Finance Specialist Resume examples & templates

Copyable Finance Specialist Resume examples

Ever wonder why Finance Specialists are increasingly in demand while other jobs get automated away? It's simple: companies need professionals who can translate complex financial data into strategic decisions—something AI struggles with. Finance Specialists sit at the intersection of analytical rigor and business acumen, turning numbers into narratives that drive organizational success. The role has evolved dramatically from mere number-crunching to becoming key advisors in business planning, risk management, and growth initiatives.

The Bureau of Labor Statistics projects a 9.7% growth for financial specialist positions through 2030, outpacing many other professional sectors. This growth comes as businesses face increasingly complex regulatory environments (thanks, Dodd-Frank!) and the need for sophisticated financial modeling. The pandemic accelerated this trend, with 78% of CFOs reporting they now rely more heavily on financial specialists to navigate economic uncertainty. Whether you're drawn to the stability, competitive compensation (median salary $76,570), or the intellectual challenge of solving financial puzzles, this field offers remarkable career flexibility. As data systems grow more sophisticated, tomorrow's Finance Specialists will focus less on gathering information and more on the human elements of financial decision-making that machines can't replicate.

Junior Finance Specialist Resume Example

Eric Thornton

Chicago, IL | (312) 555-8901 | ethornton@email.com | linkedin.com/in/ericthornton

Recent Finance graduate with hands-on experience in financial analysis, accounts payable, and budget management. Strong analytical skills with proficiency in Excel and financial reporting tools. Quick learner who thrives in fast-paced environments, having balanced academic commitments with part-time professional roles. Looking to grow my career in corporate finance where I can apply my education and emerging expertise.

Experience

Junior Finance Specialist | Meridian Partners Group | Chicago, IL | January 2023 – Present

- Process and verify 75+ accounts payable transactions weekly, reducing payment errors by 14% in first 6 months

- Assist with month-end closing procedures, preparing 3 recurring journal entries and reconciling 5 bank accounts

- Support senior staff in budget preparation by gathering historical data and creating preliminary expense projections

- Develop and maintain Excel tracking spreadsheets for department expense monitoring (saved about 4 hours of manual work weekly)

Finance Intern | Westlake Regional Bank | Chicago, IL | May 2022 – August 2022

- Analyzed customer account data to identify potential cross-selling opportunities, contributing to 7 new product conversions

- Assisted with daily cash reconciliation procedures and prepared summary reports for management review

- Conducted research on competitive financial products and created comparison analysis for marketing team

Accounting Assistant (Part-time) | University Student Services | Northwestern University | September 2021 – April 2022

- Processed student organization reimbursements and maintained financial records for 15+ campus groups

- Reconciled monthly expense reports and flagged discrepancies to supervisor

- Supported annual budget allocation process for student organizations

Education

Bachelor of Science in Finance | Northwestern University | Evanston, IL | Graduated December 2022

- GPA: 3.7/4.0

- Relevant Coursework: Financial Management, Investment Analysis, Corporate Finance, Financial Markets & Institutions

- Member, Finance Club; Volunteer, Financial Literacy Community Outreach Program

Certifications

- Excel for Financial Analysis (LinkedIn Learning, 2022)

- Bloomberg Market Concepts (2022)

- Currently preparing for CFA Level I examination (anticipated June 2024)

Skills

- Financial Analysis & Reporting

- MS Excel (VLOOKUP, PivotTables, financial modeling)

- QuickBooks

- Accounts Payable/Receivable

- Bank Reconciliations

- Budget Preparation

- Data Visualization (Tableau basics)

- SAP (foundational knowledge)

- Financial Research

- Written & Verbal Communication

Mid-level Finance Specialist Resume Example

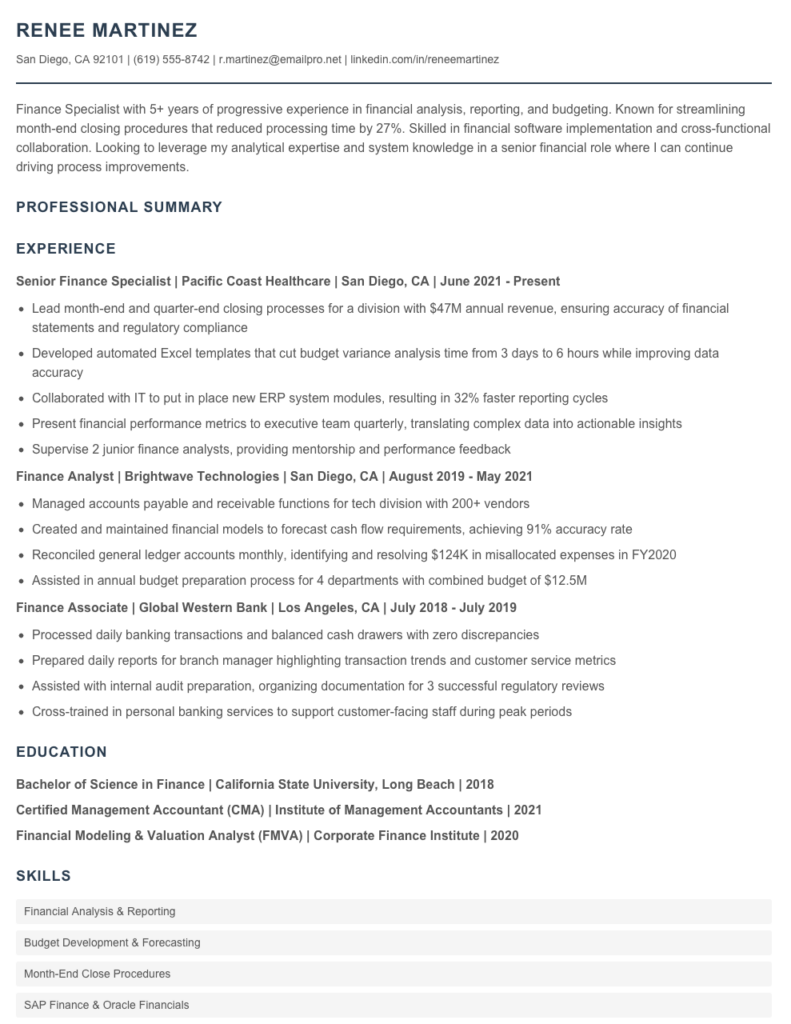

Renee Martinez

San Diego, CA 92101 | (619) 555-8742 | r.martinez@emailpro.net | linkedin.com/in/reneemartinez

Professional Summary

Finance Specialist with 5+ years of progressive experience in financial analysis, reporting, and budgeting. Known for streamlining month-end closing procedures that reduced processing time by 27%. Skilled in financial software implementation and cross-functional collaboration. Looking to leverage my analytical expertise and system knowledge in a senior financial role where I can continue driving process improvements.

Experience

Senior Finance Specialist | Pacific Coast Healthcare | San Diego, CA | June 2021 – Present

- Lead month-end and quarter-end closing processes for a division with $47M annual revenue, ensuring accuracy of financial statements and regulatory compliance

- Developed automated Excel templates that cut budget variance analysis time from 3 days to 6 hours while improving data accuracy

- Collaborated with IT to put in place new ERP system modules, resulting in 32% faster reporting cycles

- Present financial performance metrics to executive team quarterly, translating complex data into actionable insights

- Supervise 2 junior finance analysts, providing mentorship and performance feedback

Finance Analyst | Brightwave Technologies | San Diego, CA | August 2019 – May 2021

- Managed accounts payable and receivable functions for tech division with 200+ vendors

- Created and maintained financial models to forecast cash flow requirements, achieving 91% accuracy rate

- Reconciled general ledger accounts monthly, identifying and resolving $124K in misallocated expenses in FY2020

- Assisted in annual budget preparation process for 4 departments with combined budget of $12.5M

Finance Associate | Global Western Bank | Los Angeles, CA | July 2018 – July 2019

- Processed daily banking transactions and balanced cash drawers with zero discrepancies

- Prepared daily reports for branch manager highlighting transaction trends and customer service metrics

- Assisted with internal audit preparation, organizing documentation for 3 successful regulatory reviews

- Cross-trained in personal banking services to support customer-facing staff during peak periods

Education

Bachelor of Science in Finance | California State University, Long Beach | 2018

Certified Management Accountant (CMA) | Institute of Management Accountants | 2021

Financial Modeling & Valuation Analyst (FMVA) | Corporate Finance Institute | 2020

Skills

- Financial Analysis & Reporting

- Budget Development & Forecasting

- Month-End Close Procedures

- SAP Finance & Oracle Financials

- Advanced Excel (VLOOKUP, Pivot Tables, Macros)

- Power BI & Tableau

- Variance Analysis

- Regulatory Compliance (SOX, GAAP)

- Cross-Functional Collaboration

- Financial Data Visualization

Additional Information

Volunteer Treasurer, San Diego Urban Outreach (2020-Present)

Fluent in Spanish and conversational in Portuguese

Recipient, Pacific Coast Healthcare “Process Innovator Award” (2022)

Senior / Experienced Finance Specialist Resume Example

PATRICIA (PATTY) M. REYNOLDS

Seattle, WA | (206) 555-8974 | preynolds@emaildomain.com | linkedin.com/in/patriciareynolds

Senior Finance Specialist with 9+ years driving financial analysis and reporting excellence. Known for translating complex data into strategic insights that guide business decisions. Expertise in budget management, forecasting, and implementing cost-saving measures that improved bottom-line results by $1.2M across previous roles. Skilled at leading cross-functional projects while maintaining regulatory compliance.

PROFESSIONAL EXPERIENCE

Senior Finance Specialist | Westbrook Financial Services | Seattle, WA | January 2020 – Present

- Manage monthly, quarterly, and annual financial close processes for a $78M division, reducing close time by 27% through process improvements

- Lead a team of 4 financial analysts, providing mentorship and professional development while establishing clear KPIs that increased team efficiency

- Developed comprehensive financial models that identified $427K in cost-saving opportunities, which were implemented across 3 departments

- Partner with executive leadership to create annual budgets and 5-year forecasting models, improving accuracy by 18% compared to previous years

- Spearheaded the implementation of new financial software that streamlined reporting capabilities and reduced manual processes by 35%

Finance Analyst II | Meridian Holdings Group | Portland, OR | March 2017 – December 2019

- Prepared and analyzed financial statements, variance reports, and KPI dashboards for C-suite executives and board presentations

- Created and maintained rolling 12-month cash flow forecasts with 91% accuracy, enabling better capital allocation decisions

- Collaborated with department heads to build annual budgets totaling $42M and monitored performance against targets

- Led a cross-functional team to identify and eliminate redundant expenses, resulting in $293K annual savings

Financial Analyst | Northwest Credit Partners | Portland, OR | August 2014 – February 2017

- Conducted financial analysis for loan portfolio worth $125M, including risk assessments and performance tracking

- Managed accounts payable and receivable processes while ensuring compliance with internal controls

- Built automated Excel models that reduced monthly reporting time from 3 days to 4 hours (my first big win!)

- Assisted with annual audit preparation, gathering documentation and responding to auditor inquiries

EDUCATION & CERTIFICATIONS

Master of Science in Finance | University of Washington | Seattle, WA | 2014

Bachelor of Business Administration | Oregon State University | Corvallis, OR | 2012

Certified Financial Analyst (CFA) – Level II Candidate

Certified Management Accountant (CMA) – Completed 2019

TECHNICAL SKILLS

- Financial Modeling & Analysis

- Budget Development & Management

- Forecasting & Scenario Planning

- Microsoft Excel (Advanced – VBA, Power Query)

- ERP Systems (SAP, Oracle Financials)

- Business Intelligence Tools (Tableau, Power BI)

- GAAP Compliance & Financial Reporting

- SQL (Intermediate)

- Cash Flow Management

- Variance Analysis

ADDITIONAL

Professional Affiliations: Financial Executives International (FEI), Association for Financial Professionals (AFP)

Languages: English (Native), Spanish (Conversational)

Volunteer: Treasurer, Seattle Animal Rescue Foundation (2018-Present)

How to Write a Finance Specialist Resume

Introduction

Landing that Finance Specialist role means your resume needs to speak the language of numbers, analysis, and financial systems. I've reviewed thousands of finance resumes over my career, and the difference between those that get interviews and those that don't often comes down to specificity and relevance. Your resume isn't just a career history—it's a marketing document that positions you as the solution to an employer's problem.

Resume Structure and Format

Finance professionals need resumes that are as organized as their spreadsheets. Here's what works:

- Keep it to 1-2 pages (one page for those with under 7 years of experience)

- Use a clean, conservative design—finance departments rarely reward creative layouts

- Choose readable fonts like Calibri, Arial, or Georgia at 10-12pt

- Include clear section headings to guide the reader's eye

- Use bullet points rather than dense paragraphs for experience

- Save as a PDF to preserve formatting (unless specifically asked for Word)

Profile/Summary Section

Your summary should pack a punch in 3-5 lines. For finance roles, focus on your analytical prowess, technical skills, and industry knowledge.

Skip the generic "detail-oriented professional seeking opportunity" opener. Instead, try something like: "Finance Specialist with 5+ years optimizing cash flow management processes, reducing DSO by 18% while implementing SAP financial modules across three business units."

The summary should highlight your biggest selling points—whether that's your experience with specific financial systems, regulatory knowledge, or track record of process improvement.

Professional Experience

This section makes or breaks finance resumes. For each role:

- Start with company name, location, your title, and dates (month/year)

- Include 4-6 bullet points per position (more for current/recent roles)

- Lead with strong action verbs (analyzed, reconciled, forecasted, etc.)

- Quantify results with percentages, dollar amounts, and time frames

- Showcase both technical finance skills and soft skills like stakeholder communication

Example bullet: "Reduced month-end close process from 8 days to 3.5 days by automating 14 reconciliation reports and training staff on new validation protocols."

Education and Certifications

Finance is credential-heavy, so this section matters. Include:

- Degrees with graduation dates, institution names, and locations

- GPA if above 3.5 and graduated within last 5 years

- Relevant coursework for recent grads or career changers

- Professional certifications with dates obtained (CPA, CFA, FRM, etc.)

- Continuing education or specialized training (e.g., Bloomberg Terminal, advanced Excel modeling)

Keywords and ATS Tips

Many companies use Applicant Tracking Systems to screen resumes before human eyes see them. To clear this hurdle:

- Mirror language from the job description (without lying about skills)

- Include finance software you've used (QuickBooks, SAP, Oracle, Hyperion, etc.)

- Mention specific financial processes (month-end close, variance analysis, etc.)

- Use both spelled-out terms and acronyms where appropriate (Generally Accepted Accounting Principles/GAAP)

- Avoid headers, footers, and tables that can confuse ATS systems

Industry-specific Terms

Pepper these finance terms throughout your resume (but only if they truly apply to your experience):

- Financial analysis, forecasting, budgeting

- Accounts payable/receivable management

- Cash flow optimization

- General ledger reconciliation

- Financial reporting and compliance (SOX, GAAP, IFRS)

- Audit preparation and response

- Cost accounting and allocation methodologies

Common Mistakes

These errors tank otherwise promising finance resumes:

- Listing job duties without results or impact

- Including too much non-finance experience

- Typos or errors (especially deadly in a field that values precision)

- Missing quantifiable achievements

- Vague descriptions of technical abilities

Before/After Example

Before: "Responsible for accounts payable and helping with financial reports."

After: "Managed $2.7M monthly accounts payable cycle while streamlining vendor payment processes, reducing late payments by 76% and capturing $43K in early payment discounts annually."

The difference? Specificity, results, and proof that you don't just do tasks—you improve financial operations. That's what hiring managers want to see in a Finance Specialist.

Related Resume Examples

Soft skills for your Finance Specialist resume

- Cross-functional relationship building with accounting, operations, and executive teams

- Verbal translation of complex financial data into actionable insights for non-finance colleagues

- Deadline management during month-end close and quarterly reporting cycles

- Constructive feedback delivery when flagging budget variances

- Conflict resolution when reconciling discrepancies between departments

- Adaptability to shifting regulatory requirements and reporting standards

Hard skills for your Finance Specialist resume

- Advanced Excel modeling (VBA macros, pivot tables, VLOOKUP/INDEX MATCH)

- Financial statement analysis and reconciliation

- SAP/Oracle financial modules

- QuickBooks Enterprise and NetSuite integration

- Data visualization with Tableau and Power BI

- Bloomberg Terminal and FactSet navigation

- SQL querying for financial reporting

- Financial forecasting and FP&A techniques

- Python for financial data analysis (pandas, numpy)