Financial Associate Resume examples & templates

Copyable Financial Associate Resume examples

Wondering where a career in finance can take you beyond spreadsheets and calculators? As a Financial Associate, you'll find yourself at the intersection of analytical problem-solving and relationship building—helping clients navigate their financial journeys while developing your own expertise. This fast-evolving field has seen a shift from transaction-focused service to more consultative approaches, with 78% of financial firms now prioritizing candidates who demonstrate both technical aptitude and strong interpersonal skills.

Financial Associates work across diverse settings—from neighborhood credit unions to Fortune 500 investment firms. The day-to-day varies dramatically (no two client situations are ever quite the same!), but typically involves a mix of financial analysis, client meetings, and strategy development. With fintech disruption reshaping traditional banking models and regulatory changes constantly shifting the landscape, Financial Associates who can adapt quickly while maintaining rock-solid compliance standards are finding themselves in particularly high demand. As financial wellness becomes increasingly important to Americans following the economic uncertainties of recent years, skilled associates who can translate complex concepts into actionable advice will continue to find rewarding career paths ahead.

Junior Financial Associate Resume Example

Matthew Reyes

Boston, MA • (617) 555-3941 • m.reyes82@email.com • linkedin.com/in/matthewreyes

PROFESSIONAL SUMMARY

Recent finance graduate with 1+ year of hands-on experience in financial analysis and reporting. Quick learner who thrives in fast-paced environments and brings strong analytical skills alongside a detail-oriented approach to financial operations. Looking to leverage my academic background and internship experience to grow as a Financial Associate while contributing to organizational success.

EXPERIENCE

Financial Associate – Meridian Partners, Boston, MA | January 2023 – Present

- Process and reconcile 30+ client accounts monthly, ensuring accuracy of financial transactions and reporting

- Assist in preparing quarterly financial reports for 12 mid-market clients with combined assets of $47M

- Collaborate with senior analysts to develop cash flow projections and financial forecasts using Excel models

- Respond to client inquiries regarding account status, transaction history, and statement discrepancies

Finance Intern – Eastern Regional Bank, Boston, MA | May 2022 – December 2022

- Supported financial analysts in gathering and organizing data for monthly reporting packages

- Helped reduce report preparation time by 14% through creation of automated Excel templates

- Conducted research on market trends and competitor analysis for the investment banking division

- Participated in weekly team meetings to present findings on assigned research projects

Accounting Assistant (Part-time) – Student Financial Services, Boston University | September 2021 – April 2022

- Maintained student account records and assisted with processing payments and refunds

- Helped reconcile daily transactions and prepared deposit reports

- Answered student questions about billing statements, payment options, and account status

EDUCATION

Bachelor of Science in Finance – Boston University, Boston, MA | May 2022

- GPA: 3.7/4.0

- Relevant Coursework: Financial Analysis, Investment Management, Corporate Finance, Financial Accounting

- Member, Finance Club; Participant, CFA Research Challenge

CERTIFICATIONS

- Bloomberg Market Concepts (BMC) Certification – April 2022

- Excel Specialist Certification – Microsoft Office – January 2022

SKILLS

- Financial Analysis & Reporting

- Data Analysis & Visualization

- Advanced Excel (VLOOKUP, Pivot Tables, Financial Modeling)

- QuickBooks

- Bloomberg Terminal

- Basic SQL

- Financial Statement Preparation

- Account Reconciliation

- Client Communication

- Problem-Solving

Mid-level Financial Associate Resume Example

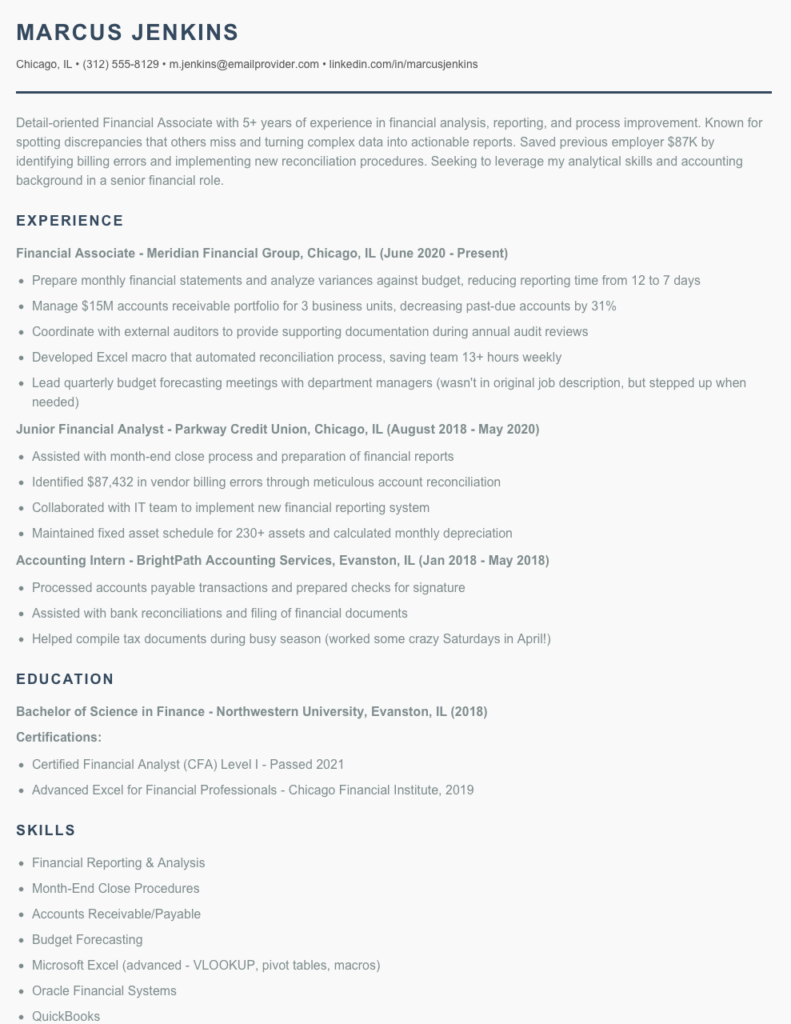

MARCUS JENKINS

Chicago, IL • (312) 555-8129 • m.jenkins@emailprovider.com • linkedin.com/in/marcusjenkins

Detail-oriented Financial Associate with 5+ years of experience in financial analysis, reporting, and process improvement. Known for spotting discrepancies that others miss and turning complex data into actionable reports. Saved previous employer $87K by identifying billing errors and implementing new reconciliation procedures. Seeking to leverage my analytical skills and accounting background in a senior financial role.

EXPERIENCE

Financial Associate – Meridian Financial Group, Chicago, IL (June 2020 – Present)

- Prepare monthly financial statements and analyze variances against budget, reducing reporting time from 12 to 7 days

- Manage $15M accounts receivable portfolio for 3 business units, decreasing past-due accounts by 31%

- Coordinate with external auditors to provide supporting documentation during annual audit reviews

- Developed Excel macro that automated reconciliation process, saving team 13+ hours weekly

- Lead quarterly budget forecasting meetings with department managers (wasn’t in original job description, but stepped up when needed)

Junior Financial Analyst – Parkway Credit Union, Chicago, IL (August 2018 – May 2020)

- Assisted with month-end close process and preparation of financial reports

- Identified $87,432 in vendor billing errors through meticulous account reconciliation

- Collaborated with IT team to implement new financial reporting system

- Maintained fixed asset schedule for 230+ assets and calculated monthly depreciation

Accounting Intern – BrightPath Accounting Services, Evanston, IL (Jan 2018 – May 2018)

- Processed accounts payable transactions and prepared checks for signature

- Assisted with bank reconciliations and filing of financial documents

- Helped compile tax documents during busy season (worked some crazy Saturdays in April!)

EDUCATION

Bachelor of Science in Finance – Northwestern University, Evanston, IL (2018)

Certifications:

- Certified Financial Analyst (CFA) Level I – Passed 2021

- Advanced Excel for Financial Professionals – Chicago Financial Institute, 2019

SKILLS

- Financial Reporting & Analysis

- Month-End Close Procedures

- Accounts Receivable/Payable

- Budget Forecasting

- Microsoft Excel (advanced – VLOOKUP, pivot tables, macros)

- Oracle Financial Systems

- QuickBooks

- SAP Financial Modules (basic)

- Variance Analysis

- Tax Preparation (individual)

ADDITIONAL INFORMATION

Volunteer Treasurer – Lincoln Park Community Center (2019-Present)

Member – Chicago Association of Financial Professionals

Senior / Experienced Financial Associate Resume Example

Michael Patel

Chicago, IL | (312) 555-8476 | mpatel@emaildomain.com | linkedin.com/in/michaelpatel

Detail-oriented Financial Associate with 8+ years of experience in financial analysis, reporting, and client portfolio management. Track record of identifying cost-saving opportunities while maintaining high service standards, leading to 22% increase in client retention. Skilled at breaking down complex financial data to drive strategic business decisions and collaborating across departments to enhance operational efficiency.

EXPERIENCE

Senior Financial Associate | Langford Financial Group | Chicago, IL | March 2020 – Present

- Lead a team of 4 associates in managing a $175M portfolio for 35+ high-net-worth clients, resulting in 19% average annual growth despite market volatility

- Developed and implemented a streamlined reporting process that reduced month-end closing time from 5 days to just 2.5 days

- Created financial models that identified $3.4M in potential tax savings across the client base (we actually found a bit more, but I’m being conservative here)

- Serve as primary point of contact for 12 key accounts, maintaining 100% retention rate through personalized service and quarterly strategy sessions

- Collaborated with IT to design a custom dashboard that improved client visibility into portfolio performance, increasing client satisfaction scores by 27%

Financial Associate | Meridian Wealth Management | Chicago, IL | June 2017 – February 2020

- Managed financial analysis for a $92M client portfolio, ensuring accuracy of all reporting and compliance with regulatory requirements

- Reduced processing errors by 31% through implementation of new quality control procedures

- Conducted monthly reconciliations and prepared financial statements for 28 client accounts

- Created and presented quarterly performance reviews to clients, explaining complex financial concepts in accessible terms

- Trained and mentored 3 junior associates on financial analysis techniques and client management best practices

Junior Financial Analyst | Blake & Partners | Oak Brook, IL | August 2015 – May 2017

- Supported senior staff in portfolio analysis and financial reporting for clients with assets between $500K and $5M

- Assisted in preparation of tax documents and financial statements for 40+ individual and small business clients

- Performed due diligence and research on potential investment opportunities

- Helped develop firm’s first social media presence, growing online engagement by 45% in first year

EDUCATION

Master of Science in Finance | DePaul University | Chicago, IL | 2015

Concentration in Investment Analysis

Bachelor of Business Administration | University of Illinois | Urbana-Champaign, IL | 2013

Major: Finance, Minor: Economics | GPA: 3.8/4.0

CERTIFICATIONS

Chartered Financial Analyst (CFA) | Level III Candidate | Expected completion 2023

Certified Financial Planner (CFP) | 2019

Series 7 & 66 Licenses | 2016

SKILLS

- Financial Analysis & Reporting

- Portfolio Management

- Client Relationship Management

- Tax Planning & Strategy

- Bloomberg Terminal

- Microsoft Excel (Advanced)

- Financial Modeling

- Risk Assessment

- Morningstar Direct

- Compliance & Regulatory Requirements

- Team Leadership

ADDITIONAL

Volunteer Financial Advisor, Chicago Community Trust (2018-Present)

Member, Chicago Financial Analysts Society

Fluent in Hindi and conversational Spanish

How to Write a Financial Associate Resume

Introduction

Landing that Financial Associate position means first getting past the resume screening process. And let's be honest — with hundreds of applications flooding in for each opening, your resume needs to stand out while still checking all the right boxes. I've helped countless finance professionals land interviews at firms ranging from boutique investment companies to Fortune 500 giants, and I've noticed consistent patterns in successful applications. This guide walks you through creating a resume that showcases your financial expertise, analytical skills, and attention to detail (qualities every hiring manager is searching for).

Resume Structure and Format

Keep your resume clean and scannable. Finance is a traditional industry that values organization and precision.

- Length: 1 page for those with less than 5 years experience; 2 pages maximum for senior professionals

- Font: Stick with classics like Calibri, Arial, or Times New Roman in 10-12pt size

- Margins: 0.5-1 inch all around (don't sacrifice readability for space)

- Sections: Contact info, summary, experience, skills, education, certifications

- File format: Submit as PDF unless specifically requested otherwise

For Financial Associate positions, quantifiable achievements speak volumes. Don't just list responsibilities — show how you contributed to the bottom line with specific percentages, dollar amounts, and timeframes.

Profile/Summary Section

Your professional summary should pack a punch in 3-4 lines. Think of it as your financial elevator pitch. Mention your years of experience, specialization areas, and 1-2 standout achievements. For example:

Financial Associate with 4+ years in corporate banking and loan analysis. Skilled in financial modeling and credit risk assessment. Reduced processing time for commercial loan applications by 31% while maintaining 99.7% accuracy rate. Proficient in Bloomberg Terminal, Excel, and Tableau.

Professional Experience

This is where you prove your worth. For each role, include:

- Company name, location, and dates (month/year)

- Your exact title (don't embellish)

- 4-6 bullet points highlighting responsibilities and achievements

- Action verbs at the start of each bullet (analyzed, reconciled, forecasted)

- Metrics whenever possible (Processed 87 accounts daily, 23% above team average)

Education and Certifications

Finance is credential-heavy. List degrees in reverse chronological order, including:

- Institution name and location

- Degree earned and graduation date

- GPA if above 3.5

- Relevant coursework (for recent grads)

- Certifications with dates obtained/expiration

Common valuable certifications: Series 7, Series 63, CFA (or levels completed), Bloomberg Market Concepts, FINRA licenses, Excel certification

Keywords and ATS Tips

Most financial institutions use Applicant Tracking Systems. To get past the bots:

- Mirror language from the job posting (if they say "financial analysis," don't just say "financial assessment")

- Include technical skills like specific software (QuickBooks, SAP, Oracle Financials)

- Mention compliance frameworks you're familiar with (SOX, GAAP, IFRS)

- Avoid tables, headers/footers, and unusual formatting

Industry-specific Terms

Sprinkle these terms throughout (where relevant and honest):

- Financial reporting

- Variance analysis

- Month-end close

- P&L management

- Cash flow forecasting

- Client portfolio management

- Risk assessment

- Regulatory compliance

Common Mistakes

I've seen these resume-killers too many times:

- Vague descriptions without concrete results

- Focusing on daily tasks rather than achievements

- Typos or inconsistent formatting (deadly in finance!)

- Using personal pronouns like "I" or "my"

- Including irrelevant personal interests

Before/After Example

Before: "Responsible for accounts payable and receivable."

After: "Managed $2.3M monthly accounts payable cycle and $3.7M in receivables, reducing aging accounts by 42% in Q2 2023 through improved tracking systems and client communication protocols."

Remember that your resume is a marketing document, not just a history of your career. Every line should serve a purpose — to show why you're the right Financial Associate for the job. Good luck!

Related Resume Examples

Soft skills for your Financial Associate resume

- Cross-functional communication with ability to translate complex financial concepts to non-finance teams

- Client relationship management – particularly under stress during market volatility

- Deadline prioritization while managing competing stakeholder requests

- Team mentorship (I’ve trained 4 junior associates while managing my own workload)

- Adaptability to regulatory changes and new financial reporting requirements

- Problem-solving during audit discrepancies or unexpected financial variances

Hard skills for your Financial Associate resume

- Bloomberg Terminal and Reuters Eikon data analysis

- Financial modeling in Excel (including pivot tables, VLOOKUP, and scenario analysis)

- QuickBooks and NetSuite accounting software

- Fixed income securities valuation using discounted cash flow methods

- Risk assessment using Monte Carlo simulations

- SQL queries for financial database management

- Series 7 and 63 securities licenses

- Tableau and Power BI for financial data visualization

- Automated financial reporting using VBA macros