Corporate Controller Resume examples & templates

Copyable Corporate Controller Resume examples

Ever wonder who's keeping the financial ship steady when CEOs are making the big strategic plays? That's the Corporate Controller—the unsung financial backbone of successful organizations. Controllers don't just crunch numbers; they transform complex financial data into strategic insights that drive business decisions. It's a role that's evolved dramatically over the past decade, shifting from traditional accounting oversight to becoming a key business partner across departments. In fact, a recent survey by Robert Half found that 85% of CFOs now rely on their Controllers to help guide technology decisions related to financial systems.

The Controller's desk sits at a fascinating crossroads where accounting expertise meets business strategy. With regulatory requirements growing more complex (thanks, FASB!) and the rise of automation tools changing how we handle transaction processing, today's Controllers need a broader skill set than ever before. Looking ahead, those who can balance technical accounting knowledge with strong business acumen and technology fluency will find themselves increasingly valuable as organizations continue blurring the lines between finance and strategy.

Junior Corporate Controller Resume Example

MARCUS CHEN

Princeton, NJ 08540 | (609) 555-8217 | mchen.finance@gmail.com | linkedin.com/in/marcuschen

Junior Corporate Controller with strong accounting foundation and 1+ year of progressive experience in financial operations. CPA candidate with

expertise in month-end close processes, financial reporting, and GL reconciliations. Quick learner who thrives in fast-paced environments and delivers accurate financial analysis to support business decisions.

EXPERIENCE

Assistant Controller

Pinnacle Biotech Solutions | Princeton, NJ | March 2023 – Present

- Manage full-cycle monthly close process for startup with $3.7M annual revenue, reducing close timeline from 12 to 7 days

- Prepare and review journal entries, account reconciliations, and variance analyses for senior management review

- Coordinate with external auditors during quarterly reviews and annual audit procedures

- Built automated Excel reporting package that saved 6+ hours weekly on manual data consolidation

- Assist CFO with cash flow projections and working capital management to maximize operational efficiency

Staff Accountant

NorthStar Financial Group | Edison, NJ | June 2022 – March 2023

- Performed monthly balance sheet reconciliations across 14 GL accounts with 99.8% accuracy

- Assisted with A/P functions including invoice processing, payment approvals, and vendor statement reconciliations

- Supported month-end close by preparing journal entries and account analyses

- Helped put in place new AP automation software that reduced invoice processing time by 37%

Accounting Intern

Deloitte | New York, NY | January 2022 – May 2022

- Supported senior accountants with audit procedures for mid-sized manufacturing clients

- Conducted detailed testing of revenue recognition and expense allocation methodologies

- Prepared first draft of financial statement footnotes under senior associate guidance

EDUCATION

Rutgers University, New Brunswick, NJ

Bachelor of Science in Accounting, Minor in Information Systems | May 2022

GPA: 3.78/4.0 | Dean’s List: 6 semesters

Certifications

- CPA Exam (Passed FAR & AUD sections, BEC & REG in progress) | Expected completion: December 2023

- Bloomberg Market Concepts (BMC) | Completed April 2022

SKILLS

- Financial Software: NetSuite, QuickBooks, SAP (basic), Microsoft Dynamics GP

- Technical: Advanced Excel (VLOOKUP, INDEX/MATCH, PivotTables), PowerBI (basic), SQL (basic)

- Accounting: US GAAP, Month-end close, Financial statement preparation, Variance analysis

- Process Improvement: Workflow optimization, Documentation development, Cross-functional collaboration

- Soft Skills: Problem-solving, Time management, Attention to detail, Written communication

ADDITIONAL

Professional Affiliations

- American Institute of Certified Public Accountants (AICPA) – Student Member

- New Jersey Society of CPAs (NJCPA) – Associate Member

Mid-level Corporate Controller Resume Example

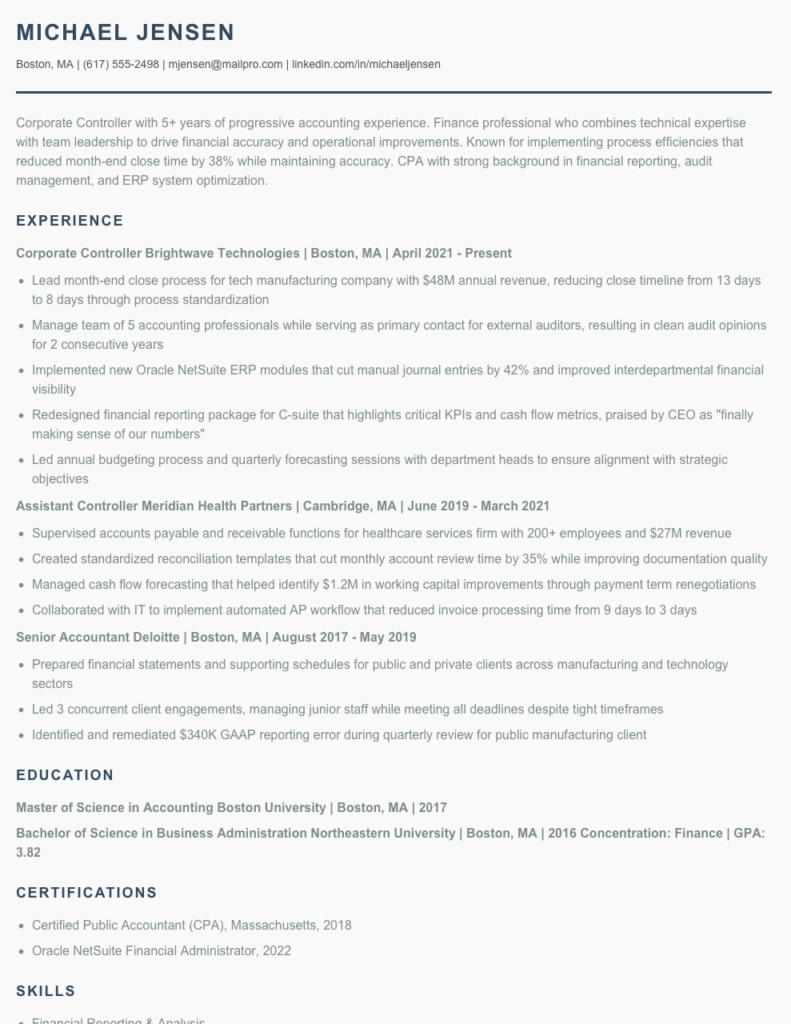

MICHAEL JENSEN

Boston, MA | (617) 555-2498 | mjensen@mailpro.com | linkedin.com/in/michaeljensen

Corporate Controller with 5+ years of progressive accounting experience. Finance professional who combines technical expertise with team leadership to drive financial accuracy and operational improvements. Known for implementing process efficiencies that reduced month-end close time by 38% while maintaining accuracy. CPA with strong background in financial reporting, audit management, and ERP system optimization.

EXPERIENCE

Corporate Controller

Brightwave Technologies | Boston, MA | April 2021 – Present

- Lead month-end close process for tech manufacturing company with $48M annual revenue, reducing close timeline from 13 days to 8 days through process standardization

- Manage team of 5 accounting professionals while serving as primary contact for external auditors, resulting in clean audit opinions for 2 consecutive years

- Implemented new Oracle NetSuite ERP modules that cut manual journal entries by 42% and improved interdepartmental financial visibility

- Redesigned financial reporting package for C-suite that highlights critical KPIs and cash flow metrics, praised by CEO as “finally making sense of our numbers”

- Led annual budgeting process and quarterly forecasting sessions with department heads to ensure alignment with strategic objectives

Assistant Controller

Meridian Health Partners | Cambridge, MA | June 2019 – March 2021

- Supervised accounts payable and receivable functions for healthcare services firm with 200+ employees and $27M revenue

- Created standardized reconciliation templates that cut monthly account review time by 35% while improving documentation quality

- Managed cash flow forecasting that helped identify $1.2M in working capital improvements through payment term renegotiations

- Collaborated with IT to implement automated AP workflow that reduced invoice processing time from 9 days to 3 days

Senior Accountant

Deloitte | Boston, MA | August 2017 – May 2019

- Prepared financial statements and supporting schedules for public and private clients across manufacturing and technology sectors

- Led 3 concurrent client engagements, managing junior staff while meeting all deadlines despite tight timeframes

- Identified and remediated $340K GAAP reporting error during quarterly review for public manufacturing client

EDUCATION

Master of Science in Accounting

Boston University | Boston, MA | 2017

Bachelor of Science in Business Administration

Northeastern University | Boston, MA | 2016

Concentration: Finance | GPA: 3.82

CERTIFICATIONS

- Certified Public Accountant (CPA), Massachusetts, 2018

- Oracle NetSuite Financial Administrator, 2022

SKILLS

- Financial Reporting & Analysis

- Month-End Close Process

- ERP Systems (NetSuite, SAP)

- Team Leadership & Development

- Audit Management

- GAAP Compliance

- Cash Flow Management

- Financial Modeling

- Process Improvement

- Budgeting & Forecasting

Senior / Experienced Corporate Controller Resume Example

Michael J. Reynolds, CPA

Boston, MA | (617) 555-8274 | m.reynolds@email.com | linkedin.com/in/michaeljreynolds

Strategic financial leader with 12+ years of progressive experience in corporate accounting and financial management. Skilled at streamlining accounting operations, improving financial reporting processes, and driving business performance. Track record of reducing costs, implementing robust controls, and leading high-performing teams. Comfortable partnering with C-suite executives to support strategic decision-making.

PROFESSIONAL EXPERIENCE

Corporate Controller | Vertex Technologies, Inc. | Boston, MA | March 2018 – Present

- Lead a team of 15 accounting professionals overseeing all accounting operations for this $278M technology manufacturing company

- Reduced monthly close process from 12 days to 5 days by redesigning workflow processes and implementing new reporting templates

- Managed successful implementation of Oracle Cloud ERP system, coming in 8% under budget and completing migration 2 weeks ahead of schedule

- Developed and executed cash management strategy that improved working capital by $3.2M

- Established comprehensive SOX compliance program that passed external audit with zero material weaknesses for 4 consecutive years

- Partnered with CFO to secure $45M in additional funding through detailed financial modeling and investor presentations

Assistant Controller | Meridian Healthcare Systems | Cambridge, MA | June 2015 – February 2018

- Supervised team of 8 accountants responsible for GL, AP, AR, and payroll functions for multi-site healthcare organization

- Led annual budget process for $125M organization with 600+ FTEs across 7 locations

- Saved $437K annually by identifying and eliminating duplicate vendor payments and negotiating early payment discounts

- Created standardized monthly reporting package that enhanced visibility into department-level performance

- Collaborated with IT to automate revenue reconciliation process, reducing manual labor by 23 hours weekly

Senior Financial Analyst | BrightPath Financial Group | Boston, MA | August 2011 – May 2015

- Produced monthly financial statements, variance analyses, and forecasts for executive leadership

- Developed complex Excel models to analyze profitability by product line and customer segment

- Managed annual external audit process, reducing preparation time by 40% through improved documentation

- Trained and mentored 3 junior analysts who all received promotions within 18 months

EDUCATION & CERTIFICATIONS

Master of Business Administration (MBA), Finance Concentration

Boston University Questrom School of Business | Boston, MA | 2014

Bachelor of Science, Accounting

University of Massachusetts | Amherst, MA | 2010

Certifications:

- Certified Public Accountant (CPA), Massachusetts #87429

- Certified Management Accountant (CMA), 2016

TECHNICAL SKILLS

- ERP Systems: Oracle Cloud, SAP, NetSuite

- Financial Reporting: Hyperion, Power BI, Tableau

- Advanced Excel (vlookups, pivot tables, macros)

- Financial Modeling & Forecasting

- M&A Due Diligence & Integration

- SOX Compliance & Internal Controls

- Tax Planning & Compliance

- Treasury Management

PROFESSIONAL AFFILIATIONS

- American Institute of Certified Public Accountants (AICPA)

- Financial Executives International (FEI) – Boston Chapter

- Institute of Management Accountants (IMA)

How to Write a Corporate Controller Resume

Introduction

Landing a Corporate Controller position means showcasing your financial leadership skills and technical expertise on paper before you ever get to an interview. Your resume isn't just a career history—it's your financial narrative that demonstrates your ability to manage complex accounting operations, ensure regulatory compliance, and drive strategic financial decisions. I've helped hundreds of financial executives revamp their resumes, and I've noticed the controllers who get interviews present themselves as both technical experts and business partners to the C-suite.

Resume Structure and Format

Financial executives need resumes that reflect their precision and attention to detail. For Corporate Controller positions, aim for these structural elements:

- Length: 2 pages for most candidates (3 pages only if you have 15+ years of relevant experience)

- Format: Clean, minimal design with clear section breaks

- Font: Professional choices like Calibri, Arial, or Garamond in 10-12pt size

- Margins: 0.7-1 inch margins all around

- File type: PDF (maintains formatting across all systems)

Keep your resume scannable—both for human eyes and ATS software. Busy CFOs and hiring managers typically spend just 7-8 seconds on initial resume scans, so clarity is crucial.

Pro tip: Name your file professionally—"FirstName_LastName_Controller.pdf" rather than "Resume_Final_v3.pdf." This small detail shows organization and professionalism before anyone even opens your document.

Profile/Summary Section

Start with a punchy 3-4 sentence summary that positions you specifically as a Corporate Controller. This isn't the place for generic accounting statements. Highlight your specific industry expertise (manufacturing, healthcare, tech), company size experience ($XXM-$XXB), and your particular technical strengths (ERP implementations, SEC reporting, treasury management).

For example: "Strategic Corporate Controller with 8+ years guiding financial operations for mid-market manufacturing companies ($75M-$250M). Expertise in NetSuite implementation, margin analysis, and rebuilding accounting teams. Reduced month-end close from 12 days to 4 days while improving accuracy by implementing streamlined reconciliation processes."

Professional Experience

For controller positions, your professional experience needs to balance technical accounting prowess with business impact. For each role:

- Begin with a brief company description including size and industry

- Include scope details (team size, budget responsibility, reporting structure)

- Emphasize achievements with concrete metrics over daily responsibilities

- Focus on: process improvements, cost reductions, audit outcomes, system implementations

Quantify everything possible: "Led 6-person accounting team through acquisition, consolidating 3 ERP systems while maintaining 99.7% accuracy in first-quarter reporting" is much stronger than "Managed accounting team during company transition."

Education and Certifications

For Controller positions, credentials matter. List your education in reverse chronological order, featuring:

- Degrees with institutions and graduation years

- Certifications (CPA, CMA, CGMA) with dates obtained

- Continuing education that's relevant (omit older or irrelevant courses)

- Technical training in relevant systems (NetSuite, SAP, Oracle, etc.)

Keywords and ATS Tips

Most controller resumes face ATS screening before human eyes. Include these terms naturally throughout your resume:

- Technical skills: GAAP, SEC reporting, SOX compliance, internal controls

- Software proficiency: Specific ERP systems, financial reporting tools

- Process terms: Month-end close, consolidation, reconciliation, audit

- Leadership terms: Team management, cross-functional collaboration

Industry-specific Terminology

Tailor your language to show deep finance expertise. Include relevant terminology like working capital management, cash flow forecasting, debt covenants, ASC 842 implementation, or revenue recognition. Be specific to your industry—real estate controllers should mention CAM reconciliations while software controllers might highlight ASC 606 experience.

Common Mistakes to Avoid

- Listing job duties without achievements or metrics

- Focusing too much on accounting tasks rather than financial leadership

- Omitting systems expertise or specific GAAP/IFRS knowledge

- Using generic templates that don't highlight controller-specific skills

- Failing to show progression in responsibility over your career

Before/After Example

Before: "Responsible for monthly close process and financial reporting."

After: "Redesigned month-end close process, reducing timeline from 15 to 6 days while implementing additional validation checks that caught $187K in previously unidentified vendor billing errors."

Remember—your controller resume should tell the story of how you've protected financial integrity while driving business performance. Make every bullet prove you're not just an accountant, but a financial leader.

Related Resume Examples

Soft skills for your Corporate Controller resume

- Cross-functional communication — translating complex financial concepts to non-finance teams without the jargon

- Team leadership during high-pressure month-end closings (managed a team that cut close time from 12 days to 7)

- Conflict resolution between accounting staff and department heads over budget variances

- Executive presence when presenting financial reports to C-suite and board members

- Adaptability during ERP system transitions and accounting standard changes

- Mentoring junior accountants on both technical skills and workplace navigation

Hard skills for your Corporate Controller resume

- Financial statement preparation (GAAP, IFRS) with multi-entity consolidation experience

- NetSuite ERP administration and GL management

- Advanced Excel modeling (VLOOKUP, INDEX/MATCH, pivot tables)

- Month-end close process optimization and 5-day close implementation

- SOX compliance and internal control framework development

- Financial forecasting and 13-week cash flow modeling

- Tax provision preparation and coordination with external auditors

- BlackLine account reconciliation system expertise

- ASC 606 revenue recognition implementation