Financial Specialist Resume examples & templates

Copyable Financial Specialist Resume examples

Ever wondered why financial specialists are the unsung heroes behind every major business decision? They're the ones translating complex financial data into strategic insights that guide companies through both calm and choppy economic waters. Financial specialists blend analytical precision with business acumen to help organizations manage risk, optimize resources, and identify growth opportunities—skills that have become even more crucial since the pandemic reshuffled market dynamics.

The field is evolving rapidly, with 67% of financial professionals now reporting that data analysis skills are more important than traditional accounting knowledge, according to a 2023 Robert Half survey. We're seeing a shift from number-crunching to strategic advisory roles, with specialists increasingly partnering with AI tools to handle routine calculations while they focus on higher-value analysis. For those with the right mix of technical knowledge and business sense, this career path offers remarkable stability (financial operations continue regardless of economic conditions!) and competitive compensation. Looking ahead, financial specialists who can connect financial metrics to sustainability goals will likely find themselves in particularly high demand as ESG reporting requirements expand across industries.

Junior Financial Specialist Resume Example

MARCUS RODRIGUEZ

Boston, MA | (617) 555-8124 | mrodriguez@emailprovider.com | linkedin.com/in/marcusrodriguez

Detail-oriented Financial Specialist with 1+ year of experience in accounts payable and financial reporting. Fast learner with strong Excel skills who thrives in fast-paced environments. Recognized for accuracy in data entry and reconciliation processes that reduced month-end closing time by 14% for my team.

EXPERIENCE

Financial Specialist – Eastern Credit Union, Boston, MA (January 2023 – Present)

- Process 75+ vendor invoices weekly, maintaining 99.7% accuracy rate and reducing payment delays by 22%

- Reconcile 4 corporate credit card accounts totaling $47,000+ in monthly expenses

- Assist with month-end closing procedures, including journal entries and account reconciliations

- Created Excel template that automated expense categorization, saving team 3.5 hours weekly

- Collaborate with Accounts Receivable team on cross-departmental reporting initiatives

Finance Intern – Meridian Financial Group, Boston, MA (May 2022 – December 2022)

- Supported accounts payable department by processing invoices and maintaining vendor files

- Performed data entry for financial transactions with 98% accuracy

- Helped prepare monthly financial reports for management review

- Organized and digitized 3 years of historical financial documents, improving accessibility

Student Assistant – University Finance Office, Boston University (Sept 2021 – April 2022)

- Processed student refunds and payments under supervision of Financial Aid coordinator

- Maintained student financial records and assisted with basic data entry tasks

- Answered student inquiries regarding account status and payment procedures

EDUCATION

Boston University – Bachelor of Science in Finance (May 2022)

- GPA: 3.6/4.0

- Relevant coursework: Financial Accounting, Corporate Finance, Financial Statement Analysis, Business Statistics

- Member, Finance & Investment Club

CERTIFICATIONS

Excel Specialist Certification (2023)

QuickBooks Online Fundamentals (In progress, expected completion Dec 2023)

SKILLS

- Accounts Payable/Receivable

- Month-End Close Procedures

- Financial Reporting

- Data Analysis

- Microsoft Excel (VLOOKUP, PivotTables)

- QuickBooks Online

- Expense Reconciliation

- Journal Entries

- Attention to Detail

- Vendor Management

Mid-level Financial Specialist Resume Example

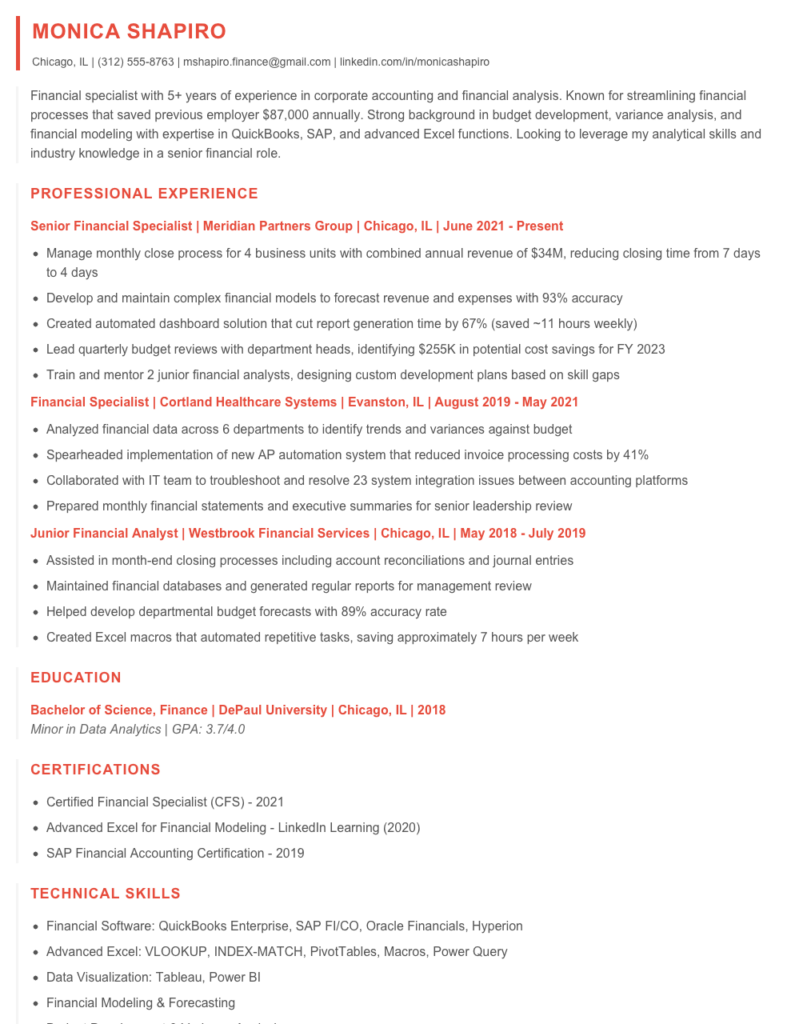

MONICA SHAPIRO

Chicago, IL | (312) 555-8763 | mshapiro.finance@gmail.com | linkedin.com/in/monicashapiro

Financial specialist with 5+ years of experience in corporate accounting and financial analysis. Known for streamlining financial processes that saved previous employer $87,000 annually. Strong background in budget development, variance analysis, and financial modeling with expertise in QuickBooks, SAP, and advanced Excel functions. Looking to leverage my analytical skills and industry knowledge in a senior financial role.

PROFESSIONAL EXPERIENCE

Senior Financial Specialist | Meridian Partners Group | Chicago, IL | June 2021 – Present

- Manage monthly close process for 4 business units with combined annual revenue of $34M, reducing closing time from 7 days to 4 days

- Develop and maintain complex financial models to forecast revenue and expenses with 93% accuracy

- Created automated dashboard solution that cut report generation time by 67% (saved ~11 hours weekly)

- Lead quarterly budget reviews with department heads, identifying $255K in potential cost savings for FY 2023

- Train and mentor 2 junior financial analysts, designing custom development plans based on skill gaps

Financial Specialist | Cortland Healthcare Systems | Evanston, IL | August 2019 – May 2021

- Analyzed financial data across 6 departments to identify trends and variances against budget

- Spearheaded implementation of new AP automation system that reduced invoice processing costs by 41%

- Collaborated with IT team to troubleshoot and resolve 23 system integration issues between accounting platforms

- Prepared monthly financial statements and executive summaries for senior leadership review

Junior Financial Analyst | Westbrook Financial Services | Chicago, IL | May 2018 – July 2019

- Assisted in month-end closing processes including account reconciliations and journal entries

- Maintained financial databases and generated regular reports for management review

- Helped develop departmental budget forecasts with 89% accuracy rate

- Created Excel macros that automated repetitive tasks, saving approximately 7 hours per week

EDUCATION

Bachelor of Science, Finance | DePaul University | Chicago, IL | 2018

Minor in Data Analytics | GPA: 3.7/4.0

CERTIFICATIONS

- Certified Financial Specialist (CFS) – 2021

- Advanced Excel for Financial Modeling – LinkedIn Learning (2020)

- SAP Financial Accounting Certification – 2019

TECHNICAL SKILLS

- Financial Software: QuickBooks Enterprise, SAP FI/CO, Oracle Financials, Hyperion

- Advanced Excel: VLOOKUP, INDEX-MATCH, PivotTables, Macros, Power Query

- Data Visualization: Tableau, Power BI

- Financial Modeling & Forecasting

- Budget Development & Variance Analysis

- Month-End Close Procedures

ADDITIONAL INFORMATION

Volunteer Treasurer, Chicago Youth Financial Literacy Program (2020-Present)

Languages: English (Native), Spanish (Conversational)

Senior / Experienced Financial Specialist Resume Example

Daniel Westbrook

New York, NY • (212) 555-7890 • daniel.westbrook@email.com • linkedin.com/in/danielwestbrook

Seasoned Financial Specialist with 9+ years of experience optimizing financial operations and driving strategic initiatives. Proven track record managing complex financial analyses, budgeting and forecasting for multi-million dollar portfolios; Excel in creating financial models that have reduced costs by 17% and improved reporting accuracy by 31% across organizations.

Professional Experience

Senior Financial Specialist | Greenwich Financial Partners | New York, NY | Jan 2019 – Present

- Lead financial planning and analysis for client portfolios totaling $87M, delivering quarterly performance reports that averaged 12.4% ROI (3.7% above industry benchmarks)

- Developed custom Excel models for cash flow forecasting that reduced projection variance by 31% and were adopted company-wide

- Manage 4-person team handling financial reporting and compliance, reducing audit findings by 76% over 3 years

- Spearheaded implementation of new financial management system that cut report generation time from 3 days to 4 hours

- Created monthly financial dashboards for C-suite executives, integrating data from 6 different sources into actionable intelligence

Financial Analyst | Meridian Capital Management | Boston, MA | Mar 2016 – Dec 2018

- Analyzed financial statements and market trends for portfolio of 28 mid-market clients ($5M-$25M revenue)

- Built comprehensive financial models for quarterly forecasting, improving accuracy by 23% year-over-year

- Collaborated with investment team on due diligence for 14 potential acquisitions, identifying $3.2M in overlooked liabilities

- Prepared financial presentations for board meetings, earning recognition for exceptional clarity from CEO

Junior Financial Analyst | Eastern Bank | Boston, MA | Aug 2014 – Feb 2016

- Supported senior analysts in budgeting and forecasting for commercial lending division ($450M portfolio)

- Automated monthly reporting process using Excel macros, saving team approximately 22 hours per month

- Reconciled general ledger accounts and prepared journal entries for month-end close

- Assisted with annual audit preparation, reducing document retrieval time by 43%

Education

Master of Science in Finance | Boston University | Boston, MA | 2014

Bachelor of Science in Accounting | University of Massachusetts | Amherst, MA | 2012

Certifications

Certified Financial Analyst (CFA), Level II Candidate

Certified Management Accountant (CMA)

Financial Modeling & Valuation Analyst (FMVA)

Technical Skills

- Advanced Excel (vlookups, pivot tables, macros, dashboard creation)

- Financial modeling & valuation

- SQL & database management

- SAP, Oracle Financials

- Bloomberg Terminal

- Microsoft Power BI & Tableau

- QuickBooks & NetSuite

- Monte Carlo simulation

Core Competencies

- Financial Planning & Analysis

- Budget Management

- Strategic Planning

- Risk Assessment

- Variance Analysis

- Cash Flow Forecasting

- Investor Relations

- Team Leadership

How to Write a Financial Specialist Resume

Introduction

Landing that Financial Specialist job means first getting past the resume gatekeepers. Whether you're applying to a large financial institution or a boutique firm, your resume is often your first impression—and it's gotta be good. Having reviewed thousands of financial resumes over my career, I've seen what works (and what really doesn't). This guide will walk you through creating a resume that showcases your financial expertise and helps you stand out from the stack of applications on a hiring manager's desk.

Resume Structure and Format

Financial professionals need resumes that reflect their attention to detail and organizational skills. Your resume should be:

- Clean and consistent – use a professional font like Calibri or Arial at 10-12pt

- Properly spaced with clear section breaks (white space is your friend!)

- 1-2 pages max – one page for less than 10 years experience, two pages for senior roles

- Saved as a PDF (unless specifically requested in another format)

- Named professionally – "FirstName_LastName_Resume.pdf" rather than "MyResume_Final_Final_v3.pdf"

For Financial Specialists in particular, consider a format that highlights both your technical expertise and your soft skills. Chronological formats work well if you have steady career progression, while combination formats can better showcase specialized skills.

Profile/Summary Section

Think of this 3-4 line section as your elevator pitch. What makes you different from the 49 other Financial Specialists applying for this job?

Skip the generic "detail-oriented professional seeking to leverage skills" opener. Instead, lead with specifics like "Financial Specialist with 5+ years optimizing cash flow management systems that reduced processing time by 31% at Morgan Stanley."

This is your chance to immediately signal your value. Include your years of experience, one or two specializations, and a notable achievement. For junior roles, emphasize relevant education and internships instead.

Professional Experience

The meat of your resume! For each position, include:

- Company name, location, and dates (month/year)

- Your exact title (don't embellish!)

- 4-6 bullet points describing achievements, not just responsibilities

- Quantifiable results whenever possible – "Processed $4.7M in monthly transactions with 99.8% accuracy" beats "Responsible for processing transactions"

Front-load your bullets with strong action verbs like "analyzed," "reconciled," "forecasted," or "streamlined." And for heaven's sake, don't just copy your job description—hiring managers want to know what you accomplished, not what you were supposed to do.

Education and Certifications

Financial roles often require specific credentials. List your:

- Degree(s), institution(s), graduation year(s), and GPA if above 3.5

- Relevant certifications (CFA, CPA, Series 7, etc.) with dates obtained

- Continuing education or specialized training

If you're fresh out of school, this section can go above your experience. Mid-career? Keep it brief and move it down.

Keywords and ATS Tips

Most companies use Applicant Tracking Systems (ATS) to screen resumes before human eyes ever see them. To get past these digital gatekeepers:

- Mirror language from the job posting (if they say "financial analysis," don't just say "financial evaluation")

- Include industry-standard abbreviations AND spelled-out versions (e.g., "Generally Accepted Accounting Principles (GAAP)")

- Avoid tables, headers/footers, and fancy formatting that ATS systems might misread

- Incorporate 8-12 key skills directly relevant to the position

Industry-specific Terms

Sprinkle these throughout your resume (where relevant) to signal your financial fluency:

- Financial reporting and analysis

- General ledger reconciliation

- Budget forecasting

- AP/AR management

- Regulatory compliance (mention specific regulations if applicable)

- Financial software (QuickBooks, SAP, Oracle Financials, etc.)

- Risk assessment and mitigation

Common Mistakes

I see these errors constantly, and they can sink an otherwise solid application:

- Listing every Excel function you know (focus on advanced skills like pivot tables, VLOOKUP, macros)

- Including irrelevant experience (your bartending job from college probably isn't helping)

- Using vague descriptors ("good communication skills") instead of concrete examples

- Inconsistent tense or formatting (past tense for previous jobs, present for current position)

- Typos or math errors (fatal in finance!)

Before/After Example

BEFORE: "Responsible for accounts payable at mid-sized company. Processed invoices and maintained records."

AFTER: "Managed $1.2M monthly AP workflow for 37 vendors, implementing digital approval system that cut processing time from 6 days to 48 hours while eliminating payment errors."

See the difference? The second version shows scale, specific improvements, and measurable results—exactly what hiring managers in finance look for.

Related Resume Examples

Soft skills for your Financial Specialist resume

- Stakeholder relationship management – adept at navigating complex financial discussions with executives, clients, and cross-functional teams

- Financial storytelling – can translate complex data into compelling narratives that non-finance colleagues understand and act upon

- Change resilience – thrived during two major accounting system migrations while maintaining reporting accuracy

- Workload prioritization – juggle competing deadlines across month-end close, special projects, and ad-hoc analysis requests

- Team mentorship – informally coach junior analysts on technical skills while building their confidence in client interactions

- Conflict resolution – diplomatically address discrepancies between departmental forecasts and actual financial results

Hard skills for your Financial Specialist resume

- Proficient in QuickBooks, Sage 50 and NetSuite financial software

- Advanced Excel modeling (VLOOKUP, pivot tables, macros)

- Accounts payable/receivable management with 3-way matching

- Experience with SAP Financial Accounting module

- Fixed asset accounting and depreciation calculations

- Month-end close procedures and financial reporting

- Tax preparation using UltraTax CS and ProSystem fx

- Working knowledge of GAAP standards and compliance

- Risk assessment and internal controls implementation