Stock Trader Resume examples & templates

Copyable Stock Trader Resume examples

Ever wondered what it's like to make split-second decisions where millions of dollars hang in the balance? Stock traders thrive in that high-pressure environment every day. Part strategist, part risk manager, and part market psychologist, traders navigate the complexities of financial markets to capitalize on price movements and generate profits. The landscape has transformed dramatically over the past decade—what once required a physical presence on trading floors now happens primarily through sophisticated electronic platforms. In fact, algorithmic trading now accounts for about 70-80% of overall trading volume in U.S. markets, though human traders still maintain crucial roles in discretionary decision-making and relationship management.

The profession rewards those with sharp analytical skills, emotional discipline, and an almost intuitive understanding of market psychology. Beyond the Hollywood stereotypes (sorry, no Wolf of Wall Street shenanigans here!), successful traders build careers through consistent performance, risk management, and adaptability. With market volatility becoming more pronounced and new asset classes emerging—from cryptocurrencies to carbon credits—the trading profession continues to evolve, creating opportunities for those who can blend technical expertise with innovative thinking in tomorrow's markets.

Junior Stock Trader Resume Example

Dylan Martinez

dylan.martinez@email.com | (213) 485-9276 | Chicago, IL 60611

LinkedIn: linkedin.com/in/dylanmartinez | Personal Trading Blog: tradingwithdy.medium.com

Junior Stock Trader with 1+ year experience in equity markets and technical analysis. Finance graduate with proven ability to execute trades across multiple platforms while maintaining risk parameters. Developed a personal trading strategy that yielded 14% returns in a 6-month period. Looking to leverage analytical skills and market knowledge in a full-time trading position.

EXPERIENCE

Junior Equity Trader – Meridian Trading Group, Chicago, IL

January 2023 – Present

- Execute 15-25 daily trades on average, primarily in small to mid-cap stocks following senior trader guidance

- Perform technical analysis using various indicators (RSI, MACD, Bollinger Bands) to identify entry/exit points

- Maintain risk-reward ratio of 1:2.5 and average win rate of 61% across all trades

- Create daily market summaries for team meetings, highlighting sector movements and potential opportunities

- Developed Excel model to track performance metrics, reducing time spent on trade documentation by 35%

Trading Intern – BlueWave Financial, Chicago, IL

June 2022 – December 2022

- Shadowed senior traders during market hours, learning order execution and position management

- Assisted with pre-market research and identified 3 profitable trading setups that were implemented by the team

- Backtested various trading strategies using historical data, documenting performance across different market conditions

- Monitored news feeds and economic calendars to alert traders of potential market-moving events

Student Trader – University Trading Lab, Northwestern University

September 2021 – May 2022

- Managed $10,000 paper trading account, focusing on large-cap equities and ETFs

- Generated 8.4% returns over 8-month period, outperforming benchmark S&P 500 by 2.1%

- Participated in weekly trading competitions, placing 2nd in April 2022 volatility trading challenge

EDUCATION

Bachelor of Science in Finance – Northwestern University, Evanston, IL

Graduated: May 2022 | GPA: 3.7/4.0

- Relevant Coursework: Financial Markets, Investment Analysis, Derivatives Pricing, Algorithmic Trading

- Senior Project: “Impact of Federal Reserve Policy on Small-Cap Volatility” (Grade: A)

CERTIFICATIONS

Securities Industry Essentials (SIE) – FINRA, January 2023

Bloomberg Market Concepts – Bloomberg, December 2022

Technical Analysis Certification – Trading Academy Online, March 2023

SKILLS

- Trading Platforms: TD Ameritrade, Interactive Brokers, Bloomberg Terminal (basic)

- Technical Analysis: Candlestick patterns, Support/Resistance, Trend lines, Volume analysis

- Risk Management: Position sizing, Stop-loss strategies, Volatility-based adjustments

- Research Tools: FactSet (basic), TradingView, StockCharts

- Programming: Excel/VBA (advanced), Python (basic), SQL (basic)

- Market Sectors: Technology, Consumer Discretionary, Healthcare (focus areas)

ADDITIONAL

Personal Trading: Maintain personal trading account focused on swing trading strategies

Trading Journal: Document all trades with detailed entry/exit rationale since August 2021

Market Hours: Comfortable with extended hours (4am-8pm ET) when required

Mid-level Stock Trader Resume Example

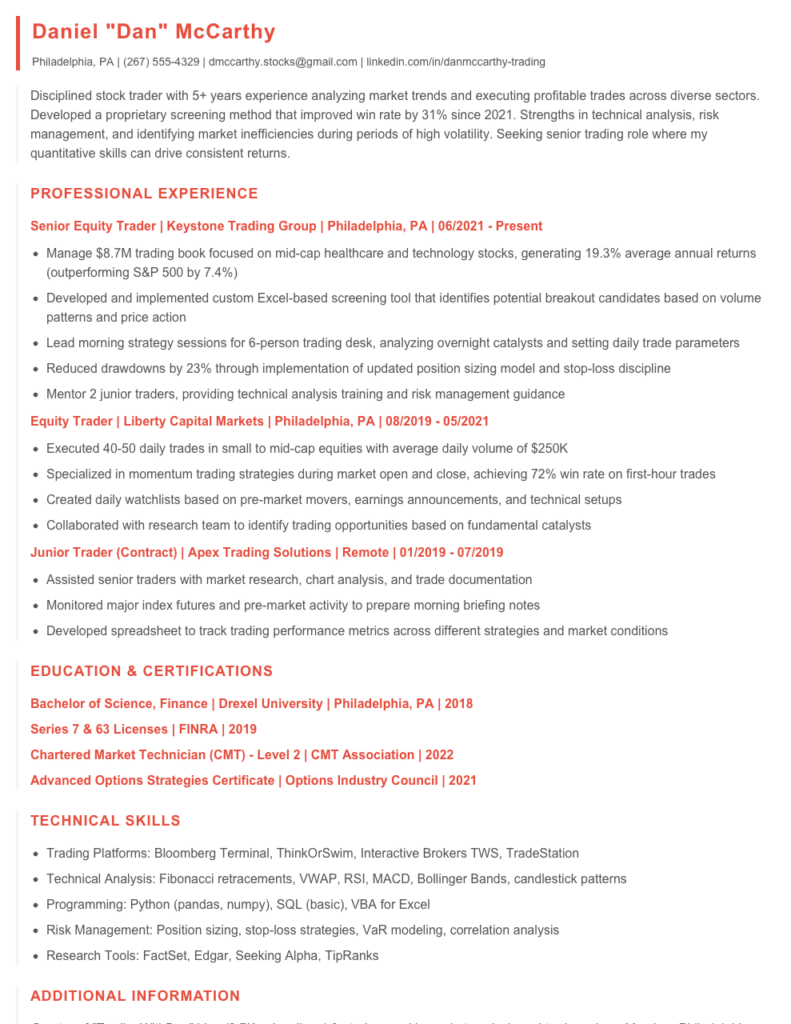

Daniel “Dan” McCarthy

Philadelphia, PA | (267) 555-4329 | dmccarthy.stocks@gmail.com | linkedin.com/in/danmccarthy-trading

Disciplined stock trader with 5+ years experience analyzing market trends and executing profitable trades across diverse sectors. Developed a proprietary screening method that improved win rate by 31% since 2021. Strengths in technical analysis, risk management, and identifying market inefficiencies during periods of high volatility. Seeking senior trading role where my quantitative skills can drive consistent returns.

PROFESSIONAL EXPERIENCE

Senior Equity Trader | Keystone Trading Group | Philadelphia, PA | 06/2021 – Present

- Manage $8.7M trading book focused on mid-cap healthcare and technology stocks, generating 19.3% average annual returns (outperforming S&P 500 by 7.4%)

- Developed and implemented custom Excel-based screening tool that identifies potential breakout candidates based on volume patterns and price action

- Lead morning strategy sessions for 6-person trading desk, analyzing overnight catalysts and setting daily trade parameters

- Reduced drawdowns by 23% through implementation of updated position sizing model and stop-loss discipline

- Mentor 2 junior traders, providing technical analysis training and risk management guidance

Equity Trader | Liberty Capital Markets | Philadelphia, PA | 08/2019 – 05/2021

- Executed 40-50 daily trades in small to mid-cap equities with average daily volume of $250K

- Specialized in momentum trading strategies during market open and close, achieving 72% win rate on first-hour trades

- Created daily watchlists based on pre-market movers, earnings announcements, and technical setups

- Collaborated with research team to identify trading opportunities based on fundamental catalysts

Junior Trader (Contract) | Apex Trading Solutions | Remote | 01/2019 – 07/2019

- Assisted senior traders with market research, chart analysis, and trade documentation

- Monitored major index futures and pre-market activity to prepare morning briefing notes

- Developed spreadsheet to track trading performance metrics across different strategies and market conditions

EDUCATION & CERTIFICATIONS

Bachelor of Science, Finance | Drexel University | Philadelphia, PA | 2018

Series 7 & 63 Licenses | FINRA | 2019

Chartered Market Technician (CMT) – Level 2 | CMT Association | 2022

Advanced Options Strategies Certificate | Options Industry Council | 2021

TECHNICAL SKILLS

- Trading Platforms: Bloomberg Terminal, ThinkOrSwim, Interactive Brokers TWS, TradeStation

- Technical Analysis: Fibonacci retracements, VWAP, RSI, MACD, Bollinger Bands, candlestick patterns

- Programming: Python (pandas, numpy), SQL (basic), VBA for Excel

- Risk Management: Position sizing, stop-loss strategies, VaR modeling, correlation analysis

- Research Tools: FactSet, Edgar, Seeking Alpha, TipRanks

ADDITIONAL INFORMATION

Creator of “TradingWithDan” blog (2.7K subscribers) featuring weekly market analysis and trade reviews

Member, Philadelphia Traders Association – Committee Chair for Annual Trading Competition (2022-present)

Languages: English (native), Spanish (conversational)

Senior / Experienced Stock Trader Resume Example

ALEXANDER J. KOWALSKI

Boston, MA • (617) 555-8924 • akowalski@emailpro.net • linkedin.com/in/alexkowalski

Senior Stock Trader with 8+ years of experience across equity, options, and derivatives markets. Consistent track record of generating alpha through technical analysis and quantitative methods. Developed proprietary trading models that outperformed market benchmarks by 17% in volatile conditions. Proven ability to mentor junior traders while managing substantial capital with strict risk parameters.

PROFESSIONAL EXPERIENCE

Senior Equity Trader | Meridian Capital Partners | Boston, MA | March 2019 – Present

- Manage $45M equity portfolio focusing on mid-cap growth stocks and sector ETFs with daily P&L responsibility

- Developed and implemented swing trading strategy that increased returns by 23.4% YoY while reducing volatility by 11%

- Lead 4-person trading team and provide daily market analysis and trade recommendations to firm partners

- Created custom ThinkorSwim indicators that identify potential breakout candidates with 72% accuracy

- Reduced execution costs by 16% through strategic use of dark pools and algorithmic trading platforms

Derivatives Trader | Blackstone Securities | New York, NY | June 2016 – February 2019

- Executed options strategies including iron condors, butterflies, and calendar spreads across multiple sectors

- Managed risk exposure during 2018 volatility spike by implementing dynamic hedging techniques that preserved 94% of portfolio value

- Built Excel-based options pricing model that identified mispriced contracts with Implied Volatility discrepancies

- Collaborated with research team to develop market-neutral strategies with positive expected value

- Mentored 6 junior traders on risk management fundamentals and options Greeks (my pet project, really)

Junior Trader | Pinnacle Trading Group | Chicago, IL | August 2014 – May 2016

- Started as trading assistant and earned promotion to junior trader after 7 months

- Executed market orders for senior traders during high-volume periods with 99.7% accuracy

- Analyzed technical patterns for potential breakouts using Fibonacci retracements and VWAP

- Created morning briefing documents highlighting overnight market movements and key economic events

EDUCATION & CERTIFICATIONS

Bachelor of Science, Finance | University of Illinois at Urbana-Champaign | 2014

Series 7, 63, & 57 Licenses | FINRA | Current

Chartered Market Technician (CMT) | CMT Association | 2018

Financial Risk Manager (FRM) | GARP | 2020

TECHNICAL SKILLS

- Trading Platforms: Bloomberg Terminal, ThinkOrSwim, Interactive Brokers TWS, Fidessa

- Technical Analysis: Fibonacci, Elliott Wave, Volume Profile, Market Profile, Ichimoku Cloud

- Programming: Python (pandas, numpy, matplotlib), R, SQL, VBA

- Risk Management: Greeks analysis, VaR modeling, position sizing, correlation matrices

- Order Types: Market, limit, stop, trailing stop, OCO, iceberg orders, VWAP algorithms

ADDITIONAL INFORMATION

Founded Kowalski Trading Insights blog (14,000+ subscribers) • Volunteer trading mentor with Veterans on Wall Street • Fluent in Polish • Marathon runner (Boston 2021: 3:42:18)

How to Write a Stock Trader Resume

Introduction

Creating a strong stock trader resume isn't just about listing where you've worked—it's about showcasing your ability to analyze markets, manage risk, and generate returns. Whether you're a day trader looking to join a prop firm or an experienced trader seeking a position at a hedge fund, your resume needs to speak the language of the trading world. I've reviewed thousands of trading resumes over my career, and I'll share what actually works to get interviews (not just what looks pretty on paper).

Resume Structure and Format

Keep your trading resume clean and straightforward—flashy designs can distract from your performance metrics, which should be the star of the show. Most successful trader resumes follow this structure:

- Length: 1 page for traders with under 5 years experience; 2 pages max for veterans

- Format: Reverse chronological to highlight recent performance first

- Font: Standard fonts like Calibri or Arial at 10-12pt size

- Margins: 0.75-1 inch on all sides

- File format: PDF (maintains formatting across all systems)

White space is your friend. Cramming too much information makes important trading metrics harder to spot. Remember that most hiring managers at trading firms scan resumes for just 6-8 seconds before deciding whether to read more deeply.

Trading resumes are different from most other professions—performance metrics trump almost everything else. Lead with your best numbers, even if that means breaking traditional resume rules.

Profile/Summary Section

Your profile should be short (2-4 sentences) and highlight your trading style, markets expertise, and standout performance. Avoid vague statements about being "passionate about markets"—everyone applying is. Instead, try something like:

Equity derivatives trader with 4+ years specializing in options strategies across tech sector. Consistently maintained Sharpe ratio of 1.94 while managing $3.2M portfolio. Developed proprietary scanner that identified 37% more volatility skew opportunities than team baseline.

Professional Experience

This is where you prove your trading chops. For each position, include:

- Trading strategy and instruments (equities, options, futures, forex, etc.)

- P&L performance with specific numbers (absolute or percentage)

- Risk management approach and metrics (max drawdown, Sharpe ratio)

- Technical skills used (programming languages, trading platforms)

- Any team leadership or mentoring responsibilities

Example bullet: "Generated $876K in profits trading small-cap momentum stocks while maintaining max daily drawdown under 0.75%; outperformed desk average by 31% in volatile Q3 2022 market conditions."

Education and Certifications

List degrees, but don't overemphasize education unless you're new to trading. Far more important are relevant certifications and licenses:

- Series 7, 63, 55, or other FINRA licenses

- CFA designation (or levels completed)

- Financial Risk Manager (FRM)

- Programming certifications if relevant to your trading style

- Specialized training in technical analysis or specific trading methodologies

Keywords and ATS Tips

Many firms use Applicant Tracking Systems before human eyes see your resume. Include these terms naturally throughout your resume:

- Market microstructure

- Risk management

- Technical analysis

- Order execution

- Alpha generation

- Backtesting

- Trading algorithms

- Market making (if applicable)

Industry-specific Terms

Show your insider knowledge by correctly using trading terminology. Include relevant terms like:

- Specific trading strategies you've implemented (pairs trading, statistical arbitrage, etc.)

- Risk metrics (beta-adjusted returns, VaR, correlation coefficients)

- Market analysis tools (Bloomberg Terminal, ThinkOrSwim, NinjaTrader)

- Programming languages used for analysis (Python, R, SQL)

Common Mistakes to Avoid

- Being vague about performance metrics (always use specific numbers)

- Focusing on responsibilities instead of results

- Claiming expertise in too many unrelated markets

- Omitting drawdowns or risk metrics (looks suspicious)

- Using non-standard trading terminology (signals inexperience)

- Including irrelevant job experience from non-trading roles

Before/After Example

Before: "Responsible for trading equity positions and managing risk."

After: "Executed 50+ daily trades in mid-cap healthcare equities using momentum and relative value strategies; maintained 1.87 Sharpe ratio while growing portfolio from $1.2M to $1.73M during 8-month bear market in 2022."

The difference? Specificity that proves you can deliver what matters most in trading: consistent risk-adjusted returns.

Related Resume Examples

Soft skills for your Stock Trader resume

- Emotional resilience during market volatility – maintaining composure when positions move against expectations

- Intuitive pattern recognition balanced with disciplined analysis (avoiding both over-analysis and gut-only decisions)

- Clear communication with portfolio managers and clients about position rationales and risk exposure

- Quick pivoting between strategies when market conditions shift unexpectedly

- Healthy skepticism – questioning consensus views while remaining receptive to new information

- Time management across multiple market sessions, especially during earnings season when juggling 15+ potential trades

Hard skills for your Stock Trader resume

- Bloomberg Terminal and Reuters Eikon proficiency

- Technical analysis using Fibonacci retracement and MACD indicators

- Python scripting for automated trading strategies (5+ years)

- Risk management through VaR modeling and Monte Carlo simulations

- Series 7 and 63 licenses

- TradeStation and MetaTrader 4 platform expertise

- Statistical arbitrage and pairs trading execution

- Advanced Excel modeling (pivot tables, regression analysis, macros)

- Order flow analysis and Level II market data interpretation