Claims Auditor Resume examples & templates

Copyable Claims Auditor Resume examples

Ever wonder who's behind the scenes making sure insurance claims don't slip through the cracks with errors? Claims Auditors are the detail-oriented professionals who serve as the quality control backbone of the insurance industry. They meticulously review claims handling processes, verify payment accuracy, and ensure compliance with increasingly complex regulatory requirements. It's a role that blends analytical thinking with investigative skills—perfect for those who find satisfaction in spotting the discrepancy that everyone else missed.

The claims auditing landscape has shifted dramatically in recent years, with the integration of predictive analytics and AI-assisted review tools transforming how audits are conducted. According to the Insurance Information Institute, companies implementing robust claims audit protocols reduced improper payments by approximately 17.3% in 2022 alone—translating to millions in savings for mid-sized insurers. Despite technological advances, the human element remains irreplaceable. As regulatory frameworks continue to evolve (especially in healthcare and property insurance), Claims Auditors with specialized knowledge and certification credentials like the CPCU or AIC will find themselves increasingly valued in an industry where accuracy isn't just preferred—it's mandated.

Junior Claims Auditor Resume Example

MORGAN REYNOLDS

Pittsburgh, PA | (412) 555-8792 | mreynolds.claims@gmail.com | linkedin.com/in/morganreynolds

Detail-oriented Claims Auditor with 18 months of experience in healthcare insurance claims processing. Quick learner with strong analytical abilities and a talent for identifying billing discrepancies. Committed to maintaining accuracy while meeting productivity requirements in fast-paced environments. Currently pursuing AHIMA certification to deepen industry knowledge.

EXPERIENCE

Claims Auditor – Highmark Blue Cross Blue Shield, Pittsburgh, PA (June 2022 – Present)

- Audit approximately 175 processed healthcare claims daily for accuracy, compliance, and proper coding

- Identify and correct billing errors resulting in $237,000 in recovered costs during first year

- Collaborate with 5-member team to maintain 97.8% accuracy rate across all audited claims

- Document findings in claims management system and prepare weekly reports for supervisors

- Developed personal tracking spreadsheet that was adopted by team to monitor error patterns

Claims Processing Intern – UPMC Health Plan, Pittsburgh, PA (Jan 2022 – May 2022)

- Assisted senior auditors with daily claims reviews and data entry tasks

- Researched claim denials and coding issues under supervision

- Participated in weekly training sessions on medical terminology and coding standards

- Created reference guide for common processing errors that reduced training time for new interns

Customer Service Representative – Allegheny Health Network, Pittsburgh, PA (Aug 2021 – Dec 2021)

- Handled 40+ daily calls from patients regarding billing questions and insurance coverage

- Documented customer interactions in CRM system

- Escalated complex claims issues to appropriate departments for resolution

EDUCATION

Associate of Science in Health Information Technology

Community College of Allegheny County, Pittsburgh, PA

Graduated: May 2021 | GPA: 3.7/4.0

Relevant Coursework: Medical Terminology, Healthcare Reimbursement, ICD-10 Coding, Health Data Analytics

CERTIFICATIONS

Certified Professional Coder (CPC) – In Progress, Expected completion Aug 2023

Medical Claims Processing Certificate – Pittsburgh Technical Institute, 2021

SKILLS

- Claims Processing Software: Epic, Meditech, ClaimLogic

- Medical Coding: ICD-10, CPT, HCPCS Level II

- MS Office Suite (advanced Excel skills)

- Healthcare compliance regulations (HIPAA)

- Insurance verification procedures

- EOB interpretation

- Attention to detail and accuracy

- Time management

- Problem-solving

ADDITIONAL INFORMATION

Member, American Health Information Management Association (AHIMA)

Volunteer, Medical Billing Assistance Program, Pittsburgh Free Clinic (4 hrs/month)

Mid-level Claims Auditor Resume Example

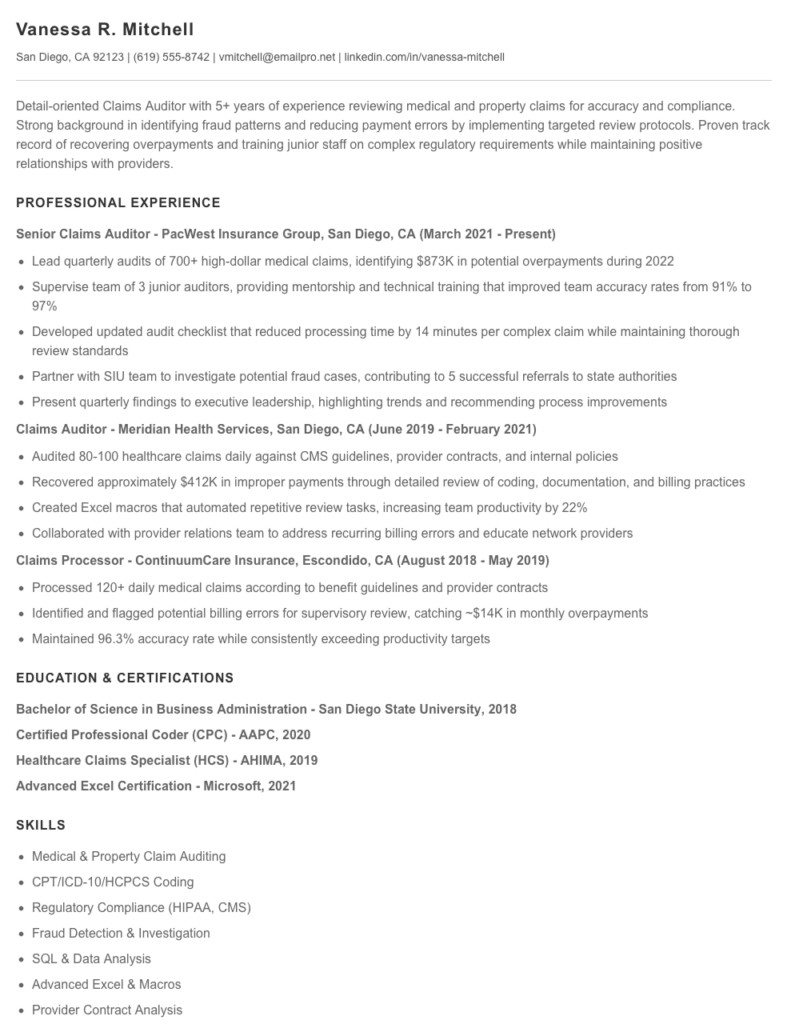

Vanessa R. Mitchell

San Diego, CA 92123 | (619) 555-8742 | vmitchell@emailpro.net | linkedin.com/in/vanessa-mitchell

Detail-oriented Claims Auditor with 5+ years of experience reviewing medical and property claims for accuracy and compliance. Strong background in identifying fraud patterns and reducing payment errors by implementing targeted review protocols. Proven track record of recovering overpayments and training junior staff on complex regulatory requirements while maintaining positive relationships with providers.

PROFESSIONAL EXPERIENCE

Senior Claims Auditor – PacWest Insurance Group, San Diego, CA (March 2021 – Present)

- Lead quarterly audits of 700+ high-dollar medical claims, identifying $873K in potential overpayments during 2022

- Supervise team of 3 junior auditors, providing mentorship and technical training that improved team accuracy rates from 91% to 97%

- Developed updated audit checklist that reduced processing time by 14 minutes per complex claim while maintaining thorough review standards

- Partner with SIU team to investigate potential fraud cases, contributing to 5 successful referrals to state authorities

- Present quarterly findings to executive leadership, highlighting trends and recommending process improvements

Claims Auditor – Meridian Health Services, San Diego, CA (June 2019 – February 2021)

- Audited 80-100 healthcare claims daily against CMS guidelines, provider contracts, and internal policies

- Recovered approximately $412K in improper payments through detailed review of coding, documentation, and billing practices

- Created Excel macros that automated repetitive review tasks, increasing team productivity by 22%

- Collaborated with provider relations team to address recurring billing errors and educate network providers

Claims Processor – ContinuumCare Insurance, Escondido, CA (August 2018 – May 2019)

- Processed 120+ daily medical claims according to benefit guidelines and provider contracts

- Identified and flagged potential billing errors for supervisory review, catching ~$14K in monthly overpayments

- Maintained 96.3% accuracy rate while consistently exceeding productivity targets

EDUCATION & CERTIFICATIONS

Bachelor of Science in Business Administration – San Diego State University, 2018

Certified Professional Coder (CPC) – AAPC, 2020

Healthcare Claims Specialist (HCS) – AHIMA, 2019

Advanced Excel Certification – Microsoft, 2021

SKILLS

- Medical & Property Claim Auditing

- CPT/ICD-10/HCPCS Coding

- Regulatory Compliance (HIPAA, CMS)

- Fraud Detection & Investigation

- SQL & Data Analysis

- Advanced Excel & Macros

- Provider Contract Analysis

- ECS Claims Management System

- Team Leadership & Training

- Statistical Sampling Methods

PROFESSIONAL AFFILIATIONS

American Association of Healthcare Administrative Management (AAHAM), Member since 2019

National Association of Claims Assistance Professionals (NACAP), Member since 2020

Senior / Experienced Claims Auditor Resume Example

Margaret “Maggie” Thornton

Cincinnati, OH 45202 • (513) 555-4892 • mthornton.claims@email.com • linkedin.com/in/maggiethornton

Senior Claims Auditor with 11+ years of progressive experience in healthcare and insurance industries. Known for implementing process improvements that reduced error rates by 31% while maintaining quality standards. Excel at training junior staff, managing high-volume audits, and identifying patterns of fraudulent claims. Certified in healthcare compliance with strong technical skills in multiple claims processing systems.

PROFESSIONAL EXPERIENCE

Senior Claims Audit Specialist – Anthem Blue Cross Blue Shield, Cincinnati, OH (June 2018 – Present)

- Lead a team of 7 auditors reviewing 4,300+ claims monthly, achieving 99.4% accuracy rate against department target of 97%

- Designed and implemented new audit workflow that increased productivity by 23% in first 6 months

- Developed targeted training program for junior auditors that reduced onboarding time from 8 weeks to 5 weeks

- Collaborated with IT to create automated fraud detection algorithm that flagged $1.2M in potentially fraudulent claims in 2022

- Serve as SME for Medicare Part B claims processing, frequently consulted for complex regulatory interpretations

Claims Audit Specialist – Humana Health Insurance, Louisville, KY (March 2015 – May 2018)

- Audited 200+ daily claims across multiple specialties including cardiology, orthopedics, and general practice

- Identified recurring billing errors resulting in $430K annual recovery

- Maintained 98.7% accuracy rate while handling 30% more volume than team average

- Created reference guide for ICD-10 transition that became standard training material company-wide

- Selected to pilot new claims processing software, providing critical feedback that shaped final implementation

Claims Processor – TriHealth Hospital System, Cincinnati, OH (August 2012 – February 2015)

- Processed and verified 120+ daily inpatient and outpatient claims for submission to insurance

- Reduced claim rejection rate by 17% through improved documentation practices

- Trained 4 new hires on claims processing procedures and insurance requirements

- Volunteered to learn new billing system ahead of department-wide rollout, later becoming an informal resource for colleagues

EDUCATION & CERTIFICATIONS

Bachelor of Science, Healthcare Administration – University of Cincinnati (2012)

Certified Professional Coder (CPC) – AAPC (2014, renewed 2023)

Healthcare Compliance Certification (CHC) – Health Care Compliance Association (2019)

Advanced Claims Auditing Certificate – AHIMA (2017)

TECHNICAL SKILLS

- Claims Management Systems: Optum, Epic, Availity, Trizetto QNXT

- Audit Tools: ClaimSearch, SmartAudit Pro, FraudFinder

- Data Analysis: Microsoft Excel (advanced), SQL (intermediate), Tableau

- Regulatory Frameworks: HIPAA, CMS Guidelines, ACA compliance

CORE COMPETENCIES

- Claims Validation & Adjudication

- Fraud Detection & Prevention

- Process Improvement

- Medical Coding (ICD-10, CPT, HCPCS)

- Team Leadership & Training

- Healthcare Billing & Reimbursement

How to Write a Claims Auditor Resume

Introduction

Landing a Claims Auditor position requires a resume that showcases your attention to detail, analytical skills, and industry knowledge. As someone who's reviewed thousands of insurance industry resumes, I can tell you that Claims Auditor resumes face unique challenges. You need to demonstrate both technical expertise and soft skills while highlighting your ability to spot discrepancies and maintain compliance. This guide will walk you through creating a resume that gets noticed by hiring managers and makes it past those pesky ATS systems (which, let's be honest, are the first hurdle in your job search).

Resume Structure and Format

Your Claims Auditor resume should be clean, organized, and easy to scan—just like your audit reports! Keep these formatting guidelines in mind:

- Stick to 1-2 pages (one page for less than 7 years experience, two pages for more senior roles)

- Use a professional, readable font like Calibri, Arial, or Garamond in 10-12pt size

- Include clear section headings with consistent formatting

- Incorporate white space to prevent a cluttered appearance

- Save your resume as a PDF unless the job posting specifically requests another format

Pro Tip: Claims departments receive dozens of applications for each opening. Make your resume skimmable with bullet points and concise statements—managers often decide whether to continue reading in less than 8 seconds!

Profile/Summary Section

Start with a focused professional summary that positions you as the ideal Claims Auditor candidate. This 3-4 line section should highlight your years of experience, specialty areas, and one or two standout achievements. For example:

"Detail-oriented Claims Auditor with 5+ years reviewing property and casualty claims. Skilled at identifying payment irregularities and compliance issues, having recovered $487K in overpayments during 2022. Experienced with XactAnalysis and Mitchell ClaimsIQ systems."

Professional Experience

This is where you'll make your case (pun intended). For each position, include:

- Company name, location, and dates of employment

- Your exact job title (Claims Auditor, Senior Claims Auditor, etc.)

- 4-6 bullet points highlighting responsibilities and achievements

Focus on quantifiable results wherever possible. Instead of saying "Reviewed many claims," try "Audited 75+ complex homeowner claims weekly, identifying documentation gaps in 23% of files." Numbers tell a compelling story!

Start each bullet with strong action verbs like "Identified," "Recovered," "Implemented," or "Analyzed." Vary your verbs throughout to avoid repetition.

Education and Certifications

Claims Auditor positions often require specific credentials. Include:

- Your degree(s), institution name, and graduation year

- Industry certifications (AIC, CPCU, ARM, etc.)

- Relevant continuing education or specialized training

- State licenses (if applicable)

If you're new to claims auditing, highlight coursework relevant to insurance, accounting, or compliance to demonstrate transferable knowledge.

Keywords and ATS Tips

To get past applicant tracking systems, incorporate these industry-specific keywords naturally throughout your resume:

- Claims processing terminology (subrogation, reserves, indemnity)

- Compliance references (regulatory guidelines, SIU referrals)

- Software platforms you've used (ClaimCenter, Xactimate, Guidewire)

- Audit procedures (random sampling, targeted reviews, compliance verification)

Industry-specific Terms

Include terminology that shows you speak the language of claims auditing:

- Leakage detection

- Reserve adequacy

- Medicare Secondary Payer compliance

- Recovery potential

- Settlement authority levels

- Loss adjustment expense (LAE)

Common Mistakes to Avoid

- Listing job duties without showcasing audit outcomes or improvements

- Omitting metrics (recovery amounts, error rates, processing times)

- Using vague statements like "good communication skills" instead of specific examples

- Forgetting to mention experience with specific claim types (auto, property, workers' comp)

- Neglecting to update certifications or continuing education entries

Before/After Example

Before: "Responsible for auditing claims and identifying errors."

After: "Conducted deep-dive audits on 120+ high-value commercial property claims quarterly, identifying $142K in reserve inadequacies and implementing a new checklist that reduced processing errors by 17%."

The difference? The improved version shows scope, impact, and initiative—exactly what hiring managers at companies like Travelers or Liberty Mutual look for when filling Claims Auditor positions.

Remember, your resume is your first audit—make sure it passes with flying colors!

Related Resume Examples

Soft skills for your Claims Auditor resume

- Diplomatic communication with claimants and internal stakeholders, especially when explaining claim discrepancies

- Critical thinking to recognize patterns in data that might indicate fraud or errors

- Time management while balancing multiple claim audits and varying deadlines

- Adaptability when switching between different policy types and regulatory frameworks

- Conflict resolution skills for handling disagreements with claims adjusters about findings

- Attention to detail that goes beyond surface-level documentation (I once caught a $47,000 error others missed!)

Hard skills for your Claims Auditor resume

- Medical claims audit methodology (including DRG validation and NCCI edits)

- SQL query writing for claims database analysis

- Proficiency with ClaimCheck and ClaimsXten software

- CPT/ICD-10/HCPCS coding knowledge

- Medicare and Medicaid billing regulations

- Tableau or Power BI for claims data visualization

- Statistical sampling techniques (RAT-STATS, stratified sampling)

- HIPAA compliance and PHI handling procedures

- Excel pivot tables and VLOOKUP functions for claims analysis