Accounts Receivable Manager Resume examples & templates

Copyable Accounts Receivable Manager Resume examples

Ever wonder who keeps the cash flowing when a company's customers take their sweet time paying? That's the Accounts Receivable Manager's domain - part detective, part diplomat, and completely essential to business health. These financial professionals do far more than chase down payments; they're the strategic minds who optimize working capital, manage credit policies, and ensure businesses maintain the liquidity needed to operate and grow. With organizations losing an average of 4.6% of revenue to uncollected receivables each year (according to a 2022 Atradius Payment Practices Barometer), skilled AR managers have never been more valuable.

The field is undergoing fascinating changes as automation streamlines routine tasks, allowing AR managers to focus more on analytics and customer relationship management. Companies increasingly seek professionals who can balance technical accounting skills with strategic thinking - those rare individuals who understand both the numbers and the psychology behind payment behaviors. For those with the right mix of financial acumen, technology savvy, and interpersonal skills, AR management offers a career path that's evolving beyond traditional accounting roles into a crucial business partnership function.

Junior Accounts Receivable Manager Resume Example

Miranda Sanchez

Phoenix, AZ 85004 | (480) 555-2189 | m.sanchez@email.com | linkedin.com/in/mirandasanchez

Detail-oriented Accounts Receivable professional with 2 years of progressive experience in AR operations, collections, and financial reporting. Successfully reduced DSO by 14 days at current position through improved collection strategies and customer communication. Proficient in QuickBooks, Microsoft Dynamics, and Excel pivot tables. Eager to leverage my skills in a management role to drive financial efficiency and process improvement.

EXPERIENCE

Accounts Receivable Lead | Desert Valley Manufacturing | Phoenix, AZ | Jan 2023 – Present

- Supervise a team of 2 AR clerks, providing training and performance feedback while managing a $4.2M AR portfolio

- Reduced days sales outstanding (DSO) from 47 to 33 days by implementing structured follow-up procedures and payment reminder system

- Reconcile customer accounts and resolve discrepancies, maintaining 99.3% accuracy in monthly AR aging reports

- Create and distribute weekly AR status reports to finance leadership team highlighting collection performance and past-due accounts

- Collaborate with sales team to clarify customer payment terms and resolve invoice disputes before they impact cash flow

Accounts Receivable Specialist | Southwest Medical Supplies | Tempe, AZ | Jul 2021 – Dec 2022

- Processed and posted daily cash receipts averaging $87K, ensuring accurate application to customer accounts

- Managed collections for 160+ customer accounts, making 30+ outbound calls daily to resolve payment issues

- Reduced past-due receivables by 22% in first 6 months through consistent follow-up and documentation

- Assisted with month-end close activities including account reconciliation and AR aging analysis

Accounts Payable Clerk (Part-time) | Green Valley Community College | Chandler, AZ | Sep 2020 – Jun 2021

- Processed vendor invoices and expense reports while maintaining compliance with institutional payment policies

- Maintained vendor files and payment records for audit purposes

- Assisted with transition to paperless AP system, scanning and organizing historical documents

EDUCATION

Bachelor of Science in Accounting | Arizona State University | Tempe, AZ | May 2021

- GPA: 3.7/4.0

- Member, Accounting Student Association

CERTIFICATIONS

Certified Accounts Receivable Specialist (CARS) | Institute of Finance & Management | Jul 2022

QuickBooks Online ProAdvisor Certification | Intuit | Mar 2022

SKILLS

- Account Reconciliation

- Collections & Dispute Resolution

- Cash Application

- AR Aging Analysis

- MS Excel (VLOOKUP, pivot tables)

- QuickBooks

- Microsoft Dynamics 365

- Financial Reporting

- Team Leadership

- Customer Relationship Management

Mid-level Accounts Receivable Manager Resume Example

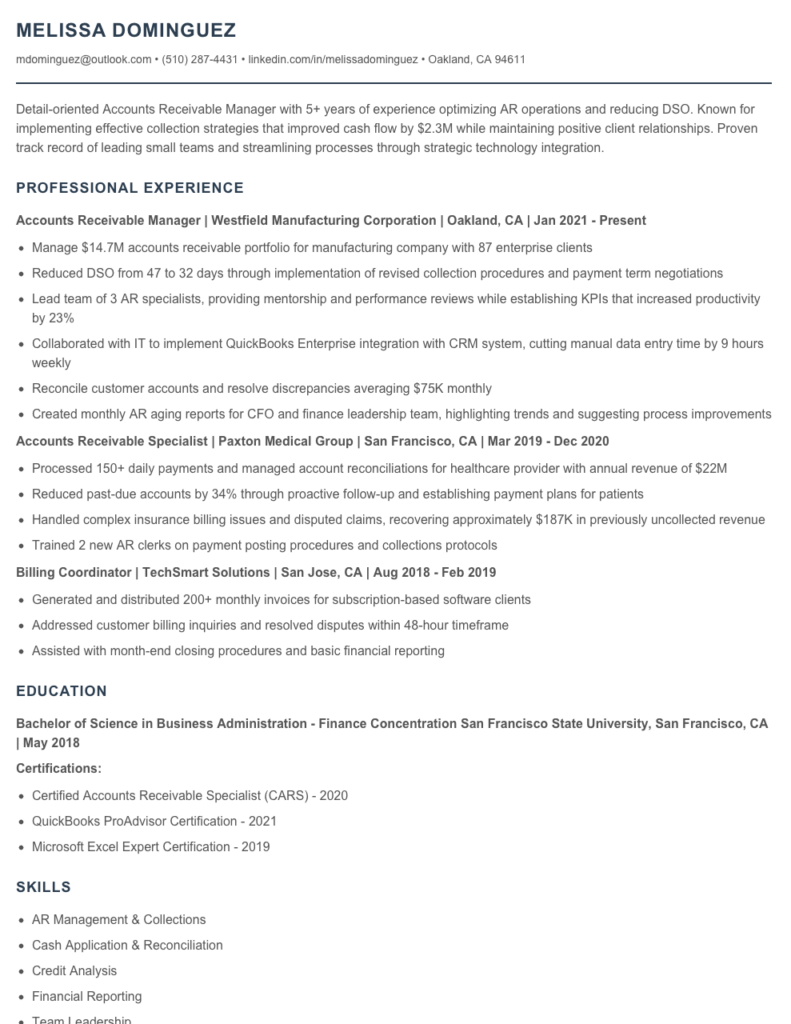

Melissa Dominguez

mdominguez@outlook.com • (510) 287-4431 • linkedin.com/in/melissadominguez • Oakland, CA 94611

Detail-oriented Accounts Receivable Manager with 5+ years of experience optimizing AR operations and reducing DSO. Known for implementing effective collection strategies that improved cash flow by $2.3M while maintaining positive client relationships. Proven track record of leading small teams and streamlining processes through strategic technology integration.

PROFESSIONAL EXPERIENCE

Accounts Receivable Manager | Westfield Manufacturing Corporation | Oakland, CA | Jan 2021 – Present

- Manage $14.7M accounts receivable portfolio for manufacturing company with 87 enterprise clients

- Reduced DSO from 47 to 32 days through implementation of revised collection procedures and payment term negotiations

- Lead team of 3 AR specialists, providing mentorship and performance reviews while establishing KPIs that increased productivity by 23%

- Collaborated with IT to implement QuickBooks Enterprise integration with CRM system, cutting manual data entry time by 9 hours weekly

- Reconcile customer accounts and resolve discrepancies averaging $75K monthly

- Created monthly AR aging reports for CFO and finance leadership team, highlighting trends and suggesting process improvements

Accounts Receivable Specialist | Paxton Medical Group | San Francisco, CA | Mar 2019 – Dec 2020

- Processed 150+ daily payments and managed account reconciliations for healthcare provider with annual revenue of $22M

- Reduced past-due accounts by 34% through proactive follow-up and establishing payment plans for patients

- Handled complex insurance billing issues and disputed claims, recovering approximately $187K in previously uncollected revenue

- Trained 2 new AR clerks on payment posting procedures and collections protocols

Billing Coordinator | TechSmart Solutions | San Jose, CA | Aug 2018 – Feb 2019

- Generated and distributed 200+ monthly invoices for subscription-based software clients

- Addressed customer billing inquiries and resolved disputes within 48-hour timeframe

- Assisted with month-end closing procedures and basic financial reporting

EDUCATION

Bachelor of Science in Business Administration – Finance Concentration

San Francisco State University, San Francisco, CA | May 2018

Certifications:

- Certified Accounts Receivable Specialist (CARS) – 2020

- QuickBooks ProAdvisor Certification – 2021

- Microsoft Excel Expert Certification – 2019

SKILLS

- AR Management & Collections

- Cash Application & Reconciliation

- Credit Analysis

- Financial Reporting

- Team Leadership

- Microsoft Dynamics 365

- QuickBooks Enterprise

- SAP (basic)

- Excel (advanced formulas, pivot tables)

- Customer Relationship Management

Senior / Experienced Accounts Receivable Manager Resume Example

Melissa R. Thompson

Denver, CO 80202 • (303) 555-8721 • mthompson.ar@emaildomain.com • linkedin.com/in/melissarthompson

Professional Summary

Detail-oriented Accounts Receivable Manager with over 10 years of progressive experience in financial operations and team leadership. Known for implementing strategic collection procedures that have consistently reduced DSO by 15-30% while maintaining positive client relationships. Skilled in streamlining AR processes, training staff, and managing complex ERP systems including SAP, Oracle, and QuickBooks Enterprise.

Professional Experience

Accounts Receivable Manager | Precision Manufacturing Solutions | Denver, CO | January 2019 – Present

- Lead a team of 7 AR specialists managing a $42M annual accounts receivable portfolio for a mid-sized manufacturing company with 200+ active B2B clients

- Reduced DSO from 47 to 32 days in first year through implementation of strategic collection procedures and credit policies (saving approximately $1.2M in working capital)

- Decreased bad debt write-offs by 23% by collaborating with sales to establish more effective credit approval processes

- Orchestrated migration from QuickBooks to Oracle Financials, including creation of custom reports and staff training

- Simplified month-end close process, reducing completion time from 5 days to 2.5 days while improving accuracy of reporting

- Manage cash application process for an average of 675 monthly payments, maintaining 99.7% accuracy rate

Senior AR Specialist | Colorado Medical Systems | Boulder, CO | March 2016 – December 2018

- Managed a $15M portfolio of healthcare client accounts, prioritizing collection efforts based on aging analysis

- Collaborated with IT to develop automated dunning notice system that reduced past-due accounts by 27%

- Created Excel macros for aging reports that saved team approximately 12 hours per week in manual data entry

- Trained and mentored 3 junior AR specialists, developing a cross-training program that ensured coverage during absences

- Resolved complex billing disputes and discrepancies, often involving insurance claims and contractual adjustments

AR Specialist | Wilson Financial Group | Denver, CO | June 2013 – February 2016

- Processed daily cash receipts averaging $175K and applied payments to appropriate customer accounts

- Maintained aging AR reports and conducted collection calls for accounts 30+ days past due

- Reconciled customer accounts and resolved discrepancies, reducing billing errors by 18%

- Assisted in quarterly financial reviews and year-end audit preparation

Education & Certifications

Bachelor of Science in Accounting | University of Colorado Denver | 2012

Certified Accounts Receivable Specialist (CARS) | Institute of Finance & Management | 2017

SAP Financial Accounting Certification | SAP America | 2019

Technical Skills

- ERP Systems: SAP, Oracle Financials, QuickBooks Enterprise, Microsoft Dynamics

- Advanced Excel (VLOOKUP, pivot tables, macros, Power Query)

- Collection Management Software (Anytime Collect, CollBox)

- Electronic payment processing platforms (ACH, wire transfers, lockbox)

- Financial reporting & analysis

- Credit risk assessment

- Database management & SQL basics

- Process automation & workflow design

Professional Skills

- Team leadership & development

- Cash flow forecasting

- Aging analysis & collections strategy

- Customer relationship management

- Cross-departmental collaboration

- Month-end close procedures

- Dispute resolution & negotiation

How to Write an Accounts Receivable Manager Resume

Introduction

Landing that Accounts Receivable Manager job means showcasing your financial acumen, leadership skills, and attention to detail—all on a single document. Your resume isn't just a list of past jobs; it's your ticket to an interview. I've helped countless finance professionals transform their work history into compelling career stories, and I'm here to walk you through creating a resume that gets noticed (and not for the wrong reasons!).

Resume Structure and Format

Keep your resume clean and organized—just like your AR department. Finance hiring managers typically spend just 6-8 seconds on initial resume scans, so clarity is crucial.

- Stick to 1-2 pages (one page for less than 10 years of experience, two for more)

- Use a clean, professional font like Calibri or Arial in 10-12pt

- Include clear section headers with consistent formatting

- Use bullet points rather than dense paragraphs

- Save as a PDF unless specifically asked for another format

Pro Tip: Mirror the company's own language in your resume. If the job posting mentions "cash application" rather than "payment processing," adjust your terminology accordingly. This subtle alignment can make a big difference.

Profile/Summary Section

Your professional summary should pack a punch in 3-5 lines. Skip the objective statement (your objective is obviously to get the job) and focus on your value proposition.

Good example: "Detail-oriented Accounts Receivable Manager with 7+ years supervising AR functions for manufacturing companies. Reduced DSO by 12 days through implementing new collection strategies and customer payment portals. Experienced in managing teams of 4-8 AR specialists across multiple locations."

Professional Experience

This is where you shine! Don't just list job duties—showcase your achievements.

- Lead with action verbs: "Managed," "Reduced," "Implemented," "Streamlined"

- Include specific metrics: "Decreased bad debt write-offs by 17% in FY2022"

- Highlight team management: "Supervised a team of 6 AR specialists, providing training on new ERP system"

- Show process improvements: "Redesigned aging report format, cutting weekly reporting time by 3 hours"

- Mention relevant software: "Proficient in SAP, Oracle, NetSuite, or QuickBooks" (whatever you've actually used)

Education and Certifications

For most AR Manager positions, your work experience carries more weight than education, but credentials still matter. List degrees in reverse chronological order, and highlight relevant certifications.

- Bachelor's degree (accounting, finance, or business administration preferred)

- Relevant certifications: CPRM (Certified Professional Receivables Manager), CBA (Credit Business Associate), etc.

- Recent professional development courses (especially in new accounting software)

Keywords and ATS Tips

Most companies use Applicant Tracking Systems that scan resumes before human eyes ever see them. Include these key terms (where applicable to your experience):

- Cash application

- Collections management

- Aging analysis

- Credit risk assessment

- DSO (Days Sales Outstanding)

- Bad debt reduction

- Payment reconciliation

- ERP systems (SAP, Oracle, etc.)

Industry-specific Terms

Show you speak the language of accounts receivable by naturally incorporating terminology like:

- Dunning notices

- Credit holds

- Aging buckets (30/60/90 days)

- Deduction management

- Payment terms (Net 30, 2/10 Net 30)

- Month-end close processes

Common Mistakes to Avoid

- Focusing only on duties instead of achievements

- Omitting metrics that demonstrate your impact

- Using generic descriptions that could apply to any AR role

- Neglecting to mention specific systems/software experience

- Including irrelevant personal information (save the kayaking hobby for the interview small talk)

Before/After Example

Before: "Responsible for accounts receivable functions including collections and reporting."

After: "Managed $4.2M monthly receivables portfolio, implementing structured collection strategy that reduced past-due accounts by 32% and improved cash flow by $750K within first quarter."

Your resume is your financial statement of career value—make every word count! Tailor it for each application, focusing on the skills and experiences most relevant to that specific role. Just like you wouldn't send the same collection letter to every client, don't send the same resume to every employer.

Related Resume Examples

Soft skills for your Accounts Receivable Manager resume

- Cross-functional communication with sales, finance and customer service teams (particularly during payment disputes)

- Diplomatic yet firm client relationship management for collections

- Team leadership and mentoring of junior A/R specialists

- Priority management when juggling multiple aging accounts

- Conflict resolution during payment discrepancies – I’ve talked down some pretty upset clients!

- Adaptability to changing financial software platforms and processes

Hard skills for your Accounts Receivable Manager resume

- QuickBooks Enterprise (9+ years, advanced reporting configuration)

- NetSuite ERP system administration and AR module customization

- Excel financial modeling (pivot tables, VLOOKUP, complex formulas)

- Month-end reconciliation and aging accounts analysis

- Oracle Financial Cloud integration and troubleshooting

- Blackline account reconciliation platform

- SQL query writing for custom AR reports

- Collections workflow automation using Salesforce

- GAAP compliance for revenue recognition practices