Investment Banking Associate Resume examples & templates

Copyable Investment Banking Associate Resume examples

Ever wondered why Investment Banking Associates put in those notorious 80-hour weeks? It's not just about the six-figure compensation packages (though that certainly helps). These roles sit at the intersection of high finance and corporate strategy, where associates drive the analysis behind billion-dollar deals that reshape industries. The position has evolved significantly since the 2008 financial crisis, with today's associates needing stronger quantitative skills than ever before. According to recent industry surveys, top-tier investment banks have increased their technical assessment components by 37% during associate-level interviews over the past five years.

The landscape for IB Associates continues to shift in 2023. While traditional powerhouses like Goldman Sachs and Morgan Stanley remain prestigious landing spots, boutique banks are gaining ground—offering faster advancement and better work-life balance (yes, that exists in banking... sort of). As cross-border M&A activity rebounds post-pandemic and ESG considerations become non-negotiable in deal evaluation, associates with international experience and sustainability knowledge will find themselves particularly well-positioned in the coming years.

Junior Investment Banking Associate Resume Example

MICHAEL J. THOMPSON

New York, NY | (917) 555-8294 | michael.thompson@email.com | linkedin.com/in/michaeljthompson

Investment Banking Associate with strong financial modeling skills and transaction experience. Former summer analyst at Morgan Stanley with hands-on experience in M&A advisory and equity offerings. Seeking to leverage my analytical abilities and finance background to excel in a fast-paced IB environment. Columbia Business School graduate with Series 79 certification.

EXPERIENCE

Goldman Sachs – Investment Banking Associate

New York, NY | June 2022 – Present

- Support deal teams on 7 transactions including a $1.4B consumer goods acquisition and $875M healthcare IPO

- Build and maintain detailed financial models including DCF, LBO, and comparable company analyses

- Create client-facing presentations and pitch books for senior bankers, often under tight deadlines

- Perform industry research and company due diligence across the consumer retail and healthcare sectors

- Coordinate with legal teams and clients to complete transaction documentation and due diligence requests

Morgan Stanley – Investment Banking Summer Associate

New York, NY | May 2021 – August 2021

- Completed 10-week summer associate program within the Technology, Media & Telecommunications group

- Assisted in the preparation of a $2.3B IPO for a SaaS company, including financial modeling and industry analysis

- Conducted comparable company analysis and precedent transactions analysis for potential M&A targets

- Created and maintained transaction tracking documents and status updates for senior bankers

Deloitte Consulting – Business Analyst

Boston, MA | July 2019 – July 2020

- Performed financial analysis and strategic planning for Fortune 500 clients in the financial services industry

- Developed Excel models to assess impact of potential cost-saving initiatives (identified $3.7M in annual savings)

- Supported due diligence efforts for a $420M acquisition, including financial statement analysis

- Collaborated with cross-functional teams to gather requirements and implement process improvements

EDUCATION

Columbia Business School – Master of Business Administration (MBA)

New York, NY | August 2020 – May 2022

- Concentration in Finance; GPA: 3.8/4.0

- Investment Banking Club, VP of Education; organized 14 speaker events and technical workshops

- Participated in Columbia Student Investment Management Association; managed $2.5M portion of endowment

Boston College – Bachelor of Science in Finance, Minor in Economics

Chestnut Hill, MA | September 2015 – May 2019

- GPA: 3.7/4.0; Dean’s List all semesters

- Treasurer, Finance Club; Led team that won 2nd place in campus investment competition

SKILLS & CERTIFICATIONS

- Financial Modeling: DCF, LBO, M&A, Accretion/Dilution, Sensitivity Analysis

- Valuation Methods: Comparable Company Analysis, Precedent Transaction Analysis

- Technical Skills: Excel (advanced), PowerPoint, Bloomberg Terminal, FactSet, Capital IQ

- Deal Experience: IPOs, M&A, Debt Offerings, Restructuring

- Certifications: FINRA Series 79 (Investment Banking Representative), Wall Street Prep Financial Modeling

- Languages: Conversational Spanish, basic Mandarin (studied abroad in Shanghai, Fall 2017)

INTERESTS

Distance running (completed NYC Marathon 2022), chess, historical fiction, travel (visited 18 countries)

Mid-level Investment Banking Associate Resume Example

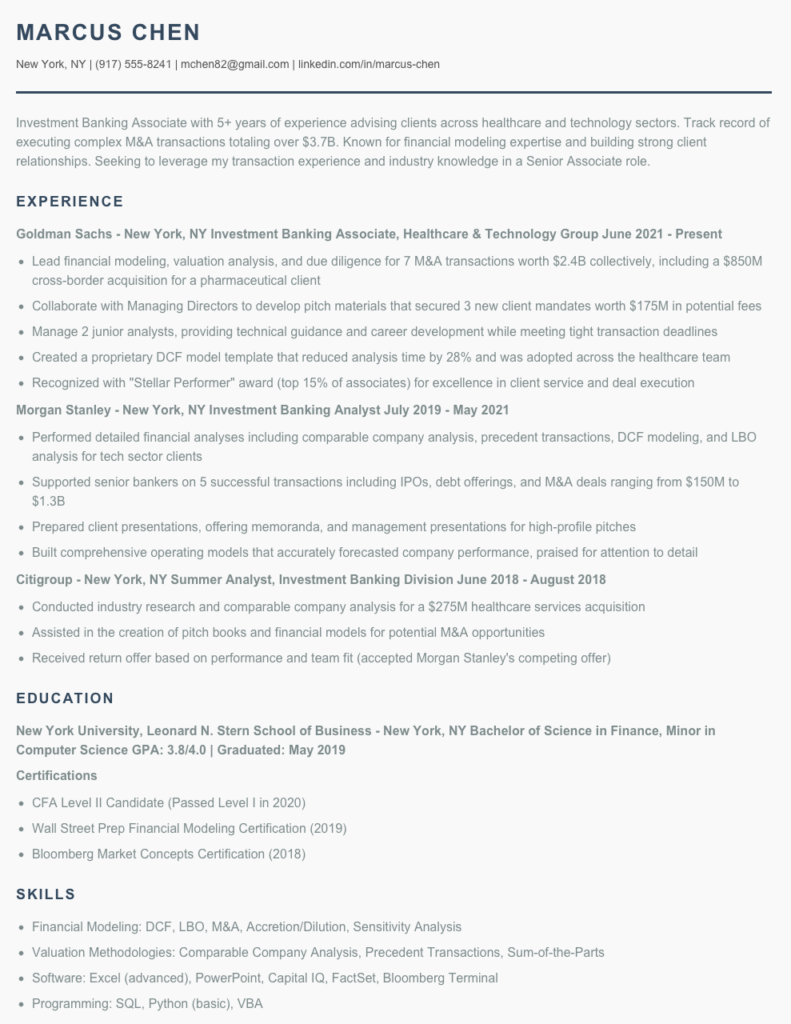

Marcus Chen

New York, NY | (917) 555-8241 | mchen82@gmail.com | linkedin.com/in/marcus-chen

Investment Banking Associate with 5+ years of experience advising clients across healthcare and technology sectors. Track record of executing complex M&A transactions totaling over $3.7B. Known for financial modeling expertise and building strong client relationships. Seeking to leverage my transaction experience and industry knowledge in a Senior Associate role.

EXPERIENCE

Goldman Sachs – New York, NY

Investment Banking Associate, Healthcare & Technology Group

June 2021 – Present

- Lead financial modeling, valuation analysis, and due diligence for 7 M&A transactions worth $2.4B collectively, including a $850M cross-border acquisition for a pharmaceutical client

- Collaborate with Managing Directors to develop pitch materials that secured 3 new client mandates worth $175M in potential fees

- Manage 2 junior analysts, providing technical guidance and career development while meeting tight transaction deadlines

- Created a proprietary DCF model template that reduced analysis time by 28% and was adopted across the healthcare team

- Recognized with “Stellar Performer” award (top 15% of associates) for excellence in client service and deal execution

Morgan Stanley – New York, NY

Investment Banking Analyst

July 2019 – May 2021

- Performed detailed financial analyses including comparable company analysis, precedent transactions, DCF modeling, and LBO analysis for tech sector clients

- Supported senior bankers on 5 successful transactions including IPOs, debt offerings, and M&A deals ranging from $150M to $1.3B

- Prepared client presentations, offering memoranda, and management presentations for high-profile pitches

- Built comprehensive operating models that accurately forecasted company performance, praised for attention to detail

Citigroup – New York, NY

Summer Analyst, Investment Banking Division

June 2018 – August 2018

- Conducted industry research and comparable company analysis for a $275M healthcare services acquisition

- Assisted in the creation of pitch books and financial models for potential M&A opportunities

- Received return offer based on performance and team fit (accepted Morgan Stanley’s competing offer)

EDUCATION

New York University, Leonard N. Stern School of Business – New York, NY

Bachelor of Science in Finance, Minor in Computer Science

GPA: 3.8/4.0 | Graduated: May 2019

Certifications

- CFA Level II Candidate (Passed Level I in 2020)

- Wall Street Prep Financial Modeling Certification (2019)

- Bloomberg Market Concepts Certification (2018)

SKILLS

- Financial Modeling: DCF, LBO, M&A, Accretion/Dilution, Sensitivity Analysis

- Valuation Methodologies: Comparable Company Analysis, Precedent Transactions, Sum-of-the-Parts

- Software: Excel (advanced), PowerPoint, Capital IQ, FactSet, Bloomberg Terminal

- Programming: SQL, Python (basic), VBA

- Industry Knowledge: Healthcare (pharma, biotech, services), Technology (SaaS, fintech)

- Languages: English (native), Mandarin Chinese (conversational)

ADDITIONAL

- Member, New York Society of Financial Analysts (2020-Present)

- Volunteer, Wall Street Mentorship Program for Underrepresented Students (2021-Present)

- Completed NYC Marathon in 2022 (personal fundraising goal of $4,500 for cancer research)

Senior / Experienced Investment Banking Associate Resume Example

MARCUS J. RICHARDSON

New York, NY | (212) 555-7842 | m.richardson@emaildomain.com | linkedin.com/in/mjrichardson

Investment Banking Associate with 8+ years of experience across M&A, capital markets and corporate finance. Executed 14+ transactions valued at $3.7B+ in the technology and healthcare sectors. Adept at financial modeling, due diligence and client relationship management. Consistently recognized for analytical rigor and ability to close complex deals under tight deadlines.

EXPERIENCE

Vice President – Investment Banking, Goldman Sachs | New York, NY | Jan 2021 – Present

- Lead execution of 5 M&A transactions (combined value $1.2B) within the enterprise software sector, driving 17% YoY growth in division revenue

- Manage team of 3 associates and 4 analysts; implemented new training program that reduced ramp-up time by 23%

- Developed proprietary valuation model for SaaS companies that improved accuracy of EBITDA projections by 12%

- Created pitch materials that secured 2 mandates worth $15M in fees, including the division’s largest tech client win of 2022

- Serve as primary day-to-day contact for C-suite executives at 4 key accounts, strengthening client retention

Senior Associate, Morgan Stanley | New York, NY | Aug 2018 – Dec 2020

- Executed 6 debt and equity offerings totaling $780M for mid-market healthcare companies

- Co-led due diligence for $450M acquisition of medical device manufacturer, identifying $27M in synergies

- Built complex financial models for LBOs, M&A, DCF and accretion/dilution analyses under tight deadlines

- Mentored 5 junior associates, 2 of whom received early promotions based on exceptional performance

Investment Banking Associate, Credit Suisse | New York, NY | June 2015 – July 2018

- Supported senior bankers on 3 IPOs and 4 M&A transactions valued at $1.7B+ across technology and healthcare sectors

- Created comprehensive company and industry analyses, competitive landscapes and client presentations

- Performed detailed financial analysis and modeling for buy-side and sell-side M&A situations

- Recognized with “Outstanding Contributor” award for working through technical valuation issues on a difficult healthcare merger (2017)

EDUCATION

Master of Business Administration (MBA) – Finance Concentration

Columbia Business School | New York, NY | 2015

GPA: 3.86/4.0 | Investment Banking Club President

Bachelor of Science, Economics – Minor in Computer Science

University of Pennsylvania | Philadelphia, PA | 2013

GPA: 3.75/4.0 | Summa Cum Laude

CERTIFICATIONS & PROFESSIONAL DEVELOPMENT

Chartered Financial Analyst (CFA) – Levels I, II, III (2017)

Financial Modeling & Valuation Analyst (FMVA) – Corporate Finance Institute (2016)

Wall Street Prep – Financial Modeling Bootcamp (2015)

SKILLS

- Financial Modeling (M&A, LBO, DCF, Comps)

- Due Diligence & Deal Execution

- Capital Markets (Debt & Equity)

- Client Relationship Management

- Team Leadership & Mentoring

- Bloomberg Terminal & FactSet

- Pitch Book Development

- Financial Statement Analysis

- Excel & PowerPoint (Expert)

- Salesforce CRM

ADDITIONAL INFORMATION

Languages: English (Native), Spanish (Proficient), Mandarin (Basic)

Volunteer: Junior Achievement Financial Literacy Program, Instructor (2018-Present)

Interests: Marathon running (completed NYC Marathon 2019, 2022), classical piano

How to Write an Investment Banking Associate Resume

Introduction

Landing that coveted Investment Banking Associate role means first getting past the resume screening process—where you're up against hundreds of equally qualified candidates. Your resume isn't just a document; it's your ticket to the interview stage. Having reviewed thousands of banking resumes over the years, I've seen what works (and what spectacularly fails). This guide will help you craft a resume that catches a hiring manager's eye in the 30 seconds they typically spend reviewing it.

Resume Structure and Format

Investment banking is conservative by nature and your resume should reflect that sensibility.

- Length: Stick to one page unless you have 7+ years of significant experience

- Font: Use clean, professional fonts like Calibri or Arial (11-12pt)

- Margins: 0.75-1 inch on all sides (don't cram everything by shrinking margins!)

- File format: Submit as PDF to maintain formatting

- Naming convention: "FirstName_LastName_Resume.pdf" (sounds obvious, but you'd be surprised how many "Resume_Final_v3.pdf" I receive)

Don't waste valuable space with an objective statement. Banking recruiters know what your objective is—to get the job you're applying for. Use that space for achievements instead.

Profile/Summary Section

For Associate positions, a brief 2-3 line professional summary works well. Focus on your banking experience, deal exposure and quantifiable results. For example:

"Investment professional with 3.5 years of M&A experience across healthcare and technology sectors. Executed 6 transactions totaling $1.7B in deal value. Proficient in financial modeling, valuation and due diligence processes."

Professional Experience

This is where you'll win or lose the interview invitation. Banking is results-driven, so your bullets should be too.

- Start each bullet with a strong action verb (led, executed, analyzed—not "responsible for")

- Quantify whenever possible (deal size, percentage improvements, number of pitchbooks)

- Highlight technical skills like LBO modeling, DCF analysis and comparable companies analysis

- Mention client exposure and specific deal types you've worked on

- Showcase your ability to work under pressure and manage multiple workstreams

Education and Certifications

For Associate roles, your education still matters significantly. Include:

- Degrees with graduation dates (and expected graduation for in-progress degrees)

- GPA if above 3.5 (if not, leave it off)

- Relevant coursework in finance, accounting, economics

- CFA progress (even Level I candidate status is worth mentioning)

- Financial modeling certifications (BIWS, Wall Street Prep, etc.)

Keywords and ATS Tips

Most banks use Applicant Tracking Systems that scan for relevant keywords before a human ever sees your resume. Some essential terms to include:

- Technical skills: Financial modeling, valuation, LBO, M&A, DCF, comps

- Software proficiency: Excel, PowerPoint, Capital IQ, FactSet, Bloomberg

- Deal exposure: Buy-side, sell-side, equity offerings, debt financing

- Soft skills: Client interaction, team leadership, project management

Industry-specific Terminology

Banking has its own language. Show you speak it fluently by naturally incorporating terms like:

- Synergy analysis

- Accretion/dilution modeling

- Pitchbook development

- Teaser and CIM preparation

- Data room management

- Working capital adjustment

Common Mistakes to Avoid

I've seen brilliant candidates sabotage themselves with these easily fixable errors:

- Spelling errors in bank names (it's "Goldman Sachs," not "Goldman Saks")

- Vague descriptions of deal experience

- Inconsistent formatting of dates and company names

- Focusing too much on responsibilities rather than achievements

- Including irrelevant personal interests (your marathon time is impressive, but irrelevant)

Before/After Example

Before: "Responsible for creating financial models and helping with client presentations."

After: "Built 15+ complex financial models (DCF, LBO, M&A) supporting a $425M cross-border acquisition in the renewable energy sector, which closed 3 weeks ahead of schedule."

Remember—banking resumes aren't just about listing jobs. They're about demonstrating your ability to execute deals, work insane hours without complaint and add immediate value to the team. Good luck!

Related Resume Examples

Soft skills for your Investment Banking Associate resume

- Cross-functional relationship building – particularly with legal, compliance, and client management teams

- Stress management under tight deal deadlines (maintained composure during 3 consecutive all-nighters for urgent M&A transaction)

- Client communication – translating complex financial models into actionable insights for non-technical stakeholders

- Team leadership in high-pressure environments – mentored 4 junior analysts while managing director was on leave

- Persuasive presentation skills – regularly pitch to C-suite executives and investment committees

- Diplomatic handling of competing priorities between deal team members and managing directors

Hard skills for your Investment Banking Associate resume

- Financial modeling (DCF, LBO, M&A, comparable company analysis)

- Bloomberg Terminal and Capital IQ proficiency

- Microsoft Excel (complex formulas, VLOOKUP, macros, pivot tables)

- Pitchbook creation using PowerPoint

- Financial statement analysis and forecasting

- Deal execution documentation (CIMs, teasers, NDAs)

- SQL querying for financial database management

- Industry-specific valuation techniques (SaaS metrics, E&P reserves)

- Series 79 and 63 licenses