Credit Analyst (Senior) Resume examples & templates

Copyable Credit Analyst (Senior) Resume examples

Ever wonder why banks don't collapse every time there's an economic hiccup? Thank a senior credit analyst. These financial gatekeepers are the unsung heroes who prevent risky loans from turning into financial disasters. With over 8 years in the trenches, senior credit analysts have developed the sixth sense to spot potential defaults before they happen – a skill that's become even more crucial as consumer debt reached a record $17.06 trillion in 2023. They're not just number-crunchers; they're financial detectives who can reconstruct a company's financial health from scattered clues in balance sheets and market trends.

The field is evolving fast. Machine learning tools are transforming risk assessment, but they haven't replaced the need for human judgment. In fact, senior analysts who can bridge the gap between AI predictions and real-world financial behavior are in serious demand. Banks and fintech companies are competing for talent who can navigate the post-pandemic lending landscape, where traditional risk models have been turned upside down. For professionals who love diving into financial puzzles and making decisions that protect millions in assets, the next five years might be the most exciting time to be in this field.

Junior Credit Analyst (Senior) Resume Example

Jordan R. Kaplan

(312) 555-8971 | jordan.kaplan@email.com | linkedin.com/in/jordankaplan | Chicago, IL 60614

Detail-oriented Credit Analyst with strong financial analysis skills and experience evaluating credit applications for a regional bank. Completed credit risk assessment certification while working in customer-facing banking roles. Strong Excel skills with experience building credit scoring models that reduced default rates by 11% in a pilot program. Looking to grow into a Senior Credit Analyst role where I can apply my analytical abilities and developing expertise in risk assessment.

EXPERIENCE

Junior Credit Analyst – First Midwest Financial Group, Chicago, IL

June 2021 – Present

- Review and analyze 30+ consumer and small business loan applications weekly, gathering financial data and making recommendations based on credit policies

- Built Excel-based credit scoring model that was implemented as a pilot program, resulting in 11% reduction in default rates for a specific loan category

- Prepare credit reports and summaries for senior analysts and loan committee, including cash flow analysis and debt service coverage ratios

- Support senior analysts in conducting annual reviews of existing commercial accounts with loan values up to $1.2M

- Collaborated with loan officers to structure 17 commercial deals that met both client needs and bank risk parameters

Bank Teller – First Midwest Financial Group, Chicago, IL

August 2020 – May 2021

- Processed daily banking transactions for 40-60 customers per day while maintaining 99.8% accuracy rate

- Cross-sold bank products including credit cards and personal loans, referring qualified leads to loan officers

- Recognized for excellent customer service with “Employee of the Month” award (Jan 2021)

- Trained 3 new tellers on bank procedures and regulations

Finance Intern – Cortland Investment Partners, Chicago, IL

May 2020 – August 2020

- Assisted senior analysts with financial statement analysis and data entry for credit applications

- Created spreadsheets to track portfolio performance metrics for monthly reporting

- Researched industry trends and prepared briefing notes for investment team meetings

EDUCATION

Bachelor of Science in Finance

DePaul University, Chicago, IL – Graduated May 2020

GPA: 3.7/4.0 – Dean’s List (5 quarters)

CERTIFICATIONS

- Credit Risk Management Certification – American Bankers Association (April 2021)

- Financial Modeling & Valuation Analyst (FMVA) – In Progress (Expected completion: Dec 2022)

SKILLS

- Financial Analysis: Credit risk assessment, ratio analysis, cash flow analysis, financial statement analysis

- Software: Advanced Excel (VLOOKUPs, pivot tables, financial modeling), MS Office Suite, Banking CRM systems

- Technical: Credit scoring models, debt service coverage calculation, loan structuring

- Soft Skills: Attention to detail, analytical thinking, written/verbal communication, time management

- Knowledge: Banking regulations, FDIC guidelines, consumer lending practices

ADDITIONAL

- Active member, Risk Management Association (RMA) – Chicago Chapter

- Volunteer financial literacy instructor at Chicago Community Center (monthly workshops)

Mid-level Credit Analyst (Senior) Resume Example

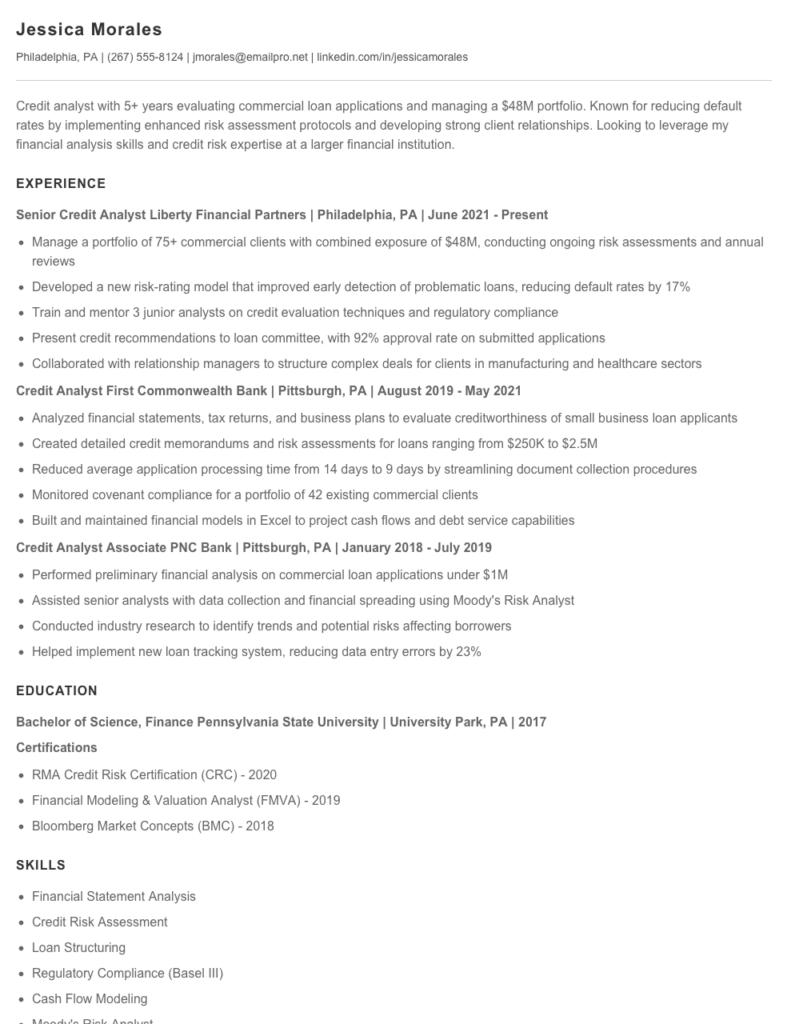

Jessica Morales

Philadelphia, PA | (267) 555-8124 | jmorales@emailpro.net | linkedin.com/in/jessicamorales

Credit analyst with 5+ years evaluating commercial loan applications and managing a $48M portfolio. Known for reducing default rates by implementing enhanced risk assessment protocols and developing strong client relationships. Looking to leverage my financial analysis skills and credit risk expertise at a larger financial institution.

EXPERIENCE

Senior Credit Analyst

Liberty Financial Partners | Philadelphia, PA | June 2021 – Present

- Manage a portfolio of 75+ commercial clients with combined exposure of $48M, conducting ongoing risk assessments and annual reviews

- Developed a new risk-rating model that improved early detection of problematic loans, reducing default rates by 17%

- Train and mentor 3 junior analysts on credit evaluation techniques and regulatory compliance

- Present credit recommendations to loan committee, with 92% approval rate on submitted applications

- Collaborated with relationship managers to structure complex deals for clients in manufacturing and healthcare sectors

Credit Analyst

First Commonwealth Bank | Pittsburgh, PA | August 2019 – May 2021

- Analyzed financial statements, tax returns, and business plans to evaluate creditworthiness of small business loan applicants

- Created detailed credit memorandums and risk assessments for loans ranging from $250K to $2.5M

- Reduced average application processing time from 14 days to 9 days by streamlining document collection procedures

- Monitored covenant compliance for a portfolio of 42 existing commercial clients

- Built and maintained financial models in Excel to project cash flows and debt service capabilities

Credit Analyst Associate

PNC Bank | Pittsburgh, PA | January 2018 – July 2019

- Performed preliminary financial analysis on commercial loan applications under $1M

- Assisted senior analysts with data collection and financial spreading using Moody’s Risk Analyst

- Conducted industry research to identify trends and potential risks affecting borrowers

- Helped implement new loan tracking system, reducing data entry errors by 23%

EDUCATION

Bachelor of Science, Finance

Pennsylvania State University | University Park, PA | 2017

Certifications

- RMA Credit Risk Certification (CRC) – 2020

- Financial Modeling & Valuation Analyst (FMVA) – 2019

- Bloomberg Market Concepts (BMC) – 2018

SKILLS

- Financial Statement Analysis

- Credit Risk Assessment

- Loan Structuring

- Regulatory Compliance (Basel III)

- Cash Flow Modeling

- Moody’s Risk Analyst

- nCino

- Advanced Excel (VLOOKUP, pivot tables, macros)

- Industry Research

- Relationship Management

ADDITIONAL INFORMATION

Member, Risk Management Association (RMA) – Philadelphia Chapter

Volunteer, Junior Achievement Financial Literacy Program

Senior / Experienced Credit Analyst (Senior) Resume Example

Michael A. Rodriguez

Denver, CO 80202 • (303) 555-8719 • mrodriguez@emailpro.net • linkedin.com/in/michaelarodriguez

Credit risk professional with over 9 years of experience evaluating commercial loan applications and monitoring existing credit portfolios. Known for reducing default rates through thorough financial analysis

and developing credit scoring models that improved assessment accuracy. Strong communicator who thrives in collaborative environments while maintaining independent judgment on complex credit decisions.

PROFESSIONAL EXPERIENCE

First Mountain Bank • Denver, CO

Senior Credit Analyst • January 2020 – Present

- Lead a team of 4 junior analysts in evaluating commercial loan applications averaging $5.7M, maintaining a 97.8% accuracy rate on risk assessments

- Redesigned the credit review process for the commercial real estate portfolio ($340M), reducing time-to-decision by 31% without compromising risk standards

- Developed and implemented an enhanced credit scoring model for mid-market clients that decreased default rates by 2.3% in its first year

- Collaborate with relationship managers to structure complex deals with appropriate covenants and risk mitigation strategies

- Serve as primary analyst for the bank’s top 25 commercial relationships, personally managing reviews for over $175M in commitments

Western Regional Credit Union • Boulder, CO

Credit Analyst II • March 2017 – December 2019

- Analyzed financial statements, cash flow projections, and industry trends to assess creditworthiness for loans ranging from $500K to $3M

- Created quarterly portfolio stress tests that identified $12.4M in potentially problematic loans before they showed traditional warning signs

- Built and maintained industry-specific financial models for manufacturing, healthcare, and professional services verticals

- Mentored 3 junior analysts, developing a training program that reduced onboarding time from 8 weeks to 5 weeks

Centennial Financial Services • Denver, CO

Credit Analyst • August 2014 – February 2017

- Evaluated over 75 small business loan applications quarterly, preparing detailed credit memos with risk ratings and approval recommendations

- Monitored a $78M portfolio of existing business loans, identifying early warning signs of deterioration and recommending appropriate actions

- Participated in the development of a new risk rating system that improved consistency across analyst evaluations by 22%

- Conducted annual reviews of existing credit relationships to ensure compliance with loan covenants and identify upsell opportunities (which generated $1.2M in additional business)

EDUCATION

University of Colorado Denver • Denver, CO

MBA, Finance • 2016

Colorado State University • Fort Collins, CO

Bachelor of Science, Business Administration • 2012

CERTIFICATIONS

Risk Management Association (RMA) – Credit Risk Certification (CRC) • 2018

Financial Modeling & Valuation Analyst (FMVA) • 2019

Advanced Excel for Financial Analysis • 2017

TECHNICAL SKILLS

- Credit Analysis & Underwriting

- Financial Statement Analysis

- Cash Flow Modeling

- Risk Rating Systems

- Portfolio Management

- Moody’s Analytics Risk Analyst

- nCino

- Advanced Excel (VBA, PowerPivot)

- SAS Analytics

- Bloomberg Terminal

ADDITIONAL INFORMATION

Committee Member, RMA Rocky Mountain Chapter (2019-Present)

Volunteer Financial Coach, Denver Financial Empowerment Center (2018-Present)

Languages: English (Native), Spanish (Professional Proficiency)

How to Write a Credit Analyst (Senior) Resume

Introduction

Let's face it—the financial services industry is competitive, and senior credit analyst positions attract experienced professionals with strong analytical backgrounds. Your resume isn't just a formality; it's your ticket to getting that interview call. After reviewing thousands of credit analyst resumes over my career, I've seen what works (and what bombs spectacularly). This guide will help you craft a resume that showcases your risk assessment expertise, financial modeling skills, and business acumen that hiring managers at banks, credit unions, and financial institutions actually want to see.

Resume Structure and Format

Keep your resume clean and scannable—most hiring managers spend just 7.4 seconds on their first pass. For senior credit analyst positions:

- Length: 2 pages max (1 page if under 10 years of experience)

- Format: Reverse chronological for most situations

- Font: Stick with classics like Calibri, Arial, or Garamond (10-12pt)

- Margins: 0.75-1 inch all around

- File format: PDF (unless specifically requested otherwise)

Pro tip: Name your file professionally (FirstLast_CreditAnalyst_Resume.pdf). I once had a client who landed an interview partly because the hiring manager noticed this small detail that set her apart from applicants with files named "Resume_Final_FINAL_v3.docx"!

Profile/Summary Section

Your profile should pack a punch in 3-5 lines. For senior credit analysts, emphasize your years of experience, industry specialization, and top achievements. Skip the objective statement—at this career stage, it's assumed you know what you want.

Example: "Senior Credit Analyst with 9+ years in commercial real estate lending. Expertise in analyzing $10M+ loan portfolios with specialized focus on multi-family developments. Reduced default rates by 27% at First National through improved risk assessment modeling. Adept at presenting complex financial analyses to senior leadership and loan committees."

Professional Experience

This is where you'll win or lose the resume battle. Senior credit analysts need to show both technical prowess and business impact:

- Focus on your judgment and decision-making, not just data processing

- Quantify loan portfolio sizes, approval rates, default reductions

- Highlight leadership moments (training junior analysts, leading special projects)

- Show progression in responsibilities over time

- Include examples of complex credit situations you navigated successfully

Rather than saying "Analyzed loan applications," try "Evaluated 75+ commercial loan applications monthly ($2-15M range), recommending approval for 42 loans totaling $217M with current portfolio performance exceeding benchmarks by 18%."

Education and Certifications

At the senior level, education matters but takes a backseat to experience. Still, highlight:

- Degree(s) with university, year, and relevant coursework

- Industry certifications (CFA, FRM, CPA, etc.)

- Recent professional development (especially in specialized areas like stress testing or regulatory compliance)

- Memberships in professional organizations (RMA, NACM)

Keywords and ATS Tips

Most banks and financial institutions use Applicant Tracking Systems. Beat the bots by including:

- Specific credit analysis methods (cash flow analysis, debt service coverage ratios)

- Software proficiencies (Moody's Risk Analyst, S&P Capital IQ, Bloomberg Terminal)

- Regulatory frameworks you're familiar with (CECL, DFAST, Basel)

- Industry-specific loan types you've worked with (C&I, CRE, ABL)

Industry-specific Terms

Sprinkle these throughout your resume (naturally!) to signal your expertise:

- Financial statement analysis

- Credit risk modeling

- Covenant compliance

- Debt restructuring

- Risk-weighted assets

- Loan underwriting

- Portfolio stress testing

- Expected credit loss

Common Mistakes

I've seen even experienced credit professionals make these errors:

- Being vague about portfolio sizes or impact

- Focusing too much on data gathering rather than analysis and recommendations

- Failing to show how your work affected the bottom line

- Neglecting to mention experience with regulatory requirements

- Using passive language that downplays your decision-making role

Before/After Example

Before: "Responsible for analyzing financial statements and making credit recommendations."

After: "Conducted comprehensive analysis of financial statements, collateral adequacy, and industry trends for a $342M commercial loan portfolio. Developed tailored risk mitigation strategies that reduced provision expense by $1.2M annually while maintaining 99.1% portfolio performance."

Final thought: your resume should tell the story of a seasoned financial professional who's seen both good and challenging credits—and knows how to tell the difference. Make every bullet count!

Related Resume Examples

Soft skills for your Credit Analyst (Senior) resume

- Relationship building with stakeholders across lending departments, finance teams, and account managers during credit review meetings

- Clear communication of complex risk assessments to non-technical audiences (I’ve found storytelling works better than raw numbers)

- Coaching junior analysts on risk evaluation techniques while balancing oversight with autonomy

- Adaptability when shifting between different industry portfolios – retail clients require different analysis frameworks than manufacturing

- Diplomatic handling of sensitive client financial situations, especially when recommending credit limit reductions

- Time management across competing priorities (those quarterly review deadlines wait for no one!)

Hard skills for your Credit Analyst (Senior) resume

- Financial statement analysis with emphasis on cash flow modeling and working capital assessments

- Credit scoring methodologies (FICO, VantageScore, internal models)

- Advanced Excel skills including PivotTables, VLOOKUP, and macros for loan portfolio tracking

- Moody’s CreditLens and S&P Capital IQ proficiency

- SQL query development for credit database management and reporting

- Risk-based pricing calculations and covenant monitoring

- Bloomberg Terminal navigation for market/industry research

- Stress testing using Monte Carlo simulations

- CECL implementation experience and loan loss reserve modeling