Reimbursement Manager Resume examples & templates

Copyable Reimbursement Manager Resume examples

Ever wonder who ensures healthcare providers actually get paid for the services they deliver? That's where Reimbursement Managers step in, serving as the critical bridge between clinical care and financial sustainability. These specialized professionals navigate the complex maze of insurance claims, government regulations, and payment processes that keep healthcare organizations financially healthy. With the healthcare landscape becoming increasingly complicated - Medicare alone processes over 1.2 billion claims annually - Reimbursement Managers have evolved from back-office billing experts into strategic leaders who directly impact their organization's bottom line.

The field is changing fast. Value-based care models are replacing traditional fee-for-service systems, and reimbursement specialists now need expertise in data analytics, compliance, and revenue cycle optimization. According to a 2023 HFMA survey, healthcare organizations with dedicated reimbursement teams saw 17% fewer claim denials and recovered an average of $3.2 million more annually than those without such specialists. As healthcare costs continue climbing and payment models keep shifting, Reimbursement Managers who can adapt quickly and implement strategic solutions will find themselves in particularly high demand over the next decade.

Junior Reimbursement Manager Resume Example

JAMIE RODRIGUEZ

Los Angeles, CA 90016 | (213) 555-8742 | j.rodriguez@emaildomain.com | linkedin.com/in/jamierodriguez

PROFESSIONAL SUMMARY

Recent healthcare administration graduate with 1+ year of experience in medical billing and reimbursement processes. Knowledgeable in insurance verification, claim submission and denial management with a track record of reducing A/R days by 17%. Seeking to leverage analytical skills and healthcare financial knowledge to grow as a Reimbursement Manager while improving revenue cycle performance.

EXPERIENCE

Reimbursement Specialist | Pacific Health Systems | March 2023 – Present

- Process and track an average of 75+ daily claims across Medicare, Medicaid and commercial insurance providers

- Identified and corrected systematic billing errors that reduced claim denials by 23% in Q2 2023

- Collaborate with 3 billing coordinators to resolve complex claim issues and patient billing disputes

- Updated outdated payer contract information database, improving payment accuracy by 11%

- Created quick-reference guides for new hires on common reimbursement procedures (they’re still using them!)

Medical Billing Intern | Westside Medical Group | June 2022 – February 2023

- Assisted with processing insurance claims and payments for a 12-physician practice

- Verified patient eligibility and benefits prior to scheduled appointments

- Researched and appealed denied claims, recovering approximately $18,700 in previously denied payments

- Helped reorganize the filing system for EOBs, cutting document retrieval time in half

Administrative Assistant (Part-time) | UCLA Health Department | September 2021 – June 2022

- Maintained departmental files and assisted with basic data entry tasks while completing degree

- Scheduled meetings and managed calendars for 4 department faculty members

- Handled sensitive patient information according to HIPAA guidelines

EDUCATION

Bachelor of Science in Healthcare Administration | UCLA | 2022

Minor in Business Management | GPA: 3.7

Relevant Coursework: Healthcare Finance, Medical Coding & Billing, Healthcare Compliance, Medical Terminology

CERTIFICATIONS

Certified Revenue Cycle Representative (CRCR) | HFMA | 2023

Certified Medical Reimbursement Specialist (CMRS) | AMBA | In progress (expected completion Nov 2023)

SKILLS

- Medical Billing & Coding (ICD-10, CPT, HCPCS)

- Claim Denial Management

- Revenue Cycle Operations

- Payer Contract Analysis

- Epic Systems & Meditech

- Medicare/Medicaid Regulations

- Payment Posting & Reconciliation

- Patient Financial Counseling

- Microsoft Excel (vlookups, pivot tables)

- HIPAA Compliance

ADDITIONAL INFORMATION

Active member of Healthcare Financial Management Association (HFMA) | Volunteer, UCLA Medical Center Patient Financial Services (3 hrs/week)

Mid-level Reimbursement Manager Resume Example

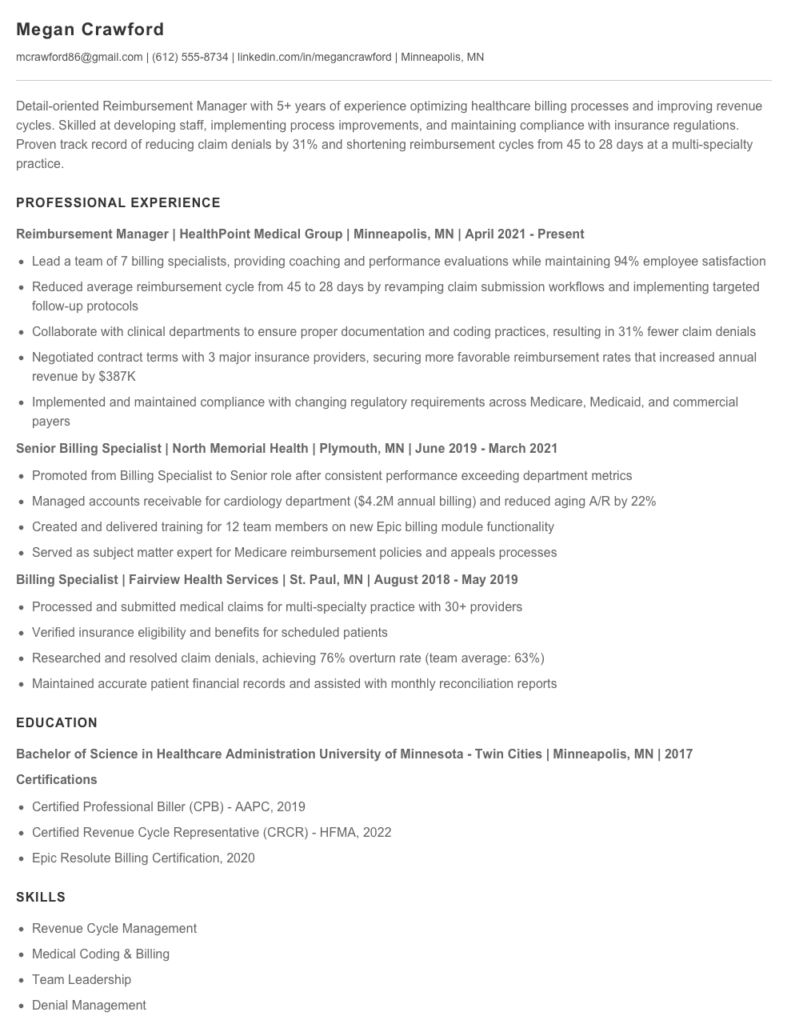

Megan Crawford

mcrawford86@gmail.com | (612) 555-8734 | linkedin.com/in/megancrawford | Minneapolis, MN

Detail-oriented Reimbursement Manager with 5+ years of experience optimizing healthcare billing processes and improving revenue cycles. Skilled at developing staff, implementing process improvements, and maintaining compliance with insurance regulations. Proven track record of reducing claim denials by 31% and shortening reimbursement cycles from 45 to 28 days at a multi-specialty practice.

PROFESSIONAL EXPERIENCE

Reimbursement Manager | HealthPoint Medical Group | Minneapolis, MN | April 2021 – Present

- Lead a team of 7 billing specialists, providing coaching and performance evaluations while maintaining 94% employee satisfaction

- Reduced average reimbursement cycle from 45 to 28 days by revamping claim submission workflows and implementing targeted follow-up protocols

- Collaborate with clinical departments to ensure proper documentation and coding practices, resulting in 31% fewer claim denials

- Negotiated contract terms with 3 major insurance providers, securing more favorable reimbursement rates that increased annual revenue by $387K

- Implemented and maintained compliance with changing regulatory requirements across Medicare, Medicaid, and commercial payers

Senior Billing Specialist | North Memorial Health | Plymouth, MN | June 2019 – March 2021

- Promoted from Billing Specialist to Senior role after consistent performance exceeding department metrics

- Managed accounts receivable for cardiology department ($4.2M annual billing) and reduced aging A/R by 22%

- Created and delivered training for 12 team members on new Epic billing module functionality

- Served as subject matter expert for Medicare reimbursement policies and appeals processes

Billing Specialist | Fairview Health Services | St. Paul, MN | August 2018 – May 2019

- Processed and submitted medical claims for multi-specialty practice with 30+ providers

- Verified insurance eligibility and benefits for scheduled patients

- Researched and resolved claim denials, achieving 76% overturn rate (team average: 63%)

- Maintained accurate patient financial records and assisted with monthly reconciliation reports

EDUCATION

Bachelor of Science in Healthcare Administration

University of Minnesota – Twin Cities | Minneapolis, MN | 2017

Certifications

- Certified Professional Biller (CPB) – AAPC, 2019

- Certified Revenue Cycle Representative (CRCR) – HFMA, 2022

- Epic Resolute Billing Certification, 2020

SKILLS

- Revenue Cycle Management

- Medical Coding & Billing

- Team Leadership

- Denial Management

- Contract Negotiations

- Epic & Cerner EHR Systems

- Medicare/Medicaid Regulations

- Financial Analysis & Reporting

- Process Improvement

- Compliance Management

PROFESSIONAL MEMBERSHIPS

- Healthcare Financial Management Association (HFMA)

- American Association of Healthcare Administrative Management (AAHAM)

Senior / Experienced Reimbursement Manager Resume Example

Monica R. Daniels

Chicago, IL | (312) 555-4782 | m.daniels@email.com | linkedin.com/in/monicardaniels

Reimbursement Manager with 9+ years of progressive experience maximizing revenue capture through strategic payer negotiations and claims management. Consistently reversed declining reimbursement trends by implementing process improvements and advanced analytics. Known for building high-performing teams that reduced denial rates by 27% and increased collections by $4.3M annually at Northshore Health. Passionate about healthcare finance modernization and patient advocacy.

PROFESSIONAL EXPERIENCE

Senior Reimbursement Manager – Northshore Health System, Chicago, IL (June 2019 – Present)

- Direct a team of 12 reimbursement specialists handling $215M in annual claims across 3 hospitals and 17 outpatient facilities

- Led implementation of ClaimFlow automation platform that reduced processing time from 12 days to 4.5 days while improving accuracy by 31%

- Renegotiated contracts with 5 major commercial payers resulting in an 8.7% increase in reimbursement rates for high-volume procedures

- Created comprehensive payer scorecard system to track denial patterns, payment variances, and contract compliance issues

- Spearheaded the development of a revenue integrity program that recovered $893K in previously denied claims during first year

Reimbursement Manager – Lakeside Medical Center, Evanston, IL (March 2016 – May 2019)

- Managed a team of 7 specialists responsible for $87M in annual claims processing and follow-up

- Cut first-pass denial rate from 18.3% to 11.6% through staff training and enhanced pre-submission verification

- Collaborated with IT to develop custom reporting tools for tracking reimbursement KPIs and identifying bottlenecks

- Established quarterly payer meetings to address systemic issues, improving payment timeframes by 23%

- Restructured the appeals process, increasing successful appeals from 42% to 69%

Reimbursement Specialist – University Health Partners, Chicago, IL (August 2014 – February 2016)

- Processed and tracked approximately 1,200 monthly claims for specialty services, ensuring proper coding and documentation

- Investigated and appealed denied claims, recovering an average of $127K monthly

- Created training materials on Medicare reimbursement rules for clinical departments

- Served as point person for Medicare RAC audit responses, achieving 76% favorable outcomes

EDUCATION & CERTIFICATIONS

Master of Health Administration (MHA)

DePaul University, Chicago, IL – 2016

Bachelor of Science, Healthcare Administration

University of Illinois, Chicago – 2013

Certifications:

- Certified Revenue Cycle Representative (CRCR) – 2017, renewed 2020

- Certified Healthcare Financial Professional (CHFP) – 2019

- Epic Resolute Billing Certification – 2018

TECHNICAL SKILLS & EXPERTISE

- Revenue Cycle Management Systems: Epic Resolute, Cerner RevWorks, Meditech

- Contract Analysis & Negotiation

- Denial Management Workflows

- Claims Auditing & Compliance

- Medicare & Medicaid Regulations

- Value-Based Reimbursement Models

- Healthcare Financial Analytics

- Team Leadership & Development

- Process Improvement (Lean/Six Sigma principles)

- Advanced Excel & SQL Query Development

PROFESSIONAL AFFILIATIONS

- Healthcare Financial Management Association (HFMA) – Member since 2015

- American Association of Healthcare Administrative Management (AAHAM) – Member since 2017

How to Write a Reimbursement Manager Resume

Introduction

Landing that perfect Reimbursement Manager job starts with a resume that showcases your healthcare financial expertise, analytical skills, and leadership abilities. I've reviewed thousands of healthcare finance resumes over my career, and the difference between those that get interviews and those that don't often comes down to how well candidates position their specific reimbursement knowledge and achievements. Your resume needs to speak the language of healthcare revenue cycle while demonstrating your value in concrete terms.

Resume Structure and Format

Keep your resume clean and scannable. Healthcare organizations receive stacks of applications, and hiring managers typically spend just 7.4 seconds on initial resume screenings.

- Stick to 1-2 pages (2 pages is fine for candidates with 7+ years of experience)

- Use a professional, readable font like Calibri or Arial (11-12pt)

- Include plenty of white space to avoid overwhelming the reader

- Create clear section headings that stand out

- Save your final document as a PDF (unless specifically asked for another format)

Profile/Summary Section

Your summary should immediately establish your reimbursement expertise and highlight what makes you valuable. Think of it as your professional elevator pitch.

Aim for 3-5 impactful sentences that capture your experience level, specialization areas (Medicare/Medicaid/commercial payers), and biggest career wins. This isn't the place for generic statements!

Example: "Reimbursement Manager with 6+ years specializing in Medicare payment systems and payer contract analysis. Recovered $2.3M in underpayments through systematic claim auditing and successfully negotiated a 13% rate increase with Blue Cross. Known for translating complex reimbursement regulations into actionable processes for revenue cycle teams."

Professional Experience

This section carries the most weight. Focus on achievements rather than just listing job duties.

- Start each bullet with a strong action verb (analyzed, implemented, negotiated)

- Include specific metrics where possible (dollar amounts, percentages, timeframes)

- Highlight experience with relevant payment methodologies (DRG, APC, RBRVS, etc.)

- Showcase your work with specific payer types (Medicare, Medicaid, commercial)

- Mention any reimbursement systems you've used (Epic, Cerner, Meditech, Experian)

Weak: "Responsible for monitoring claim denials and appeals."

Strong: "Reduced initial claim denials by 22% by identifying patterns in payer rejections and retraining staff on proper documentation requirements."

Education and Certifications

For Reimbursement Managers, relevant certifications can be just as important as formal education. List your degree(s) first, followed by certifications.

- Bachelor's degree (field of study, university, year if recent grad)

- Industry certifications (CPAR, CHFP, CPC, CRCE)

- Relevant continuing education or specialized training

Keywords and ATS Tips

Most healthcare organizations use Applicant Tracking Systems (ATS) to screen resumes before human eyes ever see them. Include these terms naturally throughout your resume:

- Payment methodologies: DRG, RBRVS, APCs, fee schedules

- Software: Epic Resolute, Cerner Revenue Cycle, Experian, MedeAnalytics

- Processes: charge capture, claims adjudication, denial management

- Regulations: CMS guidelines, HIPAA, state-specific requirements

- Payer types: Medicare, Medicaid, commercial insurance, self-pay

Industry-specific Terms

Pepper your resume with healthcare reimbursement terminology to show you speak the language:

- Revenue cycle management (RCM)

- Clean claim rate

- Days in A/R

- Charge description master (CDM)

- Contractual allowances

- ICD-10/CPT coding

- Case mix index

Common Mistakes to Avoid

- Being too vague about your specific reimbursement expertise

- Focusing solely on duties instead of accomplishments

- Neglecting to mention specific payer types you've worked with

- Omitting relevant software proficiency

- Including outdated terminology (ICD-9 without mentioning ICD-10)

Before/After Example

Before: "Managed reimbursement processes and worked with insurance companies to resolve payment issues."

After: "Led 5-person reimbursement team that identified $1.8M in underpayments through line-by-line review of 750+ Medicare claims, resulting in successful appeals and payment recovery within 6 months."

Remember, your resume should tell the story of how you've made a difference in your organization's bottom line through your reimbursement expertise. Be specific, be quantitative, and highlight the unique value you bring!

Related Resume Examples

Soft skills for your Reimbursement Manager resume

- Cross-functional communication with clinical staff, insurance reps, and finance teams

- Conflict resolution when handling disputed claims or patient payment concerns

- Attention to detail while juggling multiple payer requirements

- Team leadership (mentored 4 billing specialists through system migration)

- Adaptability to evolving healthcare reimbursement models and payer policies

- Stress management during month-end closing and audit periods

Hard skills for your Reimbursement Manager resume

- CPT/ICD-10 Coding Knowledge

- Epic Revenue Cycle Module

- Medicare/Medicaid Billing Regulations

- UB-04/CMS-1500 Claims Processing

- Microsoft Excel (advanced formulas, pivot tables)

- Charge Description Master (CDM) Maintenance

- SQL Query Writing for Claims Data

- Revenue Cycle Analytics & Reporting

- HFMA Certified Revenue Cycle Representative (CRCR)