Tax Specialist Resume examples & templates

Copyable Tax Specialist Resume examples

Ever wonder who thrives in that maze of tax codes that seems to get more complicated every year? Tax Specialists are the professionals who don't just survive in that environment—they excel in it. These financial detectives work across public accounting firms, corporations, and government agencies, interpreting tax laws and finding legitimate ways to minimize tax burdens while ensuring compliance. What's fascinating is how the role has evolved from number-crunching to strategic advisory; today's Tax Specialists increasingly work alongside business leaders to shape financial decisions from the ground up.

The field is experiencing rapid transformation thanks to automation software that handles routine calculations, freeing specialists to focus on higher-value analysis. According to the Bureau of Labor Statistics, employment of tax professionals is projected to grow 6.4% through 2032—slightly faster than the average for all occupations—with roughly 13,200 openings each year. This growth reflects the persistent complexity of tax regulations (the U.S. tax code now exceeds 2.4 million words!) and the rising premium on professionals who can navigate cross-border taxation as businesses go global. For those with analytical minds and problem-solving instincts, tax specialization offers a surprisingly dynamic career path that will remain relevant even as technology reshapes financial services.

Junior Tax Specialist Resume Example

MARCUS WINTERS

Chicago, IL | (312) 555-8761 | marcuswinters@email.com | linkedin.com/in/marcuswinters

Detail-oriented Tax Specialist with 1+ year experience preparing individual and small business tax returns. Quick learner who thrives in fast-paced environments during tax season. My academic background in Accounting combined with hands-on experience at H&R Block has built a solid foundation for analyzing complex tax scenarios and ensuring compliance with changing regulations.

EXPERIENCE

Tax Specialist | H&R Block | Chicago, IL | January 2023 – Present

- Prepare and file approximately 175 individual tax returns during 2023 tax season, maintaining 98.7% accuracy rate

- Conduct thorough client interviews to gather financial information and identify all possible deductions and credits

- Use ProSeries tax software to process returns efficiently while ensuring compliance with federal and state regulations

- Explain tax laws and implications to clients in clear, understandable terms, resulting in 92% client satisfaction

Tax Preparation Intern | Johnson Accounting Services | Chicago, IL | January – April 2022

- Assisted in preparing 65+ tax returns for individuals and sole proprietorships under CPA supervision

- Organized and maintained client documentation while ensuring confidentiality of sensitive information

- Researched tax code changes and updates to ensure compliance with 2022 filing requirements

Accounting Assistant (Part-time) | Riverdale Community College | Chicago, IL | September 2020 – December 2021

- Managed accounts payable processing for department with $450K annual budget

- Reconciled monthly expense reports and flagged discrepancies for review

- Created Excel spreadsheets to track departmental spending against budget

EDUCATION

Bachelor of Science in Accounting | Riverdale Community College | Chicago, IL | May 2022

- GPA: 3.7/4.0

- Relevant Coursework: Principles of Taxation, Individual Income Tax, Business Taxation, Tax Research

- Vice President, Accounting Club (2021-2022)

CERTIFICATIONS

- IRS Annual Filing Season Program Participant (2023)

- H&R Block Tax Preparation Certification (2022)

- QuickBooks Online ProAdvisor (2022)

SKILLS

- Tax Software: ProSeries, TurboTax, CCH Axcess

- Individual & Small Business Tax Preparation

- Tax Research (IRS Publications, Thomson Reuters Checkpoint)

- Microsoft Excel (VLOOKUP, PivotTables, data analysis)

- Client Relationship Management

- Financial Statement Analysis

- Bookkeeping & QuickBooks

- Data Entry (90 WPM)

- Problem-solving & Critical Thinking

ADDITIONAL

- Volunteer, VITA (Volunteer Income Tax Assistance) Program (2022 Tax Season)

- Fluent in Spanish (conversational)

Mid-level Tax Specialist Resume Example

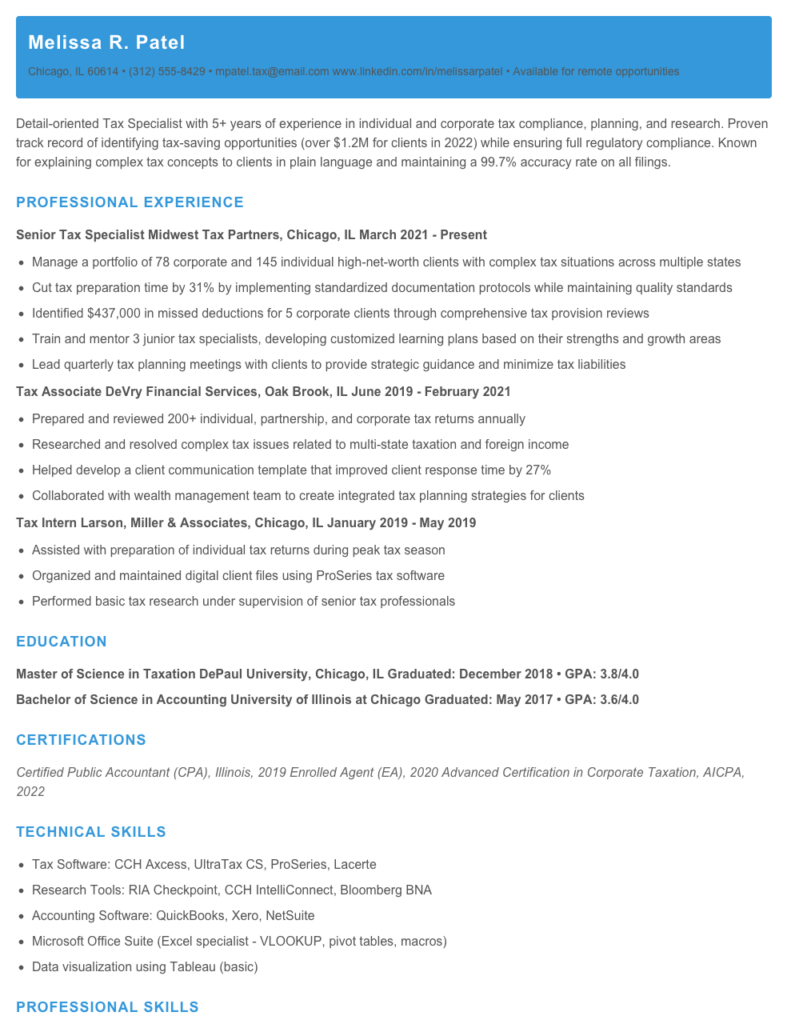

Melissa R. Patel

Chicago, IL 60614 • (312) 555-8429 • mpatel.tax@email.com

www.linkedin.com/in/melissarpatel • Available for remote opportunities

Detail-oriented Tax Specialist with 5+ years of experience in individual and corporate tax compliance, planning, and research. Proven track record of identifying tax-saving opportunities (over $1.2M for clients in 2022) while ensuring full regulatory compliance. Known for explaining complex tax concepts to clients in plain language and maintaining a 99.7% accuracy rate on all filings.

PROFESSIONAL EXPERIENCE

Senior Tax Specialist

Midwest Tax Partners, Chicago, IL

March 2021 – Present

- Manage a portfolio of 78 corporate and 145 individual high-net-worth clients with complex tax situations across multiple states

- Cut tax preparation time by 31% by implementing standardized documentation protocols while maintaining quality standards

- Identified $437,000 in missed deductions for 5 corporate clients through comprehensive tax provision reviews

- Train and mentor 3 junior tax specialists, developing customized learning plans based on their strengths and growth areas

- Lead quarterly tax planning meetings with clients to provide strategic guidance and minimize tax liabilities

Tax Associate

DeVry Financial Services, Oak Brook, IL

June 2019 – February 2021

- Prepared and reviewed 200+ individual, partnership, and corporate tax returns annually

- Researched and resolved complex tax issues related to multi-state taxation and foreign income

- Helped develop a client communication template that improved client response time by 27%

- Collaborated with wealth management team to create integrated tax planning strategies for clients

Tax Intern

Larson, Miller & Associates, Chicago, IL

January 2019 – May 2019

- Assisted with preparation of individual tax returns during peak tax season

- Organized and maintained digital client files using ProSeries tax software

- Performed basic tax research under supervision of senior tax professionals

EDUCATION

Master of Science in Taxation

DePaul University, Chicago, IL

Graduated: December 2018 • GPA: 3.8/4.0

Bachelor of Science in Accounting

University of Illinois at Chicago

Graduated: May 2017 • GPA: 3.6/4.0

CERTIFICATIONS

Certified Public Accountant (CPA), Illinois, 2019

Enrolled Agent (EA), 2020

Advanced Certification in Corporate Taxation, AICPA, 2022

TECHNICAL SKILLS

- Tax Software: CCH Axcess, UltraTax CS, ProSeries, Lacerte

- Research Tools: RIA Checkpoint, CCH IntelliConnect, Bloomberg BNA

- Accounting Software: QuickBooks, Xero, NetSuite

- Microsoft Office Suite (Excel specialist – VLOOKUP, pivot tables, macros)

- Data visualization using Tableau (basic)

PROFESSIONAL SKILLS

- Tax Compliance & Reporting

- Multi-state Taxation

- Tax Planning & Strategy

- IRS Representation & Audit Defense

- Client Relationship Management

- Staff Training & Development

PROFESSIONAL AFFILIATIONS

American Institute of Certified Public Accountants (AICPA)

Illinois CPA Society

National Association of Tax Professionals

Senior / Experienced Tax Specialist Resume Example

Sarah J. Thornton

Denver, CO 80202 • (303) 555-9876 • sthornton@emailpro.net • linkedin.com/in/sarahjthornton

Detail-oriented Tax Specialist with over 10 years of progressive experience in corporate taxation and compliance. Known for finding creative tax-saving strategies that have saved clients over $4.7M collectively. I bring a pragmatic approach to complex tax matters, combining technical expertise with clear communication skills. Strong background in international tax planning, M&A tax implications and tax technology implementation.

PROFESSIONAL EXPERIENCE

Senior Tax Manager – Deloitte Tax LLP, Denver, CO

June 2019 – Present

- Lead a team of 7 tax professionals handling 120+ corporate clients with annual revenues ranging from $50M to $2.4B

- Reduced client audit exposure by 31% through implementing enhanced documentation procedures and proactive planning strategies

- Saved a manufacturing client $738,000 in tax liability by restructuring international operations (they still thank me at every quarterly meeting!)

- Developed internal training program on new tax legislation that improved staff technical competency scores by 27%

- Serve as point person for the firm’s emerging cannabis industry tax practice, growing this segment from 3 to 17 clients

Tax Manager – PricewaterhouseCoopers, Denver, CO

March 2016 – May 2019

- Managed tax compliance and consulting for 45+ clients across various industries including tech, healthcare and retail

- Identified and implemented $1.2M in R&D tax credits for a mid-sized software development client

- Coordinated with international tax team on complex cross-border transactions, reducing effective tax rates by 4-7% for multinational clients

- Mentored 12 junior staff members, with 5 receiving promotions during my tenure

Tax Specialist – Rocky Mountain Tax Advisors, Boulder, CO

January 2013 – February 2016

- Prepared and reviewed corporate, partnership and individual tax returns for clients with revenues up to $75M

- Specialized in state and local tax issues for clients operating in multiple jurisdictions

- Created standardized work papers that reduced preparation time by 22%

- Developed expertise in oil & gas taxation, becoming the firm’s go-to resource for this niche

EDUCATION & CERTIFICATIONS

Master of Science in Taxation

University of Denver, Daniels College of Business – 2012

GPA: 3.85/4.0

Bachelor of Science in Accounting

Colorado State University – 2010

GPA: 3.7/4.0, cum laude

Certifications:

- Certified Public Accountant (CPA), Colorado, License #CPA12345

- Enrolled Agent (EA) – 2014

- Certified Tax Planner (CTP) – 2018

TECHNICAL SKILLS

- Tax Software: CCH Axcess, UltraTax CS, ProSystem fx, GoSystem Tax RS

- Research Tools: CCH IntelliConnect, RIA Checkpoint, Bloomberg BNA

- ERP Systems: Oracle, SAP, NetSuite (Administrator level)

- Advanced Excel (VLOOKUP, pivot tables, macros)

- Data visualization: Tableau, Power BI

- Foreign tax credit optimization

- Fixed asset management & depreciation strategies

- M&A tax structuring

PROFESSIONAL AFFILIATIONS

- American Institute of Certified Public Accountants (AICPA)

- Colorado Society of CPAs – Tax Committee Member

- Denver Tax Association – Board Member (2020-present)

How to Write a Tax Specialist Resume

Introduction

Creating a standout resume for Tax Specialist roles requires more than just listing your tax preparation experience. It's about showcasing your technical expertise, attention to detail, and ability to navigate complex tax regulations. I've reviewed thousands of tax professional resumes over my career, and the difference between those that land interviews and those that don't often comes down to how effectively candidates highlight their specific tax skills and accomplishments. Let's walk through exactly what you need to craft a resume that tax managers and HR pros will notice (for all the right reasons).

Resume Structure and Format

First impressions matter. Your resume should be clean, organized, and easy to scan—just like a well-prepared tax return!

- Keep your resume to 1-2 pages (1 page for those with less than 7 years of experience)

- Use a clean, professional font like Calibri or Arial, size 10-12

- Include clear section headings and plenty of white space

- Save your file as a PDF (unless specifically asked for another format)

- Name your file professionally: "FirstName_LastName_TaxSpecialist.pdf"

Profile/Summary Section

This 3-5 line section sits at the top of your resume and serves as your "elevator pitch." For a Tax Specialist position, emphasize your years of experience, areas of tax expertise, and one or two standout achievements.

Example: "Detail-oriented Tax Specialist with 6+ years of experience in individual and small business tax preparation. Proficient in tax research and planning, with expertise in federal and multi-state returns. Saved clients an average of $3,742 in tax liability through strategic deduction planning while maintaining 99.7% accuracy rate."

Pro Tip: Customize your summary for each job application by mirroring key terms from the job description. This signals to employers that you're a perfect match for their specific needs.

Professional Experience

This is where you prove your tax expertise. For each role, include:

- Company name, location, your title, and dates employed

- 4-6 bullet points highlighting your responsibilities and achievements

- Specific metrics whenever possible (number of returns processed, error rates, client satisfaction scores)

- Tax software proficiency relevant to each role

Start each bullet with strong action verbs like "Analyzed," "Prepared," "Researched," or "Identified." And don't just list duties—show results! "Prepared 350+ individual tax returns" is okay, but "Prepared 350+ individual tax returns with 98% accuracy, resulting in zero IRS audits over 3 tax seasons" is much better.

Education and Certifications

Tax is a credential-heavy field. Make your qualifications shine:

- List your degrees in reverse chronological order

- Feature relevant certifications prominently (EA, CPA, etc.)

- Include continuing education courses related to tax law

- Mention specialized training (international taxation, estate planning, etc.)

Keywords and ATS Tips

Most employers use Applicant Tracking Systems to filter resumes before a human ever sees them. To get past these digital gatekeepers:

- Include specific tax software names (UltraTax, ProSeries, Lacerte, CCH Axcess)

- Mention specific tax forms you're experienced with (1040, 1120, 1065, etc.)

- Use industry terminology from the job description

- Avoid tables, headers/footers, and unusual formatting that can confuse ATS

Industry-specific Terms

Pepper your resume with relevant tax terminology like:

- Tax compliance and preparation

- Federal/state/local tax regulations

- Tax research and planning

- Audit support/representation

- GAAP principles

- Tax code sections relevant to your expertise

Common Mistakes to Avoid

Don't sabotage your chances with these frequent errors:

- Using vague descriptions like "responsible for taxes"

- Focusing only on duties rather than achievements

- Neglecting to mention specific tax software proficiency

- Including outdated certifications without noting continuing education

- Using a generic objective statement instead of a targeted summary

Before/After Example

Before: "Prepared tax returns for clients. Handled tax questions. Used tax software."

After: "Prepared 200+ individual and small business tax returns annually using ProSeries and CCH Axcess. Researched complex tax questions, identifying an average of $2,875 in additional deductions per business client. Maintained 99.5% accuracy rate across all returns."

Remember, your resume isn't just a history of your jobs—it's a marketing document that should position you as the solution to an employer's tax department needs. Good luck with your application!

Related Resume Examples

Soft skills for your Tax Specialist resume

- Client relationship management – skilled at explaining complex tax concepts to non-specialists while maintaining trust during sensitive financial discussions

- Cross-functional collaboration with accounting, legal, and financial teams to resolve tax discrepancies and ensure compliance

- Time management during high-pressure tax seasons (juggling multiple deadlines without sacrificing accuracy)

- Analytical problem-solving – finding creative solutions to minimize tax liability while staying within regulatory boundaries

- Adaptability to frequent tax code changes and shifting regulatory requirements

- Clear written communication for tax memos, correspondence with tax authorities, and technical documentation

Hard skills for your Tax Specialist resume

- IRS Form Preparation (1040, 1099, W-2, Schedule C, K-1)

- Tax research using CCH Intelliconnect and RIA Checkpoint

- Expertise in corporate taxation and S-Corp elections

- QuickBooks and Drake Tax software proficiency

- Excel modeling for tax liability forecasting

- Multi-state tax compliance (nexus determination)

- Tax provision calculation (ASC 740/FAS 109)

- Fixed asset depreciation management

- Microsoft Power BI for tax data visualization