Tax Associate Resume examples & templates

Copyable Tax Associate Resume examples

Ever wondered why tax professionals are in such high demand even in economic downturns? Tax Associates sit at the fascinating intersection of finance, law, and business strategy—making them vital players in helping companies and individuals navigate an increasingly complex tax landscape. With the Tax Cuts and Jobs Act still reverberating through the industry and ESG reporting requirements on the rise, the field is anything but static.

According to the Bureau of Labor Statistics, employment for tax professionals is projected to grow about 6% through 2028, slightly faster than average. But what this statistic doesn't show is the evolving nature of the role. Today's Tax Associates need more than just number-crunching skills; they need tech savvy (those spreadsheet macros won't write themselves!), client communication finesse, and the ability to spot opportunities others miss. As digital transformation reshapes how we handle tax compliance and planning, Tax Associates who can blend traditional expertise with forward-thinking approaches will find themselves perfectly positioned for growth in this rewarding field.

Junior Tax Associate Resume Example

Daniel Reyes

Boston, MA • (617) 555-4092 • dreyes@emailprovider.com • linkedin.com/in/danielreyes

Recent accounting graduate with IRS VITA certification and 1+ year of tax preparation experience. Quick learner who efficiently manages multiple client deadlines while maintaining accuracy. Seeking to leverage my tax preparation skills, QuickBooks proficiency, and strong attention to detail to grow as a Tax Associate at a regional firm.

EXPERIENCE

Junior Tax Associate | Blackwell & Murray CPA, Boston, MA | January 2023 – Present

- Prepare 75+ individual tax returns (Form 1040) and supporting schedules for clients with incomes ranging from $45K-$175K

- Research tax implications for clients with investment income, rental properties, and small business interests

- Assist with quarterly tax planning meetings for 12 small business clients

- Respond to IRS notices regarding client accounts and help resolve discrepancies

- Document client interactions and maintain organized digital files using CCH Axcess

Tax Preparation Volunteer | VITA Program (IRS), Boston, MA | January 2022 – April 2022

- Completed 42 tax returns for low-income families and individuals during 2021 tax season

- Explained tax concepts and refund expectations to clients in clear, non-technical language

- Received perfect score on quality reviews conducted by VITA site coordinator

Accounting Intern | Northeast Credit Union, Boston, MA | June 2021 – August 2021

- Reconciled general ledger accounts and helped prepare monthly financial statements

- Assisted with accounts payable processing and vendor management

- Created Excel templates for tracking departmental expenses that reduced reporting time by 23%

EDUCATION

Bachelor of Science in Accounting | Suffolk University, Boston, MA | May 2022

- GPA: 3.7/4.0

- Relevant Coursework: Federal Taxation, Business Law, Advanced Accounting, Auditing

- Member, Beta Alpha Psi (Accounting Honor Society)

CERTIFICATIONS

IRS Volunteer Income Tax Assistance (VITA) Program | Certified 2022-2023

QuickBooks Online ProAdvisor | Certified March 2023

SKILLS

- Tax Preparation Software: CCH Axcess, ProSeries, TurboTax

- Accounting Software: QuickBooks, Xero, Microsoft Dynamics

- Technical: Advanced Excel (VLOOKUP, pivot tables, macros), Microsoft Office Suite

- Soft Skills: Client communication, deadline management, detail-oriented

- Knowledge Areas: Individual and small business taxation, tax research, basic bookkeeping

ADDITIONAL

Fluent in Spanish • Member of Massachusetts Society of CPAs (Student Member) • Currently studying for CPA exam (completed FAR section)

Mid-level Tax Associate Resume Example

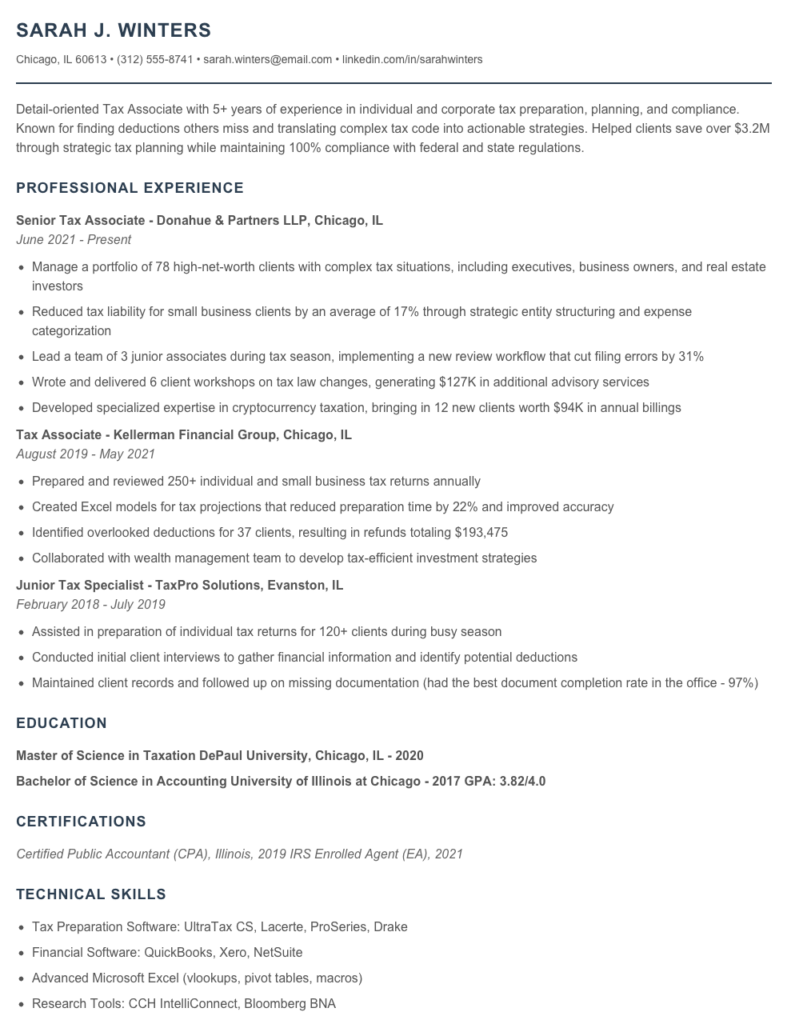

Sarah J. Winters

Chicago, IL 60613 • (312) 555-8741 • sarah.winters@email.com • linkedin.com/in/sarahwinters

Detail-oriented Tax Associate with 5+ years of experience in individual and corporate tax preparation, planning, and compliance. Known for finding deductions others miss and translating complex tax code into actionable strategies. Helped clients save over $3.2M through strategic tax planning while maintaining 100% compliance with federal and state regulations.

PROFESSIONAL EXPERIENCE

Senior Tax Associate – Donahue & Partners LLP, Chicago, IL

June 2021 – Present

- Manage a portfolio of 78 high-net-worth clients with complex tax situations, including executives, business owners, and real estate investors

- Reduced tax liability for small business clients by an average of 17% through strategic entity structuring and expense categorization

- Lead a team of 3 junior associates during tax season, implementing a new review workflow that cut filing errors by 31%

- Wrote and delivered 6 client workshops on tax law changes, generating $127K in additional advisory services

- Developed specialized expertise in cryptocurrency taxation, bringing in 12 new clients worth $94K in annual billings

Tax Associate – Kellerman Financial Group, Chicago, IL

August 2019 – May 2021

- Prepared and reviewed 250+ individual and small business tax returns annually

- Created Excel models for tax projections that reduced preparation time by 22% and improved accuracy

- Identified overlooked deductions for 37 clients, resulting in refunds totaling $193,475

- Collaborated with wealth management team to develop tax-efficient investment strategies

Junior Tax Specialist – TaxPro Solutions, Evanston, IL

February 2018 – July 2019

- Assisted in preparation of individual tax returns for 120+ clients during busy season

- Conducted initial client interviews to gather financial information and identify potential deductions

- Maintained client records and followed up on missing documentation (had the best document completion rate in the office – 97%)

EDUCATION

Master of Science in Taxation

DePaul University, Chicago, IL – 2020

Bachelor of Science in Accounting

University of Illinois at Chicago – 2017

GPA: 3.82/4.0

CERTIFICATIONS

Certified Public Accountant (CPA), Illinois, 2019

IRS Enrolled Agent (EA), 2021

TECHNICAL SKILLS

- Tax Preparation Software: UltraTax CS, Lacerte, ProSeries, Drake

- Financial Software: QuickBooks, Xero, NetSuite

- Advanced Microsoft Excel (vlookups, pivot tables, macros)

- Research Tools: CCH IntelliConnect, Bloomberg BNA

PROFESSIONAL SKILLS

- Corporate & Individual Tax Compliance

- Tax Planning & Minimization Strategies

- IRS Representation & Audit Defense

- Multi-state Taxation

- Entity Structure Planning

- Financial Statement Analysis

PROFESSIONAL MEMBERSHIPS

American Institute of Certified Public Accountants (AICPA)

Illinois CPA Society

National Association of Tax Professionals

Senior / Experienced Tax Associate Resume Example

Megan A. Callahan

Boston, MA 02116 • (617) 555-8743 • mcallahan.tax@email.com

LinkedIn: linkedin.com/in/megancallahan • CPA License #MA-38472

Senior Tax Associate with 8+ years specializing in corporate and partnership taxation. Known for reducing client tax liabilities through strategic planning and deep regulatory knowledge. Proven track record of saving clients $1.7M+ through tax strategies and successfully representing clients in IRS audits with zero penalties assessed. Skilled mentor who’s trained 14 junior associates while managing complex engagements.

EXPERIENCE

Garrison & McKnight LLP — Boston, MA

Senior Tax Associate (June 2019 – Present)

- Lead tax planning and compliance services for 27 corporate clients with revenues ranging from $5M to $87M, primarily in manufacturing and technology sectors

- Identified and implemented tax strategies that saved clients an average of $214,000 annually through R&D credits, cost segregation studies, and accounting method changes

- Managed and mentored team of 4 junior associates, improving their efficiency by 31% through targeted training and workflow improvements

- Developed specialized expertise in IRC §199A pass-through deductions, becoming the firm’s go-to resource and generating $178K in additional advisory fees

- Streamlined tax provision process for quarterly filings, reducing preparation time from 6 days to 2.5 days while improving accuracy

Wainwright Tax Partners — Cambridge, MA

Tax Associate (August 2016 – May 2019)

- Prepared and reviewed federal and multi-state tax returns for 35+ clients, including partnerships, S-corps, and high-net-worth individuals

- Successfully represented 7 clients in IRS audits with zero penalties assessed, preserving $893K in claimed deductions

- Conducted research on complex tax issues including foreign income reporting, nexus determination, and state apportionment rules

- Created tax planning models that identified $450K in potential tax savings for top 5 clients through restructuring and timing strategies

Deloitte — Boston, MA

Tax Associate (July 2014 – July 2016)

- Prepared corporate, partnership, and individual tax returns for clients across diverse industries

- Participated in 12 year-end provision engagements for publicly traded companies

- Assisted senior team members with tax research projects and client deliverables

- Developed Excel automation tools that reduced return preparation time by 23%

EDUCATION

Boston University, School of Management — Boston, MA

Master of Science in Taxation, GPA: 3.8/4.0 (2014)

University of Massachusetts — Amherst, MA

Bachelor of Business Administration in Accounting, GPA: 3.7/4.0 (2012)

CERTIFICATIONS

- Certified Public Accountant (CPA), Massachusetts (2015)

- IRS Enrolled Agent (2017)

- Advanced Certification in Partnership Taxation, Boston Tax Institute (2018)

SKILLS

- Corporate & Partnership Taxation

- Multi-State Tax Compliance

- Tax Research (CCH Intelliconnect, RIA Checkpoint)

- IRS Audit Defense

- ASC 740 Tax Provisions

- Tax Software: CCH Axcess, GoSystem Tax RS, Lacerte

- Advanced Excel Modeling

- Entity Structuring

- Tax-Efficient M&A Planning

- Client Relationship Management

How to Write a Tax Associate Resume

Introduction

Landing a Tax Associate position means proving you can handle complex tax regulations while maintaining meticulous attention to detail. Your resume is your first chance to demonstrate these qualities. I've reviewed thousands of tax professional resumes over my career, and I can tell you this: the difference between getting called for an interview and being passed over often comes down to how well your resume speaks to the specific needs of accounting firms and tax departments.

Resume Structure and Format

Tax work requires precision, and your resume format should reflect this professional standard:

- Keep length to 1 page for entry-level positions, 2 pages max for experienced tax pros

- Use a clean, conservative layout with consistent formatting

- Stick with standard fonts like Calibri, Arial, or Garamond (10-12pt)

- Include clear section headings with adequate white space

- Save as a PDF unless specifically requested otherwise (preserves formatting)

A well-structured resume isn't just about aesthetics—it signals to hiring managers that you approach your work with the same organized mindset required for tax preparation and compliance.

Profile/Summary Section

Your professional summary should be brief (3-4 lines) and highlight your tax specialization, years of experience, and biggest strengths. For Tax Associates, emphasize:

- Specific tax areas you've worked in (individual, corporate, partnership, etc.)

- Relevant software proficiency (UltraTax, ProSeries, Lacerte, CCH Axcess)

- Key credentials (CPA, EA, MST) or progress toward them

Example for an entry-level candidate: "Recent accounting graduate with internship experience at H&R Block preparing 87+ individual returns. Proficient in ProSeries and Excel. Pursuing CPA certification with completed FAR and AUD sections."

Professional Experience

This is where most Tax Associate resumes fall flat. Don't just list job duties—show impact and specifics:

- Include exact numbers of returns prepared (e.g., "Prepared 143 individual and 26 small business returns")

- Mention specific tax forms you're familiar with (1040, 1120, 1065, etc.)

- Highlight any tax research you've conducted (using RIA Checkpoint, CCH, etc.)

- Note any client interaction experience or review responsibilities

- Showcase any tax savings identified or process improvements

Education and Certifications

For Tax Associates, education credentials carry significant weight:

- List degrees in reverse chronological order

- Include GPA if above 3.3 (or accounting GPA if that's higher)

- Feature relevant coursework (Federal Taxation, Advanced Tax Research, etc.)

- Highlight certifications or exam progress (CPA sections passed)

- Include CPE hours if you're maintaining a credential

Keywords and ATS Tips

Many firms use Applicant Tracking Systems to filter resumes before human eyes see them. Include these tax-specific terms naturally throughout your resume:

- Tax compliance and tax planning

- Federal, state, and local tax preparation

- Tax research and analysis

- Specific tax software names

- Specific tax forms and schedules

- GAAP and tax accounting

Industry-specific Terms

Smart inclusion of technical terminology signals your familiarity with tax work:

- Tax provision

- Basis calculations

- Depreciation methods

- Section 1231/1245/1250 property

- NOL carryforwards

- Passive activity limitations

Common Mistakes to Avoid

I see these errors repeatedly on Tax Associate resumes:

- Being too vague about specific tax experience ("Helped with tax season")

- Overemphasizing bookkeeping when applying for tax roles

- Forgetting to mention specific tax software proficiency levels

- Including irrelevant work experience without tax connections

- Typos! (Nothing kills a tax resume faster than errors)

Before/After Example

Before: "Prepared tax returns for clients during tax season."

After: "Prepared 78 individual returns (Forms 1040, 1040NR) and 12 small business returns (Schedule C, Forms 1065/1120S) with 96% acceptance rate on first e-file submission. Used ProSeries to identify $4,300 average tax savings through proper treatment of home office expenses and business deductions."

See the difference? The second version proves you understand the specifics of tax work, not just the general concept. Ultimately, your Tax Associate resume should demonstrate both technical knowledge and attention to detail—exactly what firms need during those hectic tax seasons!

Related Resume Examples

Soft skills for your Tax Associate resume

- Client relationship building – ability to maintain trust with taxpayers while navigating sensitive financial discussions

- Technical translation skills – explaining complex tax concepts to non-specialists without overwhelming them

- Deadline management during high-pressure tax seasons (I’ve never missed an April filing!)

- Cross-functional collaboration with audit teams, financial analysts and legal specialists

- Ethical judgment when handling gray-area tax questions that require professional discretion

- Adaptability to frequent regulatory changes and software platform updates

Hard skills for your Tax Associate resume

- Federal and multi-state income tax preparation using CCH ProSystem fx and UltraTax CS

- Reconciliation of book-to-tax differences and Schedule M-1/M-3 preparation

- Tax research using RIA Checkpoint and BNA Tax Management Portfolios

- Partnership K-1 allocation calculations and basis tracking

- Fixed asset depreciation analysis and tax planning using Bloomberg Tax Fixed Assets

- Excel modeling for tax provision calculations (ASC 740/FAS 109)

- Tax compliance for S-corporations, partnerships, and LLCs

- Experience with IRS notice responses and audit representation

- Foreign tax credit calculations and international tax reporting (Forms 5471, 8865)