Loan Servicing Specialist Resume examples & templates

Copyable Loan Servicing Specialist Resume examples

Ever wonder who makes sure your mortgage payment gets to the right place every month? Loan Servicing Specialists are the unsung heroes of the financial world, managing the day-to-day operations of loans after they've been funded. They're the ones who process payments, maintain escrow accounts, and often serve as the first point of contact when borrowers have questions or concerns. It's a role that combines financial acumen with customer service skills—and it's growing fast. According to the Bureau of Labor Statistics, financial services positions are projected to grow by 7.1% through 2029, outpacing many other sectors.

The field has changed dramatically in recent years. With the rise of digital banking, many loan servicers now manage automated payment systems and work with sophisticated software platforms (goodbye paper ledgers!). Meanwhile, regulatory changes since 2008 have added layers of compliance requirements. For those with attention to detail and problem-solving skills, this career offers stability and growth potential. As mortgage refinancing continues to surge in the current low-interest environment, qualified Loan Servicing Specialists will remain in high demand for years to come.

Junior Loan Servicing Specialist Resume Example

Maya Rodriguez

Philadelphia, PA 19103 • (215) 555-8742 • maya.rodriguez@email.com • linkedin.com/in/mayarodriguez

Detail-oriented Loan Servicing Specialist with 1+ years of experience in loan processing and customer service. Skilled in loan documentation review, payment processing, and account maintenance. Known for accuracy in data entry and strong problem-solving abilities. Eager to grow in financial services while delivering exceptional client support.

EXPERIENCE

Loan Servicing Specialist – First Capital Financial Services, Philadelphia, PA (August 2022 – Present)

- Process 40+ daily loan payments and post transactions to appropriate accounts with 99.7% accuracy rate

- Respond to 20-25 customer inquiries per day regarding loan status, payment history, and escrow accounts

- Prepare monthly reports tracking delinquent accounts, resulting in 14% improvement in collection rates

- Maintain and update borrower information in loan servicing platform (MSP) following regulatory guidelines

- Collaborate with loan officers to resolve discrepancies in loan documentation and payment applications

Customer Service Representative – Citizens Bank, Philadelphia, PA (May 2021 – July 2022)

- Assisted customers with account inquiries, balance verification, and basic banking transactions

- Processed 30+ daily deposits and withdrawals while maintaining cash drawer balance within $5 variance

- Cross-sold banking products including personal loans and credit cards, exceeding quarterly targets by 12%

- Identified and escalated potential fraud cases according to bank protocols

Financial Services Intern – Liberty Credit Union, Philadelphia, PA (January 2021 – April 2021)

- Shadowed loan servicing team to learn mortgage and auto loan processing procedures

- Assisted with organizing and digitizing loan documentation for 127 client accounts

- Prepared weekly statistical reports on loan application processing times and approval rates

EDUCATION

Bachelor of Science in Business Administration – Temple University, Philadelphia, PA

Concentration in Finance • Graduated: December 2020 • GPA: 3.6/4.0

CERTIFICATIONS

Mortgage Loan Servicing Fundamentals Certificate – American Bankers Association (June 2022)

Excel for Financial Professionals – LinkedIn Learning (March 2021)

SKILLS

- Loan Processing & Documentation

- Payment Processing & Reconciliation

- Escrow Analysis

- Customer Service

- MSP Loan Servicing Platform

- Black Knight Financial Software

- Microsoft Office Suite (Excel, Word, Outlook)

- Financial Calculations

- Data Entry (65 WPM)

- Problem Resolution

- Basic Spanish (conversational)

Mid-level Loan Servicing Specialist Resume Example

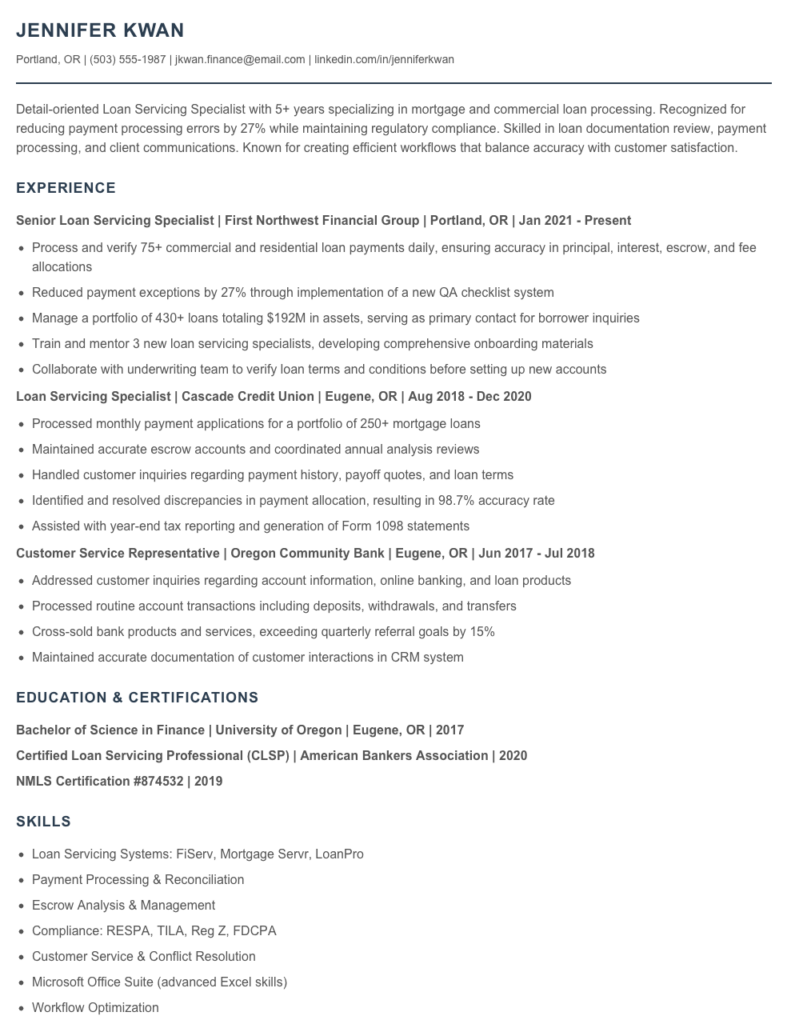

JENNIFER KWAN

Portland, OR | (503) 555-1987 | jkwan.finance@email.com | linkedin.com/in/jenniferkwan

Detail-oriented Loan Servicing Specialist with 5+ years specializing in mortgage and commercial loan processing. Recognized for reducing payment processing errors by 27% while maintaining regulatory compliance. Skilled in loan documentation review, payment processing, and client communications. Known for creating efficient workflows that balance accuracy with customer satisfaction.

EXPERIENCE

Senior Loan Servicing Specialist | First Northwest Financial Group | Portland, OR | Jan 2021 – Present

- Process and verify 75+ commercial and residential loan payments daily, ensuring accuracy in principal, interest, escrow, and fee allocations

- Reduced payment exceptions by 27% through implementation of a new QA checklist system

- Manage a portfolio of 430+ loans totaling $192M in assets, serving as primary contact for borrower inquiries

- Train and mentor 3 new loan servicing specialists, developing comprehensive onboarding materials

- Collaborate with underwriting team to verify loan terms and conditions before setting up new accounts

Loan Servicing Specialist | Cascade Credit Union | Eugene, OR | Aug 2018 – Dec 2020

- Processed monthly payment applications for a portfolio of 250+ mortgage loans

- Maintained accurate escrow accounts and coordinated annual analysis reviews

- Handled customer inquiries regarding payment history, payoff quotes, and loan terms

- Identified and resolved discrepancies in payment allocation, resulting in 98.7% accuracy rate

- Assisted with year-end tax reporting and generation of Form 1098 statements

Customer Service Representative | Oregon Community Bank | Eugene, OR | Jun 2017 – Jul 2018

- Addressed customer inquiries regarding account information, online banking, and loan products

- Processed routine account transactions including deposits, withdrawals, and transfers

- Cross-sold bank products and services, exceeding quarterly referral goals by 15%

- Maintained accurate documentation of customer interactions in CRM system

EDUCATION & CERTIFICATIONS

Bachelor of Science in Finance | University of Oregon | Eugene, OR | 2017

Certified Loan Servicing Professional (CLSP) | American Bankers Association | 2020

NMLS Certification #874532 | 2019

SKILLS

- Loan Servicing Systems: FiServ, Mortgage Servr, LoanPro

- Payment Processing & Reconciliation

- Escrow Analysis & Management

- Compliance: RESPA, TILA, Reg Z, FDCPA

- Customer Service & Conflict Resolution

- Microsoft Office Suite (advanced Excel skills)

- Workflow Optimization

- Default Management & Loss Mitigation

- Financial Statement Analysis

- Spanish (conversational)

PROFESSIONAL DEVELOPMENT

- Mortgage Bankers Association – Loan Administration Workshop (2022)

- Excel Advanced Formulas for Financial Professionals (2020)

- Customer Service Excellence in Banking – In-house Training (2019)

Senior / Experienced Loan Servicing Specialist Resume Example

Denise R. Wallace

Portland, OR 97214 • (503) 555-8719 • deniserwallace@email.com • linkedin.com/in/deniserwallace

Professional Summary

Loan Servicing Specialist with 9+ years of experience managing complex lending portfolios and loan processing operations. Proven track record resolving escalated client issues while maintaining compliance with federal regulations including TILA, RESPA, and Dodd-Frank. Excel at cross-functional collaboration between borrowers, loan officers, and underwriting teams to ensure smooth loan servicing operations that reduced delinquencies by 17% at my current employer.

Professional Experience

Senior Loan Servicing Specialist | Northwest Financial Partners | Portland, OR | June 2019 – Present

- Manage portfolio of 450+ mortgage loans ($127M) including payment processing, escrow analysis, and loss mitigation

- Decreased default rate by 22% through proactive outreach to at-risk borrowers and implementation of custom modification programs

- Train and mentor team of 4 junior specialists on regulatory compliance and customer service best practices

- Developed streamlined process for annual escrow analysis that reduced processing time from 5 days to 36 hours

- Collaborate with legal department to ensure compliance with changing state and federal lending regulations

- Recognized as “Specialist of the Year” in 2021 for outstanding customer satisfaction scores (4.8/5)

Loan Servicing Specialist | First Columbia Bank | Vancouver, WA | March 2016 – May 2019

- Managed portfolio of 300+ conventional and FHA loans, processing monthly payments and maintaining accurate records

- Reduced payment posting errors by 31% through implementation of quality control checkpoints

- Handled escrow accounts including tax and insurance payments, reconciliation, and annual analysis

- Processed loan payoffs, assumptions, and modifications while maintaining compliance with banking regulations

- Participated in system migration team during conversion to new loan servicing platform (Black Knight MSP)

Loan Processing Assistant | Cascade Credit Union | Portland, OR | January 2014 – February 2016

- Processed loan applications and supporting documentation for consumer loans averaging $3.2M monthly volume

- Verified borrower information including employment, income, and credit history

- Coordinated with underwriters to resolve documentation issues and expedite loan approvals

- Maintained customer files in compliance with regulatory requirements and internal policies

Education & Certifications

Bachelor of Science in Business Administration – Finance Concentration

Portland State University, Portland, OR (2013)

Certifications:

- Certified Loan Servicing Professional (CLSP) – 2018, renewed 2021

- Mortgage Bankers Association – Residential Mortgage Servicing Basics Certificate (2017)

- FDIC Compliance Training – Annual completion since 2016

- Black Knight MSP System Certification (2019)

Technical Skills

- Loan Servicing Platforms: Black Knight MSP, Fiserv, LoanSphere

- Banking Software: Jack Henry Silverlake, FIS, Mortgage Builder

- Regulatory Compliance: TILA-RESPA, CFPB, Dodd-Frank, FCRA

- Document Management: FileHold, SharePoint, OnBase

- Microsoft Office Suite (advanced Excel including pivot tables and VLOOKUP)

- Customer Relationship Management: Salesforce, proprietary systems

Professional Skills

- Loss Mitigation & Default Management

- Escrow Administration & Analysis

- Payment Processing & Reconciliation

- Customer Service & Conflict Resolution

- Loan Modification & Restructuring

- Cross-functional Team Collaboration

How to Write a Loan Servicing Specialist Resume

Introduction

Landing that perfect Loan Servicing Specialist job starts with a resume that showcases your financial expertise and attention to detail. I've reviewed thousands of these resumes over my career, and the difference between those that get interviews and those that don't often comes down to how well you communicate your specific skills in loan management, payment processing, and customer service. Your resume isn't just a history of your career—it's a marketing document that should highlight exactly how you can solve problems for your future employer.

Resume Structure and Format

Keep your resume clean and scannable. Loan departments are busy places, and hiring managers typically spend just 7.4 seconds on their first review of your resume!

- Stick to 1-2 pages maximum (one page is preferable for those with less than 5 years experience)

- Use clear section headings (Experience, Skills, Education)

- Select a readable font like Calibri or Arial in 10-12pt size

- Include plenty of white space to avoid a cluttered appearance

- Save as a PDF unless specifically asked for another format (this preserves your formatting)

Profile/Summary Section

Start with a punchy 3-4 line summary that captures who you are professionally. For a Loan Servicing Specialist, focus on your experience with specific loan types and servicing platforms.

Pro Tip: Customize your summary for each job application. If the position emphasizes mortgage servicing, highlight your mortgage experience. If it's about commercial loans, adjust accordingly. This small change can make a huge difference!

Example: "Detail-oriented Loan Servicing Specialist with 4+ years managing a portfolio of 850+ FHA and conventional loans. Proficient in Fiserv and Black Knight MSP platforms with a track record of reducing delinquency rates by 17% through proactive borrower outreach."

Professional Experience

This is where you'll spend most of your resume real estate. For each position:

- Start with your job title, company name, location, and dates (month/year)

- Include 4-6 bullet points that focus on achievements, not just duties

- Begin bullets with strong action verbs (processed, managed, resolved, reduced)

- Include specific metrics where possible (loan volume handled, error reduction percentages)

Example bullet point: "Processed an average of 126 loan payments daily while maintaining a 99.8% accuracy rate, exceeding department standards by 3.2%"

Education and Certifications

List your education in reverse chronological order. For Loan Servicing Specialists, relevant certifications can sometimes be more valuable than degrees. Include:

- Degrees with institution names and graduation years

- Industry certifications like NMLS licensing, ABA certifications, etc.

- Relevant coursework or continuing education in banking, finance, or lending

Keywords and ATS Tips

Most banks and financial institutions use Applicant Tracking Systems to filter resumes before human eyes ever see them. To get past these digital gatekeepers:

- Incorporate keywords from the job description (loan servicing, payment processing, escrow analysis)

- Mention specific software you've used (Mortgage Servicing Platform, LoanServ, FiServ)

- Avoid using tables, headers/footers, or images that might confuse the ATS

- Don't try to game the system with invisible text or keyword stuffing—it'll backfire when a human reviews it

Industry-specific Terms

Sprinkling in the right terminology shows you know the industry. Consider including terms like:

- Escrow administration

- Loss mitigation

- Payment reconciliation

- Regulatory compliance (RESPA, TILA, CFPB requirements)

- Default management

- Loan boarding

Common Mistakes to Avoid

- Being too vague about your experience ("handled loans" vs. "managed a $42M portfolio of 320 VA and FHA loans")

- Focusing only on job duties rather than accomplishments

- Ignoring compliance aspects of the role (huge in loan servicing!)

- Using generic skills that could apply to any job ("hardworking," "team player")

- Forgetting to proofread (nothing kills credibility faster in a detail-oriented field)

Before/After Example

Before: "Responsible for customer service and processing payments."

After: "Resolved 28-35 complex borrower inquiries daily while processing $2.3M in monthly payments with zero balancing errors, earning recognition as Employee of the Quarter in Spring 2022."

Remember, your resume should tell the story of how you've made a difference in your previous roles. Loan servicing is detail-oriented work that directly impacts both borrowers and the financial institution's bottom line—make sure your resume reflects your understanding of this responsibility and your ability to excel in it!

Related Resume Examples

Soft skills for your Loan Servicing Specialist resume

- Tactful customer interaction skills, particularly when handling sensitive financial distress cases (developed through conflict resolution training)

- Active listening ability – can pinpoint unstated concerns in borrower conversations that often reveal underlying issues

- Cross-functional collaboration – coordinate effectively between underwriting, collections and legal teams during complex loan modifications

- Deadline management under pressure, especially during month-end reporting cycles when processing 120+ accounts simultaneously

- Adaptability to evolving regulatory frameworks (TILA, RESPA, FDCPA) while maintaining productivity

- Clear communication of complex loan terms to borrowers with varying financial literacy levels

Hard skills for your Loan Servicing Specialist resume

- Loan Portfolio Management using Fiserv and Black Knight MSP platforms

- Payment processing and reconciliation through ACH, wire transfers, and lockbox services

- Mortgage servicing rights (MSR) valuation calculations

- Loan modification documentation preparation (HAMP, proprietary mods)

- Escrow analysis and annual statement generation

- Proficiency with LoanServ, LoanSphere, and Encompass software

- Compliance monitoring for RESPA, TILA, and Reg Z requirements

- Default management and loss mitigation workflows

- NMLS licensure and continuing education maintenance