Audit Associate Resume examples & templates

Copyable Audit Associate Resume examples

Ever wonder what it's like to crack open a company's financial books and see what's really going on behind the numbers? As an Audit Associate, you'll do exactly that – serving as a financial detective who examines, analyzes, and validates financial information to ensure accuracy and compliance. It's not just about finding errors; it's about protecting the integrity of financial reporting in an increasingly complex business landscape. With regulatory requirements tightening since the 2008 financial crisis, the demand for skilled auditors has grown steadily, with the Bureau of Labor Statistics projecting a 7% increase in accounting and auditing positions through 2030.

Today's audit associates are moving beyond traditional tick-and-tie procedures as technology transforms the profession. Data analytics, automation tools, and even AI are changing how audits happen – fewer manual spreadsheet reviews, more sophisticated pattern analysis. Your career might start with validating expense reports, but could evolve into using visualization software to spot unusual transactions or consulting on risk management strategies. For those with sharp analytical minds and an eye for detail, audit offers a solid foundation that can branch into specialties like forensic accounting, internal audit, or even cybersecurity risk assessment.

Junior Audit Associate Resume Example

Michael Zhang

Chicago, IL | (312) 555-9087 | mzhang@emaildomain.com | linkedin.com/in/michaelzhang

PROFESSIONAL SUMMARY

Recent accounting graduate with 1+ year of audit experience at a mid-size public accounting firm. Skilled in financial statement auditing, risk assessment, and control testing for clients in manufacturing and retail sectors. Quick learner who has developed proficiency in multiple audit software platforms while maintaining strong attention to detail and meeting tight deadlines.

EXPERIENCE

Audit Associate | Benson & Mitchell LLP | Chicago, IL | June 2023 – Present

- Support senior team members in conducting financial statement audits for 7 clients with annual revenues ranging from $5M to $78M

- Perform cash, accounts receivable, and inventory testing procedures, identifying $143K in misclassified transactions across 3 client engagements

- Document internal control processes and test operating effectiveness using firm’s proprietary audit methodology

- Assist with preparation of audit workpapers and financial statement footnotes under supervision of senior associates

- Completed training on CCH Audit Acceleration software and implemented new documentation techniques that saved roughly 4 hours per engagement

Audit Intern | Benson & Mitchell LLP | Chicago, IL | January 2023 – May 2023

- Supported audit teams during busy season by preparing account reconciliations and performing analytical procedures

- Assisted with inventory counts at 3 client locations, documenting observations and test counts

- Organized client-provided documentation and maintained electronic workpaper files

- Participated in weekly team meetings and presented findings to senior associates

Accounting Tutor | University of Illinois Chicago | Chicago, IL | September 2021 – December 2022

- Provided one-on-one and small group tutoring for intermediate accounting courses

- Created study materials and practice problems to help students prepare for exams

- Maintained 97% positive feedback rating from students seeking assistance

EDUCATION

Bachelor of Science in Accounting | University of Illinois Chicago | May 2023

- GPA: 3.8/4.0

- Dean’s List: 6 semesters

- Member, Beta Alpha Psi Accounting Honor Society

- Treasurer, Asian Business Student Association (2021-2023)

Certifications & Professional Development:

- Passed 2 parts of CPA exam (AUD, FAR), scheduled to complete remaining sections by December 2023

- Bloomberg Market Concepts Certificate (2022)

- Excel Expert Certification (2022)

SKILLS

- Audit Tools: CCH Engagement, AuditBoard, PBC request tracking

- Accounting Software: QuickBooks, NetSuite (basic), SAP (basic)

- Technical: Advanced Excel (VLOOKUP, pivot tables, macros), Access, SQL (basic)

- Analysis: Financial statement analysis, variance analysis, account reconciliation

- Communication: Client interaction, audit documentation, team collaboration

- Languages: Fluent in English and Mandarin Chinese

Mid-level Audit Associate Resume Example

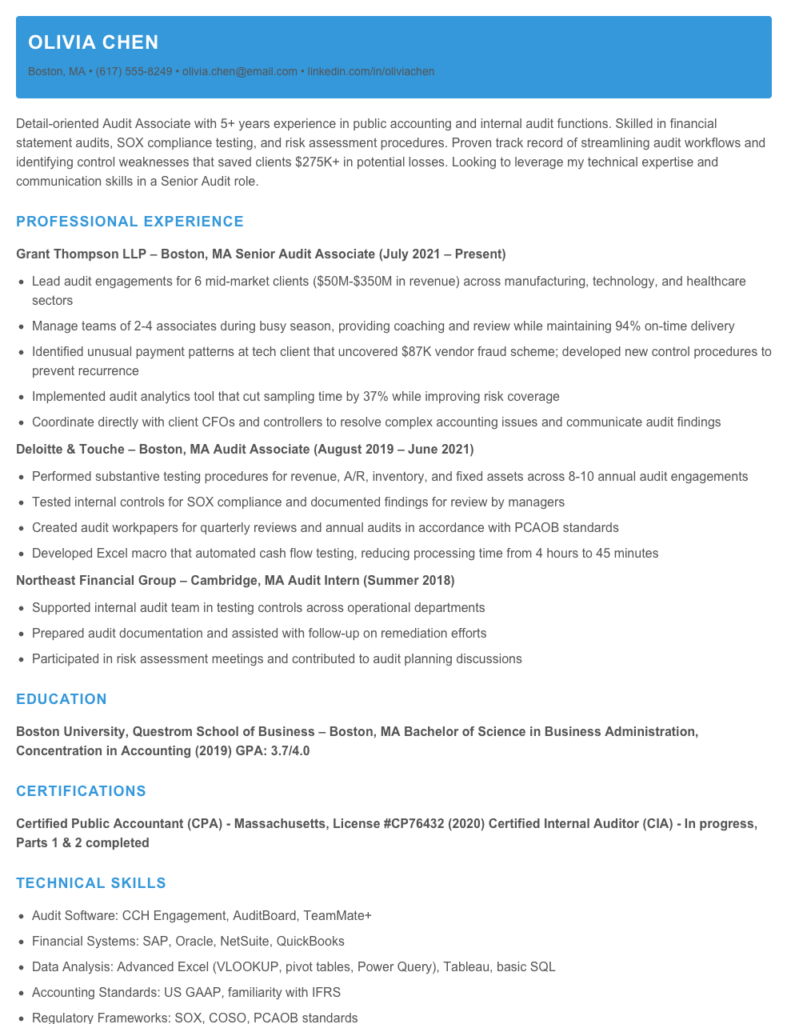

OLIVIA CHEN

Boston, MA • (617) 555-8249 • olivia.chen@email.com • linkedin.com/in/oliviachen

Detail-oriented Audit Associate with 5+ years experience in public accounting and internal audit functions. Skilled in financial statement audits, SOX compliance testing, and risk assessment procedures. Proven track record of streamlining audit workflows and identifying control weaknesses that saved clients $275K+ in potential losses. Looking to leverage my technical expertise and communication skills in a Senior Audit role.

PROFESSIONAL EXPERIENCE

Grant Thompson LLP – Boston, MA

Senior Audit Associate (July 2021 – Present)

- Lead audit engagements for 6 mid-market clients ($50M-$350M in revenue) across manufacturing, technology, and healthcare sectors

- Manage teams of 2-4 associates during busy season, providing coaching and review while maintaining 94% on-time delivery

- Identified unusual payment patterns at tech client that uncovered $87K vendor fraud scheme; developed new control procedures to prevent recurrence

- Implemented audit analytics tool that cut sampling time by 37% while improving risk coverage

- Coordinate directly with client CFOs and controllers to resolve complex accounting issues and communicate audit findings

Deloitte & Touche – Boston, MA

Audit Associate (August 2019 – June 2021)

- Performed substantive testing procedures for revenue, A/R, inventory, and fixed assets across 8-10 annual audit engagements

- Tested internal controls for SOX compliance and documented findings for review by managers

- Created audit workpapers for quarterly reviews and annual audits in accordance with PCAOB standards

- Developed Excel macro that automated cash flow testing, reducing processing time from 4 hours to 45 minutes

Northeast Financial Group – Cambridge, MA

Audit Intern (Summer 2018)

- Supported internal audit team in testing controls across operational departments

- Prepared audit documentation and assisted with follow-up on remediation efforts

- Participated in risk assessment meetings and contributed to audit planning discussions

EDUCATION

Boston University, Questrom School of Business – Boston, MA

Bachelor of Science in Business Administration, Concentration in Accounting (2019)

GPA: 3.7/4.0

CERTIFICATIONS

Certified Public Accountant (CPA) – Massachusetts, License #CP76432 (2020)

Certified Internal Auditor (CIA) – In progress, Parts 1 & 2 completed

TECHNICAL SKILLS

- Audit Software: CCH Engagement, AuditBoard, TeamMate+

- Financial Systems: SAP, Oracle, NetSuite, QuickBooks

- Data Analysis: Advanced Excel (VLOOKUP, pivot tables, Power Query), Tableau, basic SQL

- Accounting Standards: US GAAP, familiarity with IFRS

- Regulatory Frameworks: SOX, COSO, PCAOB standards

ADDITIONAL INFORMATION

Professional Memberships: American Institute of CPAs (AICPA), Institute of Internal Auditors (IIA)

Languages: Fluent in Mandarin Chinese

Volunteer: Treasurer, Boston Community Food Bank (2020-Present)

Senior / Experienced Audit Associate Resume Example

DAVID R. PATTERSON

San Francisco, CA | (415) 555-8901 | dpatterson@email.com | linkedin.com/in/davidpatterson

Experienced audit professional with 8+ years progressive experience specializing in financial services and technology sectors. Strong track record of leading complex audit engagements, implementing risk-based methodologies, and mentoring junior staff. Known for exceptional analytical skills and ability to translate technical findings into actionable business insights for stakeholders.

EXPERIENCE

Senior Audit Associate | Keller & Winslow LLP, San Francisco, CA | August 2019 – Present

- Lead 5-7 person teams on complex audit engagements for clients with revenues ranging from $50M to $1.2B, driving a 31% reduction in average audit completion time

- Developed and implemented new audit approach for SaaS clients resulting in 23% fewer testing exceptions and more targeted risk assessment

- Serve as SME for revenue recognition issues under ASC 606, creating firm-wide training materials used to train 75+ professionals

- Mentor 4 junior associates through quarterly performance reviews and informal coaching sessions

- Identified material weaknesses in client’s control environment that helped them avoid potential $875K regulatory penalty

Audit Associate | Keller & Winslow LLP, San Francisco, CA | June 2016 – July 2019

- Conducted financial statement audits for 12+ public and private clients across technology and financial services industries

- Designed and performed tests of controls and substantive procedures for complex accounting areas including revenue recognition, equity compensation, and business combinations

- Drafted technical memos addressing complex accounting issues for partner review, receiving commendation for thoroughness

- Selected to participate in firm’s “Future Leaders” program (top 15% of associates)

Staff Auditor | Meridian Accounting Group, Portland, OR | July 2014 – May 2016

- Performed substantive testing procedures for mid-sized manufacturing and retail clients

- Assisted in preparation of financial statements and supporting documentation

- Helped implement new paperless audit documentation system that cut review time by 27%

- Conducted inventory observations and cash counts at multiple client locations

EDUCATION

Master of Accounting, University of Oregon, Eugene, OR (2014)

GPA: 3.8/4.0 | Beta Alpha Psi Honor Society

Bachelor of Science in Business Administration, University of Oregon, Eugene, OR (2013)

Concentration: Accounting | GPA: 3.7/4.0

CERTIFICATIONS

Certified Public Accountant (CPA), California, License #CPA-12345 (2015)

Certified Internal Auditor (CIA) (2018)

Certified Information Systems Auditor (CISA) (2020)

SKILLS

- Audit Planning & Execution

- Risk Assessment

- SOX 404 Compliance

- Technical Accounting Research

- Staff Training & Development

- Client Relationship Management

- Data Analytics (Tableau, PowerBI)

- ERP Systems (SAP, Oracle)

- Audit Software (CCH, AuditBoard)

- Advanced Excel & VBA

PROFESSIONAL MEMBERSHIPS

American Institute of Certified Public Accountants (AICPA)

Institute of Internal Auditors (IIA)

California Society of CPAs

How to Write an Audit Associate Resume

Introduction

Landing an Audit Associate position means competing with dozens (sometimes hundreds) of qualified candidates. Your resume isn't just a summary of your work history—it's your ticket to getting that coveted interview call. I've reviewed thousands of audit resumes over my 15+ years in recruiting and career coaching, and the difference between those that get interviews and those that don't often comes down to subtle details. This guide will walk you through creating a resume that showcases your audit skills, attention to detail, and professional potential.

Resume Structure and Format

Most audit firms expect a clean, organized resume that reflects your analytical mindset and eye for detail.

- Keep your resume to 1 page if you have less than 5 years of experience

- Use a clean, professional font (Calibri, Arial, or Times New Roman work well)

- Maintain consistent spacing and bullet formatting throughout

- Include clear section headings that stand out (bold or slightly larger font)

- Save your file as a PDF (unless specifically asked for another format) to preserve formatting

Pro Tip: Name your resume file professionally with your name and the position (e.g., "Jane_Smith_Audit_Associate.pdf"). This small touch shows attention to detail—a critical skill for auditors!

Profile/Summary Section

Start with a concise summary (3-4 lines max) that captures your audit experience, key skills, and what makes you valuable; For junior positions, highlight your education and internships; for experienced roles, focus on your specific audit expertise.

Example for entry-level: "Recent accounting graduate with 6 months of audit internship experience at a regional CPA firm. Proficient in audit sampling techniques and Excel-based analysis. Quick learner with strong analytical skills seeking to leverage academic excellence and internship experience as an Audit Associate."

Professional Experience

This is the meat of your audit resume. Focus on achievements rather than just responsibilities.

- Start bullets with strong action verbs (examined, analyzed, reconciled, identified)

- Quantify your achievements (e.g., "Examined 47 client accounts representing $13.2M in assets")

- Highlight specific audit areas you've worked with (inventory, A/R, fixed assets)

- Mention audit software you've used (ACL, IDEA, TeamMate)

- Include client interaction experience if applicable

Education and Certifications

For audit positions, your education credentials matter significantly. Include:

- Your degree, university, graduation date, and GPA (if above 3.3)

- CPA exam status (passed sections, scheduled exams, or eligibility)

- Relevant coursework (audit, advanced accounting, etc.)

- Other certifications like CIA, CISA, or even in-progress designations

Keywords and ATS Tips

Many firms use Applicant Tracking Systems to filter resumes before a human ever sees them. To get past these digital gatekeepers:

- Include industry terms from the job description (risk assessment, testing procedures, GAAP, GAAS)

- Mention specific regulations you're familiar with (SOX, IFRS, PCAOB standards)

- List relevant software skills (QuickBooks, SAP, Oracle, Excel)

- Avoid excessive formatting, headers/footers, and tables that can confuse ATS systems

Industry-specific Terms

Show your audit knowledge by naturally incorporating terms like:

- Control testing

- Substantive procedures

- Risk-based approach

- Materiality assessment

- Sampling methodologies

- Internal control evaluation

Common Mistakes to Avoid

I see these errors repeatedly on audit resumes, and they can be instant deal-breakers:

- Typos or grammatical errors (fatal in a profession that demands precision)

- Generic descriptions that could apply to any accounting role

- Focusing solely on tasks rather than accomplishments

- Too much technical jargon without showing practical application

- Missing quantifiable results (numbers speak volumes in audit roles!)

Before/After Example

Before: "Helped with audits and worked on testing procedures."

After: "Performed substantive testing across 12 client engagements, identifying $157K in misclassified expenses that improved financial statement accuracy. Developed Excel macros that reduced testing time by 31% for the audit team."

Your resume is often your first audit—make sure it passes with flying colors! Tailor it specifically for each position you apply to, and don't be afraid to highlight your unique strengths that set you apart from other candidates.

Related Resume Examples

Soft skills for your Audit Associate resume

- Tactful communication with clients when discussing sensitive findings (developed through handling 30+ client interactions)

- Cross-functional collaboration – regularly work with IT, Finance and Operations teams during complex audits

- Analytical problem-solving to identify root causes behind financial discrepancies

- Deadline management across multiple concurrent audits (typically 3-4 projects in different phases)

- Mentoring junior staff while maintaining personal productivity targets

- Adaptability to changing regulatory requirements and industry standards

Hard skills for your Audit Associate resume

- IDEA Data Analysis Software proficiency (6+ years advanced usage)

- Internal control testing and risk assessment documentation

- SAP ERP modules (FI/CO) for financial data extraction

- Microsoft Excel (pivot tables, VLOOKUP, complex formulas)

- SOX 404 compliance testing and remediation

- ACL Analytics for fraud detection and transaction testing

- U.S. GAAP and IFRS framework knowledge

- TeamMate+ audit management system

- SQL query writing for database audits (intermediate level)