Banking Consultant Resume examples & templates

Copyable Banking Consultant Resume examples

Ever wondered what keeps financial institutions competitive in today's digital-first economy? Banking Consultants are the behind-the-scenes architects transforming traditional banking operations into streamlined, customer-focused experiences. They bridge the gap between old-school banking principles and cutting-edge financial technology—a balance that's become crucial as traditional banks face mounting pressure from fintech startups. According to McKinsey's 2023 Global Banking Report, banks that leverage external consulting expertise showed 27% higher adoption rates of digital solutions compared to those relying solely on in-house teams.

The banking consultant landscape has shifted dramatically since the 2008 financial crisis. What was once primarily focused on cost-cutting and regulatory compliance has evolved into a multifaceted role encompassing digital transformation, data analytics, and customer experience design. Today's consultants need both technical savvy and people skills to navigate complex stakeholder relationships. For ambitious professionals with financial expertise, this field offers remarkable growth potential—especially as banks continue investing in technological infrastructure to meet changing customer expectations in the post-pandemic era.

Junior Banking Consultant Resume Example

Maya Rodriguez

(551) 987-4321 • maya.rodriguez@email.com • linkedin.com/in/mayarodriguez • Boston, MA 02108

Detail-oriented Banking Consultant with 1+ years of experience supporting retail banking operations and client services. Skilled in financial product analysis, customer needs assessment, and process improvement. Eager to leverage my banking knowledge and analytical skills to help clients improve their banking systems while delivering exceptional customer experiences.

EXPERIENCE

Junior Banking Consultant – FinServe Solutions, Boston, MA

January 2023 – Present

- Support senior consultants on 4 major regional bank projects, analyzing current processes and recommending improvements that reduced client transaction times by 17%

- Conduct weekly data analysis of banking operations metrics, creating visual reports that highlight performance trends and areas for improvement

- Assist in developing tailored solutions for clients’ retail banking needs, including product recommendations and service enhancements

- Collaborated with a cross-functional team to implement a new client onboarding system, reducing paperwork by 35% and improving customer satisfaction scores

Banking Operations Intern – Commonwealth Financial Group, Boston, MA

May 2022 – December 2022

- Shadowed relationship managers during client meetings, gaining firsthand insight into needs assessment and solution development processes

- Supported the update of internal banking procedures documentation, making it more accessible for new employees (my manager still uses my templates!)

- Conducted competitive analysis of 7 regional banks’ product offerings and fee structures

- Assisted with the branch’s quarterly compliance review, helping identify and resolve 3 procedural inconsistencies

Customer Service Representative (Part-time) – First National Bank, Boston, MA

September 2021 – April 2022

- Handled approximately 30-40 customer inquiries daily regarding account services, online banking, and financial products

- Processed routine transactions including deposits, withdrawals, and account transfers with 99.7% accuracy

- Recognized for exceptional customer service, receiving 5 customer commendations in 7 months

EDUCATION

Bachelor of Science in Finance – Boston University, Boston, MA

Graduated: May 2022 | GPA: 3.7/4.0

- Relevant Coursework: Banking Systems & Regulations, Financial Analysis, Investment Management, Business Statistics

- Senior Project: “Digital Transformation in Community Banking” – Received department recognition

CERTIFICATIONS

Certified Associate in Banking (CAB) – American Bankers Association

Obtained March 2023

Financial Modeling & Valuation Analyst (FMVA) – Corporate Finance Institute

In progress – Expected completion August 2023

SKILLS

- Banking Operations: Retail banking procedures, financial product knowledge, regulatory compliance, customer needs assessment

- Technical: Microsoft Excel (advanced formulas, pivot tables), PowerPoint, Tableau, Banking CRM systems

- Analysis: Financial data analysis, process improvement, competitive analysis, market research

- Soft Skills: Client communication, presentation skills, team collaboration, problem-solving

ADDITIONAL

- Active member of Young Banking Professionals Network of Boston

- Volunteer financial literacy instructor at Brighton Community Center (teach budgeting basics to young adults)

- Fluent in Spanish and conversational Portuguese

Mid-level Banking Consultant Resume Example

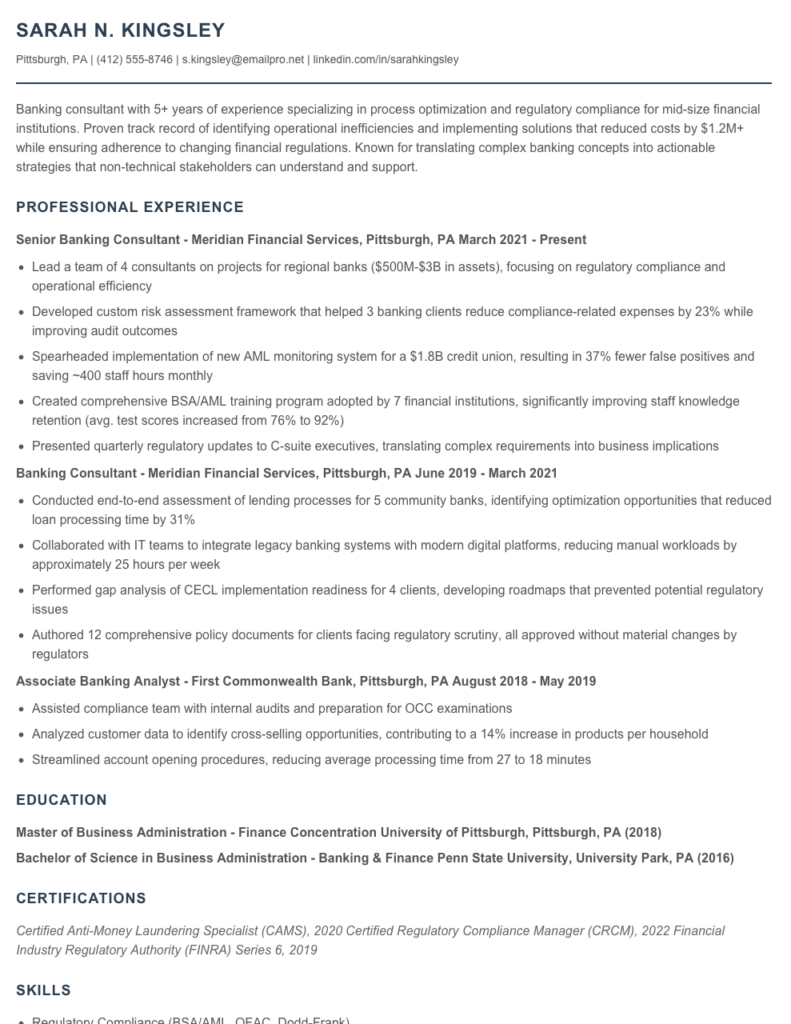

Sarah N. Kingsley

Pittsburgh, PA | (412) 555-8746 | s.kingsley@emailpro.net | linkedin.com/in/sarahkingsley

Banking consultant with 5+ years of experience specializing in process optimization and regulatory compliance for mid-size financial institutions. Proven track record of identifying operational inefficiencies and implementing solutions that reduced costs by $1.2M+ while ensuring adherence to changing financial regulations. Known for translating complex banking concepts into actionable strategies that non-technical stakeholders can understand and support.

PROFESSIONAL EXPERIENCE

Senior Banking Consultant – Meridian Financial Services, Pittsburgh, PA

March 2021 – Present

- Lead a team of 4 consultants on projects for regional banks ($500M-$3B in assets), focusing on regulatory compliance and operational efficiency

- Developed custom risk assessment framework that helped 3 banking clients reduce compliance-related expenses by 23% while improving audit outcomes

- Spearheaded implementation of new AML monitoring system for a $1.8B credit union, resulting in 37% fewer false positives and saving ~400 staff hours monthly

- Created comprehensive BSA/AML training program adopted by 7 financial institutions, significantly improving staff knowledge retention (avg. test scores increased from 76% to 92%)

- Presented quarterly regulatory updates to C-suite executives, translating complex requirements into business implications

Banking Consultant – Meridian Financial Services, Pittsburgh, PA

June 2019 – March 2021

- Conducted end-to-end assessment of lending processes for 5 community banks, identifying optimization opportunities that reduced loan processing time by 31%

- Collaborated with IT teams to integrate legacy banking systems with modern digital platforms, reducing manual workloads by approximately 25 hours per week

- Performed gap analysis of CECL implementation readiness for 4 clients, developing roadmaps that prevented potential regulatory issues

- Authored 12 comprehensive policy documents for clients facing regulatory scrutiny, all approved without material changes by regulators

Associate Banking Analyst – First Commonwealth Bank, Pittsburgh, PA

August 2018 – May 2019

- Assisted compliance team with internal audits and preparation for OCC examinations

- Analyzed customer data to identify cross-selling opportunities, contributing to a 14% increase in products per household

- Streamlined account opening procedures, reducing average processing time from 27 to 18 minutes

EDUCATION

Master of Business Administration – Finance Concentration

University of Pittsburgh, Pittsburgh, PA (2018)

Bachelor of Science in Business Administration – Banking & Finance

Penn State University, University Park, PA (2016)

CERTIFICATIONS

Certified Anti-Money Laundering Specialist (CAMS), 2020

Certified Regulatory Compliance Manager (CRCM), 2022

Financial Industry Regulatory Authority (FINRA) Series 6, 2019

SKILLS

- Regulatory Compliance (BSA/AML, OFAC, Dodd-Frank)

- Risk Assessment & Management

- Process Optimization & Efficiency

- Financial Analysis & Modeling

- Client Relationship Management

- Project Management (PMP methodology)

- Banking Software (FIS, Fiserv, Jack Henry)

- Microsoft Office Suite & Power BI

- Team Leadership & Mentoring

- Public Speaking & Executive Presentations

ADDITIONAL INFORMATION

Active member of the Pennsylvania Bankers Association

Volunteer financial literacy instructor at Pittsburgh Community College (2020-Present)

Fluent in Spanish – worked on cross-border banking compliance projects with Mexican subsidiaries

Senior / Experienced Banking Consultant Resume Example

Melissa R. Donovan

Boston, MA • (617) 555-9284 • melissa.donovan@email.com • linkedin.com/in/melissadonovan

Professional Summary

Seasoned Banking Consultant with over 8 years of experience guiding financial institutions through regulatory changes, digital transformation, and operational efficiency challenges. Known for translating complex banking regulations into practical implementation strategies that reduce compliance risk. Track record of leading cross-functional teams to deliver projects that cut costs while improving customer experience and satisfaction rates.

Professional Experience

Senior Banking Consultant | Beacon Financial Advisory Group, Boston, MA | January 2020 – Present

- Lead consultant for 6 regional banks ($5B-$12B assets) implementing Basel III capital requirements, resulting in 17% average reduction in compliance-related costs

- Designed and executed digital transformation roadmaps for 4 community banks, increasing mobile banking adoption by 43% and reducing branch transaction costs by $2.1M annually

- Created credit risk assessment frameworks that helped clients reduce non-performing loan ratios by an average of 2.3% within 14 months

- Manage team of 7 consultants working across 12 concurrent client engagements, maintaining 92% client retention rate

- Developed proprietary compliance monitoring system adopted by 9 clients, generating $750K in additional annual revenue

Banking Consultant | Deloitte Consulting, New York, NY | March 2017 – December 2019

- Advised 8 mid-sized banks on CECL implementation strategies, reducing implementation costs by 28% compared to industry averages

- Led 3 post-merger integration projects for regional banks, achieving synergy targets 2 months ahead of schedule

- Collaborated with IT teams to enhance fraud detection systems, cutting fraud losses by 31% for a $7.4B asset bank

- Conducted regulatory readiness assessments for 11 clients, identifying and remediating 73 high-risk compliance gaps

Associate Consultant | PwC Banking Practice, Chicago, IL | June 2015 – February 2017

- Supported development of strategic plans for 5 community banks facing competitive pressures from fintech disruptors

- Analyzed branch network profitability for regional bank, identifying $3.7M in potential cost savings

- Assisted in creating AML/KYC process improvements that reduced false positives by 47% while maintaining regulatory compliance

- Co-authored white paper on the impact of blockchain technology on traditional banking services (presented at 2016 ABA Banking Conference)

Education & Certifications

Master of Business Administration – Finance Concentration

Boston University, Questrom School of Business | 2015

Bachelor of Science in Economics

University of Illinois at Urbana-Champaign | 2012

Certifications:

- Certified Regulatory Compliance Manager (CRCM) | 2018

- Certified Anti-Money Laundering Specialist (CAMS) | 2017

- Project Management Professional (PMP) | 2016

- Financial Modeling & Valuation Analyst (FMVA) | 2015

Technical Skills & Expertise

- Regulatory Compliance (Basel III, CECL, Dodd-Frank, BSA/AML)

- Risk Management & Credit Analysis

- Digital Banking Transformation

- Branch Network Optimization

- M&A Due Diligence & Integration

- Financial Modeling & Analysis

- Process Improvement & Lean Six Sigma

- Banking Software: FIS, Fiserv, Jack Henry, Moody’s Analytics

- Data Analytics: SQL, Tableau, Power BI

- Core Banking Systems Implementation

Selected Client Achievements

- Helped mid-sized bank ($8.2B assets) navigate regulatory consent order, resulting in full remediation 6 months ahead of deadline

- Redesigned commercial lending process for community bank, reducing approval time from 19 days to 7 days

- Led workshop series for bank executives on fintech partnerships, resulting in 3 successful vendor relationships that generated $4.2M in new fee income

How to Write a Banking Consultant Resume

Introduction

Banking consultants bridge the gap between technical financial expertise and strategic business solutions. Your resume needs to showcase both analytical prowess and client-facing skills to stand out in this competitive field. I've reviewed thousands of

banking consultant resumes over my career, and the ones that get interviews aren't just lists of jobs—they tell a compelling story about the candidate's impact on financial institutions.

Resume Structure and Format

Keep your banking consultant resume clean and professional—banks aren't typically looking for creative layouts. Stick to these format guidelines:

- Length: 1-2 pages (2 pages only if you have 8+ years of relevant experience)

- Font: Classic choices like Calibri, Arial, or Garaday at 10-12pt

- Margins: 0.5-1 inch on all sides

- File format: PDF (preserves formatting across systems)

- Naming convention: FirstName_LastName_BankingConsultant.pdf

Remember that many banking institutions use strict ATS systems that can't process headers, footers, or tables. Keep your format simple with standard sections and bullet points rather than fancy design elements.

Profile/Summary Section

Your summary should highlight your banking expertise, consulting approach, and unique value proposition in 3-5 sentences. Don't just say you're "results-oriented"—prove it with a specific achievement.

Bad example: "Experienced banking consultant seeking new opportunities to leverage skills."

Better example: "Banking consultant with 6 years specializing in risk management frameworks for regional banks. Reduced non-performing assets by 31% for a $4.2B credit union through custom early warning systems. Known for translating complex regulatory requirements into practical operational procedures."

Professional Experience

This section carries the most weight on your resume. For each role, include:

- Company name, location, and dates (month/year)

- Your title and a brief description of the organization if not well-known

- 4-6 achievement-focused bullet points that follow this formula: Action + Context + Result

Example bullet: "Designed and implemented Basel III compliance strategy for a community bank ($780M in assets), resulting in 17% capital adequacy improvement while reducing compliance staff hours by 24 hours weekly."

Education and Certifications

Banking consultants need solid credentials. List degrees in reverse chronological order and include relevant certifications like:

- MBA or finance-related master's degree

- Chartered Financial Analyst (CFA)

- Certified Banking & Credit Analyst (CBCA)

- Financial Risk Manager (FRM)

- Certified Anti-Money Laundering Specialist (CAMS)

For each, include the institution, completion date, and any honors/distinctions. If you're currently pursuing a certification, note "Expected completion: [Month Year]."

Keywords and ATS Tips

Banking institutions often use sophisticated ATS software to screen candidates. Include these industry-specific keywords naturally throughout your resume:

- Risk management/mitigation

- Regulatory compliance (mention specific regulations like Dodd-Frank, CECL, etc.)

- Financial analysis/modeling

- Process optimization/reengineering

- Core banking systems (mention specific platforms you've worked with)

- Client relationship management

Industry-specific Terms

Sprinkle these banking terms throughout your resume to demonstrate industry knowledge:

- Capital adequacy ratios

- Stress testing methodologies

- Liquidity coverage ratio (LCR)

- Credit risk assessment

- Digital transformation strategy

- Counterparty risk

- RAROC (Risk-Adjusted Return on Capital)

Common Mistakes to Avoid

- Being too vague about project outcomes (always quantify impact when possible)

- Focusing on day-to-day responsibilities instead of achievements

- Neglecting to mention specific banking platforms or technologies used

- Using generic consultant language without banking industry context

- Forgetting to tailor your resume to the specific banking segment (retail, commercial, investment)

Before/After Example

Before: "Helped bank improve their risk management processes."

After: "Redesigned credit risk assessment framework for a $2.3B regional bank, reducing loan loss provisions by 8.7% while maintaining regulatory compliance with OCC guidelines."

The difference? Specificity, measurable results, and industry terminology that proves you know your stuff. Banking is about managing risk and driving profitability—your resume should reflect both.

Related Resume Examples

Soft skills for your Banking Consultant resume

- Cross-functional relationship building (especially between front office and operational teams)

- Financial storytelling and translating complex data into client-friendly narratives

- Active listening during stakeholder requirements gathering

- Adaptive problem-solving under regulatory constraints

- Meeting facilitation and consensus-building with diverse banking teams

- Diplomatic pushback when managing client expectations

Hard skills for your Banking Consultant resume

- Financial Modeling (Excel, Bloomberg) with proficiency in forecasting loan performance and stress testing

- Basel III regulatory framework implementation and capital adequacy assessment

- Proficient in CRM systems (Salesforce, Zoho) and banking core platforms like Fiserv and Jack Henry

- Credit risk analysis using FICO scoring models and proprietary tools

- Banking operations workflow optimization and cost reduction strategy development

- Certified Financial Consultant (CFC) with Series 7 & 63 licenses

- API integration experience with payment gateways (PayPal, Stripe, Plaid)

- Data visualization using Tableau and PowerBI for executive reporting packages

- Experience with AML compliance tools and KYC verification protocols