Mortgage Processor Resume examples & templates

Copyable Mortgage Processor Resume examples

Ever wondered what happens to your mortgage application after you click "submit"? Behind that button is a Mortgage Processor—the detail-oriented professional who transforms your financial story into a decision-ready package. These specialists serve as the crucial link between eager homebuyers and nervous sellers, verifying income, assets, credit history, and property details while navigating a maze of compliance requirements that change almost quarterly.

The mortgage processing field has evolved dramatically since 2020, when record-low interest rates triggered a 65% surge in refinancing applications. Today's processors aren't just paper-pushers; they're tech-savvy professionals balancing automated underwriting systems with critical thinking skills. With the recent adoption of digital verification tools at major lenders, processors now spend less time chasing documents and more time analyzing complex financial scenarios. The mortgage industry's shift toward hybrid work models has also opened up flexible career paths—many processors now work remotely at least part-time, collaborating with loan officers and underwriters across multiple time zones. If you're someone who thrives on attention to detail and wants to play a meaningful role in helping people achieve homeownership, mortgage processing offers a stable career with room to grow.

Junior Mortgage Processor Resume Example

Jessica Rodriguez

Phoenix, AZ 85012 | (480) 555-9021 | jessica.r.rodriguez@gmail.com | linkedin.com/in/jessicarodriguez

Detail-oriented Mortgage Processor with 1+ year experience in loan documentation review and processing. Known for accuracy in compliance verification and customer communication. Familiar with conventional, FHA, and VA loan requirements. Quick learner who thrives in fast-paced environments while maintaining attention to detail.

EXPERIENCE

Mortgage Loan Processor – Desert Valley Mortgage Services, Phoenix, AZ

February 2023 – Present

- Process 15-18 mortgage applications weekly, reviewing documentation for completeness and accuracy while maintaining 97.3% error-free processing rate

- Verify income, employment, and assets according to specific loan program guidelines (conventional, FHA, VA)

- Coordinate with underwriters to address conditions and resolve discrepancies before final approval

- Communicate with borrowers to obtain missing documentation, reducing processing time by 1.5 days on average

- Utilize Encompass mortgage software to track and update loan files throughout the mortgage process

Loan Processing Assistant (Part-time) – First Home Financial, Phoenix, AZ

August 2022 – January 2023

- Assisted senior processors with document collection and organization for 30+ loan files per week

- Ordered credit reports, verifications of employment, and preliminary title reports

- Maintained accurate electronic filing system for loan documentation

- Handled incoming calls from borrowers regarding application status and document requirements

Administrative Assistant – Phoenix Real Estate Group, Phoenix, AZ

May 2022 – August 2022

- Managed front office operations and greeted clients in professional manner

- Assisted with basic document preparation and filing for real estate transactions

- Scheduled appointments and maintained office calendar for 3 real estate agents

EDUCATION

Associate of Business – Phoenix Community College, Phoenix, AZ

Graduated: December 2021

Relevant coursework: Business Communication, Financial Accounting, Business Law

CERTIFICATIONS

Mortgage Processing Fundamentals Certificate – Mortgage Bankers Association

Completed: January 2023

NMLS Safe Act Training – 20 Hour Course

Completed: November 2022

SKILLS

- Loan Documentation Analysis

- Encompass Mortgage Software

- FHA/VA/Conventional Loan Guidelines

- Customer Communication

- TILA-RESPA Integrated Disclosure (TRID)

- Microsoft Office Suite (Word, Excel, Outlook)

- Compliance Verification

- Document Management

- Attention to Detail

- Problem-solving

ADDITIONAL

Bilingual: Fluent in English and Spanish

Volunteer: Financial Literacy Workshop Assistant, Phoenix Community Center (quarterly)

Mid-level Mortgage Processor Resume Example

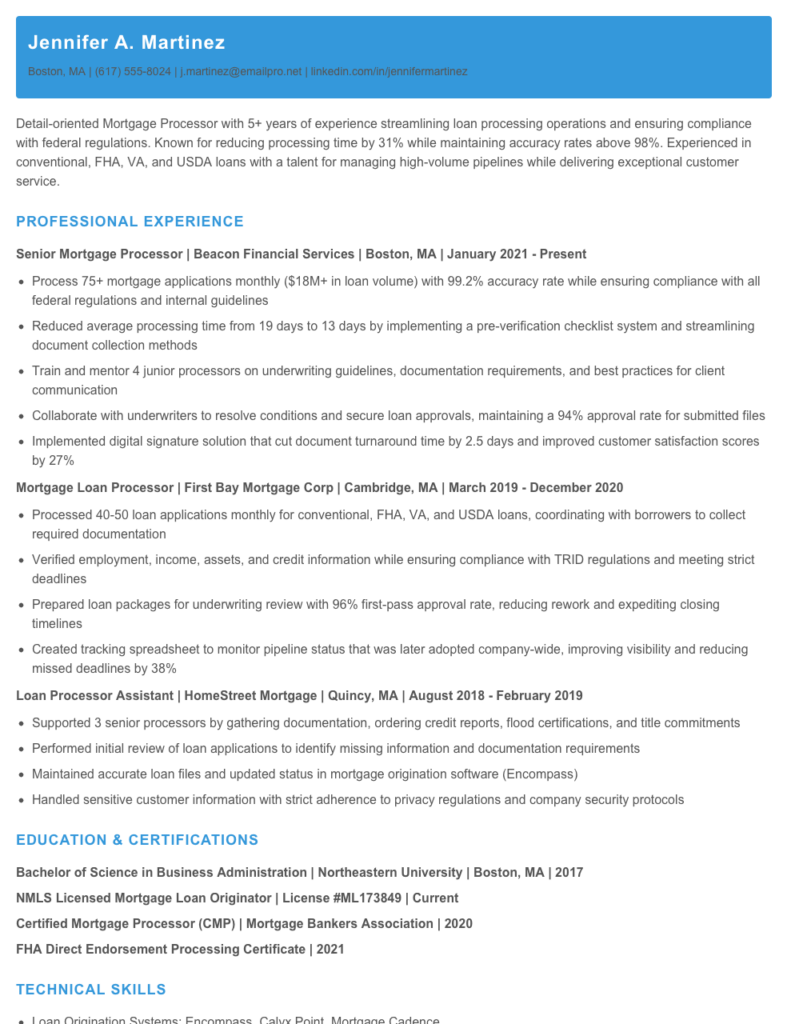

Jennifer A. Martinez

Boston, MA | (617) 555-8024 | j.martinez@emailpro.net | linkedin.com/in/jennifermartinez

Detail-oriented Mortgage Processor with 5+ years of experience streamlining loan processing operations and ensuring compliance with federal regulations. Known for reducing processing time by 31% while maintaining accuracy rates above 98%. Experienced in conventional, FHA, VA, and USDA loans with a talent for managing high-volume pipelines while delivering exceptional customer service.

PROFESSIONAL EXPERIENCE

Senior Mortgage Processor | Beacon Financial Services | Boston, MA | January 2021 – Present

- Process 75+ mortgage applications monthly ($18M+ in loan volume) with 99.2% accuracy rate while ensuring compliance with all federal regulations and internal guidelines

- Reduced average processing time from 19 days to 13 days by implementing a pre-verification checklist system and streamlining document collection methods

- Train and mentor 4 junior processors on underwriting guidelines, documentation requirements, and best practices for client communication

- Collaborate with underwriters to resolve conditions and secure loan approvals, maintaining a 94% approval rate for submitted files

- Implemented digital signature solution that cut document turnaround time by 2.5 days and improved customer satisfaction scores by 27%

Mortgage Loan Processor | First Bay Mortgage Corp | Cambridge, MA | March 2019 – December 2020

- Processed 40-50 loan applications monthly for conventional, FHA, VA, and USDA loans, coordinating with borrowers to collect required documentation

- Verified employment, income, assets, and credit information while ensuring compliance with TRID regulations and meeting strict deadlines

- Prepared loan packages for underwriting review with 96% first-pass approval rate, reducing rework and expediting closing timelines

- Created tracking spreadsheet to monitor pipeline status that was later adopted company-wide, improving visibility and reducing missed deadlines by 38%

Loan Processor Assistant | HomeStreet Mortgage | Quincy, MA | August 2018 – February 2019

- Supported 3 senior processors by gathering documentation, ordering credit reports, flood certifications, and title commitments

- Performed initial review of loan applications to identify missing information and documentation requirements

- Maintained accurate loan files and updated status in mortgage origination software (Encompass)

- Handled sensitive customer information with strict adherence to privacy regulations and company security protocols

EDUCATION & CERTIFICATIONS

Bachelor of Science in Business Administration | Northeastern University | Boston, MA | 2017

NMLS Licensed Mortgage Loan Originator | License #ML173849 | Current

Certified Mortgage Processor (CMP) | Mortgage Bankers Association | 2020

FHA Direct Endorsement Processing Certificate | 2021

TECHNICAL SKILLS

- Loan Origination Systems: Encompass, Calyx Point, Mortgage Cadence

- Automated Underwriting Systems: Desktop Underwriter (DU), Loan Product Advisor (LPA)

- Document Management: FileVision, DocuSign, Adobe Acrobat Pro

- MS Office Suite (advanced Excel including pivot tables, VLOOKUP)

- Credit Analysis: Equifax, Experian, TransUnion reporting

CORE COMPETENCIES

- Federal Lending Regulations (TRID, HMDA, ECOA, Reg Z)

- Income Analysis & Debt-to-Income Calculations

- Quality Control & Compliance Validation

- Pipeline Management & Prioritization

- Client Relationship Management

- Problem Resolution & Communication

Senior / Experienced Mortgage Processor Resume Example

Amanda Reyes

San Diego, CA • (619) 555-7124 • areyes.mortgage@email.com • linkedin.com/in/amandareyes

Senior Mortgage Processor with 8+ years of experience handling conventional, FHA, and VA loans. Recognized for reducing processing time by 31% while maintaining compliance standards. Skilled at resolving complex underwriting issues and managing high-volume pipelines while ensuring exceptional customer service. Calm under pressure with strong attention to detail and documented success improving departmental efficiency.

PROFESSIONAL EXPERIENCE

Senior Mortgage Loan Processor | First Capital Mortgage Group | San Diego, CA | March 2019 – Present

- Process 45-50 loan applications monthly with 98.7% accuracy rate, consistently exceeding department goals by 12%

- Lead team of 4 junior processors; developed training materials that reduced onboarding time from 4 weeks to 17 days

- Streamlined documentation verification process, cutting conditional approval time from 7 days to 4.5 days

- Perform thorough reviews of income documentation, credit reports, and property valuations to ensure compliance with investor guidelines

- Collaborate with underwriters to resolve complex loan scenarios, resulting in 27% fewer loan suspensions

- Implemented new checklist system that reduced follow-up requests by 41% and improved borrower satisfaction scores

Mortgage Processor | Pacific Lending Solutions | San Diego, CA | June 2016 – February 2019

- Processed 35+ conventional, FHA, and VA loans monthly while maintaining pipeline of 60-75 active files

- Reduced file turn times from application to closing by 22% through improved coordination with title companies

- Analyzed financial documents including tax returns, bank statements, and pay stubs to verify borrower eligibility

- Worked directly with appraisers and real estate agents to resolve property valuation issues, saving 14 at-risk loans in 2018

- Trained and mentored 3 new processors on company systems and compliance requirements

Junior Mortgage Processor | HomeFirst Mortgage | Los Angeles, CA | January 2015 – May 2016

- Assisted senior processors with document collection and verification for conventional loan applications

- Prepared initial disclosure packages and coordinated delivery to borrowers within regulatory timeframes

- Managed communication between borrowers, loan officers, and third-party service providers

- Created and maintained accurate loan files in Encompass mortgage origination software

EDUCATION & CERTIFICATIONS

Bachelor of Business Administration, Finance

San Diego State University | 2014

Certifications:

- Certified Mortgage Processor (CMP) – 2017, renewed 2020

- NMLS Licensed Mortgage Loan Originator (MLO) #173492 – 2018

- FHA Direct Endorsement Certification – 2019

- VA Loan Processing Certification – 2020

TECHNICAL SKILLS

- Loan Origination Systems: Encompass, Calyx Point, Byte

- Document Management: FileVision, BlitzDocs, SmartDoc

- Underwriting Tools: Desktop Underwriter (DU), Loan Prospector (LP)

- Microsoft Office Suite (advanced Excel skills including pivot tables and VLOOKUP)

- Credit Analysis: Credit Plus, CoreLogic, Credit Technologies

- Federal/State Compliance: TRID, RESPA, TILA, ECOA, HMDA

CORE COMPETENCIES

- Risk Assessment & Mitigation

- Loan Documentation Analysis

- Pipeline Management

- Borrower Communication

- Problem Resolution

- Team Leadership & Training

- Quality Control & Compliance

- Process Improvement

How to Write a Mortgage Processor Resume

Introduction

Getting noticed in the competitive mortgage industry starts with a standout resume. As someone who's reviewed thousands of Mortgage Processor applications, I can tell you that hiring managers typically spend just 7-9 seconds scanning each resume before deciding whether to pursue a candidate. Your resume needs to quickly demonstrate your knowledge of loan processing workflows, attention to detail, and ability to handle multiple files simultaneously.

Resume Structure and Format

Keep your resume clean and scannable. Most mortgage processors should stick to 1-2 pages max, depending on experience level. Banking and financial services tend to be traditional industries, so I recommend:

- Standard fonts like Calibri, Arial, or Times New Roman (10-12pt)

- Clear section headings with consistent formatting

- Half-inch to one-inch margins all around

- Limited use of bold/italics (only for emphasis on key achievements)

- Simple bullet points rather than paragraphs for experience

Pro tip: Save your resume as both a Word doc AND PDF. Send the PDF version when applying online to preserve formatting, but keep the Word version handy as some mortgage companies specifically request this format for their internal systems.

Profile/Summary Section

Start with a concise 2-4 sentence summary that highlights your mortgage processing experience, specialized skills, and what makes you valuable. For example:

"Detail-oriented Mortgage Processor with 5+ years handling conventional, FHA, and VA loans. Consistent track record of processing 47+ loans monthly while maintaining 99.3% accuracy. Known for exceptional communication with underwriters and strong TRID compliance knowledge."

Professional Experience

This is where you'll make your case. For each position, include:

- Company name, location, your title, and dates employed

- 4-6 bullet points per role highlighting achievements, not just duties

- Specific loan volumes, turnaround times, or accuracy rates you've achieved

- Systems and software you've used (Encompass, Calyx Point, etc.)

Strong bullet example: "Reduced file processing time from 7 days to 4.5 days by implementing a pre-verification checklist, resulting in 31% faster loan closings and improved customer satisfaction scores."

Weak bullet example: "Responsible for processing mortgage applications and verifying documents."

Education and Certifications

List your education in reverse chronological order. Include:

- Degree, institution name, graduation year (omit if >10 years ago)

- Relevant certifications like NMLS licensing, FHA certification

- Training in specific loan processing software

- Continuing education courses related to mortgage regulations

Keywords and ATS Tips

Most mortgage companies use Applicant Tracking Systems to filter resumes before a human sees them. Include these industry terms where relevant:

- Loan types: Conventional, FHA, VA, USDA, Jumbo

- Regulations: TRID, RESPA, TILA, QM, ATR

- Tasks: Income verification, credit analysis, title review

- Software: Encompass, Calyx Point, Mortgage Cadence, LendingQB

Industry-specific Terms

Sprinkle these throughout your resume to demonstrate industry knowledge:

- Closing Disclosure (CD)

- Loan Estimate (LE)

- Debt-to-Income Ratio (DTI)

- Automated Underwriting Systems (DU/LP)

- Conditions (PTD/PTF/CTC)

Common Mistakes to Avoid

I've seen these errors sink otherwise qualified candidates:

- Listing job duties without measurable achievements

- Failing to highlight knowledge of current mortgage regulations

- Not specifying types of loans processed or volume handled

- Using generic descriptions that could apply to any administrative role

- Typos! (Nothing kills a mortgage processor application faster than errors)

Before/After Example

Before: "Processed loans and gathered documents from borrowers."

After: "Processed 30+ conventional and government loans monthly, reducing condition fulfillment turnaround from 72 to 48 hours by implementing a structured borrower communication schedule and leveraging Encompass automation tools."

Remember that your resume should tell the story of how you've contributed to efficient, compliant, and accurate loan processing. Focus on how you've improved processes, maintained quality, and supported production goals in your previous roles. Good luck with your application!

Related Resume Examples

Soft skills for your Mortgage Processor resume

- Active listening while gathering client financial information (helps catch important details others miss)

- Cross-functional communication with underwriters, loan officers and clients

- Stress management during high-volume closing periods and tight deadlines

- Attention to detail when reviewing complex financial documentation

- Process improvement mindset – found ways to trim 17 minutes from average file processing time

- Patience explaining procedural requirements to first-time homebuyers

Hard skills for your Mortgage Processor resume

- Loan Origination Software (LOS) proficiency – Encompass, Calyx Point, Byte

- FHA/VA/USDA/Conventional loan processing expertise

- Document verification and validation techniques

- Automated Underwriting Systems (DU, LP, GUS)

- TRID compliance knowledge and implementation

- Credit report analysis and debt ratio calculation

- NMLS certification and continuing education requirements

- Microsoft Office Suite (particularly Excel loan calculators)

- Electronic document management systems (FileInvite, BlitzDocs)