Financial Services Representative Resume examples & templates

Copyable Financial Services Representative Resume examples

Ever wondered what it's like to be the financial GPS for people navigating life's biggest money decisions? Financial Services Representatives do exactly that—guiding clients through everything from buying their first home to planning for retirement. It's a career that blends analytical thinking with genuine human connection, where you'll translate complex financial concepts into actionable advice that real people can use. And the timing couldn't be better: with nearly 76% of Americans feeling anxious about their financial situation (according to a 2023 Capital One CreditWise survey), skilled financial guides are in serious demand.

The industry is shifting toward a more holistic approach too. Gone are the days when the job was just about selling products. Today's financial services reps are part advisor, part educator, and part coach—helping clients build financial literacy while addressing their unique needs. As traditional banking continues to merge with digital services, those who can bridge the human-tech gap will find themselves with plenty of opportunities to grow. Whether you're naturally good with numbers or love helping people solve problems, this field offers a path where both skills can shine.

Junior Financial Services Representative Resume Example

LUCAS HAYES

Chicago, IL • (312) 555-8741 • l.hayes@emaildomain.com • linkedin.com/in/lucashayes

Detail-oriented Financial Services Representative with 18 months of experience in customer service and financial operations. Quick learner with strong communication skills and a knack for explaining complex financial concepts in simple terms. Reliable team player with excellent time management skills seeking growth opportunities in retail banking.

PROFESSIONAL EXPERIENCE

Financial Services Representative – First Community Bank, Chicago, IL

January 2023 – Present

- Process 30+ daily transactions including deposits, withdrawals, and loan payments with 99.7% accuracy

- Identify and recommend appropriate financial products to customers based on their needs and financial goals, resulting in 17 new account openings last quarter

- Assist branch manager with daily reconciliation and branch opening/closing procedures

- Resolve customer inquiries and complaints with a 94% first-contact resolution rate

- Completed advanced training in mortgage pre-qualifications and personal loan applications

Customer Service Intern – Midwest Credit Union, Evanston, IL

May 2022 – December 2022

- Shadowed senior representatives to learn credit union operations and member service procedures

- Managed incoming calls and directed members to appropriate departments

- Assisted with document preparation and filing for new accounts and loan applications

- Participated in weekly team meetings to discuss process improvements and customer satisfaction metrics

Retail Sales Associate (Part-time) – Urban Outfitters, Chicago, IL

September 2020 – May 2022

- Processed payments and maintained cash drawer accuracy during busy shopping periods

- Provided attentive customer service to 50+ customers daily while multitasking in a fast-paced environment

- Recognized as “Employee of the Month” in March 2021 for exceptional customer service

EDUCATION

Bachelor of Business Administration, Finance

DePaul University, Chicago, IL

Graduated: December 2021

Relevant Coursework: Financial Markets, Banking Operations, Consumer Lending, Financial Statement Analysis, Business Communication

CERTIFICATIONS & TRAINING

- FINRA Securities Industry Essentials (SIE) Exam – In progress

- First Community Bank Customer Service Excellence Program (2023)

- Anti-Money Laundering (AML) Compliance Training (2023)

- Microsoft Excel Intermediate Certification (2021)

SKILLS

- Banking Software: Fiserv DNA, Jack Henry Silverlake

- Transaction Processing & Cash Handling

- Customer Needs Assessment

- Financial Product Knowledge

- CRM Systems (Salesforce basics)

- Microsoft Office Suite (Advanced Excel)

- Regulatory Compliance (BSA/AML basics)

- Problem Resolution

- Spanish (Conversational)

PROFESSIONAL AFFILIATIONS

- Young Professionals in Finance – Chicago Chapter, Member since 2022

- Financial Services Volunteer Corps – Participated in 2 community financial literacy workshops

Mid-level Financial Services Representative Resume Example

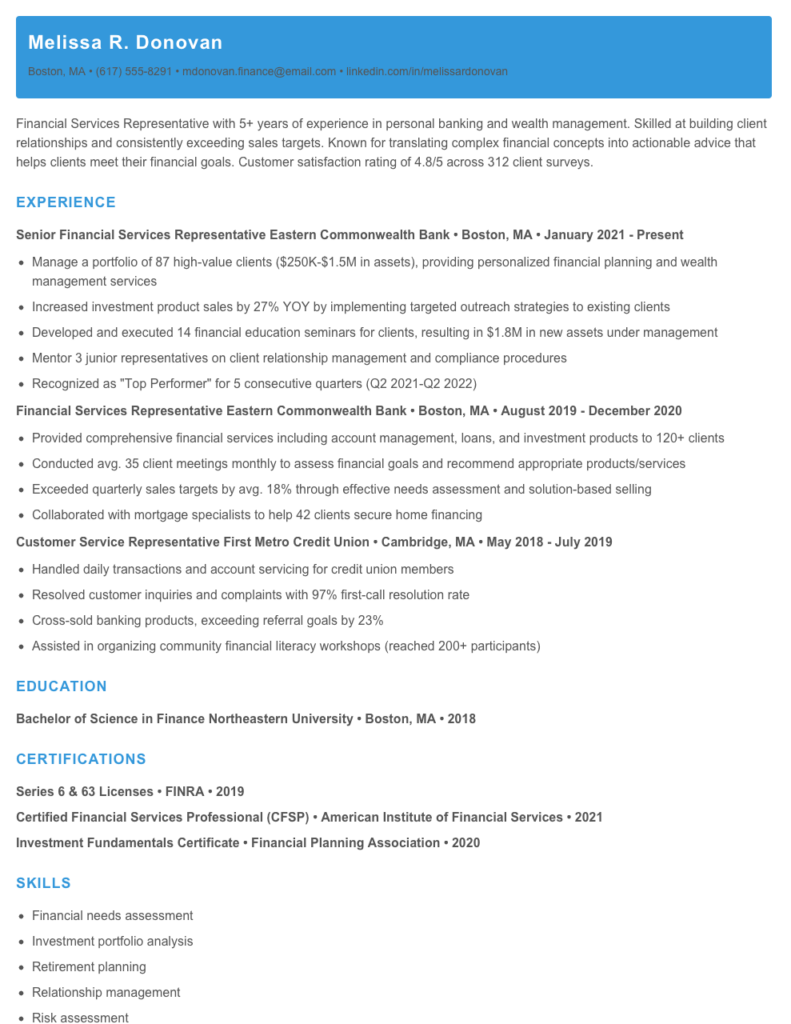

Melissa R. Donovan

Boston, MA • (617) 555-8291 • mdonovan.finance@email.com • linkedin.com/in/melissardonovan

Financial Services Representative with 5+ years of experience in personal banking and wealth management. Skilled at building client relationships and consistently exceeding sales targets. Known for translating complex financial concepts into actionable advice that helps clients meet their financial goals. Customer satisfaction rating of 4.8/5 across 312 client surveys.

EXPERIENCE

Senior Financial Services Representative

Eastern Commonwealth Bank • Boston, MA • January 2021 – Present

- Manage a portfolio of 87 high-value clients ($250K-$1.5M in assets), providing personalized financial planning and wealth management services

- Increased investment product sales by 27% YOY by implementing targeted outreach strategies to existing clients

- Developed and executed 14 financial education seminars for clients, resulting in $1.8M in new assets under management

- Mentor 3 junior representatives on client relationship management and compliance procedures

- Recognized as “Top Performer” for 5 consecutive quarters (Q2 2021-Q2 2022)

Financial Services Representative

Eastern Commonwealth Bank • Boston, MA • August 2019 – December 2020

- Provided comprehensive financial services including account management, loans, and investment products to 120+ clients

- Conducted avg. 35 client meetings monthly to assess financial goals and recommend appropriate products/services

- Exceeded quarterly sales targets by avg. 18% through effective needs assessment and solution-based selling

- Collaborated with mortgage specialists to help 42 clients secure home financing

Customer Service Representative

First Metro Credit Union • Cambridge, MA • May 2018 – July 2019

- Handled daily transactions and account servicing for credit union members

- Resolved customer inquiries and complaints with 97% first-call resolution rate

- Cross-sold banking products, exceeding referral goals by 23%

- Assisted in organizing community financial literacy workshops (reached 200+ participants)

EDUCATION

Bachelor of Science in Finance

Northeastern University • Boston, MA • 2018

CERTIFICATIONS

Series 6 & 63 Licenses • FINRA • 2019

Certified Financial Services Professional (CFSP) • American Institute of Financial Services • 2021

Investment Fundamentals Certificate • Financial Planning Association • 2020

SKILLS

- Financial needs assessment

- Investment portfolio analysis

- Retirement planning

- Relationship management

- Risk assessment

- Salesforce CRM

- Financial modeling (Excel)

- Banking compliance regulations

- Client acquisition strategies

- Cross-selling techniques

ADDITIONAL

Volunteer Financial Coach, Boston Community Center (2020-Present)

Member, Massachusetts Financial Services Association

Fluent in Spanish

Senior / Experienced Financial Services Representative Resume Example

Marcus J. Whitaker

Philadelphia, PA | (267) 555-8943 | mwhitaker@emailpro.net | linkedin.com/in/marcuswhitaker

Dedicated financial services professional with 8+ years of progressive experience helping clients achieve their financial goals. Known for building long-term client relationships through personalized financial planning and exceptional service. Consistently exceeded quarterly sales targets while maintaining a 97% client retention rate. Skilled at explaining complex financial products in accessible terms to clients from diverse backgrounds.

Professional Experience

Senior Financial Services Representative | Keystone Financial Group | Philadelphia, PA | March 2019 – Present

- Manage a portfolio of 175+ high-value clients ($28M in assets) providing comprehensive financial planning, investment strategies and retirement solutions

- Increased personal client base by 31% over 3 years through referral program optimization and community networking events

- Developed and implemented “Financial Wellness at Work” program that generated $4.2M in new business from corporate clients

- Mentor junior representatives on client acquisition strategies and relationship management techniques

- Recognized as “Rep of the Year” (2021) for achieving 142% of annual sales goal while maintaining perfect compliance record

Financial Services Representative | First Capital Partners | Philadelphia, PA | June 2016 – February 2019

- Served diverse client base providing solutions for retirement planning, education funding and wealth accumulation

- Conducted 15-20 client consultations weekly, with 58% conversion rate (12% above office average)

- Collaborated with tax professionals and attorneys to create holistic financial strategies for clients with complex needs

- Organized quarterly investment seminars that attracted 30+ prospective clients per event

Associate Financial Representative | Liberty Financial Services | Camden, NJ | August 2014 – May 2016

- Supported senior advisors in client relationship management and financial product recommendations

- Prepared financial analyses and presentations for client meetings and seminars

- Processed new account applications, transfers and service requests while ensuring regulatory compliance

- Completed firm’s intensive 6-month training program while exceeding initial sales targets by 17%

Education & Certifications

Bachelor of Science in Finance | Drexel University | Philadelphia, PA | 2014

Certified Financial Planner (CFP®) | Certified Financial Planner Board of Standards | 2017

Series 7, 63, 65 and Life & Health Insurance Licenses | FINRA | Current

Retirement Income Certified Professional (RICP®) | The American College | 2020

Technical Skills

- Financial Planning Software: eMoney Advisor, MoneyGuidePro, Naviplan

- CRM: Salesforce, Redtail CRM

- Investment Research: Morningstar, Bloomberg Terminal

- Microsoft Office Suite (advanced Excel skills including complex modeling)

Additional Skills

- Needs-based selling and consultative approach

- Client relationship management and retention strategies

- Compliance and regulatory knowledge (SEC, FINRA, DOL)

- Public speaking and financial education seminars

- Fluent in Spanish (conversational Portuguese)

How to write a Financial Services Representative Resume

Introduction

Landing that perfect Financial Services Representative job starts with a resume that stands out from the pile. In an industry where trust and expertise matter, your resume needs to showcase not just your experience with financial products, but also your customer service skills and sales abilities. I've reviewed thousands of these resumes over my career, and the difference between those that get interviews and those that don't often comes down to how well they balance technical knowledge with client relationship skills.

Resume Structure and Format

Keep your resume clean and professional—this is finance, after all! Aim for 1-2 pages (one page for those with under 5 years of experience, two pages if you're more seasoned).

- Use a readable font like Calibri or Arial in 10-12pt size

- Include clear section headings with plenty of white space

- Stick to reverse chronological format (most recent experience first)

- Save as a PDF to preserve formatting (unless asked for a specific format)

- Name your file professionally (FirstName_LastName_Resume.pdf)

Profile/Summary Section

Your professional summary should be 3-5 lines that highlight your financial services background, client relationship skills, and what makes you uniquely qualified. Think of this as your 30-second elevator pitch.

Avoid generic statements like "Dedicated professional seeking opportunity." Instead, try something like: "Licensed Financial Services Representative with 4+ years helping clients navigate retirement planning and insurance products. Consistently exceeded quarterly sales targets by 17% while maintaining 94% customer satisfaction ratings."

Professional Experience

This is where you'll win or lose the hiring manager. Financial services is results-driven, so showcase yours!

- Start each bullet with strong action verbs (generated, advised, analyzed)

- Include specific metrics when possible ($ amounts, percentages, client numbers)

- Highlight both technical skills and people skills

- Show progression of responsibility if you've been in the field a while

For example:

Instead of: "Responsible for selling financial products to customers"

Write: "Generated $2.7M in new investment accounts by developing personalized financial strategies for 85+ clients, resulting in a 31% increase in portfolio value"

Education and Certifications

Financial services roles often require specific licenses and certifications. Make these pop! List your most relevant credentials first, followed by your education.

- FINRA licenses (Series 6, 7, 63, 65, 66)

- Insurance licenses (Life, Health, Property & Casualty)

- CFP, ChFC, CLU or other professional designations

- College degrees (with graduation year if within last 10 years)

- Relevant continuing education or training programs

Keywords and ATS Tips

Most financial institutions use Applicant Tracking Systems to filter resumes before human eyes ever see them. Get past the robots by incorporating these common terms:

- Product names (mutual funds, annuities, life insurance)

- Compliance terms (KYC, AML, suitability)

- Software platforms (Salesforce, Fiserv, Morningstar)

- Client acquisition/retention terminology

- Financial planning processes you've used

Industry-specific Terms

Pepper your resume with industry lingo (but don't overdo it). Include terms like:

- Needs assessment

- Portfolio management

- Risk tolerance analysis

- Cross-selling/upselling

- Client relationship management

- Compliance procedures

Common Mistakes to Avoid

After reviewing roughly 3,500 financial services resumes, I've seen these blunders too many times:

- Being vague about sales results (numbers speak louder than words!)

- Focusing on duties rather than achievements

- Overlooking soft skills (empathy and communication are crucial)

- Forgetting to mention specific financial products you're familiar with

- Typos or grammatical errors (nothing kills trust faster in finance)

Before/After Example

Before: "Helped customers with their banking needs and offered financial products."

After: "Conducted 12-15 client financial reviews weekly, identifying protection gaps and investment opportunities that resulted in $487K in new premium and $1.2M in managed assets during Q2 2023. Maintained client retention rate of 89%, exceeding branch average by 14 points."

Remember—your resume is your personal marketing document. It should tell your professional story while highlighting exactly how you can help a financial institution grow their business and serve their clients better. Good luck!

Related Resume Examples

Soft skills for your Financial Services Representative resume

- Active listening – can read between the lines of client needs and match them to appropriate financial products

- Relationship building with both high-net-worth clients and everyday account holders (maintained 91% client retention during market volatility)

- Clear explanation of complex financial concepts to non-technical audiences

- Tactful handling of sensitive financial situations, particularly with clients facing hardships

- Time management while juggling 45+ client relationships simultaneously

- Conflict resolution when addressing account discrepancies or service complaints

Hard skills for your Financial Services Representative resume

- Series 7 and Series 63 Securities Licenses

- Financial needs analysis using MoneyGuidePro and eMoney

- Proficiency in CRM platforms (Salesforce Financial Services Cloud)

- Risk assessment and portfolio allocation techniques

- Mortgage origination and underwriting standards

- Advanced Excel modeling (PivotTables, VLOOKUP, financial functions)

- Credit analysis and loan qualification procedures

- Familiarity with AML/KYC compliance regulations

- Retirement planning calculations and tax-advantaged account strategies