Senior Staff Accountant Resume examples & templates

Copyable Senior Staff Accountant Resume examples

Ever wondered who keeps the financial ship steady when the CFO is busy charting the course? Senior Staff Accountants are the unsung heroes of financial stability—the backbone of accounting departments across industries. They're not just number-crunchers; they're the financial detectives who spot discrepancies before they become problems and the translators who turn complex financial data into actionable business insights.

The role has evolved dramatically in recent years, with automation handling the routine tasks that once consumed hours of an accountant's day. According to a 2023 survey by the American Institute of CPAs, Senior Staff Accountants now spend 37% more time on analysis and advisory work than they did just five years ago. This shift comes as companies face increasingly complex regulatory environments and demand more strategic input from their accounting teams. For professionals who enjoy both the precision of accounting principles and the challenge of applying financial expertise to business decisions, the Senior Staff Accountant position offers a sweet spot—technical enough to satisfy detail-oriented minds, yet strategic enough to provide a pathway to financial leadership roles down the road.

Junior Senior Staff Accountant Resume Example

Melissa Chen

Philadelphia, PA | (267) 555-0128 | melissa.chen@email.com | linkedin.com/in/melissachen

Recent accounting graduate with 1.5 years of progressive experience in full-cycle accounting, financial reporting, and month-end closings. Skilled in QuickBooks, Excel, and financial analysis. Earned CPA certification in 2023 and seeking to leverage my attention to detail and analytical skills to contribute to an organization’s financial accuracy and growth.

EXPERIENCE

Staff Accountant – Riverside Financial Services, Philadelphia, PA (June 2022 – Present)

- Prepare and review journal entries, account reconciliations, and financial statements for 7 mid-sized business clients

- Assist with monthly close process, reducing closing timeline by 2 days through process improvements

- Collaborate with senior accountants to compile quarterly tax filings for S-corporations and partnerships

- Reconcile bank statements and identify discrepancies, recovering $12,740 in billing errors

- Support accounts payable/receivable functions and maintain aging reports for client follow-up

Accounting Intern – Martell Manufacturing, Philadelphia, PA (Jan 2022 – May 2022)

- Supported month-end closing process by preparing journal entries and account reconciliations

- Assisted with fixed asset management and depreciation calculations for equipment worth $3.7M

- Helped organize and digitize 3 years of financial records, improving retrieval time by 75%

- Developed Excel templates for recurring financial reports that are still in use today

Accounting Assistant (Part-time) – University Business Office, Temple University (Sept 2020 – Dec 2021)

- Processed student payments and maintained accurate financial records while attending classes

- Reconciled daily transactions and prepared deposit reports

- Responded to student billing inquiries and resolved basic account discrepancies

EDUCATION

Bachelor of Science in Accounting – Temple University, Philadelphia, PA (2021)

- GPA: 3.8/4.0

- Dean’s List: 6 semesters

- Relevant Coursework: Advanced Accounting, Auditing, Tax Accounting, Cost Accounting

CERTIFICATIONS

Certified Public Accountant (CPA) – Licensed in Pennsylvania (2023)

QuickBooks ProAdvisor Certification (2022)

SKILLS

- Financial Software: QuickBooks, Sage 50, Microsoft Dynamics

- Advanced Excel (VLOOKUP, pivot tables, macros, financial modeling)

- Financial statement preparation and analysis

- Month-end and year-end closing procedures

- General ledger maintenance and reconciliation

- Accounts payable/receivable management

- Tax preparation (individual and small business)

- Fixed asset accounting and depreciation

- Internal controls and compliance

- Financial reporting (GAAP)

PROFESSIONAL AFFILIATIONS

American Institute of Certified Public Accountants (AICPA), Student Member

Pennsylvania Institute of Certified Public Accountants (PICPA), Associate Member

Mid-level Senior Staff Accountant Resume Example

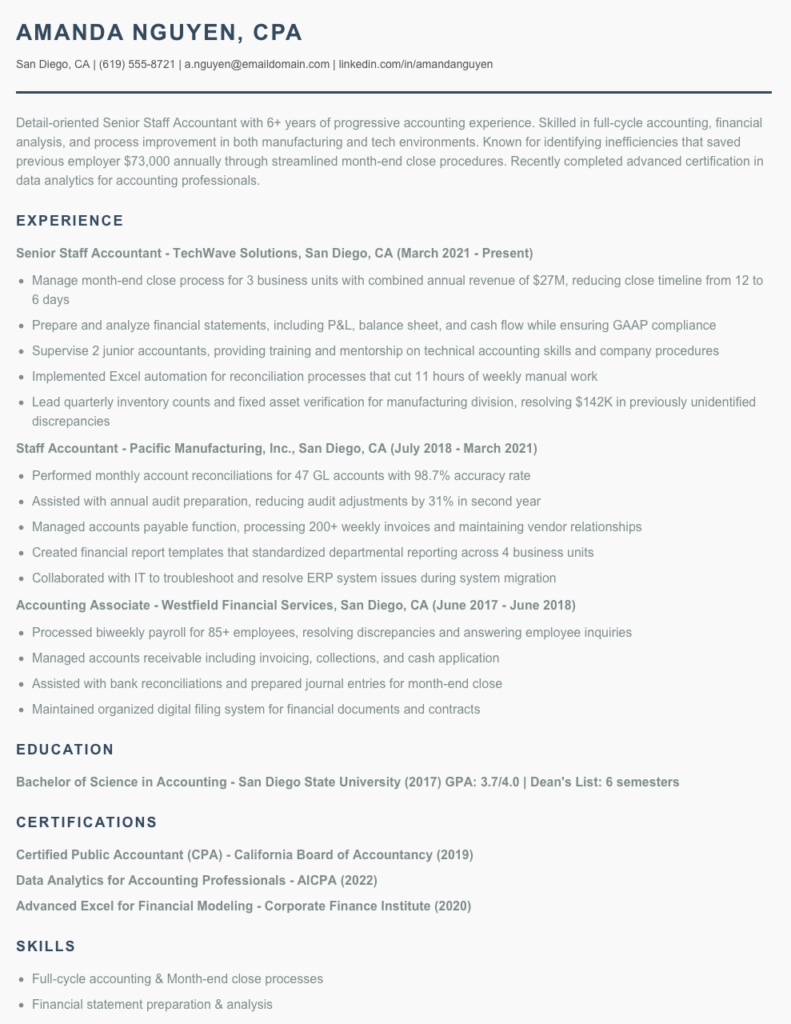

Amanda Nguyen, CPA

San Diego, CA | (619) 555-8721 | a.nguyen@emaildomain.com | linkedin.com/in/amandanguyen

Detail-oriented Senior Staff Accountant with 6+ years of progressive accounting experience. Skilled in full-cycle accounting, financial analysis, and process improvement in both manufacturing and tech environments. Known for identifying inefficiencies that saved previous employer $73,000 annually through streamlined month-end close procedures. Recently completed advanced certification in data analytics for accounting professionals.

EXPERIENCE

Senior Staff Accountant – TechWave Solutions, San Diego, CA (March 2021 – Present)

- Manage month-end close process for 3 business units with combined annual revenue of $27M, reducing close timeline from 12 to 6 days

- Prepare and analyze financial statements, including P&L, balance sheet, and cash flow while ensuring GAAP compliance

- Supervise 2 junior accountants, providing training and mentorship on technical accounting skills and company procedures

- Implemented Excel automation for reconciliation processes that cut 11 hours of weekly manual work

- Lead quarterly inventory counts and fixed asset verification for manufacturing division, resolving $142K in previously unidentified discrepancies

Staff Accountant – Pacific Manufacturing, Inc., San Diego, CA (July 2018 – March 2021)

- Performed monthly account reconciliations for 47 GL accounts with 98.7% accuracy rate

- Assisted with annual audit preparation, reducing audit adjustments by 31% in second year

- Managed accounts payable function, processing 200+ weekly invoices and maintaining vendor relationships

- Created financial report templates that standardized departmental reporting across 4 business units

- Collaborated with IT to troubleshoot and resolve ERP system issues during system migration

Accounting Associate – Westfield Financial Services, San Diego, CA (June 2017 – June 2018)

- Processed biweekly payroll for 85+ employees, resolving discrepancies and answering employee inquiries

- Managed accounts receivable including invoicing, collections, and cash application

- Assisted with bank reconciliations and prepared journal entries for month-end close

- Maintained organized digital filing system for financial documents and contracts

EDUCATION

Bachelor of Science in Accounting – San Diego State University (2017)

GPA: 3.7/4.0 | Dean’s List: 6 semesters

CERTIFICATIONS

Certified Public Accountant (CPA) – California Board of Accountancy (2019)

Data Analytics for Accounting Professionals – AICPA (2022)

Advanced Excel for Financial Modeling – Corporate Finance Institute (2020)

SKILLS

- Full-cycle accounting & Month-end close processes

- Financial statement preparation & analysis

- General ledger reconciliation

- GAAP compliance & Internal controls

- Fixed asset management & Inventory accounting

- ERP systems: SAP, NetSuite, QuickBooks

- Advanced Excel (VLOOKUP, pivot tables, macros)

- Data visualization (Tableau basics)

- Team leadership & Process improvement

- Audit preparation

PROFESSIONAL MEMBERSHIPS

American Institute of Certified Public Accountants (AICPA)

California Society of CPAs (CalCPA)

Senior / Experienced Senior Staff Accountant Resume Example

Jennifer A. Lowry, CPA

Boston, MA • (617) 555-9082 • jlowry.cpa@email.com • linkedin.com/in/jenniferlowry

Professional Summary

Detail-oriented Senior Staff Accountant with 9+ years of progressive experience in full-cycle accounting, financial reporting, and process improvement. Known for solving complex accounting issues while maintaining accuracy and compliance. Successfully led month-end close process improvements that reduced closing time by 41% while mentoring junior staff. Proficient in multiple ERP systems with strong technical accounting knowledge.

Professional Experience

Senior Staff Accountant

Brighton Financial Services, Boston, MA

June 2019 – Present

- Lead month-end close process for 4 business units with combined annual revenue of $87M, completing reconciliations and financial statements 2 days ahead of deadline

- Supervise team of 3 junior accountants, providing technical guidance and professional development while maintaining 97% staff retention rate

- Implemented new reconciliation templates and documentation standards that reduced review questions by 36%

- Spearheaded transition from QuickBooks to NetSuite, including chart of accounts restructuring and custom report development

- Collaborate with external auditors during annual audit, reducing provided by client (PBC) list requests by 28% through improved documentation

Staff Accountant

MedTech Solutions, Cambridge, MA

March 2016 – May 2019

- Managed accounts payable and receivable operations for growing healthcare technology firm ($42M revenue)

- Performed monthly account reconciliations for 75+ GL accounts, identifying and resolving discrepancies before monthly close

- Created automated Excel templates for recurring journal entries that saved approximately 4.5 hours weekly

- Assisted Controller with preparation of financial statements and management reports

- Helped implement new expense management system that reduced processing time by 62%

Junior Accountant

Beacon Tax & Advisory, Boston, MA

July 2014 – February 2016

- Prepared individual and small business tax returns for client base of 140+ accounts

- Processed payroll for 25 small business clients using ADP and Paychex

- Assisted with bookkeeping services, including bank reconciliations and financial statement preparation

- Developed client onboarding checklist that improved data collection by 47%

Education

Master of Science in Accounting

Northeastern University, Boston, MA – 2014

Bachelor of Science in Business Administration

University of Massachusetts, Amherst, MA – 2012

Concentration: Accounting

Certifications & Professional Development

- Certified Public Accountant (CPA), Massachusetts, 2015

- Advanced Excel for Financial Professionals, 2018

- NetSuite Financial User Certification, 2020

- Leadership Development Program, Brighton Financial Services, 2021

Technical Skills

- ERP Systems: NetSuite, QuickBooks, Sage Intacct

- Reporting Tools: Tableau, PowerBI, Crystal Reports

- Advanced Excel (VLOOKUP, pivot tables, macros)

- Financial Analysis & Forecasting

- Fixed Asset Management

- Variance Analysis

- Tax Preparation (individual & business)

- Internal Controls & Compliance

How to Write a Senior Staff Accountant Resume

Introduction

Getting noticed for a Senior Staff Accountant position requires more than just listing your work history. Your resume needs to showcase your technical expertise, leadership abilities, and the financial impact you've made throughout your career. I've reviewed thousands of accounting resumes over my career, and the difference between those that get interviews and those that don't often comes down to specificity and presentation. Let's break down exactly what you need to stand out in this competitive field.

Resume Structure and Format

The finance world generally appreciates clean, straightforward formatting. Keep these guidelines in mind:

- Stick to 1-2 pages (one page for under 10 years of experience, two pages if you have more)

- Use standard fonts like Calibri, Arial, or Times New Roman in 10-12pt size

- Include clear section headings with slightly larger font

- Maintain consistent formatting for dates (MM/YYYY is standard)

- Use bullet points rather than paragraphs for experience

- Leave reasonable white space (0.5-1 inch margins)

Profile/Summary Section

Your professional summary should be 3-4 lines that highlight your accounting expertise, years of experience, and 1-2 standout achievements. For a Senior Staff Accountant, focus on technical skills, leadership experience, and industry specialization.

Example: "CPA with 8+ years of progressive accounting experience specializing in manufacturing cost accounting. Skilled in managing month-end close processes, financial analysis, and leading junior staff. Reduced close cycle by 37% at Meredith Manufacturing while implementing new ERP system."

Don't just tell employers what you want—tell them what you can do for them! Your summary should address their needs, not yours. Save the "seeking opportunity" language for your cover letter.

Professional Experience

This section carries the most weight. For each position:

- Start with company name, location, your title, and dates employed

- Include 4-6 bullet points for recent roles, fewer for older positions

- Lead with strong action verbs (managed, reconciled, analyzed, implemented)

- Quantify achievements with numbers ($, %, time saved)

- Highlight supervisory experience (team size, mentoring)

- Showcase systems expertise (SAP, Oracle, NetSuite, etc.)

For example: "Managed monthly close process for 6 entities with $87M in combined revenue, reducing close timeline from 12 to 7 days through process improvements and staff training."

Education and Certifications

For Senior Staff Accountant positions, certifications often carry equal weight to education. List these in reverse chronological order:

- Degree, school, location, graduation year (omit GPA unless exceptional)

- Professional certifications (CPA, CMA, CGMA) with dates

- Relevant continuing education or specialized training

- Software proficiencies (QuickBooks, ERP systems, advanced Excel)

Keywords and ATS Tips

Many companies use Applicant Tracking Systems to screen resumes before human eyes ever see them. Include these terms naturally throughout your resume:

- Technical skills: GAAP, financial reporting, month-end close, account reconciliation

- Software: Specific ERP systems, Excel (VLOOKUP, pivot tables), reporting tools

- Process terms: internal controls, SOX compliance, audit preparation

- Industry-specific terms: cost accounting, fixed assets, inventory valuation

Common Mistakes to Avoid

- Listing job duties without achievements (what difference did you make?)

- Using vague descriptors like "responsible for" or "handled"

- Focusing too much on basic bookkeeping tasks if you're aiming for senior roles

- Forgetting to highlight leadership or training experience

- Including outdated skills or irrelevant work experience

Before/After Example

Before: "Responsible for month-end close process and financial reporting."

After: "Led 5-day month-end close process for manufacturing division with $43M annual revenue; prepared financial statements and variance analysis that identified $216K in previously unrecognized cost savings opportunities."

The key difference? Specificity about scope, timeline, and impact. Your resume should tell the story of not just what you did, but why it mattered.

Related Resume Examples

Soft skills for your Senior Staff Accountant resume

- Cross-functional communication that bridges the gap between finance and non-financial teams

- Team mentorship – helping junior accountants tackle complex reconciliation issues

- Conflict resolution when dealing with deadline pressures during month-end close

- Adaptability to shifting regulatory requirements and accounting standards

- Stakeholder management with executives, external auditors, and vendors

- Project coordination for system implementations and finance process improvements

Hard skills for your Senior Staff Accountant resume

- Advanced proficiency in ERP systems (Oracle NetSuite, SAP)

- Month-end closing processes and financial reporting

- Fixed asset management and depreciation calculations

- Cost accounting and variance analysis

- Federal and multi-state tax compliance

- Advanced Excel (VLOOKUP, PivotTables, macros)

- Revenue recognition under ASC 606

- SOX 404 compliance and internal controls

- Financial modeling and forecasting