Actuary Resume examples & templates

Copyable Actuary Resume examples

Ever wondered who calculates the financial impact of risk? That's where actuaries come in—the mathematical minds behind insurance premiums, pension funds, and increasingly, climate risk models. Actuaries blend statistical analysis with business acumen to predict and quantify future uncertainties, creating the financial safety nets that protect individuals and organizations from potential disasters. It's a profession that's evolved dramatically in recent years, with predictive analytics and machine learning transforming how actuaries approach complex problems.

The field offers remarkable stability too—with unemployment rates consistently below 1%, actuaries enjoy job security that's practically unmatched in today's economy. And while passing those rigorous exams (there are up to 10 depending on your specialty) remains a rite of passage, the payoff is substantial. The profession has expanded beyond its traditional insurance roots into banking, healthcare, climate science, and even tech startups. As data becomes the currency of modern business and uncertainty grows in our complex world, actuaries aren't just number-crunchers anymore—they're strategic advisors helping organizations navigate an increasingly unpredictable future.

Junior Actuary Resume Example

Melissa Zhang

Boston, MA • (617) 555-2938 • mzhang2023@gmail.com • linkedin.com/in/melissa-zhang-actuary

Professional Summary

Recent actuarial science graduate with 1+ year of experience in property and casualty insurance. Passed 3 SOA exams and currently preparing for my fourth. Strong analytical skills with experience in statistical modeling and risk assessment. Looking to grow my career at a company where I can apply my technical background while developing broader business acumen.

Experience

Actuarial Analyst – Liberty Mutual Insurance, Boston, MA

February 2023 – Present

- Support pricing team in developing premium rates for auto insurance products across 4 states

- Analyze claims data using R and Excel to identify trends and anomalies that impact pricing decisions

- Create monthly loss ratio reports that tracked performance against expected metrics, helping identify a 4.2% pricing gap in northeastern markets

- Assist in quarterly reserve reviews by validating data inputs and preparing exhibits for senior actuaries

- Collaborate with underwriting team to explain rate changes and technical concepts to non-actuarial staff

Actuarial Intern – Travelers Insurance, Hartford, CT

May 2022 – August 2022

- Supported catastrophe modeling team in analyzing hurricane exposure data for coastal properties

- Built Excel models to track and visualize regional property exposure concentrations

- Participated in weekly team meetings to discuss model assumptions and limitations

- Helped compile data for quarterly management presentations on catastrophe risk

Data Analysis Tutor – Boston University, Boston, MA

September 2021 – May 2022

- Tutored undergraduate students in statistical concepts and programming applications

- Supported professors by hosting weekly study sessions for students struggling with R and Excel

- Created supplementary learning materials that simplified complex statistical concepts

Education

Boston University – Boston, MA

Bachelor of Science in Actuarial Science, Minor in Statistics

GPA: 3.8/4.0, graduated May 2022

Relevant Coursework: Probability Theory, Financial Mathematics, Risk Theory, Loss Models, Time Series Analysis

Certifications

- SOA Exam P (Probability) – Passed January 2021

- SOA Exam FM (Financial Mathematics) – Passed June 2021

- SOA Exam IFM (Investment and Financial Markets) – Passed December 2022

- VEE Credits – Economics, Accounting & Finance, Mathematical Statistics

Technical Skills

- Statistical Software: R, SAS (basic), Excel (advanced)

- Programming: SQL, Python (basic)

- Statistical Methods: GLM, regression analysis, credibility theory

- Risk Assessment: pricing models, reserve analysis, exposure modeling

- Visualization: Tableau, PowerBI

- Microsoft Office Suite: Word, PowerPoint, Access

Professional Affiliations

Society of Actuaries (SOA) – Student Member

Casualty Actuarial Society (CAS) – Student Member

Boston Actuarial Club – Member

Mid-level Actuary Resume Example

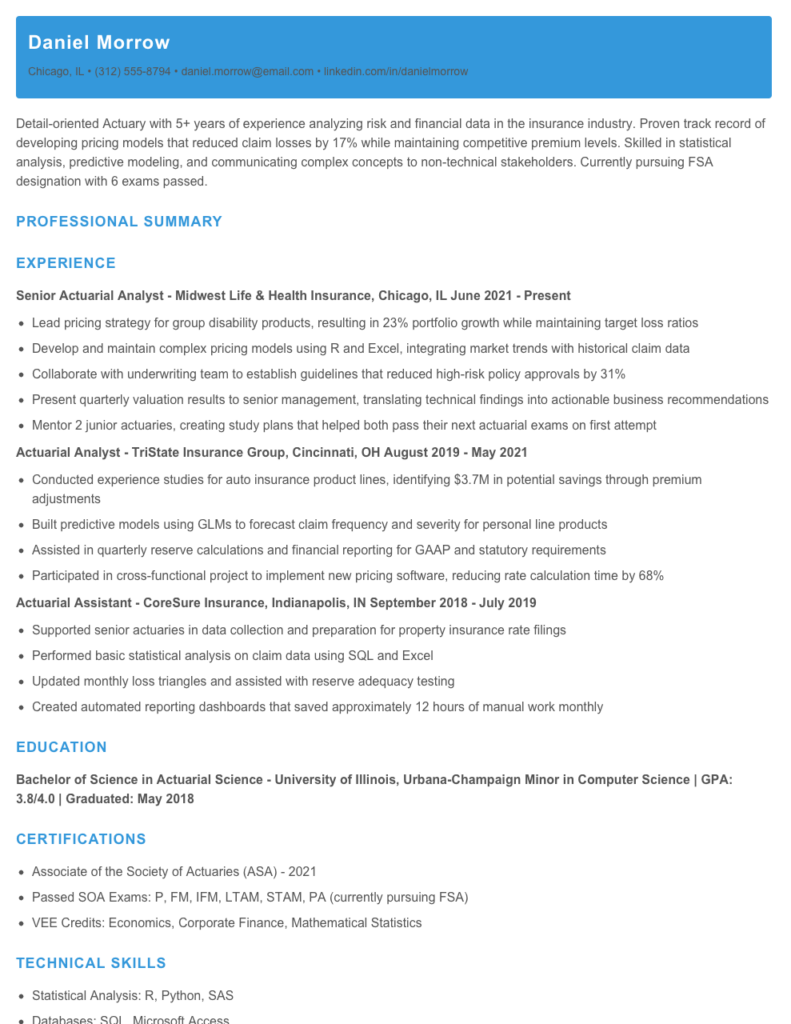

Daniel Morrow

Chicago, IL • (312) 555-8794 • daniel.morrow@email.com • linkedin.com/in/danielmorrow

PROFESSIONAL SUMMARY

Detail-oriented Actuary with 5+ years of experience analyzing risk and financial data in the insurance industry. Proven track record of developing pricing models that reduced claim losses by 17% while maintaining competitive premium levels. Skilled in statistical analysis, predictive modeling, and communicating complex concepts to non-technical stakeholders. Currently pursuing FSA designation with 6 exams passed.

EXPERIENCE

Senior Actuarial Analyst – Midwest Life & Health Insurance, Chicago, IL

June 2021 – Present

- Lead pricing strategy for group disability products, resulting in 23% portfolio growth while maintaining target loss ratios

- Develop and maintain complex pricing models using R and Excel, integrating market trends with historical claim data

- Collaborate with underwriting team to establish guidelines that reduced high-risk policy approvals by 31%

- Present quarterly valuation results to senior management, translating technical findings into actionable business recommendations

- Mentor 2 junior actuaries, creating study plans that helped both pass their next actuarial exams on first attempt

Actuarial Analyst – TriState Insurance Group, Cincinnati, OH

August 2019 – May 2021

- Conducted experience studies for auto insurance product lines, identifying $3.7M in potential savings through premium adjustments

- Built predictive models using GLMs to forecast claim frequency and severity for personal line products

- Assisted in quarterly reserve calculations and financial reporting for GAAP and statutory requirements

- Participated in cross-functional project to implement new pricing software, reducing rate calculation time by 68%

Actuarial Assistant – CoreSure Insurance, Indianapolis, IN

September 2018 – July 2019

- Supported senior actuaries in data collection and preparation for property insurance rate filings

- Performed basic statistical analysis on claim data using SQL and Excel

- Updated monthly loss triangles and assisted with reserve adequacy testing

- Created automated reporting dashboards that saved approximately 12 hours of manual work monthly

EDUCATION

Bachelor of Science in Actuarial Science – University of Illinois, Urbana-Champaign

Minor in Computer Science | GPA: 3.8/4.0 | Graduated: May 2018

CERTIFICATIONS

- Associate of the Society of Actuaries (ASA) – 2021

- Passed SOA Exams: P, FM, IFM, LTAM, STAM, PA (currently pursuing FSA)

- VEE Credits: Economics, Corporate Finance, Mathematical Statistics

TECHNICAL SKILLS

- Statistical Analysis: R, Python, SAS

- Databases: SQL, Microsoft Access

- Modeling Tools: @Risk, Prophet, Excel (advanced)

- Programming: VBA, Basic C++

- Visualization: Tableau, Power BI

- Software: Moses, MG-ALFA, TAS

PROFESSIONAL MEMBERSHIPS

- Society of Actuaries (SOA)

- Casualty Actuarial Society (CAS) – Student Member

- Actuarial Club of Chicago – Committee Member

Senior / Experienced Actuary Resume Example

ROBERT JENKINS, FSA, MAAA

Austin, TX • (512) 555-8734 • robert.jenkins@email.com • linkedin.com/in/robertjenkins

Senior actuary with 10+ years of experience in property & casualty insurance. Strong technical background in pricing, reserving and predictive modeling with proven ability to translate complex analyses into business recommendations. Skilled in leading cross-functional teams and mentoring junior actuaries. Known for developing innovative solutions that have reduced loss ratios by 4.2% and improved premium adequacy.

PROFESSIONAL EXPERIENCE

Senior Actuarial Manager | Pinnacle Insurance Group | Austin, TX | 03/2019 – Present

- Lead a team of 6 actuaries and analysts responsible for pricing and product development across 3 commercial insurance lines, generating $487M in annual premium

- Redesigned catastrophe risk model resulting in more accurate premium calculations and 3.1% reduction in adverse selection

- Developed and implemented new predictive model for commercial auto pricing that improved loss ratio by 4.2% within first year

- Collaborated with IT to automate monthly reserve analysis process, reducing reporting time from 5 days to 7 hours

- Serve as key technical resource for rate filings with state regulatory bodies, successfully defending 92% of proposed rate changes

Actuarial Manager | Meridian Property & Casualty | Dallas, TX | 06/2016 – 02/2019

- Managed reserve adequacy analysis for personal lines with $320M in annual claims, identifying and correcting a $14.2M shortfall in homeowners reserves

- Led quarterly loss ratio reviews with underwriting teams, implementing targeted interventions that improved combined ratio by 2.8 points

- Created Excel-based rating tool that standardized pricing across regions while accounting for territory-specific risk factors

- Supervised and mentored 3 junior actuaries, with 2 successfully completing FSA exams under my guidance

Actuarial Analyst | Liberty Mutual Insurance | Boston, MA | 08/2013 – 05/2016

- Performed rate adequacy analyses for workers’ compensation product line across 12 states

- Built statistical models to identify key drivers of claim severity, findings were used to revise underwriting guidelines

- Assisted in quarterly reserve reviews and financial reporting for statutory statements

- Collaborated with claims department to improve loss development factors, resulting in more accurate IBNR estimates

EDUCATION & CREDENTIALS

Fellow, Society of Actuaries (FSA) | Completed 2018

Member, American Academy of Actuaries (MAAA) | Since 2018

Associate, Society of Actuaries (ASA) | Completed 2015

Bachelor of Science, Actuarial Science & Statistics | University of Michigan | 2013

Minor in Business Administration | GPA: 3.8/4.0

TECHNICAL SKILLS

- Predictive Modeling & Machine Learning (GLMs, Random Forest, Gradient Boosting)

- Statistical Analysis Software: R, Python, SAS

- Reserving Methodologies: Chain Ladder, BF, Cape Cod

- Advanced Excel & VBA Programming

- SQL & Database Management

- Catastrophe Modeling: AIR, RMS

- Dynamic Financial Analysis

- Pricing & Rate Making

- Regulatory Compliance & Filing

- Azure-based Actuarial Systems (got certified last summer during that weird heatwave)

PROFESSIONAL AFFILIATIONS

- Casualty Actuarial Society (CAS) – Member

- American Academy of Actuaries – Member

- Central Texas Actuarial Club – Board Member (2020-Present)

How to Write an Actuary Resume

Introduction

Landing that perfect actuary job starts with a resume that showcases your analytical prowess and mathematical abilities. In a field where precision matters (both in your work and your application materials), your resume serves as the first proof that you're detail-oriented and thorough. I've reviewed thousands of actuary resumes over my career, and I can tell you firsthand that hiring managers spend an average of 37 seconds scanning each one. That's barely enough time to make an impression—so let's make every second count!

Resume Structure and Format

Keep your actuary resume clean and structured—just like a well-organized spreadsheet of mortality tables. Aim for 1-2 pages depending on your experience level, with clear section headings and consistent formatting.

- Stick with professional fonts like Calibri, Arial, or Garamond in 10-12pt size

- Use bold for section headers and job titles

- Include plenty of white space (5/8" to 1" margins work well)

- Save as a PDF unless specifically asked for another format

- Name your file professionally (FirstName_LastName_Resume.pdf)

Profile/Summary Section

Your professional summary should highlight your actuarial expertise in 3-5 punchy lines. This isn't the place for generic statements—get specific about your credentials and specialization.

Pro Tip: Tailor your summary to each job application. A property and casualty insurer will have different priorities than a health benefits consultant. Show that you understand their specific actuarial needs from the get-go.

For example, instead of writing "Experienced actuary seeking new opportunities," try something like: "ASA-credentialed actuary with 6+ years specializing in pricing and reserving for auto insurance products. Skilled in R, Python, and Excel VBA macros with proven track record reducing loss ratios by 4.3% through predictive modeling improvements."

Professional Experience

This is where you really shine! Structure each role with company name, position, dates, and measurable achievements. For actuarial roles, quantify your impact whenever possible:

- Developed pricing models for new product launch that generated $3.7M in premium within first year

- Cut reserve estimation process time from 5 days to 6 hours by automating calculations with Python

- Identified $12.8M in potential savings through analysis of claims patterns in long-term disability book

- Mentored 3 actuarial students, with all passing exams on first attempt

Education and Certifications

For actuaries, this section is crucial. List your actuarial exams passed, progress toward credentials, and relevant education. Format might look like:

- Associate of the Society of Actuaries (ASA) - Achieved 2019

- Exam LTAM, STAM, SRM, P, FM, IFM - Passed

- VEE Credits: Economics, Accounting & Finance, Mathematical Statistics - Completed

- BS in Mathematics, Minor in Computer Science - University of Wisconsin, 2016

Keywords and ATS Tips

Most companies run resumes through Applicant Tracking Systems before human eyes ever see them. Include relevant keywords from the job description, but weave them naturally throughout your resume. For actuarial positions, consider including:

- Technical skills: R, Python, SAS, Excel, VBA, SQL, Tableau

- Actuarial software: Moses, Emblem, AXIS, Prophet, MG-ALFA

- Process terms: reserving, pricing, valuation, risk assessment, predictive modeling

- Regulatory frameworks: GAAP, IFRS 17, Solvency II, principle-based reserves

Industry-specific Terms

Sprinkle your resume with actuarial terminology that shows you know your stuff. Terms like mortality/morbidity tables, stochastic modeling, Monte Carlo simulation, credibility theory, and loss development factors signal to recruiters that you understand the field's technical aspects.

Common Mistakes to Avoid

- Listing exam passes without dates (makes it look like you're hiding a slow progression)

- Focusing solely on responsibilities rather than achievements

- Using vague statements like "strong analytical skills" without examples

- Neglecting to mention specific insurance/finance sectors you've worked in

- Forgetting to include professional memberships (SOA, CAS, etc.)

Before/After Example

Before: "Responsible for pricing analysis and reserving for auto insurance products."

After: "Led quarterly reserve analysis for $278M auto insurance portfolio, implementing new segmentation approach that improved accuracy by 7.2% and reduced adverse development in tail claims by $4.1M over 18 months."

Remember—your resume isn't just a list of jobs you've had; it's a marketing document showcasing how you've used your actuarial skills to deliver measurable results. Good luck with your application! And if you're still studying for exams while job hunting... well, I've been there. Coffee helps.

Related Resume Examples

Soft skills for your Actuary resume

- Cross-functional communication – translating complex statistical concepts into actionable business insights for non-technical stakeholders

- Project leadership on risk modeling teams, including coordinating with IT and underwriting departments

- Attention to detail while maintaining big-picture perspective (balancing precision with practical business applications)

- Critical thinking and creative problem-solving when standard actuarial models need adjustment

- Time management skills for meeting strict regulatory filing deadlines while juggling multiple projects

- Collaborative mindset when working with data scientists to implement new predictive models

Hard skills for your Actuary resume

- FSA (Fellow of the Society of Actuaries) certification with specialization in Life Insurance

- Proficiency in R and Python for statistical modeling and data analysis

- Experience with SAS and SQL for large dataset manipulation

- Stochastic modeling and Monte Carlo simulation techniques

- Predictive analytics using GLMs and machine learning algorithms

- Expertise in pricing and reserving for P&C insurance products

- Proficient with Prophet and AXIS actuarial software

- Experience developing mortality tables and performing experience studies

- Enterprise Risk Management (ERM) framework implementation