Compliance Officer Resume examples & templates

Copyable Compliance Officer Resume examples

Ever wondered who keeps companies on the right side of increasingly complex regulations? That's where Compliance Officers step in. We're the professionals who navigate the maze of laws, regulations, and internal policies that govern organizations across industries. The field has evolved dramatically since the 2008 financial crisis, transforming compliance from a back-office function to a strategic business partner that helps organizations manage risk while pursuing growth opportunities.

The demand for skilled Compliance Officers continues to grow, with the Bureau of Labor Statistics projecting a 9.2% increase in compliance-related positions through 2031—faster than the average for all occupations. This growth isn't surprising given the expanding regulatory landscape. Financial services firms face Basel III requirements, healthcare organizations navigate HIPAA complexities, and virtually every company must address data privacy regulations like GDPR and CCPA. As regulatory scrutiny intensifies (just look at the $2.3 billion in FCPA penalties imposed in 2023!), Compliance Officers who can blend regulatory knowledge with business acumen will find themselves increasingly valued at the executive table.

Junior Compliance Officer Resume Example

Elaine Morris

Boston, MA • (617) 555-4289 • emorris@emaildomain.com • linkedin.com/in/elainemorris

Junior Compliance Officer with internship and 1+ year professional experience in regulatory compliance. Detail-oriented with strong analytical skills and a solid foundation in financial regulations. Completed FINRA Series 7 exam and currently pursuing Certified Anti-Money Laundering Specialist (CAMS) certification. Passionate about ethics and maintaining regulatory standards.

Experience

Compliance Officer | Northeast Credit Union | Boston, MA | March 2023 – Present

- Assist with daily compliance monitoring of banking transactions, reviewing ~75 alerts weekly with 98.2% accuracy rate

- Help maintain regulatory policies and procedures documentation, updating 14 departmental procedures to align with new regulations

- Support KYC/CIP verification processes for new account openings, processing an average of 45 applications per week

- Participate in monthly audits of branch operations, identifying compliance gaps and helping implement corrective actions

- Collaborate with senior team members on quarterly regulatory reports and filings

Compliance Intern | Meridian Financial Services | Boston, MA | May 2022 – February 2023

- Assisted compliance team with document review and organization, helping to streamline filing system

- Conducted initial reviews of customer documentation for KYC/AML requirements

- Helped monitor transaction alerts under supervision of senior compliance staff

- Created internal reference guide for common compliance questions that’s still used by new hires

Administrative Assistant (Part-time) | Smith & Weathers Law Firm | Boston, MA | September 2021 – May 2022

- Handled document management and filing for legal cases, developing attention to detail

- Assisted with client intake process and maintained confidentiality of sensitive information

- Scheduled appointments and managed office communications

Education

Bachelor of Science in Business Administration | Boston University | Boston, MA

Concentration in Finance, Minor in Ethics | May 2022 Relevant Coursework: Business Law, Financial Regulations, Corporate Governance, Business Ethics

Certifications

- FINRA Series 7 (General Securities Representative) – 2023

- AML Fundamentals Certificate – ACAMS, 2022

- CAMS Certification – In progress (expected completion Winter 2024)

Skills

- Regulatory Compliance

- Know Your Customer (KYC) Procedures

- Anti-Money Laundering (AML)

- Risk Assessment

- Policy Implementation

- Microsoft Office Suite

- Compliance Management Systems

- Documentation & Reporting

- Research & Analysis

- Detail-Oriented

Professional Memberships

- Association of Certified Anti-Money Laundering Specialists (ACAMS) – Student Member

- Boston Young Professionals in Finance – Member since 2022

Mid-level Compliance Officer Resume Example

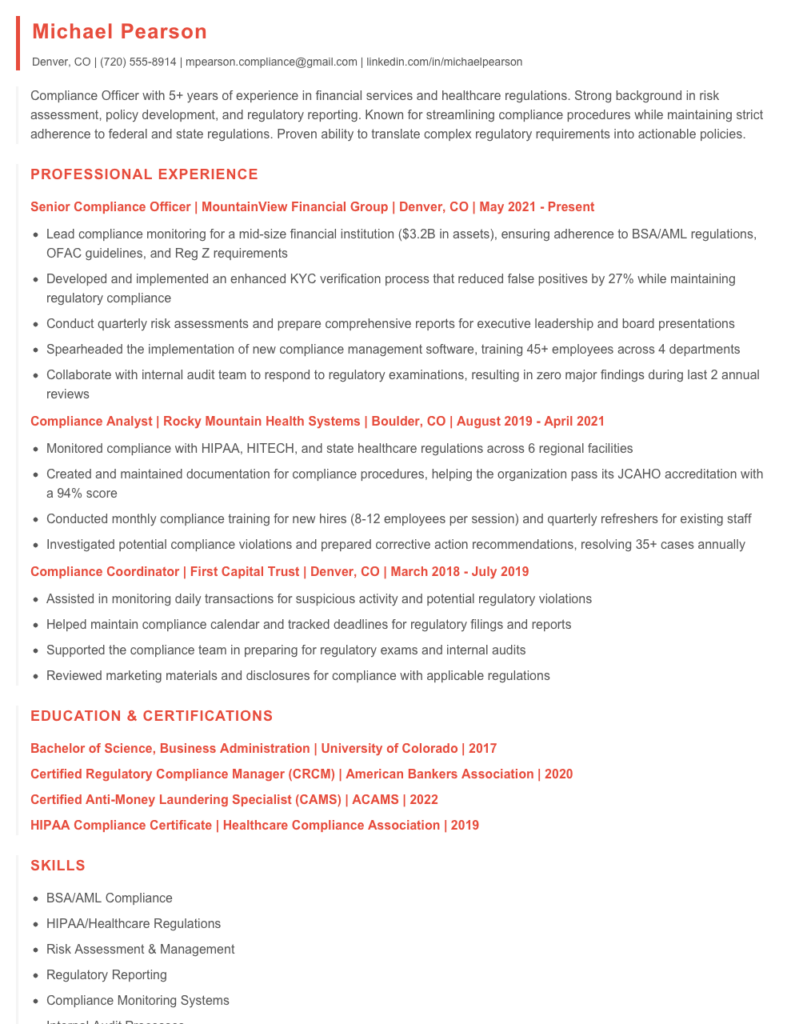

Michael Pearson

Denver, CO | (720) 555-8914 | mpearson.compliance@gmail.com | linkedin.com/in/michaelpearson

Compliance Officer with 5+ years of experience in financial services and healthcare regulations. Strong background in risk assessment, policy development, and regulatory reporting. Known for streamlining compliance procedures while maintaining strict adherence to federal and state regulations. Proven ability to translate complex regulatory requirements into actionable policies.

PROFESSIONAL EXPERIENCE

Senior Compliance Officer | MountainView Financial Group | Denver, CO | May 2021 – Present

- Lead compliance monitoring for a mid-size financial institution ($3.2B in assets), ensuring adherence to BSA/AML regulations, OFAC guidelines, and Reg Z requirements

- Developed and implemented an enhanced KYC verification process that reduced false positives by 27% while maintaining regulatory compliance

- Conduct quarterly risk assessments and prepare comprehensive reports for executive leadership and board presentations

- Spearheaded the implementation of new compliance management software, training 45+ employees across 4 departments

- Collaborate with internal audit team to respond to regulatory examinations, resulting in zero major findings during last 2 annual reviews

Compliance Analyst | Rocky Mountain Health Systems | Boulder, CO | August 2019 – April 2021

- Monitored compliance with HIPAA, HITECH, and state healthcare regulations across 6 regional facilities

- Created and maintained documentation for compliance procedures, helping the organization pass its JCAHO accreditation with a 94% score

- Conducted monthly compliance training for new hires (8-12 employees per session) and quarterly refreshers for existing staff

- Investigated potential compliance violations and prepared corrective action recommendations, resolving 35+ cases annually

Compliance Coordinator | First Capital Trust | Denver, CO | March 2018 – July 2019

- Assisted in monitoring daily transactions for suspicious activity and potential regulatory violations

- Helped maintain compliance calendar and tracked deadlines for regulatory filings and reports

- Supported the compliance team in preparing for regulatory exams and internal audits

- Reviewed marketing materials and disclosures for compliance with applicable regulations

EDUCATION & CERTIFICATIONS

Bachelor of Science, Business Administration | University of Colorado | 2017

Certified Regulatory Compliance Manager (CRCM) | American Bankers Association | 2020

Certified Anti-Money Laundering Specialist (CAMS) | ACAMS | 2022

HIPAA Compliance Certificate | Healthcare Compliance Association | 2019

SKILLS

- BSA/AML Compliance

- HIPAA/Healthcare Regulations

- Risk Assessment & Management

- Regulatory Reporting

- Compliance Monitoring Systems

- Internal Audit Processes

- Policy Development & Implementation

- Staff Training & Development

- Regulatory Exam Preparation

- Suspicious Activity Reporting (SAR)

TECHNICAL SKILLS

- Archer GRC

- AML Compass

- Microsoft Office Suite (advanced Excel)

- LexisNexis Bridger Insight

- Compliance 360

Senior / Experienced Compliance Officer Resume Example

Samantha J. Thornton

sjthornton@email.com | (617) 555-8374 | Boston, MA 02116

linkedin.com/in/samanthajthornton | CAMS, CRCM

Compliance executive with 12+ years of progressive experience in financial services regulation and risk management. Track record of building robust compliance programs that withstand regulatory scrutiny while supporting business objectives. Skilled at translating complex regulatory requirements into practical policies and procedures. Known for strong investigative abilities and developing high-performing teams.

PROFESSIONAL EXPERIENCE

Eastern Trust Bank – Boston, MA

Chief Compliance Officer

November 2019 – Present

- Lead team of 17 compliance professionals across AML, regulatory compliance, and consumer protection functions for regional bank with $3.2B in assets

- Reduced regulatory findings by 71% over 3 years by implementing risk-based monitoring program and enhancing staff training

- Spearheaded implementation of new AML transaction monitoring system, resulting in 34% increase in suspicious activity detection while decreasing false positives by 22%

- Partnered with business units to develop compliant products that grew consumer lending portfolio by $475M

- Restructured compliance testing program, bringing 93% of functions in-house (saved $340K annually in consultant fees)

First National Financial Group – Providence, RI

Senior Compliance Manager

July 2016 – October 2019

- Managed team of 8 compliance analysts responsible for BSA/AML compliance, UDAAP, fair lending, and deposit regulations

- Conducted 15+ compliance risk assessments annually, identifying key gaps and implementing targeted remediation plans

- Created comprehensive compliance training program that improved staff testing scores from 76% to 94% average

- Led regulatory exam preparation and responses, reducing time to clear exam findings by 42%

- Completely revamped KYC/CDD procedures ahead of FinCEN beneficial ownership rule implementation

Citizens Financial Services – Boston, MA

Compliance Officer

March 2013 – June 2016

- Designed and executed monitoring program covering lending, deposits, and electronic banking services

- Developed consumer complaint management process that reduced resolution time from 12 days to 4 days

- Investigated and filed 80+ SARs annually; recognized for exceptional narrative quality by FinCEN

- Collaborated with IT to automate HMDA and CRA data collection, eliminating manual processes

Beacon Investment Services – Cambridge, MA

Compliance Analyst

August 2010 – February 2013

- Monitored broker-dealer transactions for regulatory compliance and suspicious activity

- Conducted due diligence reviews on high-risk customers and PEPs

- Assisted with annual compliance testing and preparation of regulatory reports

EDUCATION & CERTIFICATIONS

Master of Business Administration – Finance Concentration

Boston University School of Management, 2015

Bachelor of Science – Criminal Justice

Northeastern University, 2010

Certifications:

- Certified Anti-Money Laundering Specialist (CAMS), 2014

- Certified Regulatory Compliance Manager (CRCM), 2016

- Certified Fraud Examiner (CFE), 2018

- FINRA Series 7 and 24 (inactive)

TECHNICAL SKILLS & EXPERTISE

- Regulatory Frameworks: BSA/AML, OFAC, UDAAP, Reg Z, Reg E, GLBA, FCRA, HMDA, CRA, Dodd-Frank

- Software: Actimize, SAS AML, Tableau, Verafin, LexisNexis Due Diligence, Moody’s

- Risk Assessment & Monitoring: Transaction monitoring, KYC/CDD, Enhanced Due Diligence (EDD)

- Specialties: Regulatory exam management, remediation program design, policy development

PROFESSIONAL AFFILIATIONS

- Association of Certified Anti-Money Laundering Specialists (ACAMS)

- Risk Management Association (RMA) – Boston Chapter Board Member

- American Bankers Association (ABA)

How to Write a Compliance Officer Resume

Introduction

Landing your dream compliance job isn't just about having the right experience—it's about showcasing that experience effectively on paper. Compliance officers operate in a strict regulatory environment where attention to detail is paramount and guess what? Hiring managers expect to see that same precision reflected in your resume. From banking to healthcare to manufacturing, compliance professionals need to demonstrate their regulatory knowledge, risk assessment capabilities and ability to implement controls—all while making it past those pesky Applicant Tracking Systems (ATS).

Resume Structure and Format

Your resume is a compliance document in itself—it needs structure, clarity and proper formatting:

- Stick to 1-2 pages (one for junior roles, two max for senior positions)

- Use clean, readable fonts like Calibri or Arial (10-12pt)

- Include clear section headers that stand out

- Use consistent formatting for dates and locations

- Break up dense text with bullets (4-6 per role is plenty)

- Leave reasonable white space—crowded documents look chaotic

The best compliance resumes mirror the profession itself: organized, precise and structured with a clear hierarchy of information. Don't make recruiters hunt for critical details!

Profile/Summary Section

Your summary isn't just a formality—it's prime real estate. In 3-4 lines, capture your compliance identity:

- Start with your professional identity (e.g., "Compliance Officer with 7+ years in financial services")

- Mention your most relevant certification (CCEP, CAMS, etc.)

- Include your biggest compliance strength (risk assessment, regulatory interpretation, etc.)

- Name-drop relevant regulations you're familiar with (GDPR, AML, HIPAA)

A junior compliance analyst might write: "Detail-oriented Compliance Analyst with 2 years supporting AML monitoring programs. CAMS certified with strong data analysis skills and experience in transaction monitoring software. Seeking to leverage my background in suspicious activity reporting and regulatory knowledge."

Professional Experience

This is where compliance officers make or break their applications. For each role:

- Lead with compliance-specific responsibilities (monitoring, reporting, policy development)

- Quantify your impact where possible (e.g., "Reduced audit findings by 37% through improved control testing")

- Show both technical knowledge and soft skills (team training, stakeholder communication)

- Highlight systems you've used (Archer, MetricStream, Thomson Reuters, etc.)

- Mention specific regulatory frameworks you've worked with

Don't just list duties—show outcomes. "Developed and implemented revised KYC procedures" isn't nearly as powerful as "Developed enhanced KYC procedures that improved regulatory compliance by 28% while reducing customer onboarding time by 3 business days."

Education and Certifications

In compliance, your credentials matter significantly:

- List relevant degrees (most recent first)

- Showcase compliance-specific certifications prominently (CCEP, CRCM, CAMS, etc.)

- Include ongoing education and recent training programs

- For junior roles, mention relevant coursework if you lack extensive experience

Keywords and ATS Tips

Compliance job descriptions are filled with specific terminology that ATS systems scan for:

- Review each job posting for key terms and mirror them exactly

- Include both spelled-out terms and acronyms (Anti-Money Laundering/AML)

- Mention specific regulations relevant to the industry

- Don't stuff keywords unnaturally—weave them into achievement statements

- Avoid complex formatting, tables, or headers/footers that ATS systems struggle with

Industry-specific Terms to Include

Depending on your compliance specialty, consider incorporating:

- Regulatory frameworks (BSA/AML, GDPR, HIPAA, FCPA, etc.)

- Compliance processes (risk assessment, monitoring, testing, remediation)

- Technical skills (data analysis, reporting software, regulatory research)

- Soft skills (stakeholder management, training, policy interpretation)

Common Mistakes to Avoid

- Being too vague about regulatory knowledge (specify which regulations)

- Focusing only on monitoring without showing remediation experience

- Neglecting to mention cross-functional collaboration

- Using compliance jargon without demonstrating practical application

- Missing opportunities to quantify improvements or efficiency gains

Before/After Example

Before: "Responsible for compliance monitoring and reporting."

After: "Conducted 47 risk-based compliance reviews across 3 business units, identifying 23 control gaps and implementing remediation plans that brought the organization into full compliance with updated BSA/AML requirements within 60 days."

The difference? Specificity, quantifiable results and clear demonstration of compliance expertise in action; Your resume should tell the story of how you've protected organizations while enabling them to meet business objectives—the true mark of an effective compliance professional.

Related Resume Examples

Soft skills for your Compliance Officer resume

- Stakeholder management – skilled at building trust with regulators, auditors, and cross-functional teams while maintaining appropriate boundaries

- Clear communication of complex regulations to non-compliance personnel (translating “compliance speak” into actionable guidance)

- Diplomatic confrontation – ability to address policy violations firmly but constructively, even with senior executives

- Investigative intuition – reading between the lines during interviews and document reviews to identify potential red flags

- Change resilience – maintaining calm effectiveness during regulatory shifts, mergers, or organizational restructuring

- Ethical decision-making when navigating gray areas where formal policies don’t provide clear direction

Hard skills for your Compliance Officer resume

- Regulatory assessment and gap analysis (GDPR, BSA/AML, SOX, FINRA)

- Risk management software proficiency (RSA Archer, MetricStream, SAP GRC)

- Compliance monitoring and testing methodologies

- CAMS certification (Certified Anti-Money Laundering Specialist)

- Audit documentation and evidence collection techniques

- Sanctions screening tools (World-Check, Bridger Insight)

- Regulatory reporting systems (FinCEN CTR/SAR filing)

- Policy management frameworks and implementation

- Statistical sampling methods for transaction monitoring