Compliance Auditor Resume examples & templates

Copyable Compliance Auditor Resume examples

Ever wonder who keeps companies on the straight and narrow? That's where Compliance Auditors come in—the unsung heroes who keep businesses out of hot water with regulators. Far from just box-ticking pencil pushers, today's compliance professionals blend investigative skills with regulatory expertise to protect organizations from increasingly complex risks. With regulatory fines hitting record levels in 2023—the SEC alone imposed $4.93 billion in penalties last year—companies are scrambling to beef up their compliance teams.

The field has evolved dramatically since the 2008 financial crisis, with compliance moving from a back-office function to a strategic business partner. ESG reporting requirements, cryptocurrency regulations, and AI governance frameworks are creating new specialties within the profession. For professionals with sharp analytical minds and ethical backbones, compliance auditing offers stable career growth (compliance roles saw 17% less turnover than other financial positions during the Great Resignation) and the satisfaction of being the guardian of corporate integrity. As regulatory landscapes continue to shift, compliance auditors who can navigate both technical requirements and build stakeholder relationships will find themselves in particularly high demand.

Junior Compliance Auditor Resume Example

Nathan Patel

Chicago, IL 60614 • (773) 555-8921 • npatel@emaildomain.com • linkedin.com/in/nathanpatel

Compliance Auditor with 1+ year of experience supporting regulatory compliance initiatives in financial services. Strong foundation in internal controls testing, data analysis, and risk assessment. Quick learner with exceptional attention to detail and experience working with cross-functional teams. Seeking to leverage analytical mindset and growing regulatory knowledge in a challenging compliance role.

EXPERIENCE

Junior Compliance Auditor | First Midwest Financial Group | Chicago, IL | March 2023 – Present

- Assist in planning and executing 15+ compliance reviews annually, focusing on BSA/AML, KYC, and consumer lending regulations

- Perform transaction testing and document findings for audit reports, identifying 17 potential risk areas in Q2 2023

- Support senior auditors in monitoring remediation of audit findings across 4 business units

- Create and maintain compliance testing workpapers using TeamMate+ audit software

- Analyze customer account data to identify unusual patterns that might indicate non-compliance (helped flag 7 suspicious transactions in first six months)

Compliance Intern | Meridian Credit Union | Chicago, IL | May 2022 – August 2022

- Assisted compliance team with regulatory research and documentation for FDIC examinations

- Helped conduct branch audits to verify adherence to company policies and procedures

- Updated compliance monitoring spreadsheets and organized documentation for audit trail purposes

- Participated in weekly compliance meetings and prepared summary notes for management

Student Finance Assistant (Part-time) | University of Illinois Chicago | Chicago, IL | September 2021 – April 2022

- Processed student financial transactions and ensured accurate record-keeping

- Assisted with reconciling departmental accounts and identifying discrepancies

- Maintained confidentiality of sensitive student financial information

EDUCATION

Bachelor of Science in Finance | University of Illinois Chicago | May 2022

Minor in Business Analytics | GPA: 3.7/4.0

Relevant Coursework: Business Law, Financial Regulations, Risk Management, Business Ethics, Data Analysis

CERTIFICATIONS

CAMS Certification (Certified Anti-Money Laundering Specialist) – In progress, expected completion December 2023

Microsoft Excel Expert Certification – May 2022

SKILLS

- Regulatory Compliance: BSA/AML, KYC, OFAC, Reg Z, UDAAP

- Risk Assessment & Controls Testing

- Data Analysis & Visualization

- Audit Planning & Documentation

- TeamMate+ Audit Software

- Microsoft Office Suite (Advanced Excel, PowerPoint, Word)

- SQL (basic queries)

- Attention to Detail & Critical Thinking

- Process Improvement

- Communication & Reporting

PROFESSIONAL AFFILIATIONS

Association of Certified Anti-Money Laundering Specialists (ACAMS) – Student Member

Institute of Internal Auditors (IIA) – Associate Member

Mid-level Compliance Auditor Resume Example

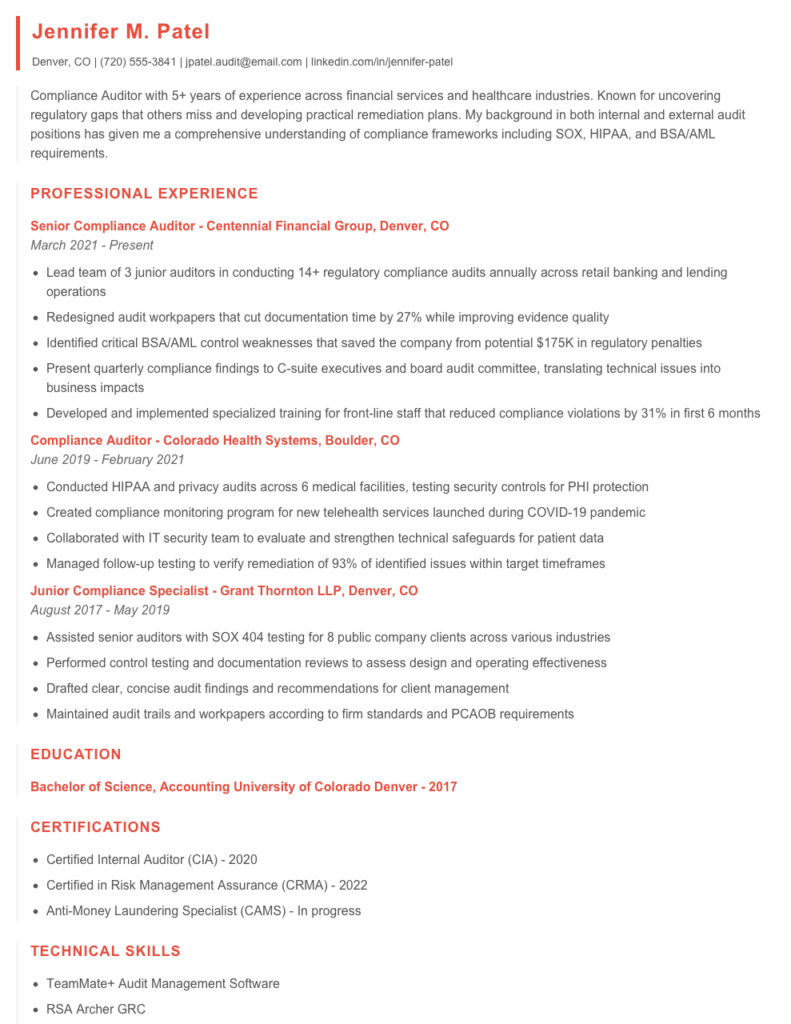

Jennifer M. Patel

Denver, CO | (720) 555-3841 | jpatel.audit@email.com | linkedin.com/in/jennifer-patel

Compliance Auditor with 5+ years of experience across financial services and healthcare industries. Known for uncovering regulatory gaps that others miss and developing practical remediation plans. My background in both internal and external audit positions has given me a comprehensive understanding of compliance frameworks including SOX, HIPAA, and BSA/AML requirements.

PROFESSIONAL EXPERIENCE

Senior Compliance Auditor – Centennial Financial Group, Denver, CO

March 2021 – Present

- Lead team of 3 junior auditors in conducting 14+ regulatory compliance audits annually across retail banking and lending operations

- Redesigned audit workpapers that cut documentation time by 27% while improving evidence quality

- Identified critical BSA/AML control weaknesses that saved the company from potential $175K in regulatory penalties

- Present quarterly compliance findings to C-suite executives and board audit committee, translating technical issues into business impacts

- Developed and implemented specialized training for front-line staff that reduced compliance violations by 31% in first 6 months

Compliance Auditor – Colorado Health Systems, Boulder, CO

June 2019 – February 2021

- Conducted HIPAA and privacy audits across 6 medical facilities, testing security controls for PHI protection

- Created compliance monitoring program for new telehealth services launched during COVID-19 pandemic

- Collaborated with IT security team to evaluate and strengthen technical safeguards for patient data

- Managed follow-up testing to verify remediation of 93% of identified issues within target timeframes

Junior Compliance Specialist – Grant Thornton LLP, Denver, CO

August 2017 – May 2019

- Assisted senior auditors with SOX 404 testing for 8 public company clients across various industries

- Performed control testing and documentation reviews to assess design and operating effectiveness

- Drafted clear, concise audit findings and recommendations for client management

- Maintained audit trails and workpapers according to firm standards and PCAOB requirements

EDUCATION

Bachelor of Science, Accounting

University of Colorado Denver – 2017

CERTIFICATIONS

- Certified Internal Auditor (CIA) – 2020

- Certified in Risk Management Assurance (CRMA) – 2022

- Anti-Money Laundering Specialist (CAMS) – In progress

TECHNICAL SKILLS

- TeamMate+ Audit Management Software

- RSA Archer GRC

- ACL Analytics

- Microsoft Office Suite (advanced Excel)

- SQL (intermediate)

- Tableau (basic)

COMPLIANCE KNOWLEDGE

- SOX 404 Controls Testing

- HIPAA Privacy & Security Rules

- BSA/AML Compliance

- Risk Assessment Methodologies

- Internal Control Frameworks (COSO)

- Regulatory Reporting Requirements

Senior / Experienced Compliance Auditor Resume Example

Olivia M. Ramirez

Chicago, IL • (312) 555-7891 • olivia.ramirez@email.com • linkedin.com/in/oliviaramirez

Compliance Auditor with 9+ years of progressive experience in financial services and healthcare sectors. Known for developing risk-based audit plans that have identified compliance gaps resulting in $1.2M

in avoided penalties. Excel at translating complex regulatory requirements into practical operational controls while building collaborative relationships with stakeholders at all levels.

PROFESSIONAL EXPERIENCE

Senior Compliance Auditor | Horizon Financial Group | Chicago, IL | March 2019 – Present

- Lead team of 4 auditors conducting 30+ comprehensive regulatory compliance reviews annually across 17 business units, covering AML, KYC, OFAC, and Dodd-Frank requirements

- Redesigned audit workflow process, cutting report delivery time from 21 days to 12 days while improving quality control checks by 38%

- Developed new BSA/AML testing protocols that uncovered previously undetected suspicious transaction patterns, resulting in 27 SARs filings

- Conducted 6 targeted audits of newly acquired subsidiaries during integration, identifying 93 compliance gaps requiring remediation before system conversion

- Spearheaded implementation of TeamMate+ audit management software, training 15 team members and designing custom workflows

Compliance Auditor | Midwest Healthcare Systems | Chicago, IL | June 2016 – February 2019

- Executed 45+ compliance audits across 8 hospitals and 23 clinics, focusing on HIPAA, HITECH, Medicare/Medicaid billing, and corporate integrity agreements

- Created audit program for tracking physician compensation arrangements that revealed 13 potential Stark Law violations, saving company from potential $775K in penalties

- Co-led Privacy Rule compliance project team during EHR implementation, reducing patient data access violations by 64% in first year

- Partnered with IT Security to develop joint HIPAA/HITECH security assessment methodology, eliminating duplicative audit efforts

Compliance Specialist | First National Bank | St. Louis, MO | August 2014 – May 2016

- Conducted branch audits for consumer compliance regulations (Reg Z, Reg E, Reg DD) across 27 locations

- Assisted with quarterly BSA/AML transaction monitoring reviews, sampling 120+ high-risk accounts per quarter

- Created training materials for frontline staff on new TRID requirements, improving documentation compliance by 31%

- Maintained tracking system for customer complaints, identifying trends that led to process improvements in account opening procedures

EDUCATION & CERTIFICATIONS

Master of Business Administration – Finance Concentration

DePaul University, Chicago, IL – 2018

Bachelor of Science, Accounting

University of Missouri, Columbia, MO – 2013

Certifications:

- Certified Internal Auditor (CIA) – 2017

- Certified Regulatory Compliance Manager (CRCM) – 2019

- Certified Information Systems Auditor (CISA) – 2021

- Anti-Money Laundering Specialist (ACAMS) – 2020

SKILLS

- Risk-Based Audit Planning

- BSA/AML/OFAC Compliance

- HIPAA/HITECH Regulations

- Regulatory Reporting

- TeamMate+, ACL Analytics

- SOX 404 Testing

- Root Cause Analysis

- Audit Committee Reporting

- Data Privacy Frameworks

- Compliance Training Development

Technical Skills: ACL Analytics, TeamMate+, MetricStream GRC, Microsoft Office Suite (advanced Excel), SQL (intermediate), Tableau

How to Write a Compliance Auditor Resume

Introduction

Landing a compliance auditor job isn't just about having the right experience—it's about communicating that experience effectively on paper. Your resume is often your first impression with employers, and in a field where attention to detail is paramount, even small mistakes can cost you an interview. I've reviewed thousands of compliance resumes over my career, and the difference between those that get interviews and those that don't often comes down to how well candidates position their regulatory knowledge, analytical skills, and industry-specific experience.

Resume Structure and Format

Compliance auditing demands precision, and your resume should reflect this quality. A clean, organized layout speaks volumes before the hiring manager reads a single word.

- Stick to 1-2 pages (1 page for junior auditors, 2 pages max for senior professionals)

- Use a conservative, professional font like Calibri, Arial, or Garamond in 10-12pt size

- Include clear section headings to guide the reader's eye

- Incorporate white space strategically—cramped documents look unprofessional

- Save as a PDF unless specifically requested in another format (maintains formatting)

Profile/Summary Section

Your professional summary should pack a punch in 3-5 lines. Think of it as your elevator pitch that highlights your compliance specialization, years of experience, and what makes you stand out.

For example, rather than writing "Experienced compliance professional with strong analytical skills," try something like: "Compliance Auditor with 6+ years specializing in financial services regulations, skilled at identifying control weaknesses that reduced potential penalties by $347K in 2022. Proficient in SOX 404 assessments and BSA/AML compliance protocols."

Pro Tip: Tailor your summary for each application. A compliance auditor applying to a healthcare organization should emphasize HIPAA knowledge, while one applying to a financial institution should highlight BSA/AML know-how.

Professional Experience

This section carries the most weight. Focus on accomplishments rather than just listing responsibilities. Compliance work can be measured!

- Start bullets with strong action verbs (conducted, analyzed, implemented, streamlined)

- Quantify results whenever possible (reduced findings by 37%, completed 42 audits)

- Highlight specific regulations relevant to your target employer's industry

- Show progression of responsibilities if you've had multiple roles

- Include any experience leading teams or training others on compliance matters

Education and Certifications

Credentials matter enormously in compliance. List degrees in reverse chronological order, but put certifications first if they're more relevant than your education.

Must-have certifications worth featuring prominently:

- CIA (Certified Internal Auditor)

- CAMS (Certified Anti-Money Laundering Specialist)

- CCEP (Certified Compliance & Ethics Professional)

- CFE (Certified Fraud Examiner)

- Industry-specific certs like CRCM (banking) or CPHRM (healthcare)

Keywords and ATS Tips

Most employers use Applicant Tracking Systems (ATS) to screen resumes before human eyes ever see them. I've seen fantastic candidates get filtered out simply because they didn't include the right terminology.

- Study the job description and mirror key terms exactly as they appear

- Include both spelled-out terms and acronyms (e.g., "Bank Secrecy Act (BSA)")

- Avoid graphics, headers/footers, and tables that ATS systems often can't read

- Use standard section headings the ATS can recognize

Industry-specific Terms

Pepper your resume with compliance language that demonstrates your expertise. This varies by industry, but might include:

- Risk assessment methodologies (RCSA, heat mapping)

- Regulatory frameworks relevant to your field (GDPR, SOX, BSA/AML, HIPAA)

- Audit software you're proficient in (TeamMate, MetricStream, Resolver)

- Compliance testing procedures (sampling, walk-throughs, document review)

Common Mistakes to Avoid

After reviewing hundreds of compliance auditor resumes, these are the pitfalls I see most often:

- Being too vague about specific regulations you've worked with

- Focusing on daily tasks rather than achievements and impact

- Omitting technical skills (data analysis tools, compliance software)

- Using passive language instead of action-oriented statements

- Including confidential information about audit findings (yes, people do this!)

Remember—your resume isn't just a history of where you've worked; it's a marketing document that should position

you as the solution to the employer's compliance needs. Make every word count, and don't be afraid to cut content that doesn't directly support your case for this specific role.

Related Resume Examples

Soft skills for your Compliance Auditor resume

- Clear verbal communication with stakeholders at all levels – from frontline staff to executives – especially when explaining complex regulatory requirements

- Relationship building with both internal teams and external regulators (built trust with 3 new FDA inspectors during our facility’s most recent audit)

- Diplomatic feedback delivery when addressing compliance gaps without creating defensiveness

- Detail-oriented documentation review while maintaining big-picture perspective of risk exposure

- Time management across multiple concurrent audit projects (typically juggle 4-6 departmental reviews simultaneously)

- Adaptability to rapidly changing regulatory environments and company priorities

Hard skills for your Compliance Auditor resume

- GAAP & IFRS Standards Application

- Risk Assessment Matrix Development

- SOX 404 Controls Testing

- AML Transaction Monitoring Systems

- SQL Database Querying (moderate)

- ACL Analytics & Tableau Reporting

- ISO 27001 Framework Implementation

- Regulatory Filing Verification (SEC, FINRA)

- CISA Certification