Credit Risk Analyst Resume examples & templates

Copyable Credit Risk Analyst Resume examples

Ever wondered who's behind the scenes when a bank decides whether to approve your loan? Enter the world of Credit Risk Analysts—financial detectives who balance the art of prediction with the science of number-crunching. These professionals serve as the guardrails of the financial industry, evaluating borrowers and determining which risks are worth taking. It's a career that's evolved dramatically since the 2008 financial crisis, with risk teams now wielding significant influence in financial institutions of all sizes.

The field is experiencing a tech revolution right now, with machine learning algorithms increasingly supplementing (but not replacing!) human judgment. According to a 2023 Risk Management Association survey, 76% of financial institutions plan to increase their investment in credit risk analytics tools over the next two years. Yet despite this technological shift, the core skills remain consistent: sharp analytical thinking, attention to detail, and the ability to communicate complex findings to decision-makers. As regulatory frameworks continue to evolve and economic uncertainties persist, Credit Risk Analysts who can blend traditional credit assessment with modern analytical approaches will find themselves in high demand across the financial landscape.

Junior Credit Risk Analyst Resume Example

BENJAMIN CHEN

Toronto, ON • (416) 555-7821 • b.chen@outlook.com • linkedin.com/in/benjamin-chen

Entry-level Credit Risk Analyst with a strong foundation in financial analysis and data interpretation. Completed internships at TD Bank and a credit union where I contributed to credit assessment processes and helped identify risk factors. Proficient in financial modeling, credit scoring methodologies, and statistical analysis tools. Seeking to use my quantitative skills and growing experience in a challenging Credit Risk Analyst role.

EXPERIENCE

Junior Credit Risk Analyst – TD Bank, Toronto, ON

February 2023 – Present

- Support senior analysts in evaluating credit applications and conducting risk assessments for consumer loans and credit card applications

- Analyze financial statements and credit reports to identify potential risk factors, contributing to 97.4% accuracy in risk predictions

- Assist in monitoring a portfolio of approximately 1,200 accounts for early warning signs and delinquency trends

- Prepare weekly risk assessment reports using SAS and Excel for management review

- Help develop and test new credit scoring models that improved default prediction by 7%

Risk Management Intern – First Ontario Credit Union, Hamilton, ON

May 2022 – August 2022

- Assisted in conducting credit analyses for small business loan applications under $250K

- Collected and organized financial data from various sources to support credit decisions

- Participated in weekly loan committee meetings and took detailed notes on risk assessment procedures

- Helped create Excel templates for standardizing financial ratio calculations (still in use today!)

Finance Research Assistant – Ryerson University, Toronto, ON

September 2021 – April 2022

- Supported professor’s research on credit risk modeling for small and medium enterprises

- Collected and cleaned financial data sets using Python and Excel

- Performed basic statistical analyses to identify correlations between financial indicators and default rates

EDUCATION

Bachelor of Commerce, Finance – Ryerson University, Toronto, ON

Graduated: May 2022 – GPA: 3.7/4.0

- Relevant Coursework: Financial Risk Management, Corporate Finance, Financial Statement Analysis, Statistics for Finance, Banking and Financial Institutions

- Awarded Dean’s List recognition for academic excellence (2020-2022)

CERTIFICATIONS

Financial Risk Manager (FRM) Part I – GARP, In Progress (Exam scheduled for November 2023)

SAS Certified Base Programmer – SAS Institute, March 2023

Bloomberg Market Concepts (BMC) – Bloomberg LP, January 2022

SKILLS

- Credit Analysis & Underwriting

- Financial Statement Analysis

- Risk Assessment & Modeling

- Data Analysis & Interpretation

- Statistical Software: SAS, SPSS

- Programming: SQL, Python (basic)

- Microsoft Office Suite (advanced Excel)

- Bloomberg Terminal

- Regulatory Compliance Awareness

- Problem-solving & Critical Thinking

PROJECTS

Credit Scoring Model Analysis – Capstone Project

January – April 2022

- Developed a predictive model to assess credit risk using a dataset of 5,000+ consumer loans

- Analyzed key variables affecting default probability including debt-to-income ratio, payment history, and employment duration

- Achieved 83% accuracy in predicting loan defaults

Mid-level Credit Risk Analyst Resume Example

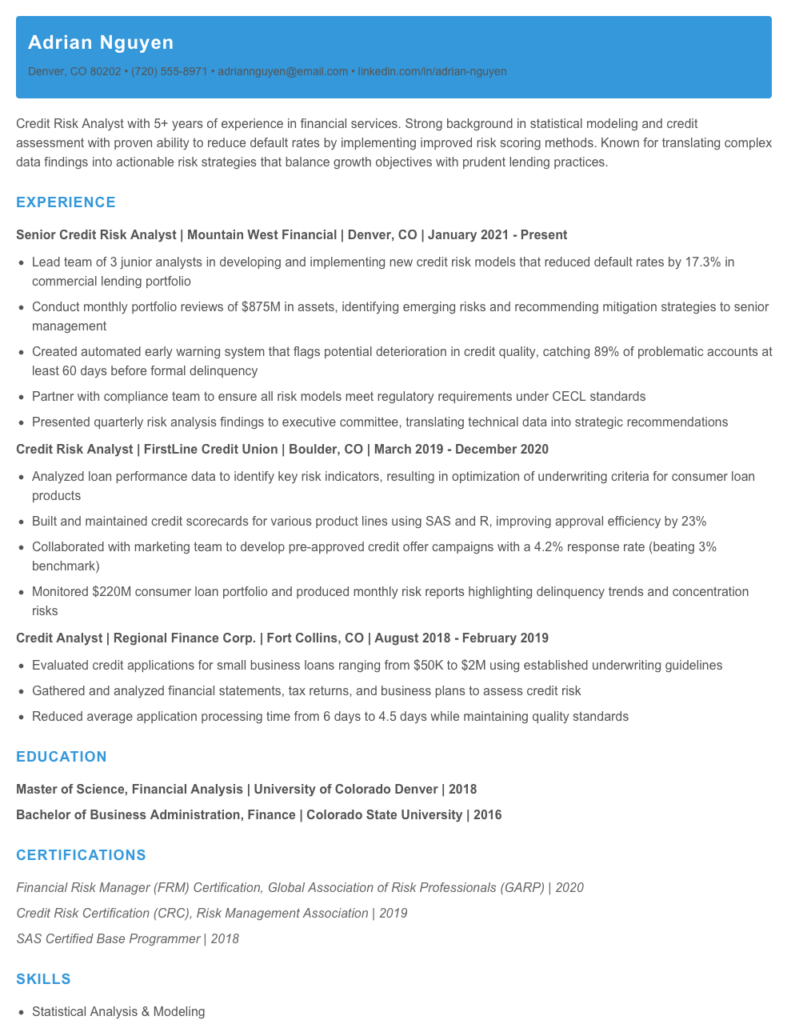

Adrian Nguyen

Denver, CO 80202 • (720) 555-8971 • adriannguyen@email.com • linkedin.com/in/adrian-nguyen

Credit Risk Analyst with 5+ years of experience in financial services. Strong background in statistical modeling and credit assessment with proven ability to reduce default rates by implementing improved risk scoring methods. Known for translating complex data findings into actionable risk strategies that balance growth objectives with prudent lending practices.

EXPERIENCE

Senior Credit Risk Analyst | Mountain West Financial | Denver, CO | January 2021 – Present

- Lead team of 3 junior analysts in developing and implementing new credit risk models that reduced default rates by 17.3% in commercial lending portfolio

- Conduct monthly portfolio reviews of $875M in assets, identifying emerging risks and recommending mitigation strategies to senior management

- Created automated early warning system that flags potential deterioration in credit quality, catching 89% of problematic accounts at least 60 days before formal delinquency

- Partner with compliance team to ensure all risk models meet regulatory requirements under CECL standards

- Presented quarterly risk analysis findings to executive committee, translating technical data into strategic recommendations

Credit Risk Analyst | FirstLine Credit Union | Boulder, CO | March 2019 – December 2020

- Analyzed loan performance data to identify key risk indicators, resulting in optimization of underwriting criteria for consumer loan products

- Built and maintained credit scorecards for various product lines using SAS and R, improving approval efficiency by 23%

- Collaborated with marketing team to develop pre-approved credit offer campaigns with a 4.2% response rate (beating 3% benchmark)

- Monitored $220M consumer loan portfolio and produced monthly risk reports highlighting delinquency trends and concentration risks

Credit Analyst | Regional Finance Corp. | Fort Collins, CO | August 2018 – February 2019

- Evaluated credit applications for small business loans ranging from $50K to $2M using established underwriting guidelines

- Gathered and analyzed financial statements, tax returns, and business plans to assess credit risk

- Reduced average application processing time from 6 days to 4.5 days while maintaining quality standards

EDUCATION

Master of Science, Financial Analysis | University of Colorado Denver | 2018

Bachelor of Business Administration, Finance | Colorado State University | 2016

CERTIFICATIONS

Financial Risk Manager (FRM) Certification, Global Association of Risk Professionals (GARP) | 2020

Credit Risk Certification (CRC), Risk Management Association | 2019

SAS Certified Base Programmer | 2018

SKILLS

- Statistical Analysis & Modeling

- Credit Scoring & Underwriting

- Portfolio Management

- Regulatory Compliance (CECL, FCRA)

- Risk Assessment

- Data Visualization (Tableau, Power BI)

- SAS, R, SQL, Python

- Financial Statement Analysis

- Loan Review Processes

- Microsoft Excel (advanced)

Senior / Experienced Credit Risk Analyst Resume Example

Samuel R. Thornton

Philadelphia, PA • (215) 555-3892 • s.thornton@email.com • linkedin.com/in/samthornton

Detail-oriented Credit Risk Analyst with 9+ years of experience in financial risk management and credit portfolio analysis. Proven track record of developing risk models that reduced default rates by 17% while maintaining portfolio growth. Skilled in stress testing methodologies, regulatory compliance, and translating complex risk data into actionable business recommendations.

EXPERIENCE

Senior Credit Risk Analyst – MetroBank Financial Group, Philadelphia, PA (June 2019 – Present)

- Lead a team of 5 analysts responsible for credit risk assessment of a $4.2B commercial loan portfolio, developing enhanced risk rating models that improved accuracy by 23%

- Spearheaded implementation of machine learning algorithms for early warning detection, reducing potential write-offs by $3.7M in first year

- Created and presented quarterly risk exposure reports to executive leadership, identifying emerging market trends and recommending strategic adjustments

- Collaborated with compliance department to ensure adherence to Basel III requirements and CECL standards while maintaining business growth targets

- Developed custom stress testing scenarios that more accurately reflected regional economic vulnerabilities, which were later adopted company-wide

Credit Risk Analyst – KeyPoint Financial Services, Philadelphia, PA (April 2016 – May 2019)

- Analyzed credit applications for commercial loans ranging from $500K to $10M, evaluating financial statements, business plans, and industry risk factors

- Built and maintained credit scoring models that reduced manual review time by 31% while maintaining risk standards

- Conducted quarterly portfolio reviews for 200+ commercial accounts, identifying high-risk accounts before delinquency

- Collaborated with loan origination team to develop risk-based pricing strategies that increased profit margins by 8.5% on new originations

Junior Risk Analyst – First Commonwealth Bank, Pittsburgh, PA (August 2014 – March 2016)

- Monitored $750M consumer loan portfolio for delinquency trends and early warning indicators

- Assisted in preparation of monthly credit committee reports and regulatory submissions

- Performed sensitivity analysis on existing loan products to determine pricing thresholds

- Helped develop and implement new documentation standards for HELOC applications that reduced processing time by 27%

EDUCATION

Master of Science in Financial Risk Management

Carnegie Mellon University, Pittsburgh, PA (2014)

Bachelor of Science in Economics

Pennsylvania State University, University Park, PA (2012)

CERTIFICATIONS

Financial Risk Manager (FRM) – Global Association of Risk Professionals (2017)

Professional Risk Manager (PRM) – Professional Risk Managers’ International Association (2019)

Advanced Credit Risk Modeling Certificate – Risk Management Association (2020)

SKILLS

- Credit Scoring & Risk Rating Models

- Regulatory Compliance (CCAR, DFAST, Basel III)

- Statistical Analysis & Financial Modeling

- SAS, R, Python, SQL

- Stress Testing & Scenario Analysis

- Portfolio Management & Optimization

- CECL Implementation & Methodology

- Risk-Based Pricing Strategies

- Commercial & Consumer Credit Analysis

- Bloomberg Terminal & Thomson Reuters

PROJECTS

Commercial Real Estate Risk Assessment Framework (2021)

Developed proprietary framework for assessing pandemic-related risks in commercial real estate portfolio, which identified $87M in at-risk loans before market deterioration became apparent.

How to Write a Credit Risk Analyst Resume

Introduction

Landing a job as a Credit Risk Analyst isn't just about having the right skills—it's about presenting those skills in a way that catches a hiring manager's eye. Your resume is often your first impression, and in a field where attention to detail is crucial, every element matters. I've reviewed thousands of Credit Risk Analyst resumes over my career, and the difference between those that get interviews and those that don't often comes down to how effectively candidates showcase their analytical abilities, financial knowledge, and risk assessment experience.

Resume Structure and Format

Keep your resume clean and readable—remember, most hiring managers spend less than 30 seconds on initial review!

- Stick to 1-2 pages (1 page for junior analysts, 2 pages max for experienced professionals)

- Use a clean, professional font like Calibri or Arial (10-12pt)

- Include clear section headings with consistent formatting

- Incorporate white space strategically—cramped resumes are hard to scan

- Save as a PDF to preserve formatting (unless specifically asked for a .doc file)

Profile/Summary Section

Your summary should pack a punch in 3-4 lines. Think of it as your "elevator pitch" that highlights your most relevant qualifications for credit risk analysis.

- Mention your years of experience in credit risk or related financial analysis

- Highlight 1-2 specialized skills (e.g., statistical modeling, portfolio management)

- Include industry-specific experience (banking, insurance, fintech)

- Avoid generic phrases like "detail-oriented professional"—be specific!

Skip the objective statement and go straight for a professional summary. Hiring managers care more about what you bring to the table than what you want from them. I've seen countless candidates waste valuable resume real estate with vague objectives.

Professional Experience

This is where you prove you can do the job. Focus on relevant accomplishments rather than just listing responsibilities.

- Lead with action verbs (analyzed, developed, implemented, assessed)

- Include specific metrics where possible (reduced loan default rate by 17%, analyzed 200+ commercial loan applications monthly)

- Highlight experience with risk models, credit scoring systems, and regulatory compliance

- Mention specific risk assessment tools you've used (SAS, R, Python, Excel)

- Tailor experiences to match the job description—different credit risk roles emphasize different skills

Education and Certifications

For Credit Risk Analysts, formal education and industry certifications carry significant weight.

- List degrees in finance, economics, statistics, or related fields

- Include relevant coursework for entry-level positions or career changers

- Highlight certifications like FRM (Financial Risk Manager), CFA, or CQF

- Mention any specialized training in Basel regulations, CECL, or IFRS 9

Keywords and ATS Tips

Many companies use Applicant Tracking Systems to filter resumes before human eyes ever see them. To get past these digital gatekeepers:

- Incorporate keywords from the job description (credit modeling, default prediction, PD/LGD analysis)

- Use standard section headings that ATS systems recognize

- Avoid headers/footers, tables, and text boxes that might confuse ATS software

- Spell out acronyms at least once (e.g., "Expected Credit Loss (ECL)")

Industry-specific Terms

Sprinkle these terms throughout your resume to signal your expertise (but only if you genuinely have experience with them):

- Credit scoring models (FICO, custom scorecards)

- Risk metrics (PD, LGD, EAD, RWA)

- Regulatory frameworks (Basel III, Dodd-Frank, CECL)

- Statistical concepts (regression analysis, time series, stress testing)

- Software and languages (SAS, R, Python, SQL, Tableau)

Common Mistakes to Avoid

I've seen talented analysts get overlooked because of these easily fixable errors:

- Being too vague about technical skills (say exactly which models you've built)

- Focusing on daily tasks rather than achievements and impact

- Neglecting to highlight quantitative abilities (your analytical skill is your calling card!)

- Including irrelevant experience without connecting it to risk analysis

- Typos and inconsistencies (particularly damaging in a field that prizes precision)

Before/After Example

Before: "Responsible for reviewing loan applications and assessing risk."

After: "Evaluated 75+ commercial loan applications monthly using proprietary risk models, identifying high-risk applications that reduced potential defaults by 22% compared to previous year while maintaining portfolio growth targets."

The difference? Specific metrics, tools used, and business impact—exactly what hiring managers in credit risk are looking for. Good luck with your application!

Related Resume Examples

Soft skills for your Credit Risk Analyst resume

- Cross-functional collaboration – particularly with lending teams and senior management during loan approval processes

- Clear communication of complex risk metrics to non-technical stakeholders (turned a 30-page risk report into a 5-minute executive presentation)

- Methodical problem-solving when investigating credit anomalies or unexpected portfolio performance

- Adaptability to shifting regulatory frameworks and economic conditions (pivoted analysis during interest rate fluctuations)

- Detail orientation without losing sight of broader portfolio implications

- Mentoring junior analysts on risk modeling techniques and credit evaluation fundamentals

Hard skills for your Credit Risk Analyst resume

- Proficiency in SAS and R for statistical modeling and credit scoring (6+ years)

- Basel III regulatory framework knowledge with practical implementation experience

- Advanced Excel skills including complex financial formulas and VBA macros

- Experience with Moody’s CreditEdge and S&P Capital IQ platforms

- SQL querying for large financial databases (Oracle, MySQL)

- Credit portfolio stress testing and scenario analysis techniques

- Loan origination systems (LOS) and underwriting software

- Validation of CECL (Current Expected Credit Loss) models

- Financial statement analysis with focus on credit quality indicators