Tax Attorney Resume examples & templates

Copyable Tax Attorney Resume examples

Tax attorneys face a constant dilemma: maintaining technical precision while translating Byzantine tax code into language clients actually understand. It's like being both a code-breaker and interpreter simultaneously. Recent IRS data shows that tax law changes from the 2017 Tax Cuts and Jobs Act still generate confusion, with over 87% of small business owners misunderstanding at least one major provision that could impact their bottom line. This complexity has only intensified with remote work arrangements creating multi-state tax obligations that weren't on most practitioners' radars three years ago.

The profession sits at an interesting crossroads right now. While AI tools promise to handle routine compliance work, they've actually increased demand for specialized tax attorneys who can navigate gray areas and strategic planning. Firms are increasingly seeking professionals who bring both technical expertise and industry-specific knowledge—particularly in emerging areas like cryptocurrency taxation and international tax structures. For those willing to develop this dual skillset (and embrace some inevitable continuing education), tax law offers remarkable career stability with genuine opportunities to directly impact clients' financial wellbeing.

Junior Tax Attorney Resume Example

Amanda J. Nguyen

San Francisco, CA 94110 • (415) 555-7892 • amanda.nguyen@email.com

linkedin.com/in/amandajnguyen • California Bar #329756

Recent JD graduate with LLM in Taxation and 1+ year of experience in tax law through internships and a junior associate position. Skilled in tax research, compliance, and corporate tax planning with a focus on pass-through entities. Seeking to leverage my academic background and growing expertise to contribute to a tax practice focused on business clients and high-net-worth individuals.

EXPERIENCE

Junior Tax Associate

Blackwell & Chen LLP, San Francisco, CA

July 2022 – Present

- Assist senior attorneys with tax research and analysis for 14+ business clients, focusing on partnership taxation and S-corporation compliance issues

- Draft client memoranda explaining tax consequences of proposed business transactions and reorganizations

- Prepare federal and state income tax returns for partnerships, S-corporations, and high-net-worth individuals

- Conduct research on IRS notices and help develop response strategies that resulted in $73,000 in penalty abatements for clients

- Support senior attorneys during client meetings and tax planning sessions

Tax Law Clerk

Morris Tax Solutions, San Francisco, CA

January 2022 – June 2022

- Researched tax issues related to business formations, mergers, and acquisitions

- Assisted with tax return preparation during 2022 tax season, handling approximately 35 individual returns

- Drafted responses to IRS and FTB notices regarding tax compliance issues

- Created client-friendly tax planning materials explaining recent tax law changes

Tax Law Intern

San Francisco City Attorney’s Office, Tax Division

May 2021 – August 2021

- Researched municipal tax ordinances and state tax law issues under attorney supervision

- Assisted with drafting legal memoranda on city business tax compliance matters

- Compiled tax revenue data for internal reports and presentations

EDUCATION

Master of Laws (LLM) in Taxation

Golden Gate University School of Law, San Francisco, CA

Graduated: May 2022

• Thesis: “Section 199A Qualified Business Income Deduction: Planning Opportunities for Pass-Through Entities”

• Tax Law Society, Vice President

Juris Doctor (JD)

University of California, Hastings College of the Law, San Francisco, CA

Graduated: May 2021

• GPA: 3.78/4.0

• Tax Law Concentration

• Hastings Business Law Journal, Associate Editor

Bachelor of Science in Business Administration, Accounting

University of California, Berkeley

Graduated: May 2018

• Minor in Economics

• Dean’s List: 7 semesters

CERTIFICATIONS & MEMBERSHIPS

- Admitted to California State Bar, December 2021

- IRS Enrolled Agent (EA) – Passed all three parts, March 2022

- American Bar Association, Tax Section – Member

- California Society of CPAs – Student Affiliate

SKILLS

- Tax Research: Lexis Advance Tax, CCH IntelliConnect, Bloomberg BNA

- Tax Compliance: Partnership, S-Corporation, and Individual taxation

- Software: UltraTax CS, GoSystem Tax RS, ProSeries

- Entity Formation & Business Restructuring

- Tax Planning for Closely-Held Businesses

- IRS Practice & Procedure

- Legal Writing & Tax Memo Drafting

- State & Local Taxation

- Spanish (Conversational)

Mid-level Tax Attorney Resume Example

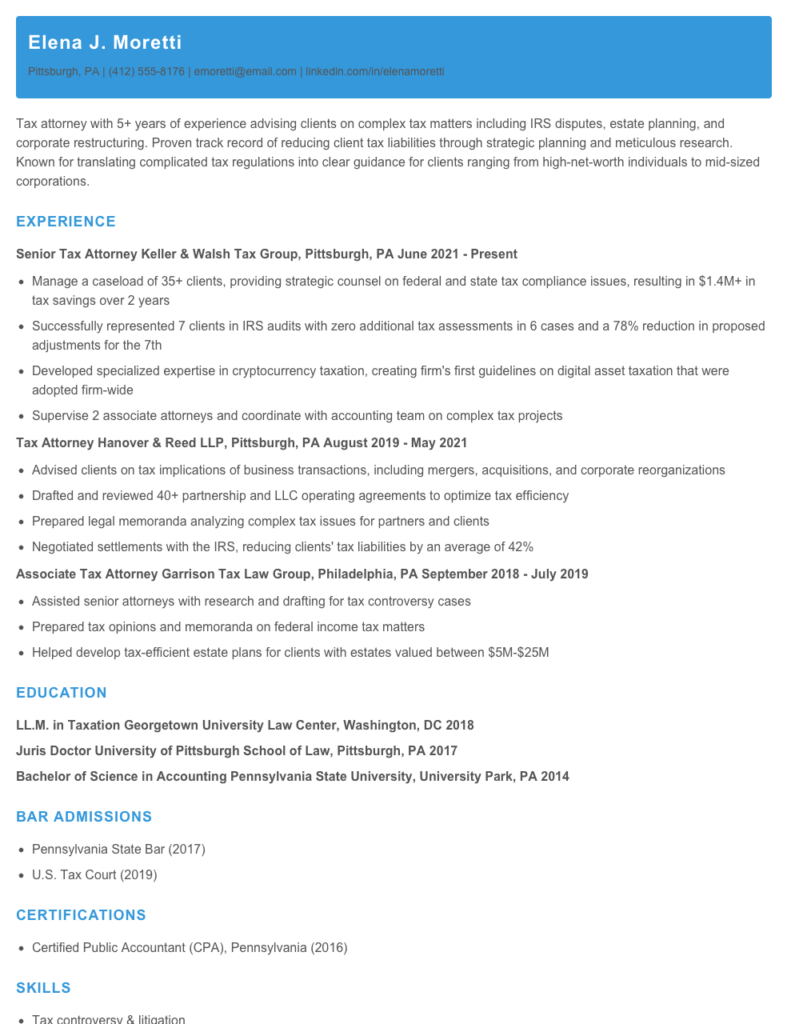

Elena J. Moretti

Pittsburgh, PA | (412) 555-8176 | emoretti@email.com | linkedin.com/in/elenamoretti

Tax attorney with 5+ years of experience advising clients on complex tax matters including IRS disputes, estate planning, and corporate restructuring. Proven track record of reducing client tax liabilities through strategic planning and meticulous research. Known for translating complicated tax regulations into clear guidance for clients ranging from high-net-worth individuals to mid-sized corporations.

EXPERIENCE

Senior Tax Attorney

Keller & Walsh Tax Group, Pittsburgh, PA

June 2021 – Present

- Manage a caseload of 35+ clients, providing strategic counsel on federal and state tax compliance issues, resulting in $1.4M+ in tax savings over 2 years

- Successfully represented 7 clients in IRS audits with zero additional tax assessments in 6 cases and a 78% reduction in proposed adjustments for the 7th

- Developed specialized expertise in cryptocurrency taxation, creating firm’s first guidelines on digital asset taxation that were adopted firm-wide

- Supervise 2 associate attorneys and coordinate with accounting team on complex tax projects

Tax Attorney

Hanover & Reed LLP, Pittsburgh, PA

August 2019 – May 2021

- Advised clients on tax implications of business transactions, including mergers, acquisitions, and corporate reorganizations

- Drafted and reviewed 40+ partnership and LLC operating agreements to optimize tax efficiency

- Prepared legal memoranda analyzing complex tax issues for partners and clients

- Negotiated settlements with the IRS, reducing clients’ tax liabilities by an average of 42%

Associate Tax Attorney

Garrison Tax Law Group, Philadelphia, PA

September 2018 – July 2019

- Assisted senior attorneys with research and drafting for tax controversy cases

- Prepared tax opinions and memoranda on federal income tax matters

- Helped develop tax-efficient estate plans for clients with estates valued between $5M-$25M

EDUCATION

LL.M. in Taxation

Georgetown University Law Center, Washington, DC

2018

Juris Doctor

University of Pittsburgh School of Law, Pittsburgh, PA

2017

Bachelor of Science in Accounting

Pennsylvania State University, University Park, PA

2014

BAR ADMISSIONS

- Pennsylvania State Bar (2017)

- U.S. Tax Court (2019)

CERTIFICATIONS

- Certified Public Accountant (CPA), Pennsylvania (2016)

SKILLS

- Tax controversy & litigation

- Estate & gift tax planning

- Partnership taxation

- Corporate restructuring

- International tax planning

- Cryptocurrency taxation

- Tax research platforms (CCH Intelliconnect, Bloomberg BNA)

- ProSeries Tax Software

- Tax Court procedure

- Contract drafting & review

PROFESSIONAL MEMBERSHIPS

- American Bar Association – Section of Taxation

- Pennsylvania Bar Association – Tax Law Section

- Pittsburgh Tax Club (newsletter editor, 2022-present)

Senior / Experienced Tax Attorney Resume Example

Michael R. Donovan

Boston, MA • (617) 555-8472 • mdonovan@emailpro.net • linkedin.com/in/michaelrdonovan

Professional Summary

Tax Attorney with 11+ years of experience specializing in corporate taxation, mergers & acquisitions and international tax planning. Strong track record of successfully representing clients before the IRS, reducing tax liabilities and developing tax-efficient structures. Combines deep technical knowledge with practical business acumen to deliver pragmatic solutions that balance compliance with optimization strategies.

Experience

Senior Tax Attorney | Blackwell Pritchard LLP | Boston, MA | June 2019 – Present

- Lead a team of 4 tax attorneys handling complex corporate restructuring matters for clients with revenues exceeding $250M

- Reduced clients’ tax exposure by $17.3M through strategic entity restructuring and identifying overlooked credits/deductions

- Successfully represented 8 clients in IRS audits with zero additional tax assessments in 7 cases

- Developed specialized practice area in cryptocurrency taxation, growing this segment by 78% in 2 years

- Regular speaker at regional tax conferences on emerging issues in corporate taxation

Tax Attorney | Goldman & Schwartz | Cambridge, MA | March 2016 – May 2019

- Advised on tax implications for 12+ M&A transactions ranging from $5M to $180M in value

- Structured international holdings for 3 expanding tech companies, resulting in annual tax savings of approximately $1.4M per client

- Collaborated with estate planning team to develop comprehensive wealth preservation strategies for high-net-worth clients

- Successfully negotiated settlement with IRS that reduced client’s proposed tax assessment from $3.2M to $470K

Associate Tax Attorney | Martinson Tax Group | Boston, MA | August 2012 – February 2016

- Prepared and reviewed federal and state tax returns for businesses with revenues between $1M and $35M

- Conducted research on complex tax issues related to business operations in multiple states

- Assisted senior attorneys with IRS audit representation and tax controversy matters

- Drafted legal memoranda on tax implications of various corporate transactions

Education

LL.M. in Taxation | Boston University School of Law | Boston, MA | 2012

Juris Doctor | Suffolk University Law School | Boston, MA | 2011

Bachelor of Science in Accounting | Bentley University | Waltham, MA | 2008

Certifications & Bar Admissions

Massachusetts Bar Association, 2011

U.S. Tax Court, 2013

Certified Public Accountant (CPA), Massachusetts, 2009

Skills

- Federal & State Tax Litigation

- Corporate Restructuring

- International Tax Planning

- Tax-Efficient M&A Structuring

- IRS Audit Defense

- Partnership & LLC Taxation

- Estate & Gift Tax Planning

- Tax Research (Lexis, CCH, RIA)

- Cryptocurrency Taxation

- Transfer Pricing

Professional Memberships

American Bar Association – Section of Taxation

Boston Bar Association – Tax Section

Massachusetts Society of CPAs

How to Write a Tax Attorney Resume

Introduction

Landing your dream tax attorney position starts with a resume that showcases your technical expertise, analytical abilities, and client management skills. Your resume isn't just a list of past jobs—it's your professional story that demonstrates how your unique combination of legal knowledge and tax code expertise makes you the perfect candidate. I've helped hundreds of tax attorneys revamp their resumes, and I'm going to share what actually works (not just generic advice).

Resume Structure and Format

Tax law is precise and so should be your resume format. Keep these structural elements in mind:

- Length: 1-2 pages maximum (partners with 15+ years might stretch to 2 full pages)

- Font: Stick with classics like Calibri, Times New Roman, or Arial (10-12pt)

- Margins: 0.75-1 inch on all sides

- Sections: Contact info, summary, experience, education, bar admissions, certifications, skills

- File format: PDF (preserves formatting and looks professional)

Pro Tip: Name your file strategically! "Jane_Smith_Tax_Attorney_Resume.pdf" helps hiring partners find your document quickly when they're sorting through dozens of applications.

Profile/Summary Section

Your summary should be 3-5 lines that pack a punch. Mention your years of experience, tax specialization areas, and 1-2 standout achievements. For example:

IRS Tax Attorney with 7+ years specializing in corporate tax controversy and international tax planning. Successfully negotiated $4.7M in tax savings for Fortune 500 clients. JD/LLM in Taxation with extensive experience in federal income tax issues and cross-border transactions.

Professional Experience

This is where tax attorneys often stumble! Don't just list responsibilities—show impact through measurable results. Each role should include:

- Position title, firm name, location, and dates (month/year)

- 4-6 bullet points highlighting achievements (not just duties)

- Specific tax matters handled, client types (while maintaining confidentiality)

- Dollar amounts, percentage improvements, and case outcomes where possible

Focus on tax planning strategies developed, favorable settlements reached, and complex compliance issues resolved. Quantify whenever you can!

Education and Certifications

For tax attorneys, your educational credentials carry significant weight. Include:

- JD degree with honors/class rank (if graduated in the top 25%)

- LLM in Taxation (if applicable)

- Bar admissions with dates (all jurisdictions)

- CPA license or other relevant certifications

- Key tax law courses or specialized training programs

Recent graduates: Include relevant tax coursework, law review participation, or tax clinic experience if you have limited professional experience.

Keywords and ATS Tips

Most law firms and companies use Applicant Tracking Systems that scan for specific keywords. Tax-specific terms to include:

- Technical terms: Tax controversy, FBAR compliance, Section 1031 exchanges, transfer pricing

- Regulatory bodies: IRS, Treasury Department, Tax Court, state tax authorities

- Software: ProSystems fx Tax, Lacerte, UltraTax, CCH Axcess

- Skills: Tax research, code interpretation, tax planning, audit defense

Industry-specific Terms

Demonstrate your tax expertise by naturally incorporating terms like:

- Specific code sections (Section 409A, Section 482)

- Tax doctrines (economic substance, step transaction)

- International concepts (GILTI, Subpart F income, tax treaties)

- Practice areas (estate and gift tax, exempt organizations, SALT)

Common Mistakes to Avoid

After reviewing thousands of tax attorney resumes, these are the mistakes I see most:

- Being too generic (saying "handled tax matters" instead of specifying the type)

- Focusing on responsibilities instead of achievements

- Overloading with legal jargon that obscures your actual expertise

- Forgetting to highlight client relationship management skills

- Neglecting to mention experience with specific tax forms or filings

Before/After Example

Before: "Responsible for advising clients on tax matters and helping with IRS audits."

After: "Developed innovative tax planning strategies for 12 high-net-worth clients ($10M-$50M net worth), resulting in legitimate tax savings of $872K while maintaining full compliance with IRC Section 199A regulations."

The difference? Specificity, quantifiable results, and showing both technical knowledge and business impact. Your resume should read like a tax attorney wrote it—precise, technical when needed, and focused on results that matter to employers.

Related Resume Examples

Soft skills for your Tax Attorney resume

- Client relationship management – ability to explain complex tax implications to non-technical stakeholders while maintaining trust during stressful situations

- Analytical problem-solving with attention to inconsistencies that might otherwise go unnoticed in financial documents

- Persuasive oral communication, particularly when presenting tax positions to IRS agents during examinations

- Cross-functional collaboration with accounting teams, financial advisors, and corporate executives

- Deadline management during overlapping tax seasons and filing extensions

- Adaptability to frequent regulatory changes (managed 3 major tax code revisions in past 5 years)

Hard skills for your Tax Attorney resume

- Tax Return Preparation & Review (Individual, Corporate, Partnership)

- IRS Section 1031 Exchange Analysis

- Bloomberg BNA Tax Management Software

- Tax Court Litigation Experience (U.S. Tax Court Rule 155 Computations)

- Cross-Border Transaction Structuring

- CCH ProSystem fx Tax & Engagement

- Trust & Estate Tax Planning (including GSTT calculations)

- R&D Tax Credit Documentation & Defense

- SEC Form 1120 Series Compliance