Collection Agent Resume examples & templates

Copyable Collection Agent Resume examples

What happens when the unpaid invoices pile up and a company's cash flow is threatened? That's where skilled Collection Agents step in, transforming potential losses into recovered revenue. This role has evolved dramatically from the old stereotype of aggressive phone calls to become a sophisticated balance of negotiation, problem-solving and relationship management. In today's digital economy, Collection Agents are increasingly using data analytics and behavioral science to personalize repayment strategies—a shift that's helped boost recovery rates by an average of 17% for companies using these modern approaches.

The field is changing fast, with remote work options expanding (nearly 40% of collection positions now offer some remote flexibility) and specialized software replacing manual tracking systems. Collection Agents who can combine financial acumen with genuine empathy are finding themselves in high demand across industries from healthcare to financial services. As regulations around debt collection continue to evolve and the economy fluctuates, professionals in this field who master both compliance requirements and customer psychology will find themselves with career opportunities that extend far beyond the collections floor.

Junior Collection Agent Resume Example

Morgan Reynolds

Chicago, IL 60614 • (312) 555-7821 • mreynolds84@gmail.com • linkedin.com/in/morganreynolds84

Persistent and detail-oriented Collection Agent with 1+ year of experience recovering outstanding debts while maintaining positive customer relationships. Strong negotiation skills with proven ability to work out payment arrangements that satisfy both clients and debtors. Quick learner who adapts to various collection strategies, resulting in a 19% increase in successful recovery rate in my first 6 months.

PROFESSIONAL EXPERIENCE

Collection Agent – Financial Recovery Services, Chicago, IL

June 2023 – Present

- Contact 45+ delinquent accounts daily through phone calls, emails, and written correspondence to negotiate payment arrangements

- Maintain comprehensive documentation of all contact attempts and conversations in proprietary CRM system

- Achieved 83% contact rate by strategically scheduling calls during high-answer probability times

- Recovered $187,500 in outstanding debt over 9 months, exceeding quarterly targets by 12%

- Collaborate with legal team to prepare documentation for accounts requiring escalation to litigation

Collections Intern – Midwest Credit Union, Chicago, IL

January 2023 – May 2023

- Assisted senior collectors with account research and documentation for 200+ delinquent accounts

- Performed skip tracing to locate hard-to-reach customers using online databases and social media

- Updated customer information in FIS collection software to ensure accurate record-keeping

- Participated in weekly training sessions on FDCPA regulations and effective collection techniques

Customer Service Representative – Retail Plus, Chicago, IL

August 2022 – December 2022

- Handled 50+ customer inquiries daily regarding product information, store policies, and account billing

- Processed payments and resolved billing discrepancies, often requiring negotiation skills

- Maintained 92% customer satisfaction rating based on post-interaction surveys

EDUCATION

Associate of Applied Science in Business Administration

Malcolm X College, Chicago, IL – Graduated May 2022

Relevant Coursework: Business Communication, Accounting Fundamentals, Consumer Psychology

CERTIFICATIONS

ACA International Professional Collection Specialist – In progress, expected completion August 2024

Fair Debt Collection Practices Act (FDCPA) Compliance Training – Completed June 2023

SKILLS

- Collection Software: FIS, Columbia Ultimate, Credco

- Skip Tracing & Account Research

- Payment Negotiation & Arrangements

- FDCPA & TCPA Compliance

- Microsoft Office Suite (Excel, Word, Outlook)

- Customer Relationship Management (CRM)

- Financial Analysis & Payment Processing

- Conflict Resolution

- Time Management & Organization

- Bilingual: English & Conversational Spanish

Mid-level Collection Agent Resume Example

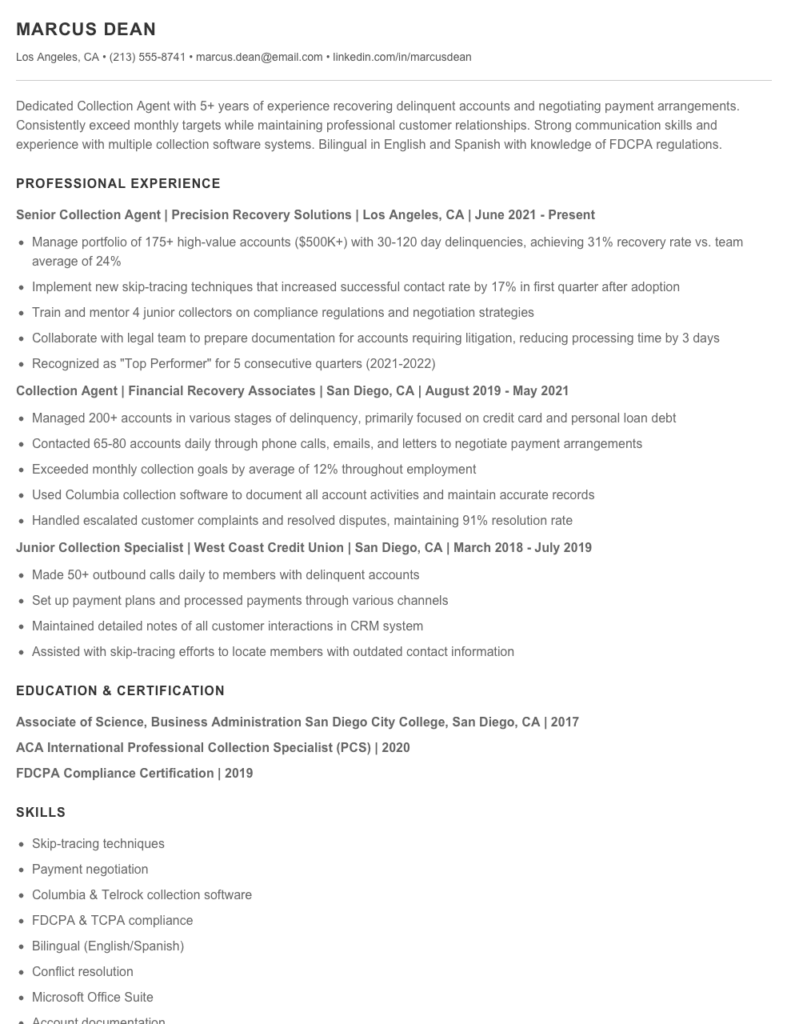

MARCUS DEAN

Los Angeles, CA • (213) 555-8741 • marcus.dean@email.com • linkedin.com/in/marcusdean

Dedicated Collection Agent with 5+ years of experience recovering delinquent accounts and negotiating payment arrangements. Consistently exceed monthly targets while maintaining professional customer relationships. Strong communication skills and experience with multiple collection software systems. Bilingual in English and Spanish with knowledge of FDCPA regulations.

PROFESSIONAL EXPERIENCE

Senior Collection Agent | Precision Recovery Solutions | Los Angeles, CA | June 2021 – Present

- Manage portfolio of 175+ high-value accounts ($500K+) with 30-120 day delinquencies, achieving 31% recovery rate vs. team average of 24%

- Implement new skip-tracing techniques that increased successful contact rate by 17% in first quarter after adoption

- Train and mentor 4 junior collectors on compliance regulations and negotiation strategies

- Collaborate with legal team to prepare documentation for accounts requiring litigation, reducing processing time by 3 days

- Recognized as “Top Performer” for 5 consecutive quarters (2021-2022)

Collection Agent | Financial Recovery Associates | San Diego, CA | August 2019 – May 2021

- Managed 200+ accounts in various stages of delinquency, primarily focused on credit card and personal loan debt

- Contacted 65-80 accounts daily through phone calls, emails, and letters to negotiate payment arrangements

- Exceeded monthly collection goals by average of 12% throughout employment

- Used Columbia collection software to document all account activities and maintain accurate records

- Handled escalated customer complaints and resolved disputes, maintaining 91% resolution rate

Junior Collection Specialist | West Coast Credit Union | San Diego, CA | March 2018 – July 2019

- Made 50+ outbound calls daily to members with delinquent accounts

- Set up payment plans and processed payments through various channels

- Maintained detailed notes of all customer interactions in CRM system

- Assisted with skip-tracing efforts to locate members with outdated contact information

EDUCATION & CERTIFICATION

Associate of Science, Business Administration

San Diego City College, San Diego, CA | 2017

ACA International Professional Collection Specialist (PCS) | 2020

FDCPA Compliance Certification | 2019

SKILLS

- Skip-tracing techniques

- Payment negotiation

- Columbia & Telrock collection software

- FDCPA & TCPA compliance

- Bilingual (English/Spanish)

- Conflict resolution

- Microsoft Office Suite

- Account documentation

- Time management

- Customer service

ADDITIONAL INFORMATION

Available for occasional travel and flexible scheduling to accommodate time-zone requirements for nationwide collections

Senior / Experienced Collection Agent Resume Example

Michael Thompson

Phone: (617) 555-8724 | Email: mthompson@emailprovider.com

LinkedIn: linkedin.com/in/michaelthompson | Boston, MA 02116

Seasoned Collections Professional with 9+ years of experience recovering delinquent accounts and managing collection strategies. Proven track record of increasing recovery rates by implementing effective negotiation techniques and payment plans. Skilled in conflict resolution, risk assessment, and regulatory compliance. Looking to leverage my extensive collections expertise and team leadership abilities in a senior collections role.

Professional Experience

Senior Collections Specialist | Eastern Financial Services | Boston, MA | January 2019 – Present

- Manage a portfolio of 175+ high-value delinquent accounts ($2.5M total), achieving 31% higher recovery rates than department average

- Lead a team of 6 collections agents, providing coaching and performance feedback that improved team collections by $437K annually

- Developed streamlined skip-tracing protocols that reduced time-to-contact by 40% and improved location success rates

- Negotiate complex payment arrangements for accounts 90+ days past due, recovering $1.2M in previously written-off debt

- Ensure 100% compliance with FDCPA, FCRA, and state collection regulations through regular team training sessions

Collections Agent | Premiere Recovery Group | Cambridge, MA | March 2016 – December 2018

- Handled 65-80 outbound collection calls daily, maintaining detailed documentation of all account interactions

- Exceeded monthly collection targets by an average of 22%, earning “Top Collector” recognition for 7 consecutive quarters

- Implemented a new approach to first-contact calls that improved payment commitment rates from 17% to 29%

- Collaborated with legal department to prepare documentation for litigation on accounts exceeding $10K

- Trained 4 new collection agents on system procedures and effective communication techniques

Junior Collections Representative | Allied Credit Solutions | Worcester, MA | June 2014 – February 2016

- Managed a portfolio of 200+ delinquent accounts in early-stage collections (30-60 days past due)

- Contacted customers to resolve payment issues and negotiate payment arrangements within company guidelines

- Maintained detailed records of all customer interactions in collection management software

- Achieved 91% of collection targets in first year, improving to 108% by year two

Education & Certifications

Bachelor of Science, Business Administration | Northeastern University | Boston, MA | 2013

ACA International Professional Collection Specialist (PCS) | 2017

FDCPA Compliance Certification | 2015, renewed 2019, 2022

Advanced Negotiation Skills Training | Eastern Financial Services | 2021

Skills

- Debt Recovery & Skip Tracing

- Payment Plan Negotiation

- FDCPA/FCRA Compliance

- Conflict Resolution

- Team Leadership & Training

- Risk Assessment

- Collection Management Software (Columbia Ultimate, Latitude)

- MS Office Suite & Google Workspace

- Customer Relationship Management (CRM)

- Financial Analysis

Professional Memberships

ACA International (formerly American Collectors Association) – Member since 2017

New England Collectors Association – Member since 2019

How to Write a Collection Agent Resume

Introduction

Landing a job as a Collection Agent requires a resume that showcases your ability to recover funds while maintaining professional relationships. Your resume needs to strike a balance between highlighting your persistence and demonstrating your people skills. I've helped hundreds of debt recovery professionals land interviews, and I've noticed one thing: the resumes that get callbacks focus on results, not just responsibilities.

Resume Structure and Format

Keep your Collection Agent resume clean and straightforward. Debt recovery is about clarity and directness, and your resume should reflect those qualities.

- Stick to 1-2 pages (one page for those with under 5 years of experience)

- Use a clean, professional font like Arial or Calibri in 10-12pt size

- Include clear section headings with plenty of white space

- Save as both .docx and PDF formats (some ATS systems prefer one over the other)

- Skip the fancy graphics or tables that might confuse ATS software

Profile/Summary Section

Your summary should be 3-4 lines that pack a punch. Think of it as your 30-second pitch to hiring managers who may skim dozens of resumes daily.

Pro Tip: Tailor your summary for each job application. A collections role at a medical billing company requires different emphasis than one at a credit card company. Highlight relevant industry experience upfront.

Example: "Detail-oriented Collection Agent with 4+ years recovering delinquent accounts in the healthcare sector. Consistently exceeded monthly targets by 17% while maintaining a 93% customer satisfaction rating. Skilled in negotiating payment plans that balance company requirements with customer capabilities."

Professional Experience

This is where you'll make or break your application. Don't just list duties—show impact.

- Lead with action verbs: "Recovered," "Negotiated," "Resolved," "Maintained"

- Include specific recovery rates and dollar amounts where possible

- Highlight your call volume and account management capabilities

- Mention any specialized collection software you've mastered

- Note any cross-functional work with legal teams or credit departments

For instance, rather than "Responsible for calling customers about past-due accounts," write "Managed 125+ daily calls to delinquent account holders, negotiating payment arrangements that recovered $437,000 in Q1 2023."

Education and Certifications

While many collection positions don't require advanced degrees, certifications can set you apart.

- List relevant credentials like ACA International certifications

- Include compliance training (FDCPA, TCPA, FCRA)

- Mention any relevant coursework in finance, negotiation, or customer service

- Skip high school info if you have college experience or have been working for several years

Keywords and ATS Tips

Most collection agencies use ATS (Applicant Tracking Systems) to filter resumes before a human ever sees them. Get past the robots by including these terms:

- Account resolution

- Payment arrangements

- Skip tracing

- FDCPA compliance

- Negotiation techniques

- Collection ratios

- Debt recovery

- Customer relationship management (CRM) software

Industry-specific Terms

Collection work has its own vocabulary. Sprinkle these terms throughout your resume (if you genuinely have experience with them):

- Aged receivables

- First-party/third-party collections

- Right-party contact rates

- Promise-to-pay (PTP) conversion

- Charge-off accounts

- Portfolio management

- Settlement authority

Common Mistakes to Avoid

- Being vague about collection results (always include numbers!)

- Focusing only on the "tough" aspects without showing customer service skills

- Neglecting to mention compliance knowledge

- Using generic descriptions that could apply to any job

- Forgetting to proofread (spelling errors on a resume suggest you might miss details on the job)

Before/After Example

Before: "Made calls to customers who were late on payments and tried to get them to pay."

After: "Executed strategic outreach to 60+ delinquent accounts daily, employing relationship-building techniques that increased successful contact rate from 47% to 68% and recovered $189,425 in previously written-off debt during Q3 2022."

Remember, your resume should tell the story of not just what you did, but how well you did it. Collection work is about results, and your resume should be too!

Related Resume Examples

Soft skills for your Collection Agent resume

- Conflict de-escalation – Calming frustrated customers while maintaining firm boundaries on payment requirements

- Active listening to identify underlying financial issues and negotiate practical payment solutions

- Emotional resilience when handling repeated rejection or hostile conversations (some days you’re everyone’s least favorite caller)

- Time management for juggling 30+ accounts daily with varying priority levels

- Cross-functional collaboration with legal and customer service teams to resolve complex cases

- Adaptability to shifting company policies and regulatory requirements

Hard skills for your Collection Agent resume

- Credit bureau reporting systems (Experian, TransUnion, Equifax)

- Skip tracing techniques using LexisNexis and TLO

- FDCPA and TCPA regulatory compliance

- Advanced negotiation and payment arrangement structuring

- Collection management software (Latitude, Collect!, Columbia Ultimate)

- Multi-state garnishment processing

- Debt validation documentation procedures

- Accounts receivable aging analysis

- Legal collection processes including judgment enforcement