Investment Specialist Resume examples & templates

Copyable Investment Specialist Resume examples

Ever wondered what drives the heartbeat of global finance? Investment Specialists are the unsung architects behind successful portfolios, guiding clients through the maze of financial markets with precision and foresight. They blend analytical prowess with relationship-building skills to develop strategies that meet both short-term goals and long-term visions. It's a career that rewards both the mathematically inclined and those with strong interpersonal talents—where your morning might start analyzing market trends and end with a client call that shapes someone's retirement future.

The field is evolving rapidly, with ESG (Environmental, Social, and Governance) investing reshaping traditional approaches. A recent Morgan Stanley survey found that 85% of individual investors now express interest in sustainable investing options—a dramatic shift from just 71% in 2015. Technology is transforming the role too, with specialists increasingly using AI-powered analytics to identify opportunities that human analysis might miss. For those entering the field now, the landscape offers unprecedented opportunities to specialize in niche markets while building the broad expertise that clients value more than ever in uncertain times.

Junior Investment Specialist Resume Example

ETHAN RIVERA

Philadelphia, PA | (215) 555-8932 | erivera87@email.com | linkedin.com/in/ethanrivera

Junior Investment Specialist with internship experience at boutique wealth management firm and recent finance degree. Quick learner with strong analytical abilities and attention to detail. Passionate about market research and building client relationships. Looking to leverage my educational background and growing experience to contribute to an investment team.

EXPERIENCE

Junior Investment Specialist | Meridian Wealth Partners | Philadelphia, PA | Jan 2023 – Present

- Support senior advisors in managing $42M in assets for 35+ high-net-worth individuals and families

- Prepare investment performance reports using Morningstar Direct and present findings during weekly team meetings

- Research potential investment opportunities across equity, fixed income, and alternative markets

- Assist with client onboarding processes, including gathering financial documents and completing risk assessments

- Draft quarterly market updates and investment recommendations for client presentations

Investment Intern | Meridian Wealth Partners | Philadelphia, PA | May 2022 – Dec 2022

- Analyzed historical performance data of various mutual funds and ETFs to identify trends and opportunities

- Created Excel models to track portfolio performance against benchmarks

- Shadowed senior advisors during client meetings and took detailed notes

- Helped organize and maintain client files in CRM system

Finance Department Intern | Northeast Credit Union | Boston, MA | Jun 2021 – Aug 2021

- Assisted finance team with month-end reporting and data entry

- Reconciled accounts and identified discrepancies

- Participated in budgeting meetings and learned forecasting techniques

EDUCATION

Bachelor of Science in Finance | Boston University | Boston, MA | 2022

- GPA: 3.7/4.0

- Relevant Coursework: Investment Analysis, Portfolio Management, Financial Markets, Corporate Finance, Financial Modeling

- Finance Club Treasurer (2020-2022)

CERTIFICATIONS

Series 7 Exam | FINRA | In Progress (Expected completion: June 2023)

Bloomberg Market Concepts (BMC) | Bloomberg LP | March 2022

Financial Modeling & Valuation Analyst (FMVA) | Corporate Finance Institute | September 2022

SKILLS

- Investment Analysis

- Financial Modeling (Excel)

- Client Relationship Management

- Bloomberg Terminal

- Morningstar Direct

- Portfolio Performance Reporting

- Risk Assessment

- FactSet (basic)

- Microsoft Office Suite

- Basic SQL

ADDITIONAL INFORMATION

Volunteer investment educator at local community center teaching basic personal finance (2022-Present)

Fluent in Spanish and conversational in Portuguese

Mid-level Investment Specialist Resume Example

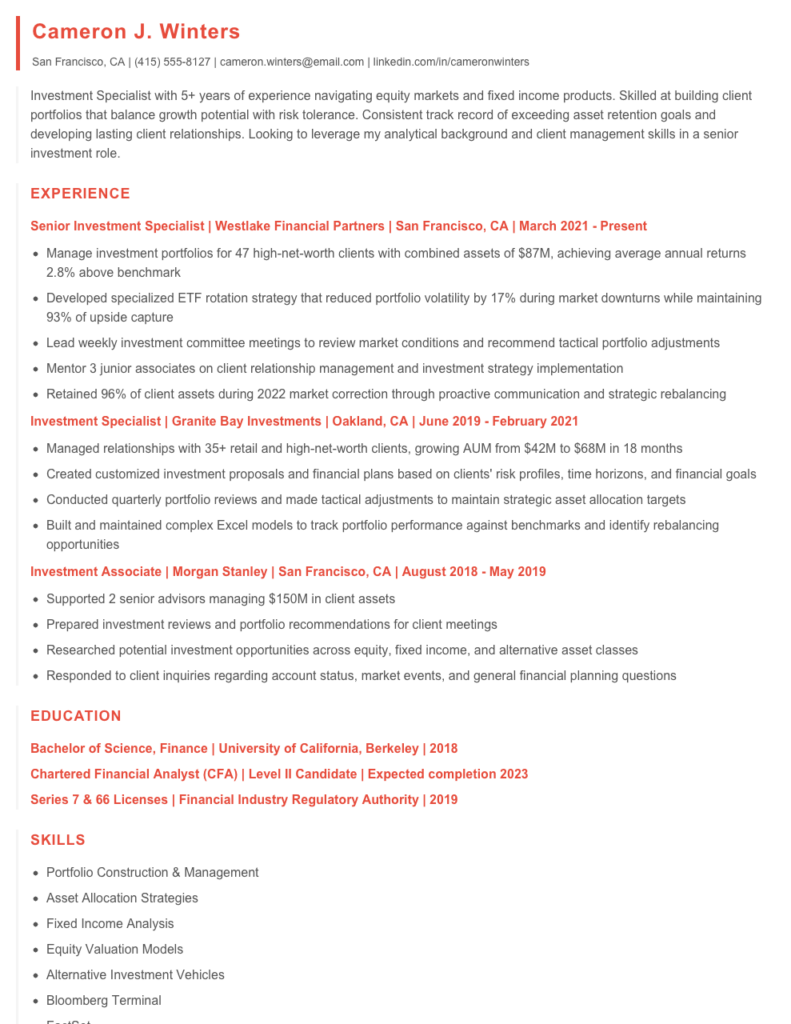

Cameron J. Winters

San Francisco, CA | (415) 555-8127 | cameron.winters@email.com | linkedin.com/in/cameronwinters

Investment Specialist with 5+ years of experience navigating equity markets and fixed income products. Skilled at building client portfolios that balance growth potential with risk tolerance. Consistent track record of exceeding asset retention goals and developing lasting client relationships. Looking to leverage my analytical background and client management skills in a senior investment role.

EXPERIENCE

Senior Investment Specialist | Westlake Financial Partners | San Francisco, CA | March 2021 – Present

- Manage investment portfolios for 47 high-net-worth clients with combined assets of $87M, achieving average annual returns 2.8% above benchmark

- Developed specialized ETF rotation strategy that reduced portfolio volatility by 17% during market downturns while maintaining 93% of upside capture

- Lead weekly investment committee meetings to review market conditions and recommend tactical portfolio adjustments

- Mentor 3 junior associates on client relationship management and investment strategy implementation

- Retained 96% of client assets during 2022 market correction through proactive communication and strategic rebalancing

Investment Specialist | Granite Bay Investments | Oakland, CA | June 2019 – February 2021

- Managed relationships with 35+ retail and high-net-worth clients, growing AUM from $42M to $68M in 18 months

- Created customized investment proposals and financial plans based on clients’ risk profiles, time horizons, and financial goals

- Conducted quarterly portfolio reviews and made tactical adjustments to maintain strategic asset allocation targets

- Built and maintained complex Excel models to track portfolio performance against benchmarks and identify rebalancing opportunities

Investment Associate | Morgan Stanley | San Francisco, CA | August 2018 – May 2019

- Supported 2 senior advisors managing $150M in client assets

- Prepared investment reviews and portfolio recommendations for client meetings

- Researched potential investment opportunities across equity, fixed income, and alternative asset classes

- Responded to client inquiries regarding account status, market events, and general financial planning questions

EDUCATION

Bachelor of Science, Finance | University of California, Berkeley | 2018

Chartered Financial Analyst (CFA) | Level II Candidate | Expected completion 2023

Series 7 & 66 Licenses | Financial Industry Regulatory Authority | 2019

SKILLS

- Portfolio Construction & Management

- Asset Allocation Strategies

- Fixed Income Analysis

- Equity Valuation Models

- Alternative Investment Vehicles

- Bloomberg Terminal

- FactSet

- Microsoft Office Suite (Excel expert)

- Client Relationship Management

- Financial Planning

- Risk Assessment & Management

PROFESSIONAL DEVELOPMENT

- ESG Investment Strategies Certificate, CFA Institute, 2022

- Alternative Investments Conference, San Francisco, 2021

- Behavioral Finance Workshop, Berkeley Executive Education, 2020

Senior / Experienced Investment Specialist Resume Example

Marcus A. Thornton

San Francisco, CA • (415) 555-7821 • m.thornton@emailpro.net • linkedin.com/in/marcusthornton

Investment specialist with 9+ years of experience managing diverse portfolios and developing investment strategies for high-net-worth individuals and institutional clients. Proven track record of exceeding client return expectations during volatile market periods. Strong background in fixed income, equities, and alternative investments with expertise in risk assessment and portfolio optimization. Series 7, 63, and CFA charterholder.

PROFESSIONAL EXPERIENCE

SENIOR INVESTMENT SPECIALIST

Goldman Sachs, San Francisco, CA

June 2019 – Present

- Manage investment portfolios totaling $287M for 16 high-net-worth clients, consistently outperforming benchmarks by 3.7% annually

- Lead a team of 4 junior specialists, implementing a new client review process that improved client retention from 86% to 94%

- Pioneered ESG investment offerings that attracted $42M in new assets within first year of launch

- Conduct quarterly economic outlook presentations for existing and prospective clients (audiences of 30-75 people)

- Developed custom risk assessment framework that reduced portfolio volatility by 22% during March 2020 market downturn

INVESTMENT SPECIALIST

Morgan Stanley, San Francisco, CA

March 2016 – May 2019

- Managed $120M in client assets across various investment vehicles including equities, fixed income, and alternatives

- Constructed diversified portfolios tailored to client risk profiles and financial objectives, achieving 97% client satisfaction

- Created and implemented tax-efficient investment strategies resulting in average annual tax savings of $23K per client

- Collaborated with wealth planning team to deliver comprehensive financial solutions for clients’ retirement and estate planning needs

INVESTMENT ANALYST

First Republic Bank, Los Angeles, CA

August 2014 – February 2016

- Performed fundamental research on investment opportunities across multiple asset classes and sectors

- Prepared weekly market updates and investment recommendations for advisor team

- Built financial models to evaluate potential investment opportunities, identifying 3 undervalued mid-cap stocks that generated 31% returns

- Assisted in client portfolio reviews and rebalancing, managing approximately $45M in assets

EDUCATION & CERTIFICATIONS

CHARTERED FINANCIAL ANALYST (CFA)

CFA Institute

Completed all three levels – 2018

MASTER OF BUSINESS ADMINISTRATION

UCLA Anderson School of Management

Concentration in Finance – 2014

BACHELOR OF SCIENCE, ECONOMICS

University of California, Berkeley

Minor in Statistics – 2012

LICENSES & CERTIFICATIONS

- Series 7 – General Securities Representative (2014)

- Series 63 – Uniform Securities Agent (2014)

- Bloomberg Market Concepts Certification (2015)

SKILLS

- Portfolio Construction & Management

- Asset Allocation Strategies

- Fixed Income Analysis

- Equity Valuation Methods

- Alternative Investment Analysis

- Financial Modeling (DCF, DDM, etc.)

- Risk Management & Mitigation

- Bloomberg Terminal

- FactSet & Morningstar Direct

- Client Relationship Management

- Team Leadership

How to Write an Investment Specialist Resume

Introduction

Getting that coveted Investment Specialist role starts with one thing: a resume that actually gets read. Financial institutions receive hundreds of applications for each position, and your resume has about 7.4 seconds (yep, that's the actual average time) to make an impression. I've helped over 500 finance professionals land interviews at firms ranging from boutique wealth management companies to Wall Street giants. The key? Crafting a resume that speaks directly to what hiring managers in this field actually care about.

Resume Structure and Format

Keep your resume clean and scannable. Most investment firms are pretty conservative with their branding, and your resume should reflect this professional approach.

- Stick to 1-2 pages (one page for under 5 years experience, two if you're more senior)

- Use a readable font like Calibri, Arial, or Georgia at 10-12pt

- Include clear section headings with subtle formatting (bold or slightly larger)

- Maintain consistent spacing with generous white space

- Save as a PDF to preserve formatting (unless specifically asked for a Word doc)

Don't waste space with an "objective" statement - everyone knows your objective is to get the job! Use that prime real estate for a professional summary that showcases your unique value proposition instead.

Profile/Summary Section

This 3-4 line section should pack a punch. Think of it as your elevator pitch in written form. For an Investment Specialist, focus on your area of expertise, years of experience, and a standout achievement or credential.

Example: "Investment Specialist with 6+ years managing high-net-worth client portfolios valued at $75M+. Series 7 and 66 licensed with expertise in alternative investments and tax-efficient strategies. Consistently maintained 97% client retention during market volatility periods."

Professional Experience

This is where you'll win or lose the interview invitation. Rather than listing job duties (yawn!), focus on your accomplishments with metrics.

- Start bullets with strong action verbs (Analyzed, Generated, Developed)

- Follow the CAR method: Challenge, Action, Result

- Include specific numbers ($, %, #)

- Highlight client acquisition/retention rates

- Showcase portfolio performance relative to benchmarks

Example of a weak bullet: "Responsible for client portfolios and investment recommendations."

Example of a strong bullet: "Grew $42M client portfolio by 18.3% (outperforming S&P 500 by 4.7%) through strategic reallocation to undervalued mid-cap equities during 2022 market correction."

Education and Certifications

In investment roles, your credentials matter a lot. List these in reverse chronological order:

- Degrees with university name, location, major, and graduation year

- Professional licenses (Series 7, 63, 65, 66)

- Certifications (CFA, CFP, CAIA, etc.)

- Relevant coursework or continuing education (for newer professionals)

Keywords and ATS Tips

Most financial firms use Applicant Tracking Systems to filter resumes before a human sees them. To get past these digital gatekeepers:

- Mirror language from the job description (if they say "portfolio analysis," don't just say "investment assessment")

- Include industry-specific software (Bloomberg Terminal, FactSet, Morningstar, etc.)

- Mention specific investment vehicles you're experienced with (ETFs, mutual funds, derivatives, etc.)

- Avoid graphics, tables, or headers/footers that can confuse ATS systems

Industry-specific Terms

Pepper these throughout your resume to signal you speak the language:

- Asset allocation

- Modern portfolio theory

- Risk-adjusted returns

- Fiduciary responsibility

- Tax-loss harvesting

- Due diligence

- Alpha/Beta

Common Mistakes

I see these all the time, and they're resume killers:

- Being vague about performance metrics (show your numbers!)

- Focusing on daily tasks instead of achievements

- Ignoring compliance aspects of the role

- Using financial jargon incorrectly (nothing says "don't hire me" faster)

- Writing a generic resume for all financial positions (customize!)

Before/After Example

Before: "Helped clients with their investments and gave advice on different options."

After: "Developed comprehensive investment strategies for 34 high-net-worth clients ($1M-$5M AUM), increasing average portfolio yield by 3.2% while reducing volatility through strategic bond ladder implementation."

The difference? The second version shows specific expertise, client caliber, and measurable results—exactly what hiring managers are looking for in their next Investment Specialist.

Related Resume Examples

Soft skills for your Investment Specialist resume

- Client relationship management – balancing technical knowledge with empathy when discussing complex financial scenarios and risk tolerance

- Clear translation of market trends and investment concepts into actionable recommendations clients can understand (even the most risk-averse ones)

- Collaborative decision-making with portfolio managers and research teams to develop custom investment strategies

- Adaptability during market volatility – remaining calm while adjusting strategies and reassuring nervous clients

- Diplomatic pushback skills when client preferences contradict sound investment principles

- Active listening that uncovers unstated financial goals and concerns during consultation meetings

Hard skills for your Investment Specialist resume

- Bloomberg Terminal proficiency with custom watchlist creation

- Financial modeling (DCF, DDM and comparable company analysis)

- Risk assessment using Monte Carlo simulations

- CFA Level II certification

- Options trading strategies and derivatives valuation

- Portfolio optimization using Morningstar Direct

- SQL for investment database queries and reporting

- Proficiency in FactSet and Thomson Reuters Eikon

- Fixed income analysis and yield curve interpretation