Grant Accountant Resume examples & templates

Copyable Grant Accountant Resume examples

Grant Accountants aren't just number crunchers—they're the financial guardians who make world-changing research, community programs, and nonprofit missions possible. Behind every funded cancer research study, every after-school program in underserved communities, and every environmental conservation effort stands a Grant Accountant ensuring every dollar is properly tracked, reported, and maximized. It's a profession where precision meets purpose, where reconciling to the penny can directly impact lives.

The field is evolving rapidly as government and private foundation funding becomes increasingly competitive. With over $789 billion in federal grants distributed annually, organizations face mounting pressure to demonstrate financial accountability. This has shifted Grant Accounting from a back-office function to a strategic partner in securing and maintaining funding streams. Today's Grant Accountants need proficiency in specialized software like Blackbaud or Sage Intacct, familiarity with Uniform Guidance regulations, and the communication skills to translate complex financial requirements to non-financial team members. As funding landscapes continue to transform—particularly with the rise of performance-based grants—professionals who can navigate both compliance requirements and strategic financial planning will find themselves at the center of tomorrow's most impactful initiatives.

Junior Grant Accountant Resume Example

Natalie Chen

natalie.chen93@gmail.com | (510) 427-9182 | linkedin.com/in/nataliechen93 | Oakland, CA

Detail-oriented Grant Accountant with 1+ year of experience monitoring financial compliance for government and foundation grants. Skilled in fund accounting, financial reporting, and maintaining documentation for multiple funding sources. Fast learner who thrives in deadline-driven environments and can explain complex financial requirements to non-finance team members.

EXPERIENCE

Grant Accountant – Bay Area Community Services (BACS) | Oakland, CA | June 2022 – Present

- Track and monitor $1.2M in government grant expenditures across 7 federal and state programs

- Prepare monthly financial reports for program directors with 97% accuracy, reducing review time by 4 hours

- Reconcile grant-related general ledger accounts and flag discrepancies over $500 for review

- Assist with quarterly grant drawdown requests, ensuring compliance with funder requirements

- Support year-end audit preparation by organizing grant documentation and expenditure records

Accounting Assistant (Part-time) – East Bay Housing Coalition | Berkeley, CA | Sept 2021 – May 2022

- Processed accounts payable for nonprofit organization managing 6 affordable housing projects

- Coded invoices to appropriate funding sources and maintained filing system for grant documentation

- Helped track expenses against 4 HUD grants totaling $875K in annual funding

- Created Excel spreadsheets to monitor budget-to-actual variances for grant-funded programs

Accounting Intern – Alameda County Office of Education | Hayward, CA | Jan 2021 – April 2021

- Assisted accounting team with basic reconciliations and data entry during 15-week internship

- Gained exposure to fund accounting principles and government reporting requirements

- Helped organize documentation for Title I educational grant programs

EDUCATION

Bachelor of Science, Accounting – California State University, East Bay | May 2021

- GPA: 3.7/4.0

- Relevant Coursework: Fund Accounting, Cost Accounting, Auditing, Government & Nonprofit Accounting

- Member, Beta Alpha Psi Accounting Honor Society

CERTIFICATIONS

Uniform Guidance Training Certificate – Grant Management USA | December 2022

Excel Specialist Certification – Microsoft | March 2021

SKILLS

- Fund Accounting

- Grant Financial Reporting

- General Ledger Reconciliation

- Compliance Documentation

- Microsoft Excel (advanced formulas, pivot tables)

- QuickBooks

- Budget Tracking

- Federal Cost Principles

- Financial Record-keeping

- Blackbaud Financial Edge (basic)

Mid-level Grant Accountant Resume Example

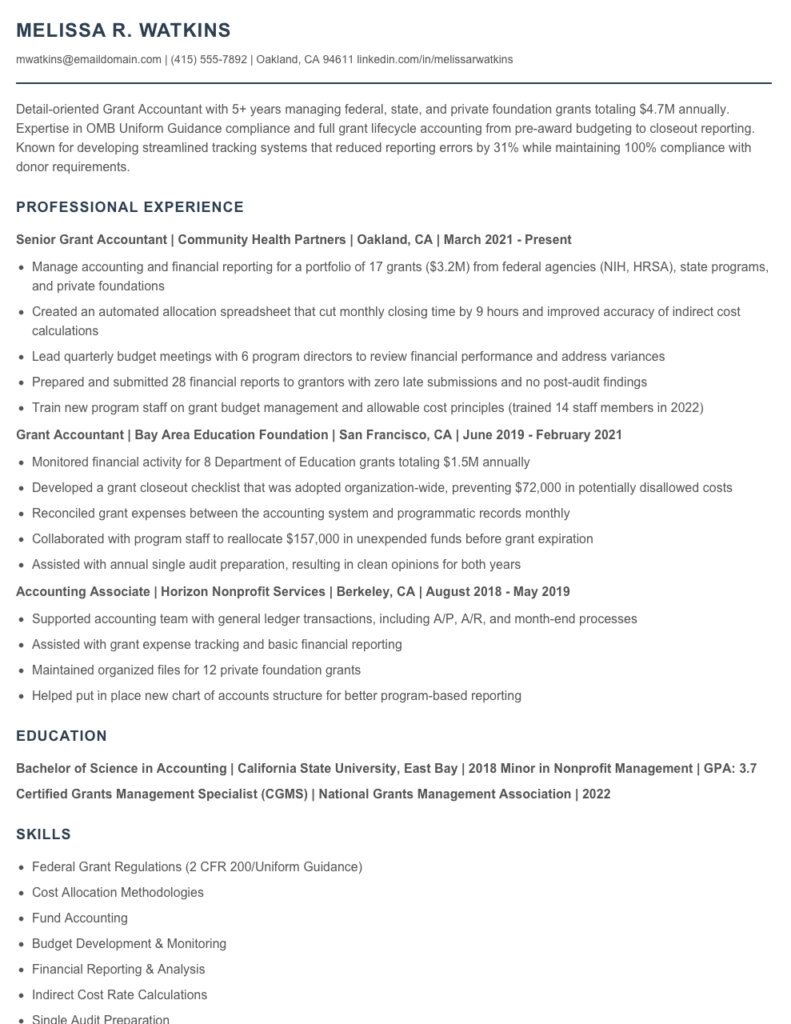

Melissa R. Watkins

mwatkins@emaildomain.com | (415) 555-7892 | Oakland, CA 94611

linkedin.com/in/melissarwatkins

Detail-oriented Grant Accountant with 5+ years managing federal, state, and private foundation grants totaling $4.7M annually. Expertise in OMB Uniform Guidance compliance and full grant lifecycle accounting from pre-award budgeting to closeout reporting. Known for developing streamlined tracking systems that reduced reporting errors by 31% while maintaining 100% compliance with donor requirements.

PROFESSIONAL EXPERIENCE

Senior Grant Accountant | Community Health Partners | Oakland, CA | March 2021 – Present

- Manage accounting and financial reporting for a portfolio of 17 grants ($3.2M) from federal agencies (NIH, HRSA), state programs, and private foundations

- Created an automated allocation spreadsheet that cut monthly closing time by 9 hours and improved accuracy of indirect cost calculations

- Lead quarterly budget meetings with 6 program directors to review financial performance and address variances

- Prepared and submitted 28 financial reports to grantors with zero late submissions and no post-audit findings

- Train new program staff on grant budget management and allowable cost principles (trained 14 staff members in 2022)

Grant Accountant | Bay Area Education Foundation | San Francisco, CA | June 2019 – February 2021

- Monitored financial activity for 8 Department of Education grants totaling $1.5M annually

- Developed a grant closeout checklist that was adopted organization-wide, preventing $72,000 in potentially disallowed costs

- Reconciled grant expenses between the accounting system and programmatic records monthly

- Collaborated with program staff to reallocate $157,000 in unexpended funds before grant expiration

- Assisted with annual single audit preparation, resulting in clean opinions for both years

Accounting Associate | Horizon Nonprofit Services | Berkeley, CA | August 2018 – May 2019

- Supported accounting team with general ledger transactions, including A/P, A/R, and month-end processes

- Assisted with grant expense tracking and basic financial reporting

- Maintained organized files for 12 private foundation grants

- Helped put in place new chart of accounts structure for better program-based reporting

EDUCATION

Bachelor of Science in Accounting | California State University, East Bay | 2018

Minor in Nonprofit Management | GPA: 3.7

Certified Grants Management Specialist (CGMS) | National Grants Management Association | 2022

SKILLS

- Federal Grant Regulations (2 CFR 200/Uniform Guidance)

- Cost Allocation Methodologies

- Fund Accounting

- Budget Development & Monitoring

- Financial Reporting & Analysis

- Indirect Cost Rate Calculations

- Single Audit Preparation

- Grant Budget Modifications

- Software: QuickBooks, Blackbaud Financial Edge, Microsoft Excel (advanced), GrantHub

PROFESSIONAL AFFILIATIONS

National Grants Management Association (NGMA), Member since 2020

American Institute of Certified Public Accountants (AICPA), Student Member

Senior / Experienced Grant Accountant Resume Example

JEFFREY L. PARKER

Boston, MA • (617) 555-0182 • jeff.parker@email.com • linkedin.com/in/jeffreyparker

Grant Accounting professional with 9+ years managing complex federal, state, and private funding portfolios. Known for developing streamlined financial tracking systems that reduced reporting errors by 27%. Proven ability to navigate compliance requirements for organizations with up to $12.4M in annual grant funding while maintaining clean audit history. Seeking to leverage expertise in a senior grant accounting role.

PROFESSIONAL EXPERIENCE

Senior Grant Accountant | Boston Medical Research Foundation | Boston, MA | March 2019 – Present

- Oversee financial management for 23 active grants totaling $8.7M, including NIH, NSF, and private foundation funding

- Developed custom Excel workbooks with advanced formulas that reduced monthly closing time from 5 days to 2.5 days

- Lead quarterly budget reviews with 7 principal investigators, providing guidance on allowable costs and spending forecasts

- Cut non-compliance incidents by 31% by implementing a pre-award review process for grant applications

- Train and supervise 2 junior accountants on grant-specific accounting procedures and federal compliance requirements

Grant Accountant | Northeastern Community Health Coalition | Cambridge, MA | June 2016 – March 2019

- Managed financial reporting for a portfolio of 14 grants ($4.2M) from HHS, CDC, and local foundations

- Created standardized documentation procedures that were adopted organization-wide, improving audit preparedness

- Reconciled complex grant expenditures across multiple cost centers, identifying $76K in misallocated expenses

- Collaborated with program directors to develop budgets for new grant proposals with 72% success rate

- Rebuilt the chart of accounts to align with federal reporting requirements while maintaining state compliance

Staff Accountant | Greenfield Public School District | Greenfield, MA | August 2014 – June 2016

- Assisted with financial management of $1.3M in Title I and IDEA grant funds

- Processed biweekly payroll allocations for grant-funded positions across 9 schools

- Maintained detailed documentation of grant expenditures to support annual single audit

- Helped implement new accounting software that reduced manual data entry by 40%

EDUCATION & CERTIFICATIONS

Master of Science, Accounting | University of Massachusetts Boston | 2017

Bachelor of Business Administration, Finance | Bentley University | 2013

Certified Public Accountant (CPA) | Massachusetts | License #CP-2398754

Certified Grants Management Specialist (CGMS) | National Grants Management Association | 2020

TECHNICAL SKILLS

- Grant Management Systems: GrantVantage, SmartSimple, Fluxx

- Accounting Software: Oracle NetSuite, Blackbaud Financial Edge, QuickBooks

- Proficient in Excel (pivot tables, VLOOKUP, macros, Power Query)

- Federal grants regulations (2 CFR 200/Uniform Guidance)

- Cost allocation methodologies and indirect cost rate calculation

- Budget development and forecasting

- Financial statement preparation and analysis

- Single Audit preparation (Subpart F)

PROFESSIONAL AFFILIATIONS

National Grants Management Association (NGMA) – Member since 2018

American Institute of Certified Public Accountants (AICPA) – Member since 2017

How to Write a Grant Accountant Resume

Introduction

Landing a Grant Accountant role isn't just about having the right skills—it's about making those skills jump off the page. I've reviewed thousands of accounting resumes over my career, and the difference between getting passed over and landing an interview often comes down to how well your resume speaks the language of grant management. Unlike general accounting positions, grant accounting requires specific expertise in fund tracking, compliance, and reporting that must be front and center on your resume.

Resume Structure and Format

Keep your resume clean and scannable. Grant accounting requires attention to detail, and your resume should reflect that quality. Most hiring managers at nonprofits, educational institutions, and government agencies spend just 7.4 seconds on initial resume scans!

- Stick to 1-2 pages (1 page for junior roles, 2 pages for roles with 5+ years of experience)

- Use clear section headings (Experience, Education, Certifications, Skills)

- Choose readable fonts like Calibri, Arial, or Garamond at 10-12pt size

- Include plenty of white space—cramped documents get overlooked

- Save as a PDF to preserve formatting (unless instructions specify otherwise)

Grant accounting is as much about storytelling as it is about numbers. Your resume should tell the story of how you've maintained compliance while maximizing the impact of funding—two things every organization desperately needs.

Profile/Summary Section

Your summary should be brief (3-4 lines) but packed with your most relevant qualifications. Mention your years of experience, areas of specialization, and one standout achievement. For example:

"Grant Accountant with 6 years of experience managing federal and private foundation awards totaling $8.7M annually. Specialized in OMB Uniform Guidance compliance, indirect cost recovery, and financial reporting. Reduced post-award audit findings by 92% at Westview Community Services through improved documentation procedures."

Professional Experience

This is where you'll make or break your

application. Grant Accountants need to demonstrate both technical accounting skills and grant-specific expertise:

- Lead with action verbs (managed, reconciled, prepared, implemented)

- Include specific grant types you've worked with (federal, state, foundation)

- Mention actual dollar amounts managed (not "$1M+" but "$1.2M")

- Highlight compliance frameworks you know (Uniform Guidance, GAAP, etc.)

- Quantify achievements where possible (error reduction, processing time)

Example bullet: "Managed monthly close process for 17 federal grants worth $3.4M, ensuring 100% compliance with OMB Uniform Guidance while reducing reporting time from 12 days to 5 days."

Education and Certifications

For Grant Accountants, relevant certifications can be just as important as degrees. List your degree(s) first, then certifications. Include:

- Bachelor's/Master's in Accounting, Finance, or related field

- CPA license (if applicable)

- Specialized certifications (CGFM, CGMS, NFP Certificate)

- Relevant training (Federal Grants Management, OMB Uniform Guidance workshops)

Keywords and ATS Tips

Most employers use Applicant Tracking Systems to filter resumes before human eyes ever see them. Include these terms naturally throughout your resume:

- Grant management software (Blackbaud, Sage Intacct, Oracle Grants)

- Compliance terms (Uniform Guidance, A-133, Single Audit)

- Financial processes (drawdowns, financial reporting, grant closeout)

- Reporting types (FFR, SF-425, SEFA)

- Budget management (cost allocation, indirect costs, match requirements)

Industry-specific Terms

Show your expertise by naturally incorporating grant accounting terminology:

- Allowable costs

- Cost principles

- Subrecipient monitoring

- Drawdown procedures

- Restricted vs. unrestricted funds

- In-kind contributions

- Time & effort reporting

Common Mistakes

I've seen hundreds of grant accounting resumes that miss the mark by:

- Focusing too much on general accounting and not enough on grant-specific skills

- Failing to mention specific funding agencies or grant types

- Omitting compliance knowledge (the #1 concern for most employers!)

- Using vague statements instead of concrete examples

- Missing key software proficiencies

Before/After Example

Before: "Responsible for grant accounting and reporting."

After: "Managed full lifecycle accounting for 12 federal grants ($2.7M) and 8 foundation grants ($943K), producing 37 financial reports annually with zero compliance findings during 2022 single audit."

Remember—your resume needs to show not just what you did, but how well you did it and what difference it made. Grant funders demand accountability, and employers want someone who can deliver it!

Related Resume Examples

Soft skills for your Grant Accountant resume

- Stakeholder relationship management – ability to translate complex financial data for non-accounting team members

- Cross-functional collaboration with program managers and funding agencies

- Attention to detail while maintaining big-picture perspective on program objectives

- Time management during high-pressure reporting periods (especially quarter/year-end)

- Adaptability to changing grant requirements and compliance frameworks

- Written communication skills for audit responses and funding justifications

Hard skills for your Grant Accountant resume

- Government grant accounting (OMB Uniform Guidance, GAAP)

- NetSuite financial modules with grant management add-ons

- Advanced Excel modeling (pivot tables, VLOOKUP, INDEX/MATCH)

- Federal Financial Report (FFR) preparation and submission

- Cost allocation methodology across multiple funding sources

- QuickBooks Non-Profit Edition (8+ years experience)

- Indirect cost rate negotiation and management

- Grant budget variance analysis and forecasting

- Blackbaud Financial Edge NXT reporting suite