Asset Management Analyst Resume examples & templates

Copyable Asset Management Analyst Resume examples

Ever wondered who's behind the scenes making sure billion-dollar investment portfolios stay on track? That's where Asset Management Analysts come in. We're the number-crunchers and market-watchers who help investment managers make smart decisions about where to allocate capital. It's a career that blends financial acumen with investigative skills—think part detective, part mathematician. The field has evolved dramatically since the 2008 financial crisis, with regulatory changes reshaping how firms approach risk management and transparency.

According to a recent CFA Institute survey, 73% of asset management firms now incorporate ESG (Environmental, Social, and Governance) factors into their investment analysis—up from just 48% five years ago. This shift reflects growing investor demand for sustainable investments and creates new opportunities for analysts who can evaluate these non-traditional metrics. As passive investment strategies continue gaining market share (now accounting for nearly $11 trillion in assets), the role of analysts is becoming more specialized. Looking ahead, those who can marry quantitative skills with qualitative insights about emerging sectors like fintech and renewable energy will find themselves particularly valuable in this competitive but rewarding field.

Junior Asset Management Analyst Resume Example

Samantha Park

Chicago, IL | (312) 555-8742 | sampark.finance@gmail.com | linkedin.com/in/samanthapark

Financial analyst with investment operations background and strong attention to detail. Experience supporting portfolio management through data analysis, performance reporting, and client service. Adept at financial modeling and investment research with proficiency in Bloomberg, FactSet, and Excel. Seeking growth in asset management to leverage my analytical skills and finance education.

EXPERIENCE

Junior Asset Management Analyst – Meridian Capital Partners, Chicago, IL (June 2022 – Present)

- Support portfolio managers by gathering and analyzing performance data for $350M in fixed income and equity assets

- Compile monthly performance reports for 20+ institutional clients, reducing reporting turnaround time by 15%

- Monitor market trends and prepare quarterly economic outlook presentations for client meetings

- Track portfolio metrics against benchmarks using Bloomberg Terminal and proprietary analytics software

- Assist with quarterly client review meetings and respond to ad-hoc data requests from investors

Investment Operations Intern – Lakeside Wealth Advisors, Chicago, IL (January 2022 – May 2022)

- Processed trade settlements and reconciliations for 75+ client accounts

- Created Excel models to track portfolio allocations against targets, flagging rebalancing needs

- Assisted with monthly NAV calculations and performance attribution analysis

- Generated client-facing performance reports using Morningstar Direct

Finance Research Assistant – University of Illinois, Chicago, IL (September 2020 – December 2021)

- Collected and cleaned financial data for faculty research on ESG investment performance

- Performed statistical analysis using R to identify correlations between ESG ratings and stock returns

- Created visualizations of research findings for department presentations

EDUCATION

Bachelor of Science in Finance – University of Illinois at Chicago (2021)

- Minor: Economics

- GPA: 3.7/4.0

- Relevant Coursework: Investment Analysis, Financial Markets, Portfolio Management, Financial Modeling, Statistics

- University Investment Fund: Student Analyst (managed $100K portfolio)

CERTIFICATIONS

CFA Level I Candidate (Exam scheduled for June 2023)

Bloomberg Market Concepts (BMC) Certification (2021)

SKILLS

- Financial Analysis: Performance attribution, risk assessment, portfolio analytics

- Software: Bloomberg Terminal, FactSet, Morningstar Direct, MS Office Suite

- Technical: Advanced Excel (pivot tables, VLOOKUP, macros), basic SQL, R programming

- Investment Research: Equity valuation, fixed income analysis, market research

- Reporting: Performance measurement, client reporting, data visualization

- Languages: Fluent in English and conversational Korean

ADDITIONAL

Member, CFA Society Chicago (Student Membership)

Volunteer, Junior Achievement Financial Literacy Program

Mid-level Asset Management Analyst Resume Example

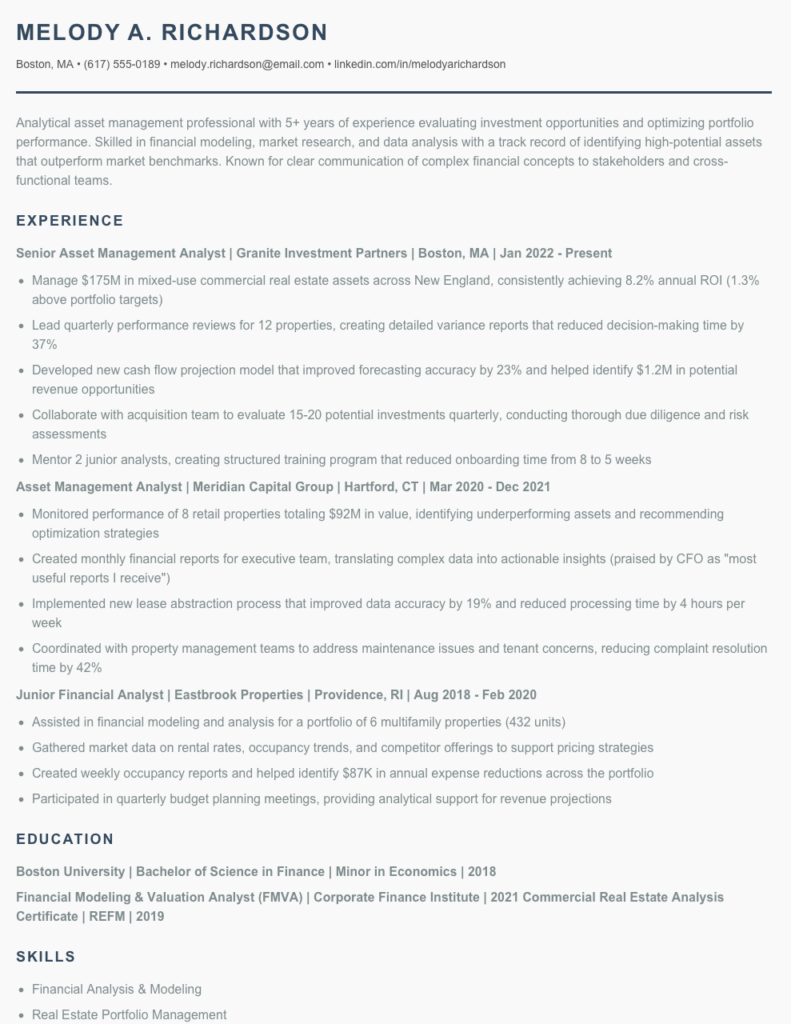

Melody A. Richardson

Boston, MA • (617) 555-0189 • melody.richardson@email.com • linkedin.com/in/melodyarichardson

Analytical asset management professional with 5+ years of experience evaluating investment opportunities and optimizing portfolio performance. Skilled in financial modeling, market research, and data analysis with a track record of identifying high-potential assets that outperform market benchmarks. Known for clear communication of complex financial concepts to stakeholders and cross-functional teams.

EXPERIENCE

Senior Asset Management Analyst | Granite Investment Partners | Boston, MA | Jan 2022 – Present

- Manage $175M in mixed-use commercial real estate assets across New England, consistently achieving 8.2% annual ROI (1.3% above portfolio targets)

- Lead quarterly performance reviews for 12 properties, creating detailed variance reports that reduced decision-making time by 37%

- Developed new cash flow projection model that improved forecasting accuracy by 23% and helped identify $1.2M in potential revenue opportunities

- Collaborate with acquisition team to evaluate 15-20 potential investments quarterly, conducting thorough due diligence and risk assessments

- Mentor 2 junior analysts, creating structured training program that reduced onboarding time from 8 to 5 weeks

Asset Management Analyst | Meridian Capital Group | Hartford, CT | Mar 2020 – Dec 2021

- Monitored performance of 8 retail properties totaling $92M in value, identifying underperforming assets and recommending optimization strategies

- Created monthly financial reports for executive team, translating complex data into actionable insights (praised by CFO as “most useful reports I receive”)

- Implemented new lease abstraction process that improved data accuracy by 19% and reduced processing time by 4 hours per week

- Coordinated with property management teams to address maintenance issues and tenant concerns, reducing complaint resolution time by 42%

Junior Financial Analyst | Eastbrook Properties | Providence, RI | Aug 2018 – Feb 2020

- Assisted in financial modeling and analysis for a portfolio of 6 multifamily properties (432 units)

- Gathered market data on rental rates, occupancy trends, and competitor offerings to support pricing strategies

- Created weekly occupancy reports and helped identify $87K in annual expense reductions across the portfolio

- Participated in quarterly budget planning meetings, providing analytical support for revenue projections

EDUCATION

Boston University | Bachelor of Science in Finance | Minor in Economics | 2018

Financial Modeling & Valuation Analyst (FMVA) | Corporate Finance Institute | 2021 Commercial Real Estate Analysis Certificate | REFM | 2019

SKILLS

- Financial Analysis & Modeling

- Real Estate Portfolio Management

- Market Research & Analysis

- DCF & NPV Calculations

- Lease Analysis & Abstraction

- Risk Assessment

- Microsoft Excel (Advanced) & Power BI

- Argus Enterprise

- Yardi Property Management

- Bloomberg Terminal

- Written & Verbal Communication

ADDITIONAL

Member, Urban Land Institute (ULI) – Boston Chapter, 2020-Present

Volunteer, Habitat for Humanity Boston (quarterly build days)

Conversational Spanish

Senior / Experienced Asset Management Analyst Resume Example

Michael R. Davidson

Chicago, IL • (312) 555-8794 • mdavidson@emailpro.net • linkedin.com/in/michaeldavidson

Senior Asset Management Analyst with over 9 years of specialized experience optimizing portfolio performance and capital allocation strategies. Known for delivering data-focused recommendations that have increased portfolio yields by up to 17% while maintaining appropriate risk parameters. Excel at translating complex financial models into actionable business strategies for C-suite audiences.

PROFESSIONAL EXPERIENCE

Senior Asset Management Analyst – Meridian Capital Partners, Chicago, IL (March 2019 – Present)

- Lead analysis and performance tracking for $2.8B real estate and alternative investment portfolio, including quarterly valuation reviews and risk assessment reporting

- Developed custom Python algorithms that reduced quarterly reporting time by 63% while expanding analytical depth

- Spearheaded implementation of new portfolio management system, resulting in $372K annual cost savings through process automation

- Mentor junior analysts and present quarterly performance insights to investment committee and board members

- Collaborated with risk management team to create stress-testing models for portfolio assets under various economic scenarios

Asset Management Analyst – Pinnacle Investment Group, Chicago, IL (June 2016 – February 2019)

- Managed performance analysis for $1.2B fixed income and equity portfolio, focusing on yield optimization and risk-adjusted returns

- Created and maintained financial models to evaluate investment opportunities, resulting in 12.7% outperformance vs. benchmark over 3-year period

- Prepared monthly performance reports for 22 institutional clients, including pension funds and endowments

- Coordinated with external fund managers to ensure alignment with investment guidelines and objectives

Junior Financial Analyst – Westbrook Financial Services, Detroit, MI (August 2014 – May 2016)

- Supported senior analysts in tracking performance metrics for mutual fund products and separately managed accounts

- Compiled and verified financial data from multiple sources to ensure accuracy of client reporting

- Assisted in due diligence process for potential acquisition targets, including data room management

- Helped develop quarterly client presentations and marketing materials (my first big project was rebuilding our fact sheets!)

EDUCATION

Master of Science in Finance – DePaul University, Chicago, IL (2016)

Bachelor of Business Administration – Michigan State University, East Lansing, MI (2014)

Major: Finance, Minor: Economics – GPA: 3.7/4.0

CERTIFICATIONS

Chartered Financial Analyst (CFA) – Completed all three levels (2018)

Financial Modeling & Valuation Analyst (FMVA) – Corporate Finance Institute (2017)

Bloomberg Market Concepts (BMC) Certification (2015)

TECHNICAL SKILLS

- Financial Analysis: DCF modeling, scenario analysis, risk assessment, asset valuation

- Software: Bloomberg Terminal, FactSet, Morningstar Direct, MSCI Barra

- Programming: Advanced Excel (VBA), Python, SQL, R (basic)

- Investment Platforms: BlackRock Aladdin, Charles River IMS

- Reporting: Power BI, Tableau

ADDITIONAL INFORMATION

Languages: English (native), Spanish (conversational)

Volunteer: Finance Committee Member, Chicago Community Housing Initiative (2018-Present)

How to Write an Asset Management Analyst Resume

Introduction

Landing that perfect Asset Management Analyst role means first getting past the resume screening phase—which isn't always easy. Your resume isn't just a list of past jobs; it's a marketing document that needs to quickly show hiring managers you can track assets, analyze performance data, and make smart recommendations. I've helped hundreds of finance professionals revamp their resumes over the years, and the difference between getting called for an interview (or not) often comes down to how you position your skills and experience.

The average hiring manager spends just 7.4 seconds scanning your resume before deciding whether to read further. Make those seconds count by front-loading your most impressive qualifications and achievements.

Resume Structure and Format

Keep your Asset Management Analyst resume clean and scannable. Financial firms typically prefer conservative formats that reflect the precision and attention to detail required in the role.

- Length: Stick to 1 page if you have under 5 years of experience; 2 pages maximum for senior roles

- Font: Use professional fonts like Calibri, Arial, or Garamond in 10-12pt size

- Margins: 0.5-1 inch on all sides

- File format: Submit as PDF unless specifically requested otherwise

- Sections: Contact info, summary, experience, skills, education, certifications

Profile/Summary Section

Your summary should be 3-4 lines that quickly establish your experience level, specialization areas, and key accomplishments. For Asset Management Analysts, emphasize your analytical abilities and financial acumen.

Example: "Asset Management Analyst with 4+ years of experience in real estate portfolio management and financial modeling. Skilled in performance attribution analysis that identified $3.7M in underperforming assets. Proficient in Bloomberg Terminal, Excel (including advanced VBA), and Argus Enterprise."

Professional Experience

This is where you'll win or lose your interview chance. For each position:

- Start with strong action verbs (analyzed, developed, implemented)

- Focus on quantifiable achievements rather than just duties

- Highlight experience with specific asset classes you've managed

- Mention software platforms and analytical tools you've mastered

- Show progression of responsibility if you've been promoted

For example, instead of "Responsible for analyzing investment performance," write "Analyzed quarterly performance of $275M fixed-income portfolio, identifying correlation patterns that led to 18% reduction in volatility."

Education and Certifications

Asset Management is credential-heavy, so highlight relevant education and certifications prominently. Include:

- Degrees with university names, graduation years, and GPA if above 3.5

- Industry certifications (CFA, CAIA, FRM, etc.) with level/status

- Relevant coursework if you're early in your career

- Financial modeling or analysis training programs

Keywords and ATS Tips

Most large investment firms use Applicant Tracking Systems to filter resumes before human eyes see them. To get past these digital gatekeepers:

- Study the job description and mirror key terms

- Include industry standard acronyms both spelled out and abbreviated (e.g., "Net Present Value (NPV)")

- Mention specific analysis methods you've used (Monte Carlo simulations, regression analysis)

- Name software platforms specifically rather than saying "familiar with financial software"

Industry-specific Terms

Weave these terms naturally throughout your resume (but only if you genuinely have experience with them):

- Performance attribution

- Asset allocation

- Portfolio optimization

- Risk-adjusted returns

- Benchmark analysis

- Due diligence

- Discounted cash flow (DCF)

- Fixed income/equity analysis

Common Mistakes to Avoid

- Being vague about the size of portfolios managed or impact of your work

- Focusing too much on routine tasks rather than analytical achievements

- Forgetting to mention specific asset classes you've worked with

- Listing every Excel function you know instead of highlighting advanced skills

- Cluttering your resume with non-relevant personal interests

Before/After Example

Before: "Helped manage assets and created reports for management."

After: "Conducted monthly performance analysis on $142M multi-asset portfolio, creating executive dashboards that highlighted a previously undetected 2.3% tracking error in emerging market allocations."

Remember—your resume needs to tell the story of not just what you did, but how well you did it and what difference it made. Good luck with your application!

Related Resume Examples

Soft skills for your Asset Management Analyst resume

- Cross-functional communication with stakeholders (including portfolio managers, risk teams and clients)

- Financial narrative development – translating complex data into actionable recommendations

- Collaborative problem-solving during market volatility

- Project prioritization under competing deadlines (especially during quarter-end reporting)

- Team mentorship of junior analysts

- Adaptability to evolving regulatory frameworks and compliance requirements

Hard skills for your Asset Management Analyst resume

- Bloomberg Terminal proficiency with custom script creation

- Advanced Excel modeling (VBA, pivot tables, regression analysis)

- Factset portfolio analytics and attribution reporting

- SQL database querying for investment data extraction

- Python for automated performance reporting (pandas, numpy libraries)

- Morningstar Direct portfolio construction tools

- CFA Level II certification (Level III candidate)

- Risk analytics using BlackRock Aladdin platform

- MSCI Barra factor model implementation