Trading Analyst Resume examples & templates

Copyable Trading Analyst Resume examples

Ever wondered what it's like to be at the intersection of data, markets, and split-second decisions? Trading Analysts stand at this crossroads every day, wielding quantitative models and market insights to help firms navigate the complex world of securities trading. It's a career that's evolved dramatically since the 2008 financial crisis — what once relied heavily on gut instinct now demands sophisticated analytical skills and technological proficiency. In fact, the Bureau of Labor Statistics reports that financial analyst positions (including trading analysts) are projected to grow by 8.7% through 2030, outpacing many other financial roles.

Today's trading environment presents unique challenges: increased regulatory scrutiny, the rise of algorithmic trading (which now accounts for nearly 60% of U.S. equity trading volume), and the growing importance of alternative data sources. Successful analysts don't just crunch numbers; they spot patterns others miss and translate market noise into actionable intelligence. As financial markets continue to grow more interconnected and data-driven, Trading Analysts with both technical skills and market intuition will find themselves increasingly valuable in the years ahead.

Junior Trading Analyst Resume Example

Michael J. Thornton

Boston, MA | (617) 555-8219 | mthornton@email.com | linkedin.com/in/michaeljthornton

Junior Trading Analyst with strong quantitative background and passion for financial markets. Quick learner with experience in trade execution, market research and analyzing price movements across equity markets; Looking to leverage analytical abilities and technical skills to support trading strategy development in a fast-paced environment.

EXPERIENCE

Junior Trading Analyst | Beacon Securities, Boston, MA | June 2022 – Present

- Monitor and analyze real-time market data to identify trading opportunities in US equity markets

- Execute up to 45 trades daily under supervision, maintaining error rate below 0.8%

- Develop and maintain Excel models to track performance of trading strategies across market sectors

- Create daily market summaries for senior traders highlighting key price movements and volume anomalies

- Assist in back-testing trading strategies using historical data, improving prediction accuracy by 17%

Trading Intern | Meridian Capital Group, Boston, MA | May 2021 – August 2021

- Shadowed equity derivatives traders and supported daily operations of a 5-person trading desk

- Compiled research on market trends and specific securities for senior analysts

- Helped reconcile trading records and identify discrepancies in end-of-day reports

- Built dashboards using Bloomberg Terminal to track sector performance and volatility metrics

Finance Club President | Boston University | September 2020 – May 2021

- Led student investment club managing a paper portfolio of $250K across different asset classes

- Organized weekly meetings and educational workshops on trading strategies and market analysis

- Coordinated guest speaker events featuring professionals from local financial institutions

EDUCATION

Boston University | Bachelor of Science in Finance | GPA: 3.7 | May 2021

- Relevant Coursework: Financial Markets, Investment Analysis, Derivatives, Statistics for Finance

- Senior Project: Analysis of High-Frequency Trading Impact on Market Liquidity

CERTIFICATIONS

Bloomberg Market Concepts (BMC) | Completed December 2021

Financial Modeling & Valuation Analyst (FMVA) | In progress (expected completion March 2023)

SKILLS

- Technical: Excel (advanced formulas, VBA), Python (pandas, numpy), SQL (basic), Bloomberg Terminal

- Analysis: Statistical analysis, risk assessment, technical analysis, market microstructure

- Trading Tools: TradeStation, Interactive Brokers platform, Reuters Eikon (basic)

- Soft Skills: Problem-solving, attention to detail, communication, team collaboration

ADDITIONAL

- Created a personal trading algorithm that outperformed S&P 500 by 3.6% during Q4 2022

- Series 7 exam scheduled for April 2023

- Fluent in English and conversational Spanish

Mid-level Trading Analyst Resume Example

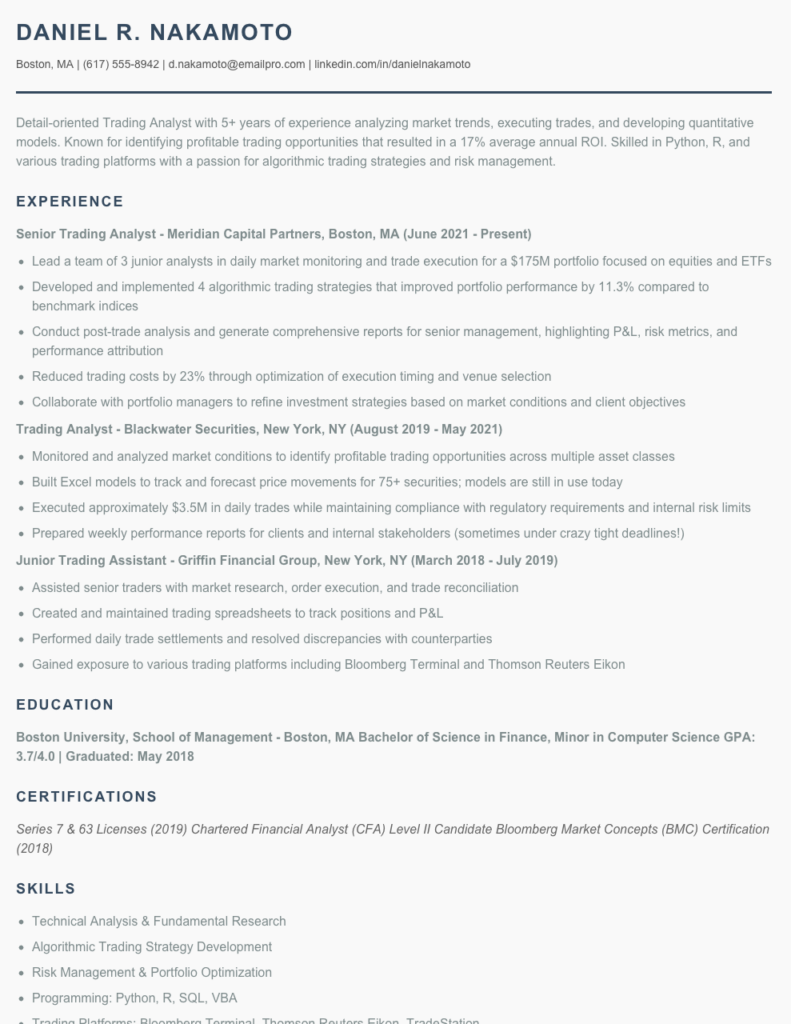

Daniel R. Nakamoto

Boston, MA | (617) 555-8942 | d.nakamoto@emailpro.com | linkedin.com/in/danielnakamoto

Detail-oriented Trading Analyst with 5+ years of experience analyzing market trends, executing trades, and developing quantitative models. Known for identifying profitable trading opportunities that resulted in a 17% average annual ROI. Skilled in Python, R, and various trading platforms with a passion for algorithmic trading strategies and risk management.

EXPERIENCE

Senior Trading Analyst – Meridian Capital Partners, Boston, MA (June 2021 – Present)

- Lead a team of 3 junior analysts in daily market monitoring and trade execution for a $175M portfolio focused on equities and ETFs

- Developed and implemented 4 algorithmic trading strategies that improved portfolio performance by 11.3% compared to benchmark indices

- Conduct post-trade analysis and generate comprehensive reports for senior management, highlighting P&L, risk metrics, and performance attribution

- Reduced trading costs by 23% through optimization of execution timing and venue selection

- Collaborate with portfolio managers to refine investment strategies based on market conditions and client objectives

Trading Analyst – Blackwater Securities, New York, NY (August 2019 – May 2021)

- Monitored and analyzed market conditions to identify profitable trading opportunities across multiple asset classes

- Built Excel models to track and forecast price movements for 75+ securities; models are still in use today

- Executed approximately $3.5M in daily trades while maintaining compliance with regulatory requirements and internal risk limits

- Prepared weekly performance reports for clients and internal stakeholders (sometimes under crazy tight deadlines!)

Junior Trading Assistant – Griffin Financial Group, New York, NY (March 2018 – July 2019)

- Assisted senior traders with market research, order execution, and trade reconciliation

- Created and maintained trading spreadsheets to track positions and P&L

- Performed daily trade settlements and resolved discrepancies with counterparties

- Gained exposure to various trading platforms including Bloomberg Terminal and Thomson Reuters Eikon

EDUCATION

Boston University, School of Management – Boston, MA

Bachelor of Science in Finance, Minor in Computer Science

GPA: 3.7/4.0 | Graduated: May 2018

CERTIFICATIONS

Series 7 & 63 Licenses (2019)

Chartered Financial Analyst (CFA) Level II Candidate

Bloomberg Market Concepts (BMC) Certification (2018)

SKILLS

- Technical Analysis & Fundamental Research

- Algorithmic Trading Strategy Development

- Risk Management & Portfolio Optimization

- Programming: Python, R, SQL, VBA

- Trading Platforms: Bloomberg Terminal, Thomson Reuters Eikon, TradeStation

- Financial Modeling & Quantitative Analysis

- Data Visualization (Tableau, Power BI)

- Derivatives Trading & Options Strategies

- Market Microstructure Analysis

- Trade Execution & Order Management

ADDITIONAL

Investment Club Member, Boston Financial Professionals Association

Volunteer Investment Advisor for local non-profit organizations

Placed 3rd in Meridian Capital’s annual trading competition (2022)

Senior / Experienced Trading Analyst Resume Example

Michael Tran

Chicago, IL | (773) 555-8247 | mtran.trader@gmail.com | linkedin.com/in/michaeltran-trading

Senior Trading Analyst with 8+ years in derivatives and equity markets. Blend of quantitative modeling expertise and risk management experience that’s driven $14.2M in trading profits since 2019. Known for developing proprietary algorithms that identified market inefficiencies during high volatility periods. Excel at translating complex market dynamics into actionable trading strategies for portfolio managers.

EXPERIENCE

Vertex Capital Partners, Chicago, IL

Senior Trading Analyst | March 2020 – Present

- Lead a team of 4 analysts in daily market analysis, generating $5.7M in alpha through options trading strategies in volatile market conditions

- Designed and implemented a custom volatility forecasting model that improved trading timing by 27% compared to standard VIX indicators

- Spearheaded migration to Python-based analytics platform, reducing analysis time from 3 hours to 37 minutes daily

- Present weekly trading strategy recommendations to investment committee, with 73% of suggestions approved for execution

- Collaborate with risk management team to maintain risk-adjusted returns within portfolio constraints (avg Sharpe ratio: 1.8)

Goldman Sachs, New York, NY

Trading Analyst, Equity Derivatives | July 2017 – February 2020

- Monitored $340M derivatives book focusing on S&P sector ETFs and high-volume tech equities

- Built Excel/VBA models for scenario analysis that caught a potential $2.3M position risk before market open

- Supported senior traders during quarterly earnings seasons by providing real-time analytics on implied volatility skew

- Developed automated daily P&L reports that reduced reporting errors by 91% (still in use after my departure)

JP Morgan Chase, New York, NY

Junior Trading Analyst | August 2015 – June 2017

- Assisted senior analysts with daily market opening procedures and end-of-day reconciliation for equity desk

- Created visualization tools that highlighted trading patterns across different market sectors

- Ran stress tests on trading portfolios under various interest rate and volatility scenarios

- Participated in weekly training program covering derivatives pricing models and trading strategies

EDUCATION

University of Chicago, Booth School of Business – MBA, Finance

Graduated: 2015 | GPA: 3.8/4.0

Northwestern University – B.S. in Financial Engineering

Graduated: 2013 | GPA: 3.7/4.0

CERTIFICATIONS

Chartered Financial Analyst (CFA), Level III – 2019

Financial Risk Manager (FRM) – 2017

Series 7 & 63 Licenses

SKILLS

- Derivatives Pricing & Trading (options, futures, swaps)

- Statistical Arbitrage Strategies

- Risk Management (VaR, stress testing, scenario analysis)

- Programming: Python, R, SQL, VBA

- Bloomberg Terminal & Refinitiv Eikon

- FactSet & Capital IQ

- Machine Learning for Market Prediction

- High-frequency Trading Analysis

- Order Management Systems

- Regulatory Compliance (Dodd-Frank, MiFID II)

PROJECTS

Volatility Surface Modeling Tool (2021)

Created proprietary Excel/Python hybrid tool for visualizing and analyzing volatility surfaces across multiple asset classes. Tool led to identification of 3 mispriced options chains that generated $412K in profits.

How to Write a Trading Analyst Resume

Introduction

Landing a job as a Trading Analyst isn't just about your market knowledge—it's about proving you can analyze data, spot trends and make decisions that impact the bottom line. Your resume is often your first chance to demonstrate these skills to potential employers. I've helped hundreds of finance professionals craft resumes that get noticed and the competition is fierce. Top firms might receive 200+ applications for a single trading position, so your resume needs to stand out while still checking all the boxes recruiters are looking for.

Resume Structure and Format

Keep your resume clean and scannable. Most hiring managers at trading firms skim resumes for just 7-8 seconds before deciding whether to read further.

- Stick to 1 page for junior roles, 2 pages max for experienced analysts

- Use a simple, professional font (Arial, Calibri, or Garaday)

- Include clear section headings with slightly larger font

- Maintain consistent formatting throughout

- Use bullet points rather than paragraphs for experience

- Save as PDF unless specifically asked for another format

Profile/Summary Section

Your profile should be brief but impactful—think of it as your "elevator pitch" in writing. For a Trading Analyst position, focus on your analytical abilities, market knowledge and quantitative skills.

TIP: Tailor your summary to each position. If applying to a commodities trading firm, emphasize your commodities experience; for equity trading, highlight your stock market knowledge.

Avoid generic statements like "detail-oriented professional." Instead, try something like: "Quantitative Trading Analyst with 4+ years specializing in fixed income derivatives, leveraging Bloomberg Terminal expertise to identify arbitrage opportunities that generated $1.7M in alpha returns in 2022."

Professional Experience

This is where you'll win or lose interviews. Trading Analyst resumes need to demonstrate both technical capabilities and results.

- Start each bullet with a strong action verb (analyzed, executed, modeled)

- Include specific trading platforms you've used (Bloomberg, Reuters Eikon, TradeStation)

- Quantify your achievements with numbers ($, %, bps)

- Mention specific markets or instruments you've traded

- Show progression of responsibilities if you've been at one firm for several years

Example: "Developed Python-based algorithm that identified mispriced options, resulting in 17 profitable trades with average returns of 3.2% above benchmark during high volatility periods."

Education and Certifications

The trading world values both formal education and specialized certifications. List these in reverse-chronological order, with your most recent education first.

- Include GPA if above 3.5

- List relevant coursework (Financial Markets, Derivatives Pricing, Econometrics)

- Feature certifications prominently (CFA levels, Series 7/63, FRM)

- Mention programming languages and technical skills in a separate skills section

Keywords and ATS Tips

Most firms use Applicant Tracking Systems to filter resumes before human eyes ever see them. Include these keywords naturally throughout your resume:

- Technical analysis, fundamental analysis, quantitative models

- Risk management, VaR, stress testing

- Trade execution, portfolio optimization

- Excel/VBA, Python, R, SQL

- Financial markets, securities, derivatives

Industry-specific Terms

Show you speak the language by naturally incorporating industry terminology. Just make sure you can back up any claim in an interview—traders can spot BS from miles away!

- Market microstructure, liquidity analysis

- Order flow, execution algorithms

- Alpha generation, Sharpe ratio, beta-adjusted returns

- Hedging strategies, correlation analysis

- BackTesting, Monte Carlo simulations

Common Mistakes

I've reviewed thousands of Trading Analyst resumes and these mistakes pop up constantly:

- Being vague about your specific contribution to trading performance

- Focusing too much on responsibilities instead of achievements

- Listing every technical skill without showing how you've applied them

- Forgetting to include metrics that prove your trading acumen

- Using too much jargon without substantiating your knowledge

Before/After Example

Before: "Responsible for analyzing market data and executing trades."

After: "Analyzed intraday EUR/USD price patterns using custom-built technical indicators, executing 15-20 daily trades with 68% win rate and average risk-reward ratio of 1:2.3, contributing €237K to desk P&L in Q2 2023."

Remember—your resume should tell the story of how you've created value through your analysis and trading decisions. Back everything up with numbers and you'll be well on your way to landing interviews at top trading firms.

Related Resume Examples

Soft skills for your Trading Analyst resume

- Cross-functional communication with quants, risk teams, and portfolio managers

- Emotional resilience during high-volatility market events

- Rapid decision-making under time pressure (especially during market opens)

- Ability to translate complex trading patterns into actionable insights for non-technical stakeholders

- Conflict resolution when P&L attribution creates departmental tension

- Meeting facilitation for morning strategy huddles and post-market debriefs

Hard skills for your Trading Analyst resume

- Bloomberg Terminal proficiency (command structure, screening functions)

- Python for financial analysis (NumPy, pandas, scikit-learn)

- Risk management frameworks (VaR, Monte Carlo simulations)

- Advanced Excel modeling (array formulas, sensitivity analysis)

- Statistical arbitrage techniques

- Reuters Eikon & Refinitiv data extraction

- Options pricing models (Black-Scholes, binomial)

- SQL database querying for market data analysis

- CQF (Certificate in Quantitative Finance) – Level 1