Tax Preparer Resume examples & templates

Copyable Tax Preparer Resume examples

Ever wondered who becomes the unexpected hero during tax season? Tax preparers step into this role every year, helping individuals and businesses navigate the labyrinth of tax codes and regulations that seem to grow more complex by the minute. It's a profession that blends analytical skills with customer service, number-crunching with problem-solving. And contrary to what many think, it's not just a seasonal gig anymore—the Bureau of Labor Statistics reports that employment of tax preparers is projected to grow 6% through 2031, faster than the average for all occupations.

The field has evolved dramatically in recent years. With the Tax Cuts and Jobs Act and other legislation continually reshaping the landscape, tax preparers need to stay on their toes. The rise of crypto assets and remote work arrangements has created new challenges (and opportunities!) for tax professionals. Many preparers now work year-round handling quarterly filings, tax planning, and financial advising services. As tax software becomes more accessible to the average person, successful tax preparers are focusing less on basic form completion and more on providing expertise that algorithms can't match—like identifying overlooked deductions or explaining implications of life changes on tax situations.

Junior Tax Preparer Resume Example

Olivia Martinez

Denver, CO 80202 • (720) 555-4217 • olivia.martinez@email.com • linkedin.com/in/oliviamartinez

Recent accounting graduate with 1+ year of tax preparation experience for individuals and small businesses. Completed over 75 tax returns during the 2023 tax season with 97% accuracy rate. Proficient in TaxAct, TurboTax Professional, and QuickBooks. Currently pursuing my Enrolled Agent designation to expand my tax expertise.

EXPERIENCE

Junior Tax Preparer – Jackson Tax Services, Denver, CO

January 2023 – Present

- Prepare and file federal and state income tax returns for 80+ individuals and 12 small businesses

- Conduct client interviews to gather financial information and identify potential deductions

- Research tax law changes and apply new regulations to client situations (SECURE 2.0, inflation adjustments)

- Reduced preparation time by 22% through improved document organization system

- Communicate with clients regarding tax notices and provide assistance with IRS correspondence

Tax Preparation Intern – Mendez Accounting Group, Boulder, CO

January 2022 – April 2022

- Assisted senior preparers with document organization and data entry for 60+ tax returns

- Verified mathematical accuracy of tax returns and supporting schedules

- Helped maintain client database and filing system for improved workflow

- Created client-friendly tax organizers that increased information collection efficiency

Office Assistant (Part-time) – Wilson Financial Advisors, Denver, CO

September 2021 – December 2021

- Managed front desk operations, including scheduling appointments and answering client inquiries

- Organized and digitized client financial documents for tax preparation

- Assisted with basic bookkeeping tasks using QuickBooks

EDUCATION

Bachelor of Science in Accounting – University of Colorado Denver

Graduated: December 2021 | GPA: 3.7/4.0

- Relevant Coursework: Individual Taxation, Business Taxation, Tax Research, Accounting Information Systems

- Member, Beta Alpha Psi Accounting Honor Society

CERTIFICATIONS & PROFESSIONAL DEVELOPMENT

Annual Filing Season Program Participant – Internal Revenue Service

Completed: December 2022

Enrolled Agent (EA) Examination – In Progress

Passed Part 1 (Individuals) – February 2023

QuickBooks Online ProAdvisor Certification – Intuit

Completed: March 2023

SKILLS

- Tax Software: TurboTax Professional, TaxAct, CCH Axcess Tax (basic)

- Accounting Software: QuickBooks, Xero, Excel (advanced functions, VLOOKUP, PivotTables)

- Individual Tax Return Preparation (1040, Schedules A-E)

- Small Business Tax Returns (Schedule C, basic 1120-S)

- Tax Research (IRS publications, tax code interpretation)

- Client Communication & Interviewing

- Document Management & Organization

- Basic Bookkeeping & Financial Statement Analysis

- Spanish (conversational)

Mid-level Tax Preparer Resume Example

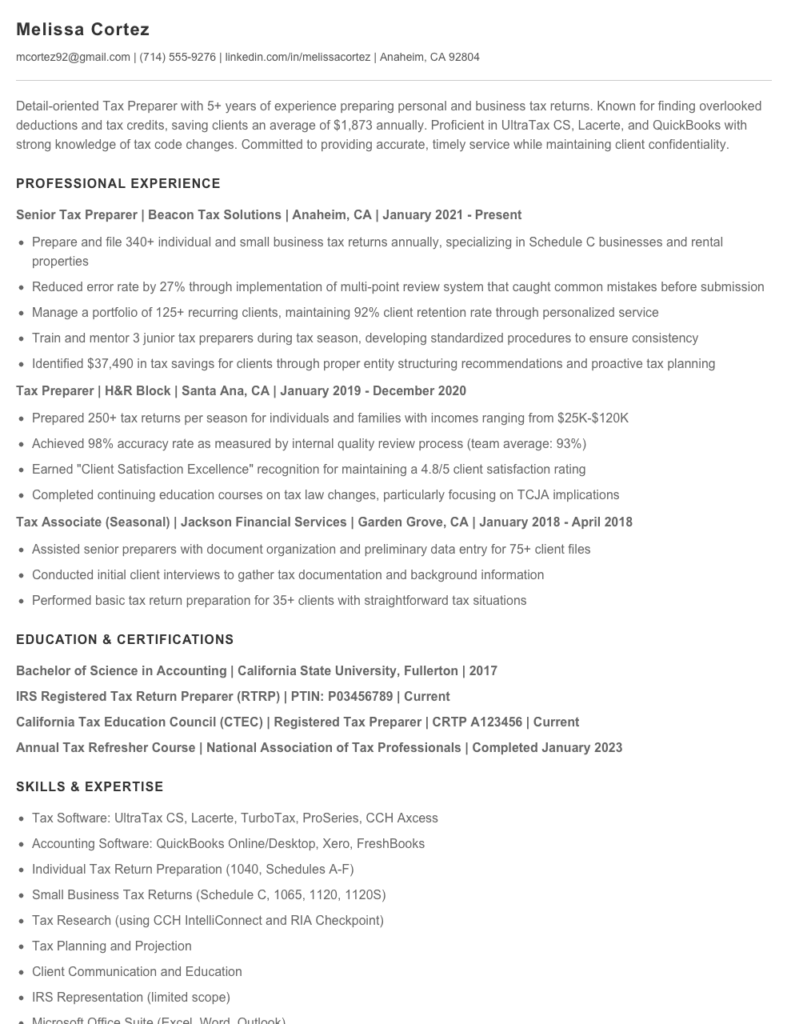

Melissa Cortez

mcortez92@gmail.com | (714) 555-9276 | linkedin.com/in/melissacortez | Anaheim, CA 92804

Detail-oriented Tax Preparer with 5+ years of experience preparing personal and business tax returns. Known for finding overlooked deductions and tax credits, saving clients an average of $1,873 annually. Proficient in UltraTax CS, Lacerte, and QuickBooks with strong knowledge of tax code changes. Committed to providing accurate, timely service while maintaining client confidentiality.

PROFESSIONAL EXPERIENCE

Senior Tax Preparer | Beacon Tax Solutions | Anaheim, CA | January 2021 – Present

- Prepare and file 340+ individual and small business tax returns annually, specializing in Schedule C businesses and rental properties

- Reduced error rate by 27% through implementation of multi-point review system that caught common mistakes before submission

- Manage a portfolio of 125+ recurring clients, maintaining 92% client retention rate through personalized service

- Train and mentor 3 junior tax preparers during tax season, developing standardized procedures to ensure consistency

- Identified $37,490 in tax savings for clients through proper entity structuring recommendations and proactive tax planning

Tax Preparer | H&R Block | Santa Ana, CA | January 2019 – December 2020

- Prepared 250+ tax returns per season for individuals and families with incomes ranging from $25K-$120K

- Achieved 98% accuracy rate as measured by internal quality review process (team average: 93%)

- Earned “Client Satisfaction Excellence” recognition for maintaining a 4.8/5 client satisfaction rating

- Completed continuing education courses on tax law changes, particularly focusing on TCJA implications

Tax Associate (Seasonal) | Jackson Financial Services | Garden Grove, CA | January 2018 – April 2018

- Assisted senior preparers with document organization and preliminary data entry for 75+ client files

- Conducted initial client interviews to gather tax documentation and background information

- Performed basic tax return preparation for 35+ clients with straightforward tax situations

EDUCATION & CERTIFICATIONS

Bachelor of Science in Accounting | California State University, Fullerton | 2017

IRS Registered Tax Return Preparer (RTRP) | PTIN: P03456789 | Current

California Tax Education Council (CTEC) | Registered Tax Preparer | CRTP A123456 | Current

Annual Tax Refresher Course | National Association of Tax Professionals | Completed January 2023

SKILLS & EXPERTISE

- Tax Software: UltraTax CS, Lacerte, TurboTax, ProSeries, CCH Axcess

- Accounting Software: QuickBooks Online/Desktop, Xero, FreshBooks

- Individual Tax Return Preparation (1040, Schedules A-F)

- Small Business Tax Returns (Schedule C, 1065, 1120, 1120S)

- Tax Research (using CCH IntelliConnect and RIA Checkpoint)

- Tax Planning and Projection

- Client Communication and Education

- IRS Representation (limited scope)

- Microsoft Office Suite (Excel, Word, Outlook)

- Basic Spanish Proficiency (can conduct simple tax interviews)

Senior / Experienced Tax Preparer Resume Example

Patricia M. Donovan

Denver, CO | (720) 555-8349 | p.donovan@emailpro.net | linkedin.com/in/patriciadonovan

Tax professional with 9+ years of experience specializing in individual and small business tax preparation. Proven track record of identifying tax-saving opportunities that resulted in over $1.2M in client savings. Known for translating complex tax codes into clear guidance for clients while maintaining 99.7% accuracy rate on all filings. Seeking to leverage deep tax expertise and client management skills in a senior tax consultant role.

PROFESSIONAL EXPERIENCE

Senior Tax Specialist | FinTax Solutions | Denver, CO | January 2019 – Present

- Manage a portfolio of 175+ high-net-worth clients with complex tax situations, including investment properties, small businesses, and international income

- Reduced client audit rates by 37% through meticulous documentation and proactive compliance strategies

- Lead a team of 4 junior tax preparers during peak season, providing training on new tax legislation and review processes

- Identified overlooked deductions resulting in $478,250 in tax savings for small business clients in 2022 alone

- Developed customized tax planning strategies for 12 small business owners that reduced quarterly tax obligations by 22% on average

Tax Preparer | Blackwell & Associates CPA Firm | Boulder, CO | March 2016 – December 2018

- Prepared and filed 340+ individual and small business tax returns annually with 99.3% accuracy rate

- Conducted tax planning meetings with clients to identify opportunities for tax-advantaged investments and strategies

- Implemented new digital documentation system that reduced preparation time by 35% and improved client satisfaction scores

- Specialized in handling tax implications of cryptocurrency investments, becoming the firm’s go-to resource for digital asset taxation

Junior Tax Associate | H&R Block | Denver, CO | January 2014 – February 2016

- Prepared 200+ individual tax returns annually during tax seasons

- Achieved highest customer satisfaction rating in office (4.9/5.0) by providing clear explanations of tax situations

- Completed continuing education courses on tax law changes and maintained perfect score on internal compliance reviews

EDUCATION & CERTIFICATIONS

Bachelor of Science in Accounting | University of Colorado Denver | 2013

Enrolled Agent (EA) | Internal Revenue Service | 2017 (Last renewed: 2023)

Certified Tax Preparer (CTP) | National Association of Tax Professionals | 2015

QuickBooks ProAdvisor Certification | Intuit | 2018

TECHNICAL SKILLS

- Tax Preparation Software: UltraTax CS, Lacerte, ProSeries, CCH Axcess

- Accounting Software: QuickBooks (Online & Desktop), Xero, FreshBooks

- Document Management: SmartVault, Canopy, Drake Documents

- Microsoft Office Suite (advanced Excel skills including pivot tables and VLOOKUP functions)

- Financial Analysis & Forecasting

SPECIALIZED TAX KNOWLEDGE

- Individual & small business taxation

- S-Corporation & Partnership returns

- Real estate investment taxation

- Cryptocurrency & digital asset taxation

- Foreign income & FBAR reporting

- Tax resolution & audit representation

PROFESSIONAL MEMBERSHIPS

- National Association of Tax Professionals (NATP)

- American Institute of Certified Public Accountants (AICPA) – Associate Member

- Colorado Society of Enrolled Agents (CSEA)

How to Write a Tax Preparer Resume

Introduction

Landing a tax preparer job requires more than just knowing your way around tax forms. Your resume needs to showcase your technical expertise, attention to detail, and client service skills in a way that makes hiring managers take notice. I've reviewed thousands of tax preparer resumes over my career, and I can tell you that even small improvements can dramatically increase your interview chances. This guide will walk you through creating a resume that highlights your tax preparation skills and professional background—whether you're a seasoned EA or just starting after tax school.

Resume Structure and Format

Tax preparation is all about precision and organization, and your resume should reflect these qualities. Keep these formatting guidelines in mind:

- Stick to 1-2 pages (one page for those with under 5 years of experience)

- Use clean, professional fonts like Calibri, Arial, or Garaday at 10-12pt

- Include clear section headings with consistent formatting

- Incorporate white space to improve readability (tax pros review hundreds of documents daily—they'll appreciate this!)

- Save your file as a PDF named "FirstName_LastName_Resume.pdf" to maintain formatting

Profile/Summary Section

Your summary should be a brief but powerful introduction—think of it as your professional elevator pitch. For tax preparers, highlighting your technical qualifications and experience level is key.

Pro Tip: Customize your summary for each job application. If the firm specializes in business returns, emphasize your corporate tax experience. Applying to a firm serving individuals? Highlight your experience with personal returns and tax planning.

A strong summary might read: "Detail-oriented Tax Preparer with 4+ years of experience preparing 300+ individual and small business

returns annually. Enrolled Agent with expertise in tax law changes, deduction optimization, and tax software including UltraTax and Lacerte. Known for 99.7% accuracy rate and clear client communication."

Professional Experience

This section carries the most weight. Focus on your accomplishments rather than just duties. Use these strategies:

- Start bullets with strong action verbs (Prepared, Analyzed, Resolved, etc.)

- Include specific numbers when possible (# of returns prepared, % accuracy rate, $ refund amounts secured)

- Highlight specialized knowledge areas (partnership returns, multi-state filings, etc.)

- Mention tax software you've mastered (ProSeries, Drake, TaxSlayer)

- Show progression if you've advanced from basic to complex returns

Example bullet: "Prepared 175+ individual and small business returns during 2022 tax season, maintaining a 98.3% accuracy rate while handling complex scenarios including rental properties, self-employment, and investment income."

Education and Certifications

Tax preparation is credential-heavy, so this section matters! Include:

- Formal degrees (Bachelor's in Accounting, etc.)

- Professional certifications (EA, CPA, AFSP)

- Relevant coursework or tax preparation programs

- Recent continuing education (Annual Tax Refresher Courses, etc.)

- PTIN status (current and in good standing)

Keywords and ATS Tips

Most firms use applicant tracking systems to filter resumes before a human sees them. Include these key terms to make it through:

- Tax preparation software names (specific to what they use if possible)

- Form numbers relevant to your experience (1040, 1120S, 1065, etc.)

- Technical terms like "tax compliance," "IRS correspondence," "tax planning"

- Credentials and affiliations (NATP, NAEA memberships)

- Skills mentioned in the job description (word-for-word when applicable)

Industry-specific Terms

Demonstrate your expertise by naturally incorporating tax terminology like:

- Schedule-specific experience (Schedule C, E, etc.)

- Knowledge areas (passive activity losses, basis calculations)

- Tax law references (TCJA familiarity, SECURE Act implications)

- State-specific tax knowledge if relevant

Common Mistakes to Avoid

I've seen talented tax pros get overlooked because of these resume blunders:

- Focusing only on tax season work (show year-round value)

- Being vague about software proficiency levels

- Neglecting to mention client communication skills

- Including outdated tax credentials without noting current status

- Typos or grammatical errors (fatal in a profession requiring attention to detail!)

Before/After Example

Before: "Responsible for doing tax returns for clients during tax season."

After: "Prepared and filed 220+ individual tax returns during 2023 tax season, specializing in self-employment and rental property scenarios. Identified overlooked deductions resulting in an average additional refund of $1,742 per applicable client."

Your tax preparer resume should demonstrate both technical know-how and client service skills. Remember that firms are looking for someone who can not only navigate tax law but also explain complex concepts to clients in plain language. Good luck with your application!

Related Resume Examples

Soft skills for your Tax Preparer resume

- Attentive listening – especially when clients explain complex financial situations or life changes that might affect their tax status

- Clear explanation of tax concepts without overwhelming clients with technical jargon

- Deadline management during the chaos of tax season (I’ve never missed a filing deadline in 5+ years)

- Emotional intelligence to handle stressed clients who may be anxious about audits or unexpected tax bills

- Discretion with sensitive financial information – clients trust me with details they wouldn’t share with close friends

- Adaptability to annual tax code changes and shifting regulatory requirements

Hard skills for your Tax Preparer resume

- Proficiency in UltraTax CS, ProSeries, and Drake Software

- Form 1040 preparation with Schedules A-F and supplemental forms

- Experience with IRS e-filing protocols and state tax filing requirements

- Business returns (1120, 1120S, 1065) with 5+ years handling K-1 distributions

- QuickBooks Pro certification for financial data reconciliation

- Excel modeling for tax liability projection (VLOOKUP, pivot tables)

- Research skills using CCH IntelliConnect and Thomson Reuters Checkpoint

- Tax planning strategies for clients with AGI between $75,000-$400,000

- Enrolled Agent (EA) certification