Mortgage Originator Resume examples & templates

Copyable Mortgage Originator Resume examples

Ever wonder who makes the dream of homeownership possible? Mortgage Originators stand at the critical intersection of finance and real estate, guiding borrowers through what's often the biggest financial decision of their lives. They're the professionals who evaluate borrowers' financial situations, recommend appropriate loan products, and shepherd applications through the approval process—all while navigating an ever-shifting regulatory landscape.

The mortgage industry has undergone dramatic changes since 2020, with the pandemic triggering record-low interest rates followed by a sharp correction. Despite recent challenges, the Bureau of Labor Statistics projects loan officer positions (including mortgage originators) to grow by 4% through 2031, with roughly 28,500 job openings annually. Today's successful originators aren't just salespeople; they're consultants who leverage technology while maintaining the human touch. Many top performers are embracing digital mortgage platforms, yet finding that clients still crave personalized guidance. For professionals with strong interpersonal skills and financial acumen, mortgage origination remains a field where you can build relationships, solve complex problems, and quite literally help people find their place in the world.

Junior Mortgage Originator Resume Example

Jason Cooper

(617) 444-8129 • jcooper.mortgages@gmail.com • linkedin.com/in/jasoncooper-mortgage • Boston, MA 02210

Recent mortgage professional with 1+ year experience in residential loan origination. Quick learner with strong customer service background now applying those skills to help first-time homebuyers navigate financing options. Known for clear communication and attention to detail when processing applications. Currently pursuing NMLS certification to expand career opportunities.

Experience

Junior Mortgage Loan Originator – FirstChoice Lending, Boston, MA January 2023 – Present

- Assist senior originators with loan applications and documentation, learning to manage 12-15 active applications simultaneously

- Conduct initial client consultations to gather financial information and explain mortgage products (FHA, conventional, VA)

- Created simplified “First-Time Buyer Guide” that improved application completion rates by 17%

- Coordinate with underwriting team to resolve conditions and keep loans moving toward closing

- Built relationships with 3 local real estate agencies, resulting in 8 new client referrals

Mortgage Loan Assistant – HomeStart Financial, Cambridge, MA

August 2022 – December 2022

- Supported 2 senior loan officers by preparing documentation, scheduling appointments, and maintaining client files

- Verified borrower information including income, employment, and credit history

- Helped process approximately 22 loans during 5-month period, gaining practical understanding of origination workflow

Customer Service Representative – Eastern Bank, Boston, MA

May 2021 – July 2022

- Handled customer inquiries regarding account services, loans, and banking products

- Recognized with “Service Star” award after receiving positive feedback from 94% of surveyed customers

- Cross-sold bank products including credit cards and home equity lines, exceeding monthly targets by 11%

Education

Bachelor of Science in Business Administration – University of Massachusetts Boston

Graduated: May 2021

Concentration: Finance

Licenses & Certifications

NMLS License (in progress) – Expected completion July 2024

Massachusetts Mortgage Loan Originator License – Issued January 2023

Financial Ethics Certification – UMass Boston Business Program, 2021

Skills

- Loan origination software (Encompass)

- FHA, VA, and conventional loan programs

- Document verification

- Client relationship management

- Credit analysis basics

- Rate lock procedures

- MS Office Suite & Google Workspace

- Clear verbal & written communication

- Time management & follow-up

- Basic knowledge of underwriting guidelines

Professional Development

- Attended “Mortgage Origination Best Practices” workshop (March 2023)

- Member, Massachusetts Mortgage Bankers Association (Junior Level)

- Participated in FirstChoice Lending mentorship program (2023-present)

Mid-level Mortgage Originator Resume Example

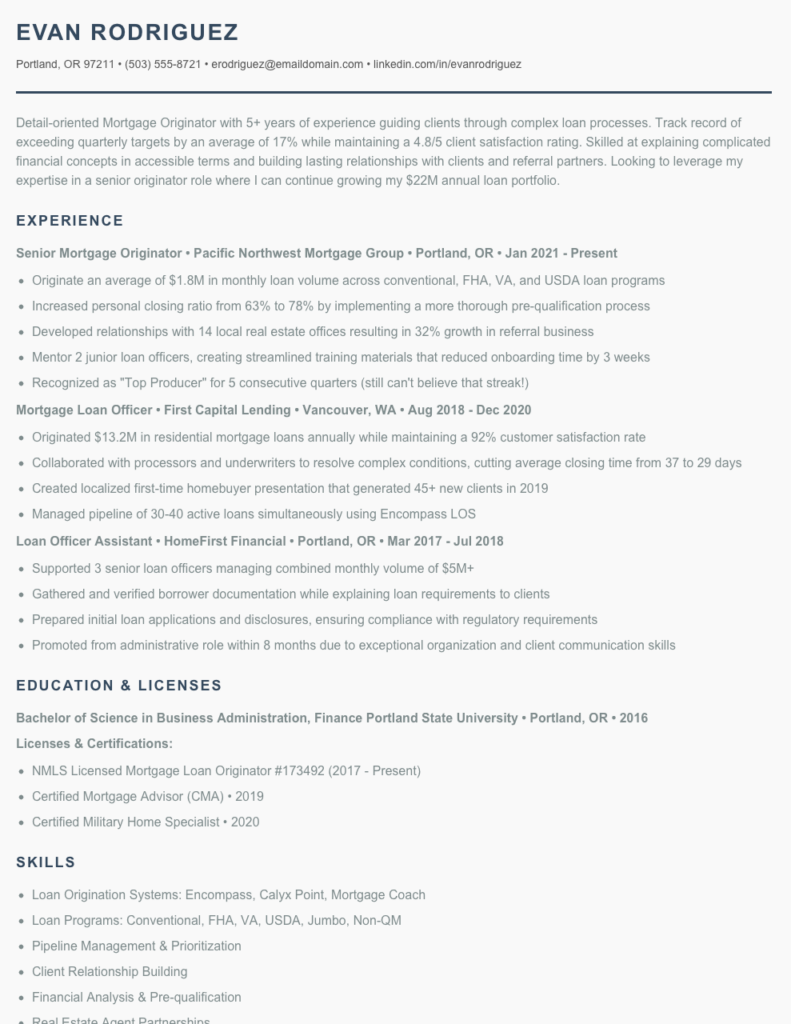

Evan Rodriguez

Portland, OR 97211 • (503) 555-8721 • erodriguez@emaildomain.com • linkedin.com/in/evanrodriguez

Detail-oriented Mortgage Originator with 5+ years of experience guiding clients through complex loan processes. Track record of exceeding quarterly targets by an average of 17% while maintaining a 4.8/5 client satisfaction rating. Skilled at explaining complicated financial concepts in accessible terms and building lasting relationships with clients and referral partners. Looking to leverage my expertise in a senior originator role where I can continue growing my $22M annual loan portfolio.

EXPERIENCE

Senior Mortgage Originator • Pacific Northwest Mortgage Group • Portland, OR • Jan 2021 – Present

- Originate an average of $1.8M in monthly loan volume across conventional, FHA, VA, and USDA loan programs

- Increased personal closing ratio from 63% to 78% by implementing a more thorough pre-qualification process

- Developed relationships with 14 local real estate offices resulting in 32% growth in referral business

- Mentor 2 junior loan officers, creating streamlined training materials that reduced onboarding time by 3 weeks

- Recognized as “Top Producer” for 5 consecutive quarters (still can’t believe that streak!)

Mortgage Loan Officer • First Capital Lending • Vancouver, WA • Aug 2018 – Dec 2020

- Originated $13.2M in residential mortgage loans annually while maintaining a 92% customer satisfaction rate

- Collaborated with processors and underwriters to resolve complex conditions, cutting average closing time from 37 to 29 days

- Created localized first-time homebuyer presentation that generated 45+ new clients in 2019

- Managed pipeline of 30-40 active loans simultaneously using Encompass LOS

Loan Officer Assistant • HomeFirst Financial • Portland, OR • Mar 2017 – Jul 2018

- Supported 3 senior loan officers managing combined monthly volume of $5M+

- Gathered and verified borrower documentation while explaining loan requirements to clients

- Prepared initial loan applications and disclosures, ensuring compliance with regulatory requirements

- Promoted from administrative role within 8 months due to exceptional organization and client communication skills

EDUCATION & LICENSES

Bachelor of Science in Business Administration, Finance

Portland State University • Portland, OR • 2016

Licenses & Certifications:

- NMLS Licensed Mortgage Loan Originator #173492 (2017 – Present)

- Certified Mortgage Advisor (CMA) • 2019

- Certified Military Home Specialist • 2020

SKILLS

- Loan Origination Systems: Encompass, Calyx Point, Mortgage Coach

- Loan Programs: Conventional, FHA, VA, USDA, Jumbo, Non-QM

- Pipeline Management & Prioritization

- Client Relationship Building

- Financial Analysis & Pre-qualification

- Real Estate Agent Partnerships

- Compliance (TRID, RESPA, ECOA)

- CRM Software (Salesforce, Top of Mind)

- Rate Lock Strategies

- MS Office Suite & Google Workspace

PROFESSIONAL AFFILIATIONS

- Oregon Mortgage Association, Member since 2018

- Portland Real Estate Networking Group, Active Participant

Senior / Experienced Mortgage Originator Resume Example

JENNIFER MULLEN

Denver, CO | (720) 555-8421 | j.mullen@emailpro.net | linkedin.com/in/jennifermullen

Senior Mortgage Loan Originator with 10+ years in the mortgage industry, consistently ranking in the top 5% of producers. Proven track record closing $49M in residential loans annually with 93% customer satisfaction ratings. Skilled at converting leads and nurturing client relationships through changing market conditions while maintaining compliance. Passionate about helping first-time homebuyers navigate complex financial decisions.

PROFESSIONAL EXPERIENCE

SENIOR MORTGAGE LOAN ORIGINATOR

Homestead Financial Group | Denver, CO | March 2018 – Present

- Generate $49M+ in annual loan volume (137 loans/year average) by cultivating relationships with 28 real estate partners and past client referrals

- Developed and implemented custom follow-up system that improved lead conversion by 31% and reduced application abandonment rates from 22% to 9%

- Manage 3 loan processors and coordinate with underwriters to ensure timely closings, resulting in 97% of loans closing on or before scheduled date

- Specialize in jumbo loans, FHA/VA financing, and construction-to-permanent loans; consistently maintain approval rates 17% above company average

- Created first-time homebuyer workshop series that has helped 79 families secure their first mortgage with an average 23% increase in approval odds

MORTGAGE LOAN OFFICER

Alpine Mortgage Services | Boulder, CO | June 2015 – March 2018

- Originated $27M in annual residential mortgage volume, specializing in conventional and government-backed loans

- Ranked #2 out of 17 LOs for client satisfaction (4.9/5 rating) based on post-closing surveys

- Exceeded quarterly targets by avg. 23% during a period when regional mortgage applications declined 8%

- Collaborated with 4 local credit unions to develop streamlined refinance programs for members, resulting in 43 closed loans in first quarter

- Mentored 3 junior loan officers who all achieved production goals within their first 6 months

LOAN PROCESSOR / JUNIOR LOAN OFFICER

First Choice Lending | Fort Collins, CO | August 2013 – June 2015

- Started as processor handling 45+ files monthly; promoted to Junior LO after demonstrating exceptional customer service skills

- Closed $8.7M in loans during first year as originator while maintaining processing responsibilities

- Implemented new document tracking system that reduced processing time by 3.6 days on average

- Received “Rookie of the Year” award for exceeding production goals by 42%

EDUCATION & CREDENTIALS

Bachelor of Science in Finance – Colorado State University, 2012

Licenses & Certifications:

- NMLS Licensed Mortgage Loan Originator #187432 (Since 2013)

- Certified Mortgage Advisor (CMA) – 2019

- VA Loan Specialist Certification – 2017

- Colorado Mortgage Association – Member Since 2014

SKILLS & EXPERTISE

- Loan Origination Systems: Encompass, Calyx Point, Mortgage Director

- Complex Loan Scenarios: Jumbo, Non-QM, Self-employed borrowers

- Regulatory Compliance: TRID, RESPA, ECOA, Fair Lending laws

- Client Relationship Management: Salesforce, Top Producer, BNTouch

- Pipeline Management & Prioritization

- Rate Lock Strategy & Secondary Market

- Real Estate Agent Relationship Development

- Credit Analysis & Enhancement Strategies

- Public Speaking & Educational Workshops

ACHIEVEMENTS

- Presidents Club – Top 5% Nationwide (2019, 2020, 2022)

- Featured speaker at 2021 Colorado Mortgage Summit – “Building Your Referral Network”

- Volunteer financial literacy instructor at Denver Urban Housing Initiative (2018-present)

How to Write a Mortgage Originator Resume

Introduction

Let's face it - the mortgage industry is competitive, and your resume needs to stand out. As someone who's reviewed thousands of mortgage originator resumes over the years, I can tell you that most hiring managers spend about 7.4 seconds scanning your resume before deciding whether to dig deeper. That's not much time to make an impression! This guide will walk you through creating a resume that showcases your lending expertise, sales skills, and track record of closing loans.

Resume Structure and Format

Keep your resume clean and scannable. Mortgage companies aren't typically looking for creative designs - they want to quickly find your production numbers and relevant experience.

- Stick to 1-2 pages (one page for junior originators, two max for experienced LOs)

- Use consistent formatting for job titles, dates, and company names

- Include plenty of white space - cramped resumes are hard to read

- Choose conservative fonts like Calibri, Arial, or Times New Roman

- Save your file as a PDF (unless specifically asked for a different format)

Profile/Summary Section

Your summary should be brief - 3-5 lines max - and highlight your production volume, specialties, and years of experience. This is your elevator pitch!

Think of your summary as your "30-second commercial." If a hiring manager reads nothing else, this section should give them a clear picture of your value as an originator.

Example: "FHA/VA loan specialist with 6+ years originating experience and $42M in annual loan volume. Consistent 78% pull-through rate with expertise in challenging credit scenarios and first-time homebuyer programs. Licensed in FL, GA, and SC."

Professional Experience

This is where most originators go wrong. Don't just list job duties - focus on your results! Hiring managers care about:

- Annual loan volume (in dollars and units)

- Types of loans you specialize in (conventional, jumbo, FHA, VA, etc.)

- Pull-through rates and conversion percentages

- Referral sources you've developed

- Team rankings or performance awards

Format each position with: Job title, company name, dates employed, then 4-6 bullet points highlighting achievements. For example:

Mortgage Loan Officer | First Capital Mortgage | March 2018 - Present

• Originated $37.4M in residential loans annually (127 units), exceeding branch goals by 23%

• Developed relationships with 14 real estate offices resulting in 63% of personal production

• Maintained 82% pull-through rate while specializing in jumbo and self-employed borrowers

• Ranked #2 LO in 17-person branch for 2019-2021

Education and Certifications

Include your NMLS ID prominently! Then list:

- State licenses (with license numbers if space permits)

- Relevant certifications (CMB, CML, military lending certs, etc.)

- College degrees (major, institution, graduation year)

- Continuing education worth mentioning

Keywords and ATS Tips

Most lenders use Applicant Tracking Systems to filter resumes. Include these terms naturally throughout your resume:

- Loan origination, mortgage sales, residential lending

- TRID, RESPA, Regulation Z compliance

- Pipeline management, pre-qualification

- Encompass, Calyx Point, or other LOS experience

- Customer acquisition, referral development

Industry-specific Terms

Show your expertise by using proper industry terminology. Include relevant terms like wholesale/retail lending, correspondent lending, delegated underwriting, DU/LP approval, non-QM lending, etc. - but only if they actually apply to your experience! Nothing screams "amateur" like misused mortgage jargon.

Common Mistakes to Avoid

- Being vague about production numbers (be specific)

- Focusing only on duties instead of achievements

- Omitting NMLS ID or licensing information

- Using generic sales language instead of mortgage-specific terminology

- Including outdated information (no one cares about your 2009 subprime experience)

Before/After Example

Before: "Responsible for originating mortgage loans and working with clients."

After: "Generated $23.8M in FHA/VA loan volume (94 units) in 2022 by cultivating relationships with 3 military-focused real estate offices and conducting twice-monthly homebuyer seminars, maintaining 79% pull-through rate."

See the difference? The second version gives specific metrics and explains how you achieved them - exactly what hiring managers want to see!

Related Resume Examples

Soft skills for your Mortgage Originator resume

- Client-focused relationship building – able to connect with first-time homebuyers and seasoned investors alike while maintaining trust through complex transactions

- Clear communication of loan options – breaking down complicated financial concepts without making clients feel overwhelmed

- Emotional intelligence when handling loan rejections or guiding clients through documentation challenges

- Time management juggling multiple loan applications at different stages (I currently manage 15-20 active files simultaneously)

- Adaptability to shifting market conditions and changing regulations (survived the 2018 interest rate spike that dropped application volume by 31%)

- Cross-functional collaboration with underwriters, processors and real estate agents to keep deals moving forward

Hard skills for your Mortgage Originator resume

- FHA/VA/USDA/Conventional loan underwriting standards

- Encompass LOS software

- Rate lock management and pipeline optimization

- Calyx Point and Mortgage Coach proficiency

- Credit analysis and debt ratio calculations

- TRID compliance requirements and disclosures

- Desktop Underwriter (DU) and Loan Prospector (LP) systems

- NMLS certification and continuing education tracking

- Secondary market pricing and margin management