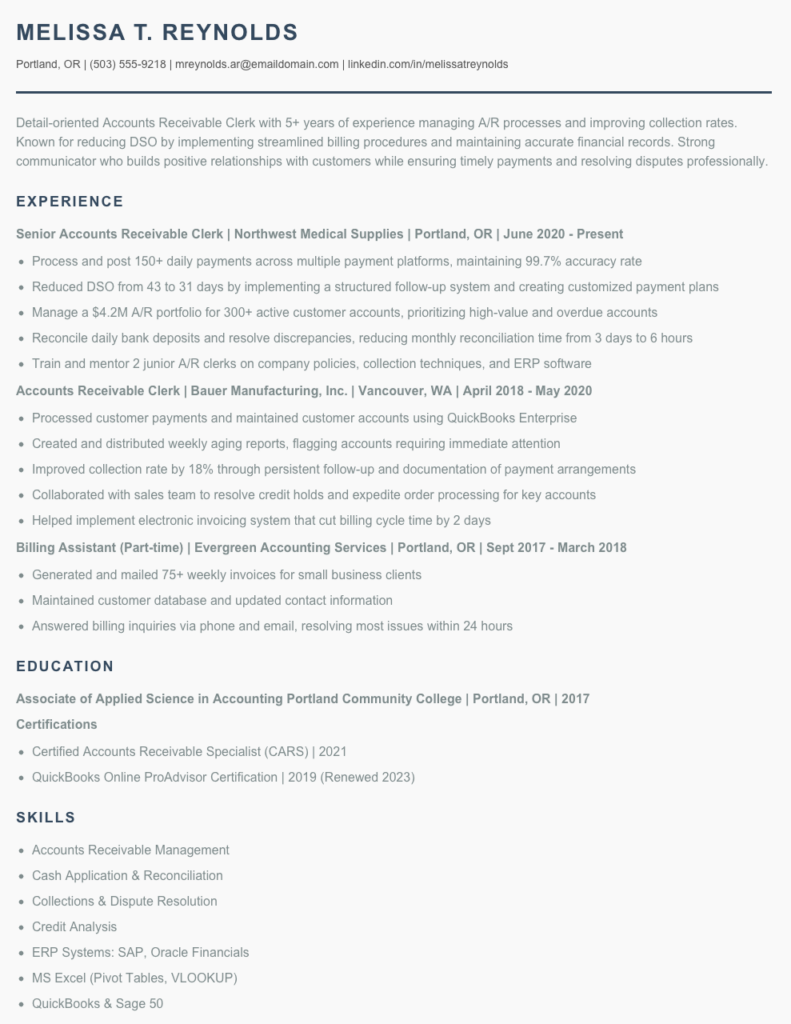

Melissa T. Reynolds

Portland, OR | (503) 555-9218 | mreynolds.ar@emaildomain.com | linkedin.com/in/melissatreynolds

Detail-oriented Accounts Receivable Clerk with 5+ years of experience managing A/R processes and improving collection rates. Known for reducing DSO by implementing streamlined billing procedures and maintaining accurate financial records. Strong communicator who builds positive relationships with customers while ensuring timely payments and resolving disputes professionally.

EXPERIENCE

Senior Accounts Receivable Clerk | Northwest Medical Supplies | Portland, OR | June 2020 – Present

- Process and post 150+ daily payments across multiple payment platforms, maintaining 99.7% accuracy rate

- Reduced DSO from 43 to 31 days by implementing a structured follow-up system and creating customized payment plans

- Manage a $4.2M A/R portfolio for 300+ active customer accounts, prioritizing high-value and overdue accounts

- Reconcile daily bank deposits and resolve discrepancies, reducing monthly reconciliation time from 3 days to 6 hours

- Train and mentor 2 junior A/R clerks on company policies, collection techniques, and ERP software

Accounts Receivable Clerk | Bauer Manufacturing, Inc. | Vancouver, WA | April 2018 – May 2020

- Processed customer payments and maintained customer accounts using QuickBooks Enterprise

- Created and distributed weekly aging reports, flagging accounts requiring immediate attention

- Improved collection rate by 18% through persistent follow-up and documentation of payment arrangements

- Collaborated with sales team to resolve credit holds and expedite order processing for key accounts

- Helped implement electronic invoicing system that cut billing cycle time by 2 days

Billing Assistant (Part-time) | Evergreen Accounting Services | Portland, OR | Sept 2017 – March 2018

- Generated and mailed 75+ weekly invoices for small business clients

- Maintained customer database and updated contact information

- Answered billing inquiries via phone and email, resolving most issues within 24 hours

EDUCATION

Associate of Applied Science in Accounting

Portland Community College | Portland, OR | 2017

Certifications

- Certified Accounts Receivable Specialist (CARS) | 2021

- QuickBooks Online ProAdvisor Certification | 2019 (Renewed 2023)

SKILLS

- Accounts Receivable Management

- Cash Application & Reconciliation

- Collections & Dispute Resolution

- Credit Analysis

- ERP Systems: SAP, Oracle Financials

- MS Excel (Pivot Tables, VLOOKUP)

- QuickBooks & Sage 50

- Aging Reports & Financial Analysis

- Customer Relationship Management

- Payment Processing Systems

ADDITIONAL INFORMATION

Active member of the American Association of Accounts Receivable Professionals (AAARP)

Volunteer tax preparer for low-income families through VITA program (2019-2022)

Senior / Experienced Accounts Receivable Clerk Resume Example

DOROTHY MARTINEZ

dmartinez82@gmail.com | (415) 555-8219 | San Francisco, CA 94110

www.linkedin.com/in/dorothy-martinez-ar | Available for remote opportunities

PROFESSIONAL SUMMARY

Detail-oriented Accounts Receivable Specialist with 9+ years of experience managing AR operations and collections for companies with annual revenues up to $78M. Proven track record of reducing DSO by an average of 17% through improved invoice accuracy and strategic collection efforts. Skilled in multiple accounting systems including QuickBooks, Oracle, and SAP with expertise in financial reporting and process optimization.

PROFESSIONAL EXPERIENCE

SENIOR ACCOUNTS RECEIVABLE SPECIALIST | Vertex Technologies, Inc. | San Francisco, CA | June 2019 – Present

- Manage complete AR cycle for tech manufacturer with $78M annual revenue, processing 800+ monthly invoices and maintaining 98.7% accuracy rate

- Reduced DSO from 52 to 39 days within first year by implementing automated payment reminders and restructuring collection call schedule

- Reconcile complex customer accounts and resolve discrepancies averaging $45K monthly, maintaining aging reports with less than 2% over 90 days

- Train and mentor 3 junior AR clerks, creating standardized processes that improved team efficiency by 23%

- Collaborate with Sales team to resolve customer disputes and credit holds, ensuring minimal disruption to revenue recognition

ACCOUNTS RECEIVABLE CLERK | Bay Area Medical Group | Oakland, CA | August 2016 – May 2019

- Processed and posted daily receipts averaging $175K from multiple payment channels including insurance providers, patients, and third-party payers

- Managed aging reports for 2,500+ patient accounts, reducing 90+ day balances by 31% through persistent follow-up

- Implemented electronic payment portal that increased on-time payments by 42% and reduced manual processing time by 15 hours weekly

- Coordinated with insurance billing specialists to resolve claim denials, recovering approximately $87K annually in previously written-off revenue

ACCOUNTS RECEIVABLE/BILLING ASSISTANT | Peterson Manufacturing | South San Francisco, CA | March 2014 – July 2016

- Posted customer payments and maintained accurate ledgers for 300+ accounts using QuickBooks Enterprise

- Generated and distributed monthly customer statements and aging reports

- Assisted with month-end close process, reconciling AR subledger to general ledger with 100% accuracy

- Improved cash application process, reducing unallocated cash from 8% to 2.5% within 6 months

EDUCATION & CERTIFICATIONS

Associate of Science, Accounting | City College of San Francisco | 2013

Certified Accounts Receivable Specialist (CARS) | Institute of Finance & Management | 2018

QuickBooks ProAdvisor Certification | Intuit | 2017, renewed 2020

TECHNICAL SKILLS

- Accounting Software: SAP, Oracle Financials, QuickBooks Enterprise, Microsoft Dynamics

- Payment Processing: PayPal, Stripe, ACH, Lockbox services, credit card processing

- Microsoft Office Suite (advanced Excel including VLOOKUP, PivotTables, and macros)

- Financial Analysis & Reporting: AR aging reports, DSO calculation, bad debt analysis

- Collections Management & Dispute Resolution

- Credit Analysis & Customer Account Management

- Month-End Close Procedures

- Banking Reconciliation & Cash Application

PROFESSIONAL DEVELOPMENT

- IOFM Accounts Receivable Management Conference | San Diego | 2021

- Advanced Excel for Finance Professionals | Online Course | 2020

- California Revenue Recognition Standards Workshop | San Francisco | 2019

How to Write an Accounts Receivable Clerk Resume

Introduction

Creating a standout Accounts Receivable (AR) Clerk resume isn't just about listing your past jobs—it's about showcasing your financial accuracy, attention to detail, and ability to manage customer accounts efficiently. As someone who's reviewed thousands of AR resumes, I can tell you that hiring managers typically spend just 6-8 seconds scanning your resume before deciding whether to continue reading. Your resume needs to quickly demonstrate that you understand the core responsibilities: processing payments, maintaining ledgers, reconciling accounts, and communicating with customers about their balances.

Resume Structure and Format

Keep your resume clean and organized—just like your accounting work! A cluttered resume sends the wrong message about your attention to detail.

- Stick to 1-2 pages maximum (one page is perfect for those with less than 5 years of experience)

- Use a clean, professional font like Arial, Calibri, or Garamond in 10-12pt size

- Include clear section headings to guide the reader's eye

- Use bullet points rather than dense paragraphs

- Save your final document as a PDF (unless specifically asked for another format)

TIP: Mirror the language found in the job description! If they're looking for someone who "processes customer payments and manages aging reports," make sure those exact phrases appear in your resume when applicable to your experience.

Profile/Summary Section

Your professional summary should be 2-4 sentences that highlight your most relevant experience and skills. For AR Clerks, focus on your years of experience, billing software proficiency, and standout accomplishments.

Example: "Detail-oriented Accounts Receivable Clerk with 3+ years of experience managing receivables for a manufacturing company with $4.2M annual revenue. Proficient in QuickBooks and SAP with a track record of reducing past-due accounts by 27% through systematic follow-up procedures."

Professional Experience

This is where you'll really shine! Don't just list job duties—showcase your achievements with specific numbers.

- Start bullets with action verbs: Processed, Reconciled, Reduced, Managed, Implemented

- Include metrics when possible: "Processed average of 120+ daily payments with 99.8% accuracy"

- Highlight efficiency improvements: "Reduced DSO (Days Sales Outstanding) from 45 to 32 days"

- Mention specific AR software you've used

- Include any cross-functional work with collections, accounting, or customer service teams

Education and Certifications

List your highest level of education first. For AR positions, relevant certifications can sometimes outweigh formal education, so don't hide them at the bottom!

- Associate's or Bachelor's degree (Accounting, Finance, or Business preferred)

- Certifications: Accounts Receivable Specialist (CARS), Certified Accounts Receivable Specialist (CARS)

- Relevant coursework in accounting principles, business software, or customer service

Keywords and ATS Tips

Most companies use Applicant Tracking Systems (ATS) to filter resumes. Include these keywords (where truthful):

- Accounts receivable, collections, invoicing, aging reports

- Payment processing, cash applications, credit terms

- Month-end close, reconciliation, general ledger

- Software names: QuickBooks, SAP, Oracle, Microsoft Dynamics, Excel

- Terms like DSO, collections ratio, bad debt

Industry-specific Terms

Show you know the lingo! Include terms like:

- Credit memo, debit memo

- Aging buckets (30/60/90 days)

- Dunning letters

- Cash application

- ACH, wire transfers, EFT

- Lockbox processing

Common Mistakes to Avoid

- Being vague about your experience with specific accounting software

- Focusing solely on duties without showing results

- Forgetting to highlight your accuracy rates or error reduction

- Overlooking soft skills like customer communication (huge for AR roles!)

- Using accounting jargon without demonstrating understanding

Before/After Example

Before: "Responsible for accounts receivable duties including invoicing and collections."

After: "Managed $1.8M in monthly receivables for 200+ customer accounts, reducing past-due balances by 31% through implementation of systematic 15/30/45-day follow-up process and negotiating payment plans with key accounts."

Remember—your resume should tell the story of not just what you did, but how well you did it! Good luck with your AR Clerk job search.

Related Resume Examples

Soft skills for your Accounts Receivable Clerk resume

- Detail-oriented with a knack for spot-checking numerical discrepancies while managing multiple accounts (caught $18K in missed payments during Q2 last year)

- Clear communicator who can explain payment terms to clients without coming across as pushy – even when following up on 90+ day overdue accounts

- Patient problem-solver who works with both clients and sales teams to resolve payment disputes (reduced disputed invoices by 27% through proactive communication)

- Tactful persistence – I’m comfortable making those awkward collection calls while maintaining positive client relationships

- Team player who jumps in during month-end crunch time, staying late when needed without complaint

- Adaptable to changing financial software systems (survived 3 different AR platforms in 5 years without losing data integrity)

Hard skills for your Accounts Receivable Clerk resume

- Advanced QuickBooks and Oracle ERP system proficiency (5+ years daily use)

- Collections management and payment processing across multiple payment channels

- Month-end reconciliation and aging reports generation

- Microsoft Excel (complex formulas, pivot tables, VLOOKUP functions)

- Blackbaud Financial Edge for nonprofit accounting (certified user)

- Credit analysis and risk assessment for new accounts

- Electronic Data Interchange (EDI) payment processing

- AR workflow automation using Billtrust and AvidXchange

- SAP Business One reporting and data extraction